OKX's IPO Bet 🔔

From Fines to Fortune

Hello

Kennedy Sr had made his fortune during Prohibition (the period between 1920 and 1933 when sale, production and distribution of alcohol was banned in the US) running liquor and then, after Prohibition ended, became the first chairman of the Securities and Exchange Commission. When asked about the appointment, President Roosevelt allegedly said, "Set a thief to catch a thief." Kennedy went on to clean up Wall Street with the zeal of a reformed sinner, implementing rules that still govern securities markets today.

A modern crypto equivalent of this looks like the journey of OKX from regulatory pariah to potential IPO candidate.

Seychelles-based crypto exchange OKX is considering a US public listing, just four months after agreeing to pay the US government $505 million for operating without proper licenses, a report claimed this Sunday.

In February 2025, the world’s second-largest centralised exchange (CEX) pleaded guilty to processing over $1 trillion in unlicensed transactions for US users while knowingly violating anti-money laundering laws and agreed to pay a hefty fine of over half a billion dollars. Now it wants to ask American investors to buy shares in their company.

Nothing probably says "we've turned over a new leaf" quite like voluntarily subjecting yourself to quarterly earnings calls, disclosures and filings the US Securities and Exchange Commission (SEC) mandates.

Can a crypto company see success at Wall Street? Circle just proved it can, most recently. In the past couple of weeks, the USDC stablecoin issuer showed investors will throw money at crypto companies with enthusiasm if they walk the regulated route.

Circle's stock went from $31 to nearly $249 in a matter of weeks, creating instant billionaires and a new template for crypto IPOs. Even Coinbase, which is the largest crypto exchange in the US and has been listed for four years, has rallied 40% in the last 10 days and is trading close to a four-year high.

Can OKX expect similar wins at the bourses?

Well, Circle had a squeaky-clean regulatory record when they went public. They spent years wearing suits, testifying at congressional hearings, and publishing transparency reports. OKX, meanwhile, recently admitted to facilitating $5 billion in suspicious transactions and criminal proceeds and had to promise very hard not to do it again.

Secure Your Life ... But in Bitcoin

Yeah, we didn’t think those words went together either. But here comes Meanwhile flipping the script.

With Meanwhile, you pay your premium in Bitcoin, then borrow against it later without selling. Yup, no tax, no selling pressure, no drama.

Here’s the alpha

You lock in BTC today

It moons tomorrow 🚀

You borrow against it, no capital gains tax

You stay insured, and stay winning

It's like hodling with benefits.

👉 Check out Meanwhile, your future self (and wallet) will thank you.

Different CEXs, Different Stories

To understand OKX's IPO prospects, let’s look at Coinbase, the only major crypto exchange that's successfully navigated public markets. Both OKX and Coinbase make money the same way: collecting fees every time someone trades crypto.

And, when crypto markets go crazy, think of a bull run, they make a fortune. Both platforms offer the crypto basics: spot trading, staking, and custody services. Yet, their approaches to building that business couldn't be more different.

Coinbase took the compliance-first route. They hired former regulators, built institutional-grade systems, and spent years preparing for the big listing on Wall Street. The strategy worked, they went public in April 2021 and despite the ups and downs of crypto markets, it’s worth more than $90 billion market cap today.

They averaged $92 billion in monthly spot trading volume through 2024, primarily from US customers paying premium fees for regulatory certainty. It's the tortoise strategy: slow, steady, and focused on one market done right.

OKX chose the hare strategy: move fast, capture global market share, worry about regulations later. The approach worked spectacularly from a business perspective.

They averaged $98.19 billion in monthly spot trading volume in 2024, 6.7% higher than Coinbase, while serving 50 million users across 160+ countries. Add in their derivatives trading (where they dominate with 19.4% global market share), and OKX processes vastly more crypto trading than Coinbase.

OKX processes about $2 billion in daily spot trading volume and over $25 billion in derivatives trading, as against Coinbase processing $1.86 billion and $3.85 billion respectively.

But speed came with costs. While Coinbase built relationships with US regulators, OKX was actively courting American customers despite being banned from operating there. Their attitude seemed to be "ask forgiveness, not permission," which works until you have to ask forgiveness from the Department of Justice.

There's a catch: revenue in crypto exchanges is entirely dependent on people continuing to trade crypto enthusiastically. When markets are hot, exchanges print money. When markets are cold, revenue can drop dramatically overnight.

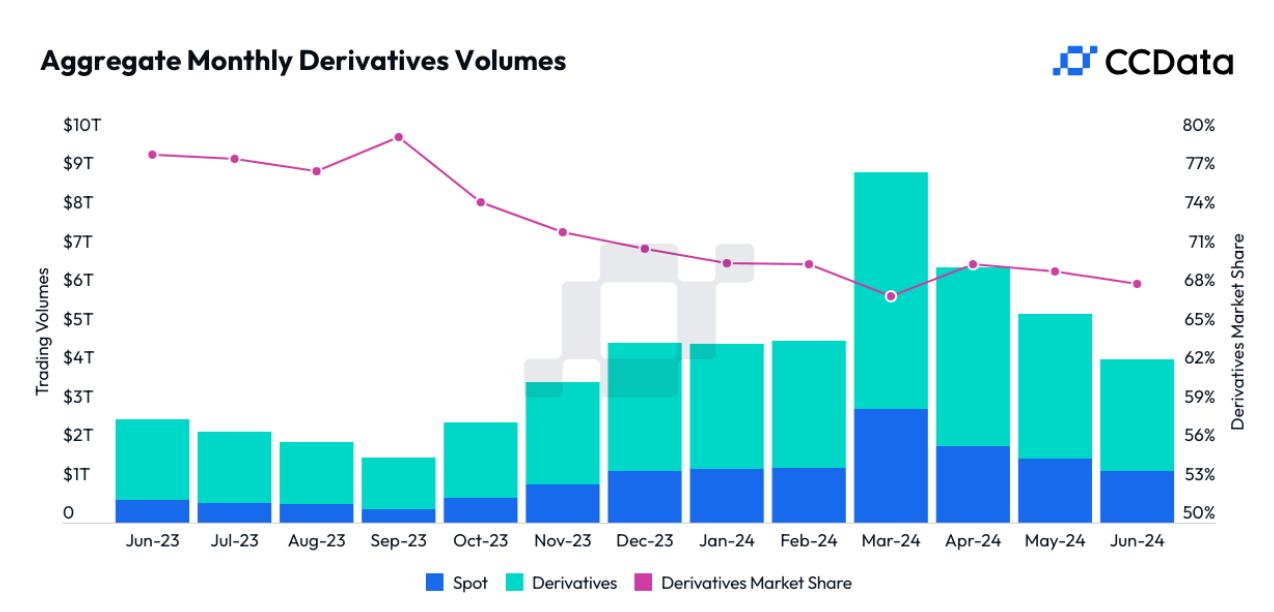

For instance, trading volumes – both spot and derivatives – had collectively slumped more than 50% in June 2024 across exchanges from the peak of ~$9 trillion in March 2024.

OKX's $500-million settlement acted as a forced education in how American financial markets actually work. They have seemed to have learned from their expensive mistakes. They've hired former Barclays executive Roshan Robert as US CEO, opened compliant offices with 500 employees across San Jose, New York, and San Francisco, and are talking about building a "category-defining super app", the kind of corporate speak that signals serious reformation efforts.

What would be interesting to see is whether investors will buy the redemption narrative.

The Valuation Game

Using trading volume as a benchmark, OKX should theoretically be worth as much as Coinbase, if not more.

Coinbase trades at roughly a single multiple of its monthly trading volume, giving it more than $90 billion market cap on $92 billion in average monthly volume. OKX processes $98.19 billion monthly, 6.7% more than Coinbase. At the same multiple, OKX would be worth $85.4 billion.

Valuation is not all math, it’s also about perception and risk.

OKX's regulatory baggage probably warrants a discount. Their international exposure means profits depend on regulatory environments that change rapidly, as they're learning in Thailand, where regulators just banned them along with several other exchanges.

Apply a 20% "regulatory risk discount," and OKX might be worth $68.7 billion. But factor in their global reach, derivatives dominance, and higher trading volumes, and they could justify a premium valuation.

The realistic range: $70-90 billion, depending on how much investors value growth versus governance.

The Advantages

OKX's investment thesis rests on several competitive advantages that Coinbase lacks.

Global Scale: While Coinbase remains primarily US-focused, OKX serves markets where crypto adoption is exploding: Asia, Latin America, and parts of Europe where traditional banking is underdeveloped.

Derivatives Dominance: OKX controls 19.4% of the global crypto derivatives market, compared to Coinbase's minimal derivatives offering. Derivatives trading generates higher fees and attracts more sophisticated traders. Coinbase has recently announced perpetual futures. This means that OKX will face more competition from an already established and regulated player.

Volume Leadership: Despite being a private company with recent regulatory troubles, OKX still processes more spot trading volume than the established, publicly-traded Coinbase.

Coinbase has advantages too — a clean regulatory record and established relationships with institutional investors who prefer predictable compliance costs to global growth stories with regulatory complexity.

What Could Go Wrong?

The risks for OKX are substantial and different from typical IPO concerns.

Regulatory Whiplash: OKX operates in dozens of jurisdictions with rapidly changing rules. The Thailand ban is just the latest example. Any major market could eliminate significant revenue overnight.

Market Cyclicality: Crypto exchange revenues rise and fall with trading activity. When crypto goes quiet, exchange revenues can collapse.

Reputation Risk: Despite the settlement, OKX remains one regulatory scandal away from serious reputational damage. Crypto exchanges are inherently risky businesses where technical failures or security breaches can destroy customer confidence overnight.

Token Dispatch View 🔍

OKX's potential IPO could be a fascinating test of whether public markets will look beyond the problematic background of the exchange.

Strip away the regulatory drama, and OKX actually has an edge over the only other successful listed crypto exchange, Coinbase. They dominate derivatives trading along with a global customer base.

It might not really matter if OKX has learned from their mistakes (expensive lessons usually tend to stick). What might, though, is whether public market investors will pay growth multiples for a company that operates across dozens of unpredictable regulatory environments. Coinbase built a moat of US compliance credibility; OKX built a global trading empire and is now retrofitting compliance around it.

Both strategies can work, but they appeal to fundamentally different investors. Coinbase is the safe play for institutions wanting regulated crypto exposure. OKX might appeal to those who bet for investors who think crypto's future lies in global adoption and sophisticated trading products.

Circle proved investors will throw money at clean crypto stories. OKX is betting investors will do the same for them, even if they come with complicated pasts.

Whether OKX's reformed image resonates with public markets will tell us a lot about how much investors really value growth over governance in the crypto sector.

That’s it for this week’s deep-dive.

See you next week,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.