Magnificent Seven vs Crypto 🤼

How BTC & ETH stack up against tech giants in 5 years. Nvidia comes out top. Bitcoin is engineered to keep winning - Saylor. Justin Sun's gas-free stablecoin. 63% US crypto holders don't have a will.

Hello, y'all. The maze of tech has got us all ♪

Do try the Music Quiz Game 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

The world of finance has a duel of late.

Crypto versus tech giants.

Remember five years ago? Choosing between tech stocks and crypto was like picking between fidget spinners and Tamagotchis (totally showing our age here).

Well, we're about to revisit that battle and see who came out on top.

Note: Coined by analyst Michael Hartnett, the "Magnificent Seven" refers to the dominant tech stocks: Apple, Microsoft, Alphabet, Meta Platforms, Amazon, Nvidia, and Tesla.

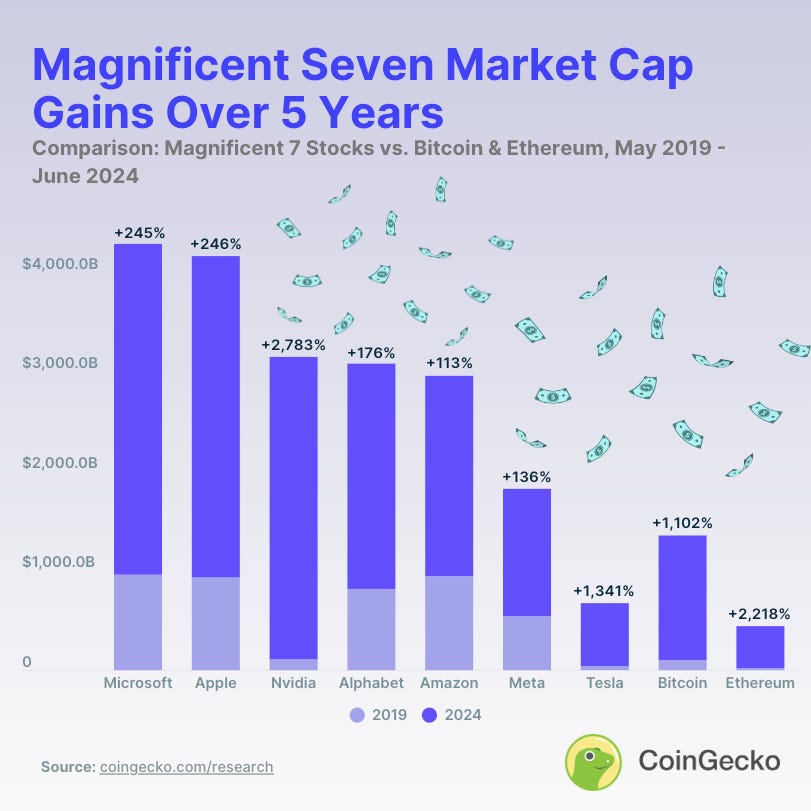

The market cap comparison

Magnificent Seven stocks v Bitcoin, and Ethereum - Coingecko research.

Timespan: May 7, 2019 - June 28, 2024

Metric: Market capitalisation

Overall Market Caps (as of June 28, 2024)

Magnificent Seven: $15.77 trillion

Bitcoin: $1.25 trillion

Ethereum: $421 billion

Top Performers: Nvidia (2,782.8% growth) & Tesla (1,340.8% growth) and Ethereum (2,218.3% growth)

Nvidia reigns

The chipmaker emerged as the only stock from the "Magnificent Seven" to outperform both Bitcoin and Ethereum over the past five years.

Nvidia's market cap skyrocketed from $105.42 billion to $3.039 trillion.

That’s 2,782.8% increase.

Crypto's performance

Ethereum's market cap surged from $18.16 billion to $368.3 billion, representing a solid 1,880% increase.

Bitcoin's market cap grew from a much larger base of $103.98 billion to $1.25 trillion, reflecting a 1,109% increase.

Growth Comparison: Ethereum's growth aligns more closely with Nvidia (2,218.3%) compared to Bitcoin's alignment with Tesla (1,102.2%).

This is likely due to Ethereum's later launch date and lower starting market cap.

The correlation between BTC, ETH and these Big 7 in 2024?

Crypto’s Ethereum boost

The Ethereum market cap hike is probably destined to go up further.

The Ethereum spot ETFs are coming and US Investors are keenly waiting.

This could significantly accelerate mainstream adoption of cryptocurrencies beyond just Bitcoin.

Which isthe top performed CEX?

Binance.

CryptoRank.io has released a list of the top 10 cryptocurrency exchanges (CEX) by capital inflow in Q2 2024.

Binance leads the pack with a capital inflow of $908 million, followed by Bitfinex with $709 million.

Block That Quote 🎙️

MicroStrategy co-founder, Michael Saylor.

“Bitcoin is engineered to keep winning.”

Well, well, well, look who's back with another Bitcoin prophecy.

Michael "Bitcoin Maximalist" Saylor is at it again.

Bitcoin continues to dominate the pack, leading all asset classes in price performance since 2011.

As of July 5th, 2024, Bitcoin boasts 145.9% surge, leaving traditional options like US Growth (16.3%), NASDAQ 100 (18.99%), and even gold (3.5%) in the dust.

This dominance seems to be fuelled by Bitcoin's halving cycles, which have historically led to huge price increases.

We are still waiting for the recent halving-effect.

Early 2024 saw an additional boost thanks to the long-awaited approval of US Bitcoin ETFs.

But, early July witnessed a correction triggered by liquidations from the defunct Mt. Gox exchange and government entities in the US and Germany.

This dip sent Bitcoin to a four-month low of $53,500 on July 5th.

Read: Fire Sale 📉

Big money accumulates

On the flip side, a recent analysis by Santiment highlights an interesting trend.

Wallets holding over 10,000 Bitcoin, likely large institutions acting as liquidity providers, have been capitalizing on the recent volatility.

They've collectively added 212,450 BTC to their coffers, bringing their control of the total supply to 1.05%.

Gas-free Stablecoin Transfers Coming To Tron?

Tron founder Justin Sun has unveiled plans for a game-changing stablecoin.

One that lets users transfer funds without any gas fees.

This stablecoin, launching on Tron by Q4, will allow seamless transfers without any network charges.

After conquering Tron, the gasless wonder will invade other EVM-compatible blockchains and even Ethereum itself.

Details are scarce, but Sun promises the stablecoin itself will somehow cover the gas fees.

Impact?

Sun believes this innovation will fuel mainstream blockchain adoption, especially for businesses using stablecoins.

This could be a direct challenge to existing options like PYUSD (requires swapping out of stablecoin) and free USDC transfers on Base (likely subsidised by Coinbase, not the token itself).

With USDC pulling out of Tron, a native gas-less stablecoin could revitalise the network.

But, details on how these gas-free transfers will function are yet to be revealed.

The SEC lawsuit against Sun and his companies regarding unregistered securities continues, casting a shadow over this announcement.

In The Numbers 🔢

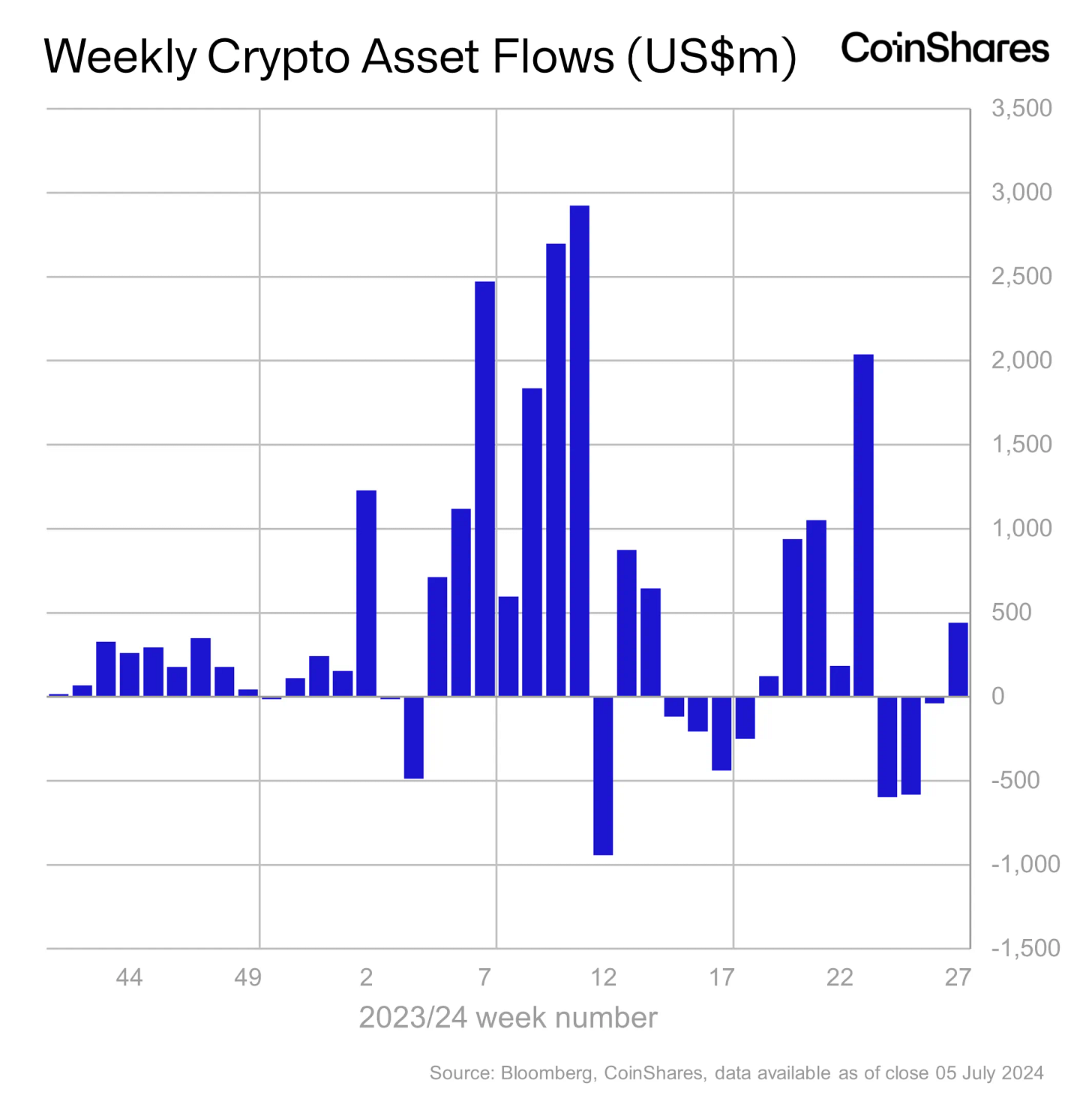

$441 million

Digital asset investment products inflows in the last week, Coinshares report.

Weakness triggered by Mt Gox and selling pressure from the German government likely seen as a buying opportunity.

According to data from blockchain tracing platform Arkham Intelligence

The German government still holds around $2.2 billion worth of BTC.

The US government has over $12 billion.

The Mt. Gox estate has more than $8 billion of assets.

Bitcoin's price has dropped nearly 20% in the past month, with broader crypto markets also experiencing declines.

CryptoQuant CEO Ki Young Ju, say these sales are a drop in the bucket compared to the overall Bitcoin market.

No Digital Will

Crypto holders are unprepared for afterlife.

A recent survey found that 63% of US crypto holders are crypto-forgetful when it comes to death.

That means their loved ones could be left out in the cold, missing out on thousands of dollars.

Only 37% got a plan: Made sure their loved ones know how to access their digital wallets after they're gone.

The median value of respondents' online assets is $8,000.

Nearly 40% of US adults store passwords mentally, creating security risks and hindering access for loved ones.

Half of respondents have online assets their partner doesn't know about, potentially causing complications upon death.

Only 24% of respondents included their online accounts in their will, indicating a lack of awareness or planning.

With more online assets, control over data after death becomes a concern. Tech companies may hold significant influence.

Communication breakdown

50% have digital assets their partner doesn't know about.

Sharing with family varies: 42% with spouse, 23% with children.

Only 13% share with parents, 8% with friends.

34% haven't shared info with anyone.

The Surfer 🏄

Taiwan's central bank is not in a rush to launch a central bank digital currency (CBDC). The bank believes that steady progress is more important than being the first to introduce a CBDC.

A bug bounty program for the Solana Firedancer client is launching this week. Participants have a chance to earn up to $1 million by finding critical bugs. The program will run for 42 days, from July 10 to August 21.

Celo has launched its Dango Layer 2 testnet, a major step towards joining the Ethereum ecosystem. The testnet is built on Optimism's OP Stack and marks the first step in transforming Celo's Layer 1 blockchain into an Ethereum L2 network.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋