Hello

Every Saturday, I dive into a podcast from our partners at Decentralised.co and share what stayed with me.

This week, I reflect on the conversation between Saurabh Deshapande and Ryan Saxe, CEO of Eco, alongside Jay Kurahashi-Sofue, CMO at Eco, hosted by Decentralised.co.

Ride aggregating platforms are excellent at optimisation. When we request a ride, we just tell the app where we want to go. We don't manually find a driver, figure out who's closest, or even choose the route. The app handles all of that: it picks the best available option, calculates the optimal path, shows us a price, and we either accept or not. As a rider, you never think about the coordination happening underneath.

That’s why when I listened to Ryan talk about crowd liquidity and how they are building a liquidity layer for stablecoins at Eco, I was hooked. He used the same Uber analogy to explain intent-based systems in crypto: "I tell Uber where I want to go. Uber chooses a driver and chooses a route. I didn't choose those things in between, right? It gives me a price. I accept it or not."

When a driver is sitting idle between rides, they are a part of a distributed network of available capacity. When demand spikes somewhere in the city, the algorithm automatically routes the closest available drivers there. Still can’t match the demand? In that case, the systems bring in surge pricing to tackle the basic demand-supply equation. Riders don't need to know where drivers are located or manually coordinate with them - the platform handles all the optimisation invisibly.

What happens when there are just not enough drivers to match the demand? We can’t just keep jacking up prices endlessly, can we? This, precisely, is the problem the team at Eco faces while attempting to optimise stablecoin liquidity.

Ryan explained that intent-based systems work well when you have enough depth on major routes, much like Uber does in cities with lots of drivers. The problem is that crypto is launching new "cities" - new chains and rollups - every week, and the driver network isn't scaling to serve them all efficiently.

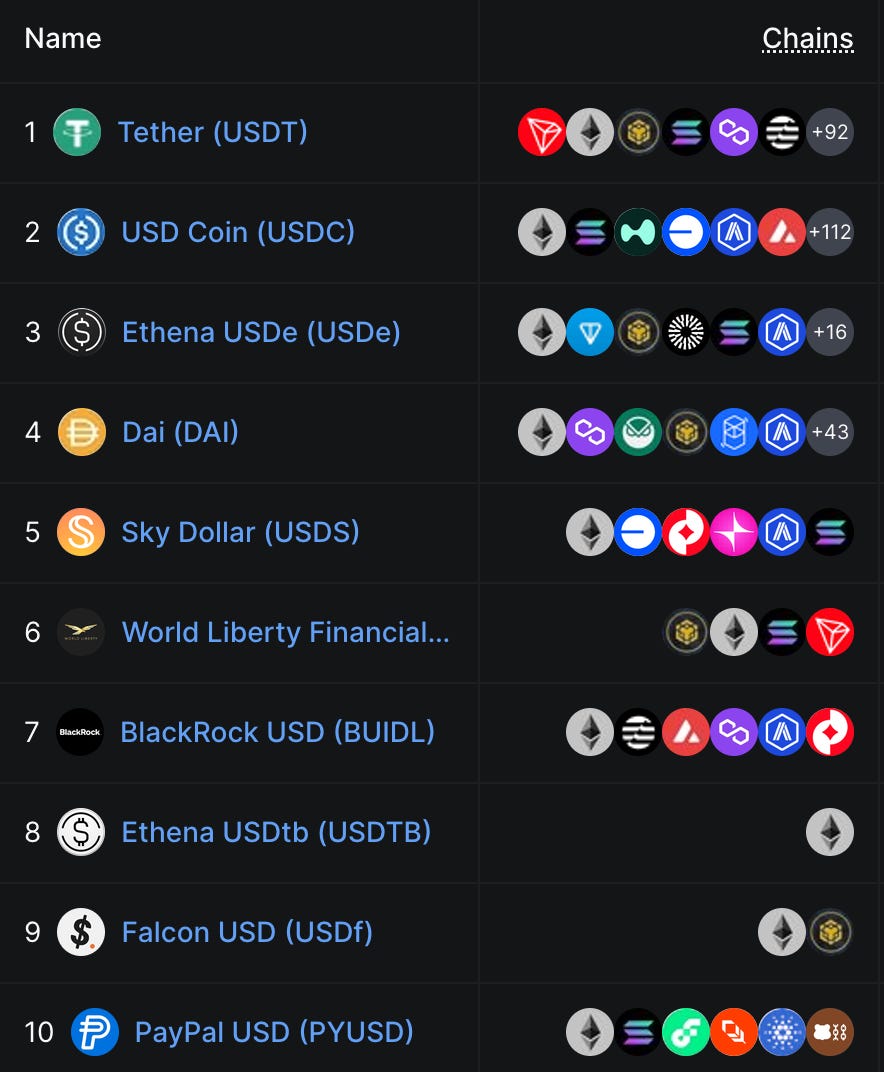

We have roughly $280 billion worth of stablecoins scattered across dozens of chains, much of it sitting idle like drivers between rides. Just between the top two stablecoins, USDT and USDC, about $240 billion worth of stablecoin is split across roughly 100 protocols.

Protocol treasuries hold millions that they actively use only occasionally. This forces users to move hundreds or thousands of dollars across multiple chains and protocols each time they want to transact on a different chain or protocol.

The coordination challenge is worsening, not improving, as new chains launch faster than liquidity can be manually allocated to serve them all.

Read: The DIY Blockchain Trend 👀

Unlock Web3 Insights with Decentralised.co

Long-form stories trusted by the best in Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Good writing. In-depth conversations. Right in your inbox.

Subscribe to Decentralised.co

The problem compounds each time someone wants to transact on a less-serviced route, just like our headaches shoot up when we try to book an Uber for a less-travelled route. Higher fees, longer wait times, or sometimes no service at all.

If blockchain, as an innovation, has to live up to the reputation it promised, then optimising liquidity is the foremost problem.

Think about what we're really asking people to do right now.

We want them to abandon familiar financial systems for something demonstrably better, except we hand them a user experience that requires constant decision-making about infrastructure details they shouldn't need to understand. Every transaction becomes a mini-engineering problem: which chain, which bridge, how much gas, what route. We've built technology that promises to be revolutionary but is wrapped in complexity that feels more like punishment than progress.

The irony is that crypto's core value proposition - programmable money that flows freely across borders and systems - is being undermined by the very fragmentation that should make it more powerful. More chains should mean more options, not more headaches. More protocols should mean more possibilities, not more friction. Right now, each new chain launch exacerbates the coordination problem for everyone.

This challenge drives away both current users and potential adopters. It will continue to do so if we keep adding new pieces to the system without building the connecting bridge that would make them work together seamlessly.

That's where Ryan's insight about market organisation became compelling.

He pointed to how "extremely valuable platforms are built when you acknowledge or you recognise that there's tons of passive capacity sitting in an unorganised market and you network that capacity and you create an efficient market structure for it."

Listen to full episode here 👇🏾

The scale of what's coming hit me when Ryan mentioned that the addressable market for stablecoins is basically the M1 and M2 money supply. Today’s stablecoin market is barely 1.3% of the $22 trillion worth of M2 supply in the US. Ryan called it "a pittance relative to what it's going to be inevitably."

Every digital dollar could eventually be a stablecoin because of what they promise: more liquidity between geographies, availability outside business hours, and faster settlement than traditional banking rails.

Crowd liquidity, as Ryan described it, would let all of this idle capacity opt into a system that puts it to work and moves it invisibly without the user having to do it manually. "Whether I'm a protocol treasury that has $10 million to put into this construct or I'm an end-user of an integrated app with only 10 bucks sitting there," the participation mechanism would be the same.

This abstraction is essential because the technical complexity of routing and rebalancing should be invisible infrastructure, not user-facing features.

When I think about crypto's future, I'm less excited about the next 10x token and more interested in infrastructure that makes the whole system work better. Crowd liquidity feels like one of those foundational improvements, the kind that makes everything else possible by solving coordination problems.

The next time someone launches a new chain or builds a new application, I don’t want to ask them, “How will you bootstrap liquidity?”. Instead, I will ask, "Do you have a plan to plug into the liquidity that already exists?"

Off to search for boring yet efficient models,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.