Mag 7 + BTC - Tesla = More Returns, Less Volatile

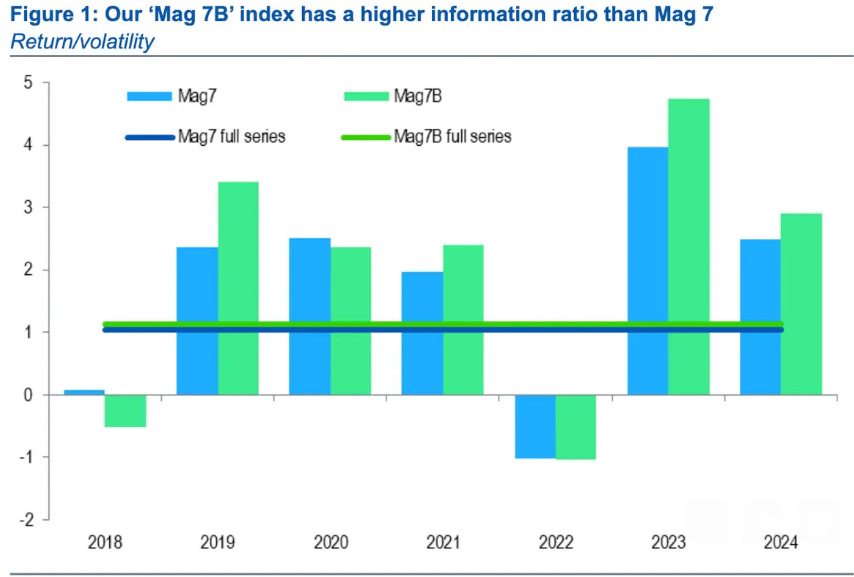

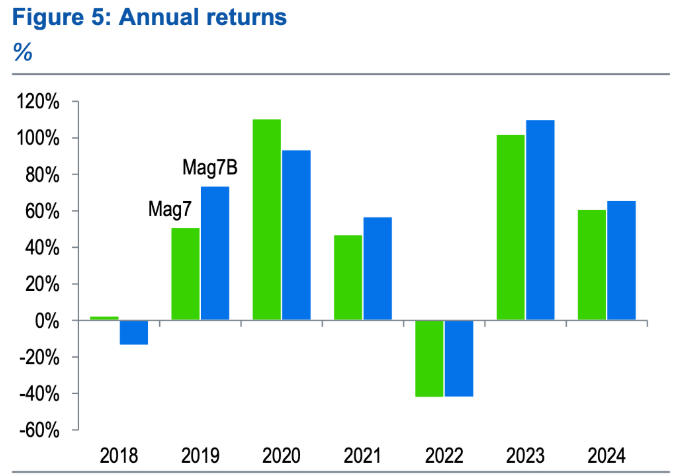

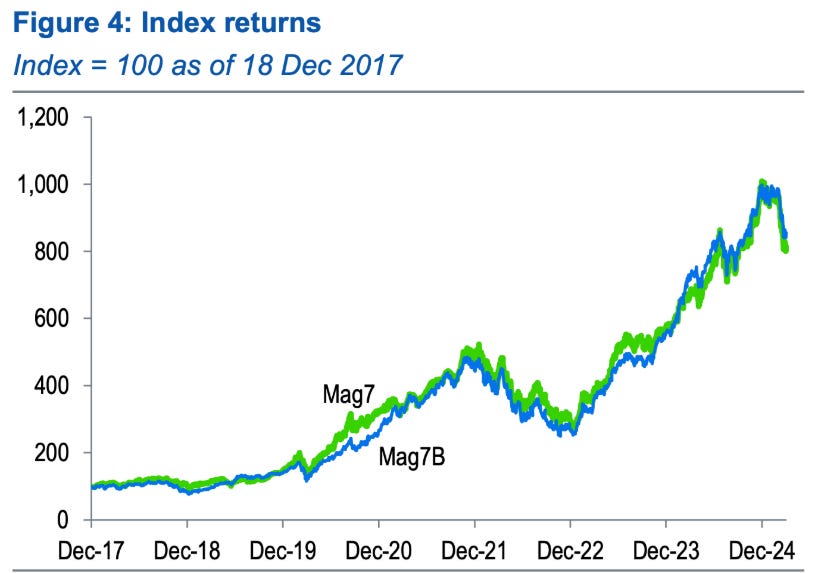

Standard Chartered’s experimental version where Bitcoin replaced Tesla in the 'Magnificent 7' tech stock index outperformed the original index.

‘Is Bitcoin really "digital gold" or just another tech stock with a fancy narrative?’

That's the question raised by Standard Chartered's Geoff Kendrick in a research note that's causing quite a stir among crypto and traditional finance circles alike.

Kendrick experimented with a hypothetical "Mag 7B" index - by replacing Tesla with Bitcoin in the "Magnificent 7" tech stock group - which includes Amazon, Apple, Alphabet (Google), Meta, Microsoft, Nvidia and Tesla.

The results?

The Bitcoin-enhanced index outperformed the original Mag 7 by 5% since 2017, delivering 1% higher annual returns with 2% lower volatility.

"Bitcoin is almost always more correlated to the Nasdaq than to gold," Kendrick wrote on Monday, challenging the long-held "digital gold" narrative carried by MicroStrategy's Michael Saylor and BlackRock's Larry Fink.

With its $1.7 trillion market cap dwarfing Tesla's $800 billion, Bitcoin would rank sixth among the Mag 7 titans — slotting between Meta and Alphabet.

Gold Flips the Script

Since January, we've witnessed a divergence

Gold: Up 15% to a record $3,000 per ounce

Bitcoin: Down 22% from its January peak of $109,000

This contrast has revived the identity debate surrounding Bitcoin.

Is it a safe-haven asset that should shine during market uncertainty (like gold), or is it fundamentally a high-beta tech play?

Institutional Reframing

According to NYDIG data cited in Kendrick's analysis, Bitcoin actually broke from traditional asset correlations in Q4 2024, outperforming all major asset classes following Trump's election.

Was this the beginning of Bitcoin finally decoupling and becoming its own asset class? Or merely a temporary divergence in an otherwise consistent pattern?

Kendrick believes it was the latter. A brief celebration before Bitcoin resumed its tech-like behaviour post-inauguration, when Trump's tariff policies sent both the Nasdaq and crypto markets tumbling.

"If it were included [in Mag 7], the implication would be more institutional buying as BTC would serve multiple purposes in investor portfolios," notes Kendrick.

What purposes exactly?

Tech sector exposure

Digital innovation play

Potential inflation hedge (when it decides to act like one)

Portfolio diversification

With spot Bitcoin ETFs making BTC as tradable as Microsoft shares, the barriers to institutional adoption have largely evaporated.

"Higher Nasdaq will equal higher Bitcoin. $90,000 in focus now." — Geoff Kendrick, Standard Chartered.

What next?

Despite Bitcoin's 19% retreat from its all-time high, market sentiment appears to be shifting. Bitcoin futures open interest has climbed 10% to $57 billion in just 24 hours, according to CoinGlass data.

Kendrick sees a potential bounce as markets digest President Trump's tariff policies, with $90,000 as the next price target if tech stocks continue their recovery.

Bitcoin’s recovery is not a concern — it almost certainly will. What will be crucial is if it will establish itself as something distinct from tech stocks.

For now, the data suggests Bitcoin is crypto's blue-chip tech stock.