In poker, “If you can’t spot the sucker at the table in the first half hour, you are the sucker.”

For decades, retail traders have been the sucker at the broker’s table. The broker sees your positions, controls the spreads, sets liquidation prices, and can change the rules when it suits them. During GameStop, Robinhood proved this by turning off buy buttons while allowing sells.

The house protected itself.

Crypto promised transparent execution and immutable rules. For years, that promise covered only crypto assets. You could trade ETH on Uniswap with verifiable pricing. But trading gold, oil, or the S&P still required a traditional broker with all the opacity that entails.

Ostium brings traditional markets on-chain. The platform offers perpetual contracts on commodities, forex, indices, and equities, all tracked by oracles and settled in USDC. You can trade gold or Tesla directly from your wallet with transparent fees and execution you can verify.

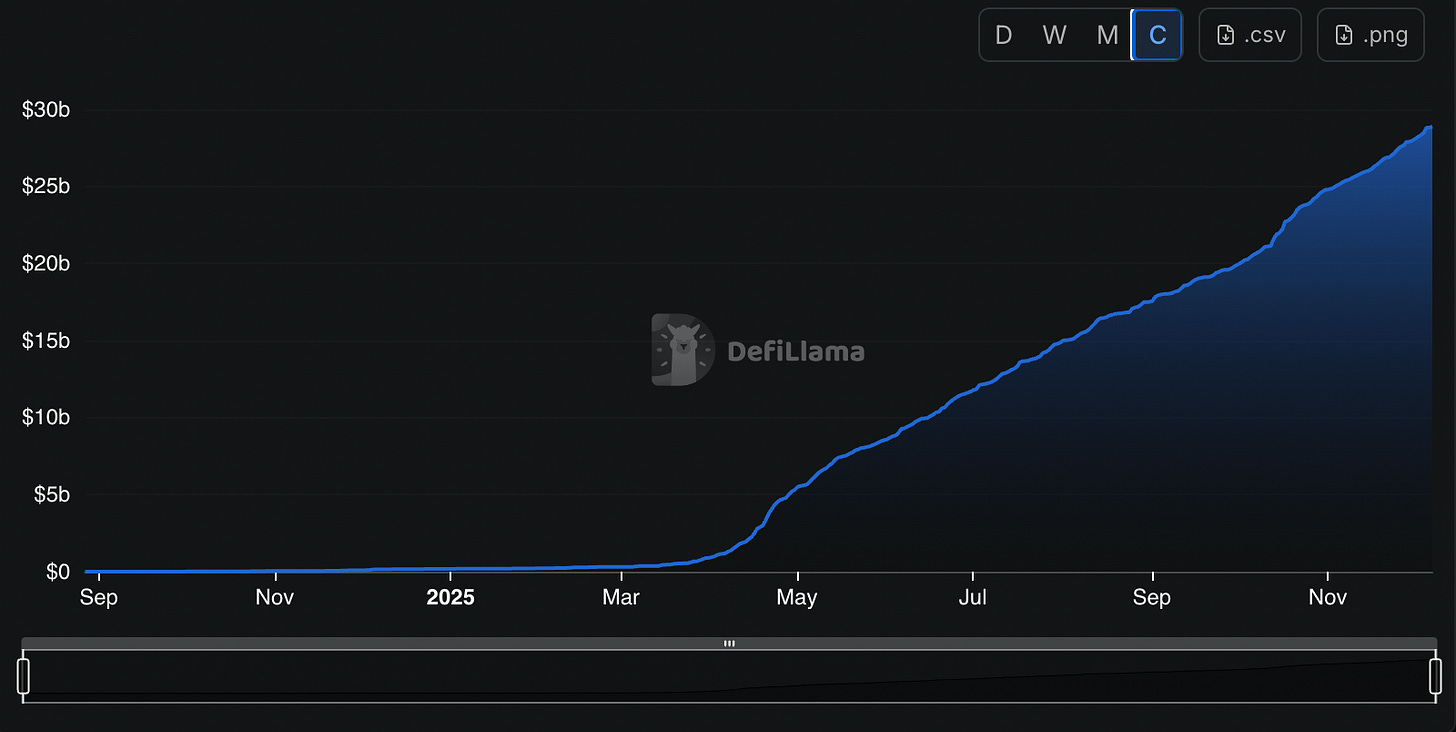

Since launching in October 2024, Ostium has processed $28.88 billion in volume and captured 50% of on-chain gold open interest during rallies. The infrastructure finally exists to trade in traditional markets without being the sucker at someone else’s table.

What Is Ostium, Without the Complexity?

Ostium is a decentralised perpetual futures exchange that lets you trade real-world assets from a crypto wallet. Not tokenised versions. Not wrapped representations. Just synthetic perpetual contracts that track the price of actual assets: gold, crude oil, EUR/USD, the Nasdaq 100, Tesla stock.

Traditional brokers let you trade these assets, but they control everything. The prices you see. The spreads you pay. Whether your order actually executes. Whether you can withdraw your money during volatility.

Ostium puts all that on-chain. The prices come from decentralised oracles. The execution rules are in smart contracts. Your collateral stays in your wallet until you trade. Nobody can freeze your account or widen spreads arbitrarily when markets move.

The platform is built on Arbitrum, uses USDC as collateral, and offers leverage up to 200x on forex pairs. It’s trying to replace eToro and Plus50. Not Binance for trading Bitcoin.

And it’s working. Since launching in October 2024, it’s processed over $28 billion in volume. During gold’s recent rally, Ostium captured 50% of all on-chain gold trading.

Why Regular Traders Should Care

If you’ve ever tried to trade traditional markets through normal channels, you know the pain points.

Contract-for-difference brokers are black boxes. They show you a price, you click buy, and you have no idea if you got a fair execution. During the GameStop saga, Robinhood just turned off the buy button. During market crashes, retail CFD platforms mysteriously widen their spreads to levels that trigger stop-losses.

The infrastructure has embedded optionality to profit from your losses.

Ostium removes that entire layer of discretion. What does it mean in practice?

For macro traders: You can express views on global markets without opening accounts at multiple brokers. Long gold, short oil, trade EUR/USD, all from the same interface. No minimum contract sizes. No separate margin requirements across products.

For retail traders: Traditional futures exchanges like CME require large contract sizes that price out smaller accounts. One gold futures contract represents 100 troy ounces, about $270,000 worth. On Ostium, you can start with $10.

For crypto natives: You already hold USDC. You understand leverage. You know how perpetual contracts work. Ostium just extends that same infrastructure to traditional assets. Trade gold with the same mechanics you use for Bitcoin, except the price feed comes from commodity markets instead of crypto exchanges.

For anyone tired of broker games: Your capital stays in your wallet. Execution is transparent. Spreads are visible. Liquidation rules are in code. Nobody can arbitrarily freeze your account because they don’t like your trading pattern.

The common thread is removing the intermediary who has conflicting incentives. In traditional CFD trading, your broker often takes the other side of your trade. They profit when you lose. Ostium uses a liquidity pool model where the counterparty is transparent smart contract logic, not a dealing desk hunting your stop-losses.

How Ostium Works?

The core innovation is the dual-liquidity architecture. Most platforms use a single pool. Ostium splits risk across two layers.

The Liquidity Buffer: The protocol’s shock absorber. It handles day-to-day profit and loss from traders. When someone wins a trade, the Buffer pays them. When someone loses, their collateral replenishes the Buffer. This prevents the main liquidity vault from experiencing wild swings from every single trade.

The Market Making Vault: This is where liquidity providers deposit USDC and earn yield. When you deposit here, you mint OLP tokens representing your share of the vault. The vault earns 50% of all opening fees and 100% of liquidation rewards. Current yields are running 15-18% APY, paid in actual trading fees, not token inflation.

The clever part is how they interact. The Buffer handles routine volatility. The Vault only steps in during sustained imbalances when traders are heavily positioned in one direction. This structure protects passive liquidity providers while still ensuring the protocol can handle extreme scenarios.

Pricing comes from dual oracles: For real-world assets, Ostium built custom oracle infrastructure with Stork Network. It includes market hours logic, holiday schedules, and contract rollover handling. You can’t exploit stale prices when markets are closed, which is a common attack vector on simpler systems.

For crypto assets, they use Chainlink Data Streams, which provide sub-second price updates. This low latency matters for high-leverage products where price gaps can trigger liquidations.

Trading mechanics are straightforward: Deposit USDC collateral. Select your asset and leverage. Choose your direction. The protocol charges a one-time opening fee (typically 0.03% to 0.15% depending on the asset). No closing fee. Your position stays open as long as you maintain a sufficient margin.

Leverage goes up to 200x on major forex pairs, 100x on commodities and indices. Liquidation happens automatically when your collateral drops below the maintenance margin, typically around a 90% loss at maximum leverage.

For the technical crowd: Ostium uses a shared liquidity model where all assets trade against a single USDC pool. This creates extreme capital efficiency compared to having separate pools per asset. The protocol employs velocity-based funding rates that compound block by block to keep perpetual prices aligned with spot markets. Gelato runs the keeper bots that monitor positions and trigger liquidations.

What Stands Out About Ostium

The genuine strengths:

Over 95% of open interest is in traditional markets, not crypto. That’s the inverse of every other decentralised exchange. They found a specific niche and dominated it.

Zero closing fees create better economics for active traders. Open at 0.10%, close at 0%. Most competitors charge both directions. Over hundreds of trades, that adds up significantly.

Market hours intelligence is built into the Oracle. Traditional markets close. Contracts expire. Holidays happen. Ostium’s infrastructure handles all that programmatically, preventing the exploitation that occurs on simpler perpetual platforms that assume 24/7 markets.

.

When gold rallied recently, Ostium handled 50% of all on-chain gold open interest. Traders wanting exposure chose this platform over competitors.

Strong institutional backing signals a serious long-term commitment. $27.8 million raised from General Catalyst, Jump Crypto, and Coinbase Ventures. Jump is one of the world’s most sophisticated trading firms. Their involvement suggests they see real infrastructure potential.

The tradeoffs

Limited asset coverage compared to competitors. Ostium offers 31 markets. dYdX has 179. Hyperliquid has over 200. If you want to trade obscure altcoins or niche markets, this isn’t the platform.

Single-chain deployment creates dependency on Arbitrum. No multi-chain redundancy yet. If Arbitrum has issues, Ostium goes down with it. High leverage attracts gamblers who often lose. 200x leverage is marketed as a feature, but it’s also how retail traders blow up accounts. The casino element exists whether they acknowledge it or not.

Regulatory uncertainty around synthetic RWAs. Nobody knows how regulators will treat on-chain perpetual contracts for traditional securities. The legal framework is undefined, which creates long-term risk.

Execution depth varies significantly by position size. For trades under $100K, Ostium often executes at zero spread. But a $5 million gold position will face 0.25-0.50% slippage, and $5 million in BTC could run 0.50-1.00%. Compare that to Hyperliquid’s 0.15-0.25% on similar-sized BTC trades. The tradeoff: Ostium is the only decentralised venue where you can trade RWAs at an institutional scale, even if crypto execution isn’t as tight as specialised platforms.

What This Means If It Scales

Traditional CFD brokers process roughly $10 trillion in monthly volume globally. It’s a massive, profitable, and largely opaque industry.

Ostium is attacking that market with a fundamentally different value proposition, which is transparency and self-custody. Every execution is verifiable. Every spread is visible. Nobody can freeze your account during volatility.

If the platform achieves meaningful adoption beyond crypto natives, it could reshape how retail traders access global markets. The current broker model exists because it was the only way to aggregate liquidity and provide leverage before blockchain. That’s no longer true.

Talking about the macro trend, as crypto infrastructure matures, more real-world financial activity migrates on-chain. We’ve seen it with stablecoins, which have proven that dollars work better on blockchain rails than in traditional banking. We’re seeing it with tokenised treasuries, which offer institutional-grade settlement without custody risk.

Ostium extends that logic to active trading. Instead of tokenising the assets, they’re tokenising the exposure. That’s a subtle but essential distinction. You don’t need to move gold on-chain to trade gold on-chain. You just need reliable price feeds and transparent settlement.

The AI agent economy narrative also matters here. As autonomous agents start transacting, they need permissionless access to markets. An AI agent can’t open a brokerage account and pass KYC. But it can hold a wallet and trade on Ostium.

What to Watch Going Forward

Ostium launched a points program on March 31, 2025. They’re distributing at least 500,000 points per week to users based on trading activity, liquidity provision, and referrals. There’s been no official token announcement, but the points structure strongly signals an eventual airdrop.

The roadmap includes a mobile app launch, which could significantly expand the addressable market beyond desktop traders. Additional asset classes are planned, including bonds and more individual equities.

A native token launch is expected in Q1-Q2 2026, introducing governance and potentially additional utility. The team has explicitly stated that their goal is to capture a meaningful share of the $10 trillion global CFD market.

Whether Ostium succeeds in the long term depends on execution across multiple dimensions. Expanding asset coverage, maintaining oracle reliability, navigating regulatory uncertainty, and converting points farmers into actual users who value the product beyond token speculation.

If you’re tired of broker games and want transparent access to global markets, Ostium is worth exploring.

Traditional CFD brokers are black boxes with conflicting incentives. Ostium is transparent code with verifiable execution. For traders who understand leverage and want exposure to macro markets without intermediary risk, that’s a meaningful upgrade.

That’s Ostium. Self-custody trading meets global markets.

Until next time, trade smart.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Wow