Nigeria's Crypto Crime Thriller 🇳🇬

Nigeria v Binance: $34M money-laundering case, jailed executive and Interpol manhunt. $121B in 1.75M Bitcoin wallets not moved over a decade. Visa - 90% stablecoin activity is machine-made, not human.

Hello, y'all. The NIgerian crypto hunt has given crypto a crime thriller 💨

Sometimes I'm happy, sometimes I'm sad | I don't know what's over me |

Sometimes I'm good, sometimes I'm wild | I don't know what's over me … 🎶

A complete go for music lovers 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 find all about us here 🤟

Nigeria has been battling the worst economic crisis in years triggered by surging inflation. Country's currency has gone in free fall due to the government’s policies.

That led to the growth of crypto.

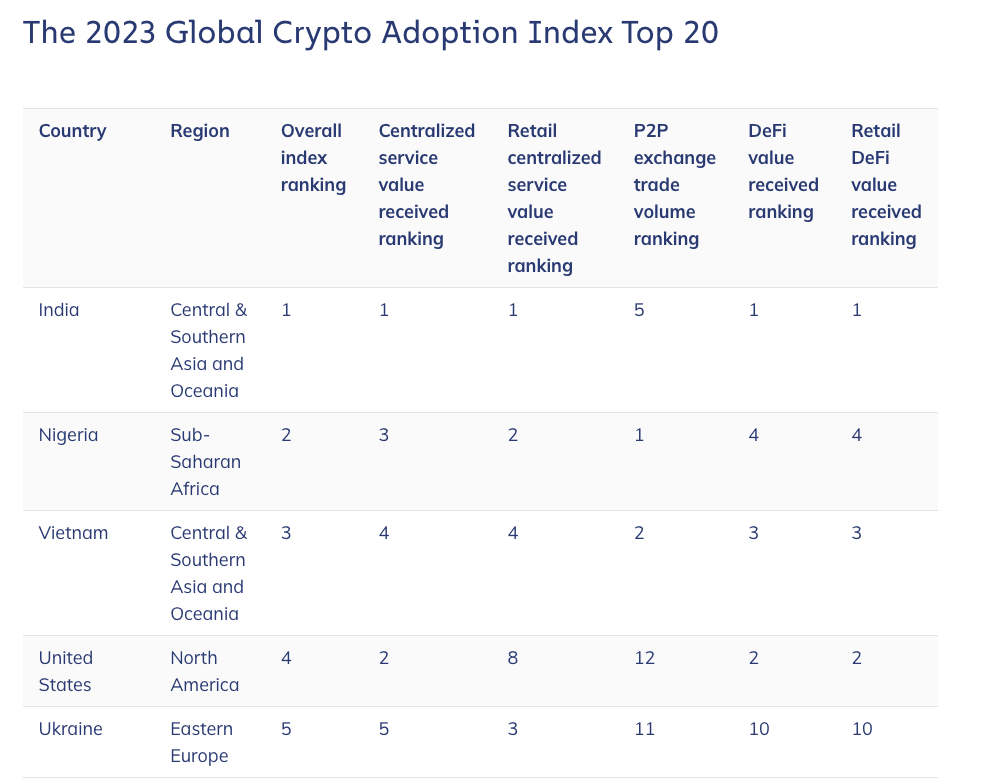

Nigeria has some 13 million crypto holders, the highest in Africa according to VOA.

The fledgeling crypto run brings trouble. It always does.

In every country. Across the world.

Now guess who got into trouble?

Binance.

The same Binance that had to paid $4.3 billion penalty in US.

Same Binance who’s beloved CEO (Changpeng Zhao aka CZ) pleaded guilty, resigned and now sentenced to four months in prison for money laundering violations.

What happened?

It went all south between Binance and the Nigerian government this year.

Ever since what happened with US government, things got messy abroad.

In the Philippines, they got kicked out for not following the rules.

They tried the same thing in Nigeria, but that got as dramatic as it can get.

It all started with Nigeria pointing the finger at Binance, accusing them of being a laundromat for dirty money and dodging taxes.

Binance did not register in Nigeria and the Nigerian money (Naira) started losing value, and officials thought Binance was to blame.

Why? Binance offering digital Naira and stablecoins, raising suspicion of market manipulation.

Accusations against Binance

Facilitating $35 million in money laundering.

Aiding manipulation of the Nigerian Naira.

Tax evasion.

They invited two Binance execs to talk, but things went south.

The officials wanted user data, which Binance wouldn't give them.

This led to one exec getting arrested and the other escaping during a prayer service.

Now, the one exec who's stuck is waiting for trial in a tough prison.

Tigran Gambaryan (compliance head): The jailed one.

Nadeem Anjarwalla (regional head): The escaped one.

Judge postponed Gambaryan’s bail hearing for the fourth time.

Original hearing: April 18th (postponed)

New hearing date: May 17th (yet to happen)

Reason for delay: Binance's lawyer submitted a new affidavit requiring a response from the prosecution.

On top of that, Gambaryan is suing the Nigerian government, claiming his detention violates his human rights.

Who’s upset?

“The ordeal has been deeply distressing for Tigran, his family and friends, as well as the entire Binance community” - Richard Teng, Binance CEO. Teng's post marks the first time he's publicly commented on the situation.

“This is purely state-sanctioned hostage-taking” - Mark Mordi, Gambrayan’s lawyer.

“It is outrageous that Tigran, an innocent man, continues to be kept in a prison cell and the ruling on his bail will not be made until after the trial starts. This is just pure cruelty”... “There is no justice in what is being done to my husband. I am in a constant state of grief and anxiety, not knowing what other injustice he is going to be put through.” - Yuki Gambaryan, his wife.

“These charges against Tigran are meritless. It’s outrageous that he would be remanded in a prison.” — Binance spokesperson.

Binance also shut down its Nigerian peer-to-peer platform voluntarily, not due to government pressure.

The Nigerian authorities said that they will ban the use of its fiat currency Naira for P2P cryptocurrency transactions.

The one who ran away?

Nigerian authorities haven't forgotten about Anjarwalla.

“Wherever he is, he will be smoked out,” said Garba Baba Umar, a Nigerian member of Interpol’s executive committee.

Interpol issued a Red Notice, obligating member states to arrest Anjarwalla if found.

His whereabouts are unknown, but he was reportedly traced to Kenya.

Meanwhile, Nigeria's stance on crypto seems to be hardening. The investigation has expanded to encompass all peer-to-peer crypto exchanges, signalling a potential "legal war" on cryptocurrencies.

Block That Quote 🎙️

Netflix's "The Roast of Tom Brady"

“How did you fall for that?”

Tom Brady's roast got spicy, and the flames came from his own crypto endorsements.

The retired NFL legend Tom Brady became a meme machine after comedians mercilessly poked fun at his association with the now-bankrupt FTX exchange.

Kevin Hart kicked things off with a jab, referring to the FTX collapse and potential lawsuits against Brady.

“You’re probably asking yourself ‘Guys, why didn’t we go to the Crypto.com Arena downtown?' … Well, the reason why we didn’t go there is because we didn’t want to remind Tom’s fans of how much money he owes them. He fucked those people. Tom fucked those people. Fucked them good, didn’t he?”

It didn't stop there. Nikki Glaser piled on.

“Tom also lost $30 million in crypto — how did you fall for that? I mean, even Gronk (Rob Gronkowski) was like ‘me know that’s not real money.’”

The backstory: Brady and his ex-wife Gisele Bündchen were both named in a lawsuit for promoting FTX before its downfall. Brady reportedly received a hefty sum in FTX shares to be a brand ambassador, while the exchange's executives were later accused of misusing customer funds. He even launched his own NFT platform in 2021, but that too fizzled out in 2023 due to waning interest in the NFT market.

90% Stablecoin Activity Is Machine-Made, Not Human.

Visa and blockchain data firm Allium in their research reveals a surprising truth: smart contracts, not humans, are driving most stablecoin action.

What's inorganic activity?

Automated bots performing tasks like arbitrage (buying low, selling high) and liquidity provision (adding funds to exchanges). These activities are crucial for DeFi (decentralised finance) but don't reflect real-world usage.

So, what does this mean? A large chunk of stablecoin transactions might not represent actual spending or adoption by people.

This adjusted metric aims to remove potential distortions that can arise from inorganic activity and other artificial inflationary practices.

Research firm Sacra predicts stablecoins will surpass Visa.

Convenience and speed for cross-border transactions will propel them past the payments giant.

They point to faster settlement times, lower fees, and 24/7 availability as key advantages.

Visa’s head of crypto Cuy Sheffield doesn’t agree.

Check out: Visa's Onchain Analytics Dashboard.

In the Numbers 🔢

$121 Billion

Value of the estimated 1.75 million Bitcoin wallets that haven't budged in over a decade, according to a Fortune report.

A combined 1,798,681 BTC, currently valued at $121 billion.

Dormant whales awakening

On May 6, a Bitcoin wallet that's been inactive for over 10 years just transferred its entire stash of 687.33 BTC, valued around $44 million

This mysterious whale first received these Bitcoins back in January 2014, when they were only worth $917 each.

Another whale sold 224.412 WBTC for $14.38 million in DAI and USDT. This whale has been actively trading, making over $4.5 million from other deals, including a large WBTC purchase at a lower price.

This isn't the only recent Bitcoin whale movement

August 2023: Dormant wallet from 2010 moved 1,005 BTC after 2014.

March 2024: The 5th richest Bitcoin address, dormant since 2019, moved $6 billion.

March 2024: Someone consolidated $140 million worth of Bitcoins mined all the way back in 2010.

January 2024: Nearly 50,000 dormant Bitcoins woke up just days after the US approved Bitcoin ETFs.

Uniswap Founder Weighs In On Token Distribution.

Token distribution and airdrops have always been contentious.

Yet, it's one the most things in crypto's adoption and growth.

The largest decentralised exchange Uniswap perhaps had the first successful token distribution, founder Hayden Adams lays out the blue print on good tokenomics.

Money Quote: Don’t be stingy - give a significant amount away.

Adams emphasises transparency and fairness. Distribute tokens openly on decentralised exchanges for genuine price discovery.

Uniswap Update: The total number of wallets on Uniswap rose 140%, from 3.03 million in May 2023 to 7.26 million in May 2024. This comes as Uniswap surpassed a historic $2 trillion in cumulative trading volume in April.

The Surfer 🏄

Bitcoin miner Marathon Digital lands spot in S&P SmallCap 600, sending shares up 18%. What's the S&P SmallCap 600? It tracks 600 small US companies with strong financials. Inclusion is a big deal, giving Marathon exposure to a wider investor audience. Marathon's stock is still up 25% since the halving, a sign investors remain bullish on the company.

Ore, a proof-of-work crypto built on Solana, took home $50K at a recent hackathon. Ore's mining activity is believed to have contributed to Solana's network congestion issues in April. Ore's mining surge is blamed for causing over 70% of non-important transactions to fail on Solana in April.

Arbitrum, a leading Layer 2 scaling solution for Ethereum, has surpassed $150 billion in total transaction volume on Uniswap. This makes Arbitrum the first Layer 2 to achieve this milestone on Uniswap. Despite having a lower total value locked (TVL) compared to Layer 1 blockchains, Arbitrum is processing a significant amount of trading activity.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter and Instagram🤞

So long. OKAY? ✋