PayPal's Stablecoin Play 🎲

PYUSD surges on Solana, overtakes Ethereum supply. Howard Lutnick to lead Donald Trump’s transition team. Brian Armstrong believes LLMs should have crypto wallets. ETFs fight - BlackRock v Grayscale.

Hello, y'all. Unlock your music personality, and test what you’ve got. Do it then 👇

The mainstream payments platforms have made the crypto play this bull run.

Why? Cross-border crypto payments and transparency in transactions.

PayPal: Launched PYUSD stablecoin on Solana, offering incentives for DeFi usage.

Visa: Integrating crypto into payment solutions; promotes stablecoins for business treasury.

Mastercard: Partners with crypto wallets and blockchains for seamless transactions.

Square (Block, Inc.): Offers Bitcoin trading through Cash App, enhancing crypto integration.

Stripe: Introduced fiat-to-crypto checkout widget for easy crypto payments.

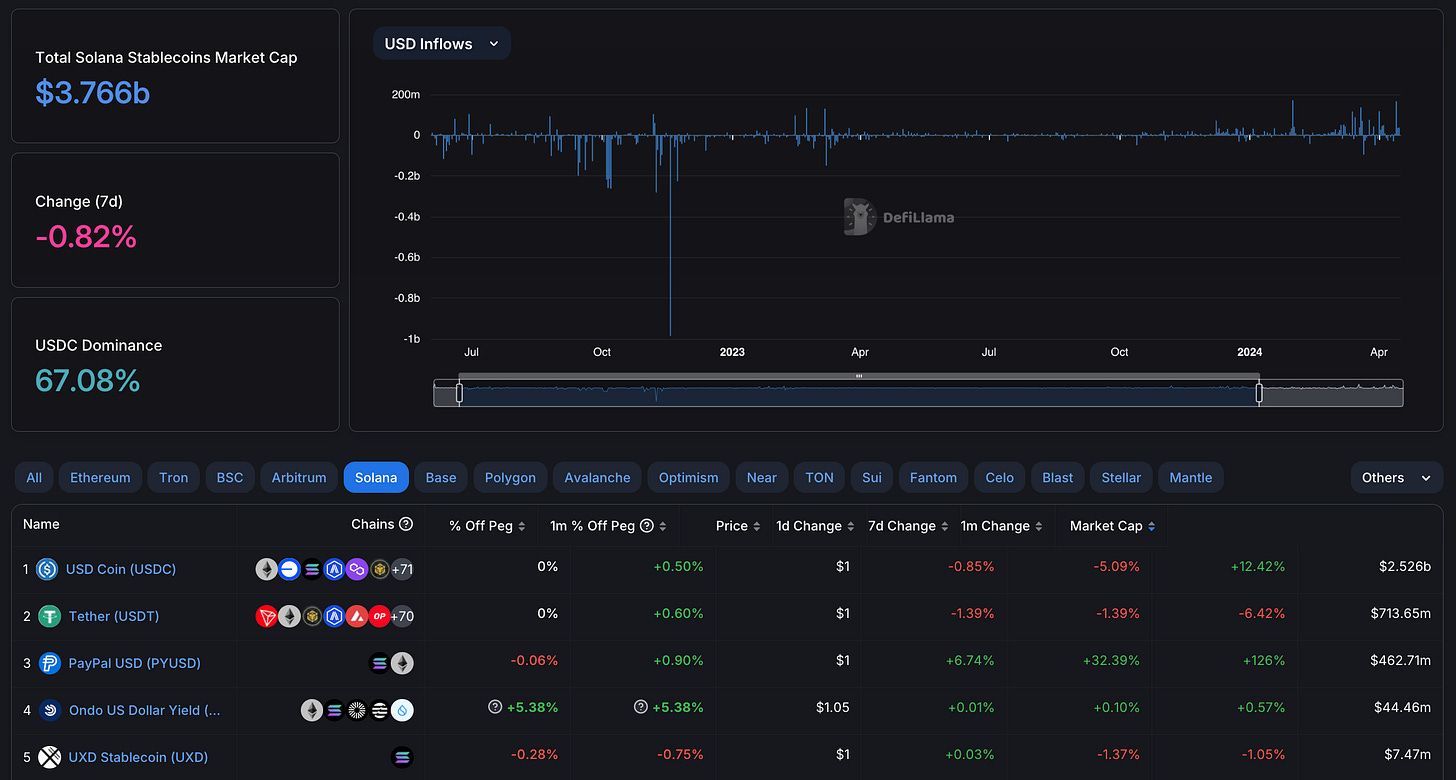

PayPal's stablecoin PYUSD has had a good run this season.

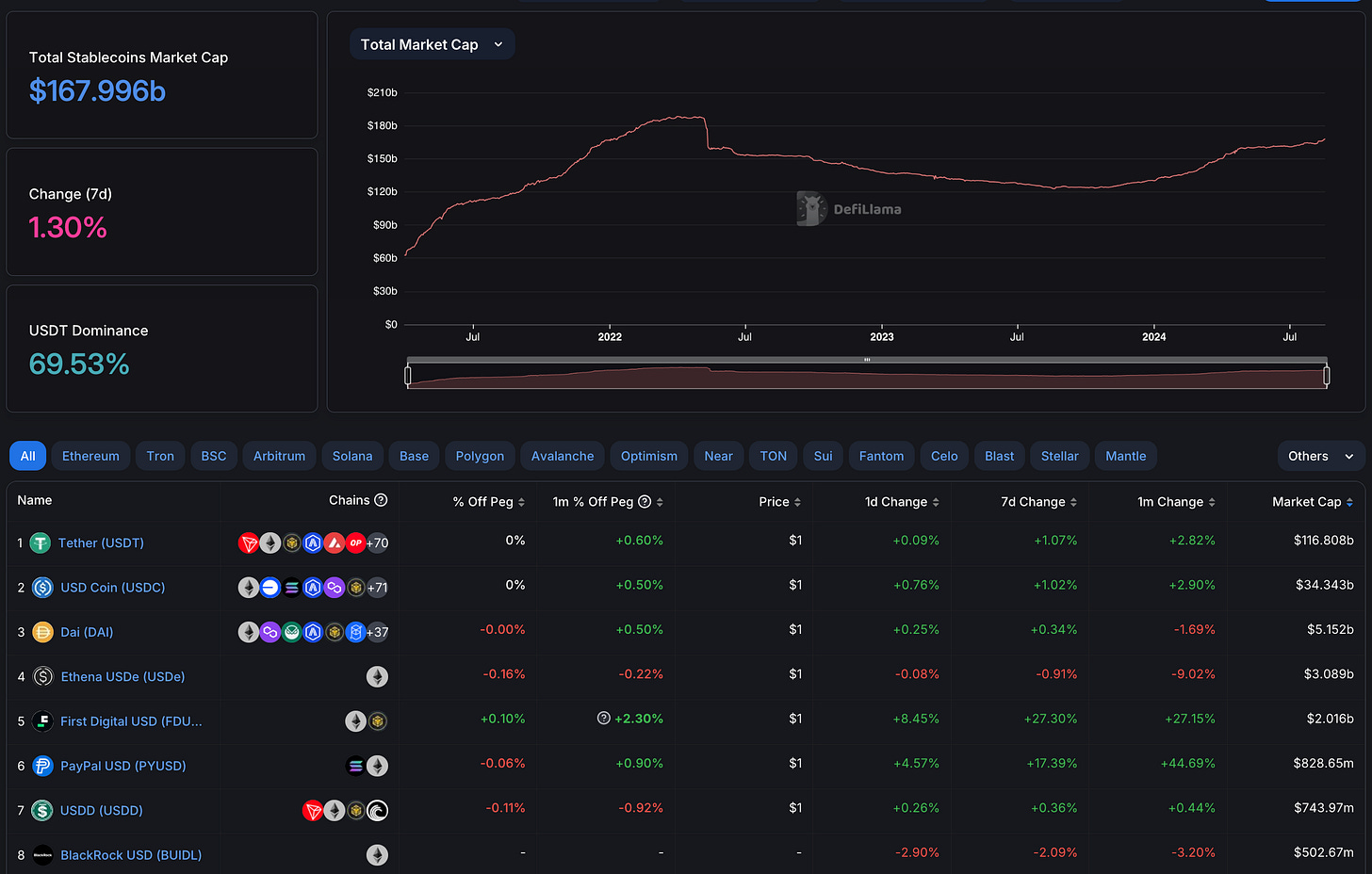

It’s worth over $800 million and is ranked 6th in the top stablecoins list by market cap.

Reason? The Solana play.

PYUSD has grown faster on Solana blockchain, and surpassed its supply on the Ethereum network.

The Solana version of PYUSD now holds over $462 million, compared to $366 million on Ethereum.

Explain with context?

PayPal first launched PYUSD on Ethereum in August 2023.

Hired liquidity management provider Trident Digital to help grow the stablecoin's use.

Stiff competition in the Ethereum stablecoin market has made it difficult for PYUSD to gain traction.

Launching on Solana in May 2024. The move has worked. Focusing on the newer blockchain.

What’s behind the PYUSD adoption on Solana?

Incentives. Simple.

PYUSD's lucrative incentives offered to users who utilise the stablecoin in DeFi protocols.

PayPal provides lending protocol Kamino and trading platform Drift with hundreds of thousands of dollars worth of PYUSD weekly to distribute to users.

Depositing PYUSD on Drift earns over 16% annually, while Kamino offers around 13%, significantly higher than the 3.5% yield on Ethereum's Aave.

PYUSD becomes third-largest Solana stablecoin

The market share has more than doubled over the past month, the third-largest on Solana behind USDC and USDT.

Is this incentive driven growth sustainable?

As forecasted, if the Federal Reserve cuts interest rates in September, it could impact PayPal's ability to maintain the current level of incentives.

But then, if PayPal operates a similar strategy to Tether in terms of holding yield-bearing US Treasury bonds, the amount given out through incentives is likely only a fraction of the overall yield generated.

Still, there is no guarantee on the the long-term sustainability of this growth strategy.

Tim Craig of DL News has an interesting report.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to the fans, fostering a sense of connection that goes beyond mere listening.

Block That Quote 🎙️

Coinbase CEO, Brian Armstrong

“LLMs should have crypto wallets. Let's help AI agents get work done (on your behalf) and participate in the economy.”

Armstrong believes large language models (LLMs) like OpenAI's ChatGPT and Anthropic's Claude could use crypto wallets to step up the finance-related tasks.

Coinbase launched an AI accelerator grant program to award $3,000 to five projects focused on combining AI with crypto wallets.

Engineering lead Yuga Cohler posted a demo showcasing a scenario where an AI system can send payments directly to a user's cryptocurrency wallet after completing a task, similar to Amazon's Mechanical Turk.

The $15,000 accelerator grant program aims to explore use cases for giving AI systems the ability to conduct and receive wallet transactions.

Coinbase is looking for developers to build useful "bots" using LLMs and connectivity to Coinbase's MPC wallets.

The grant is designed to test AI-induced economic applications, as a major barrier to building useful AI applications is the inability of AI agents to have a bank account for automated payments.

Interested developers have until Sep. 5 to submit their applications for the grants.

Howard Lutnick to Lead Trump’s Transition Team

Donald Trump announced that Howard Lutnick, CEO of Cantor Fitzgerald, will co-chair his presidential transition team with Linda McMahon, former head of the Small Business Administration.

J.D. Vance, Trump's vice presidential pick, and his sons, Donald Trump Jr. and Eric Trump, will serve as honorary chairs.

Lutnick's role in Crypto: Cantor Fitzgerald has been a custodian for Tether since late 2021. He has defended Tether, asserting that the company has the necessary funds to back its stablecoin, USDT, amid speculation about its reserves.

Alexander Grieve, vice president of government affairs at Paradigm

"Inclusion of Howard Lutnick is huge for crypto. He personally briefed the House Republican Conference last year on stablecoins, and is a big crypto bull."

Political landscape: Cryptocurrency is becoming a focal point in the 2024 election season, with millions of dollars flowing into super PACs.

Meanwhile, Vice President Kamala Harris has begun outreach to the crypto community, indicating a potential shift in her stance on the issue.

In The Numbers 🔢

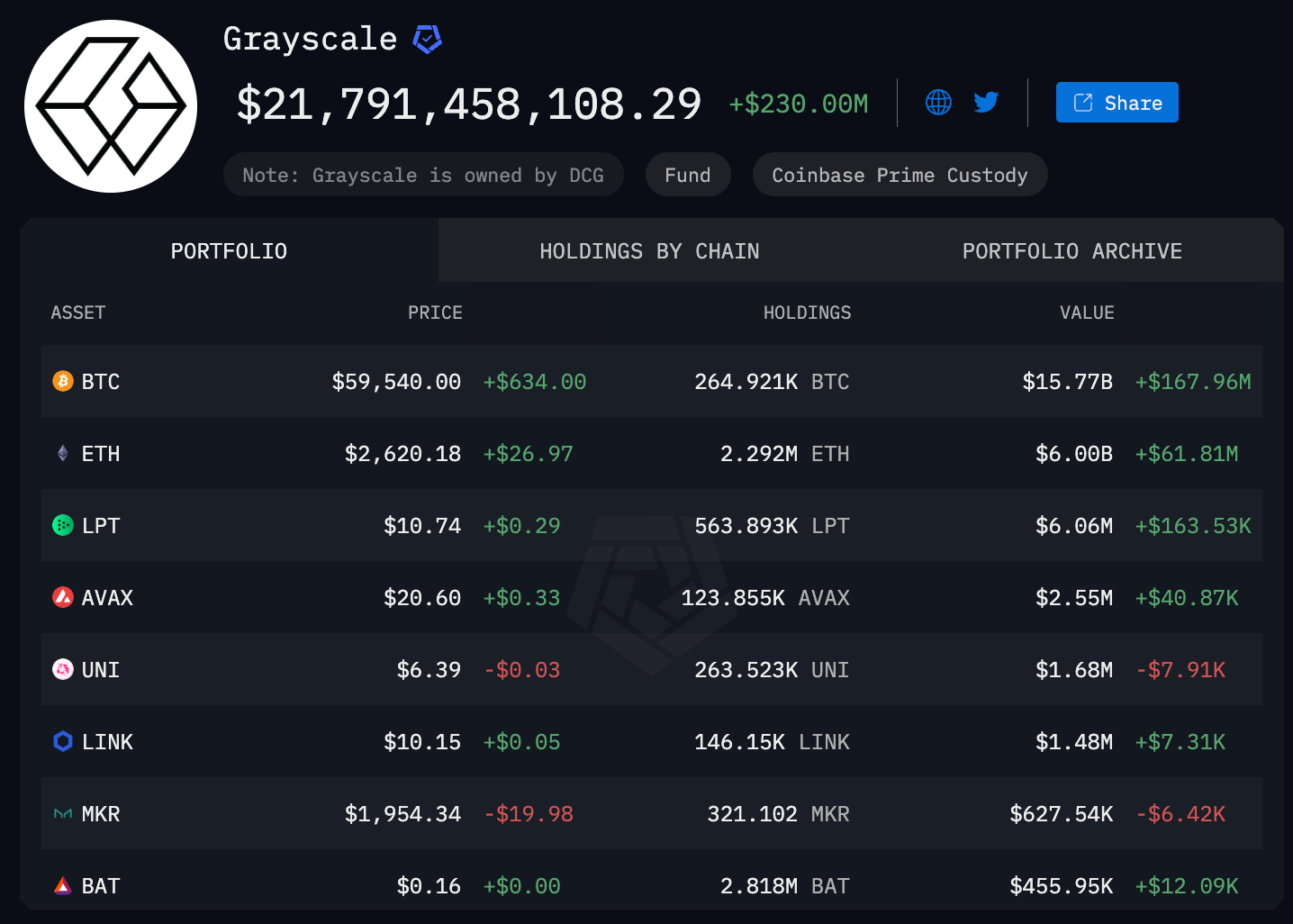

$21 billion

The key number in the battle of crypto ETFs supremacy.

BlackRock ETFs (IBIT and ETHA) and Grayscale ETFs (GBTC, BTC Mini, ETHE, and ETH Mini) are locked around $21+ billion holdings.

Taking turn to be the top of the pile in the crypto ETFs market. Track them here.

Institutional demand for Bitcoin and Ethereum grows

The growing interest in Bitcoin (BTC) and Ethereum (ETH) post ETF approvals has boosted institutional demand and has enhanced confidence of major investors.

Competitive fee structure: BlackRock's ETFs offer a more attractive fee structure, with an expense ratio of 0.25% compared to Grayscale's higher fees of 2.5%.

This has drawn investors looking for lower-cost investment options.

Rapid growth of BlackRock's ETFs: Since the launch of Bitcoin ETFs on January 11, BlackRock has quickly become the third-largest holder of Bitcoin.

This momentum is further supported by the backing of major financial institutions that have invested in BlackRock's products.

Track US spot crypto ETFs - Bitcoin and Ethereum.

Franklin Templeton Files for New Crypto ETF

Franklin Templeton has filed an S-1 form with the U.S. SEC for the Franklin Crypto Index ETF, which will hold Bitcoin and Ether.

Ticker symbol: The ETF will trade under the ticker EZPZ.

Custodian: Coinbase will serve as the digital asset custodian for the fund.

Future additions: The ETF may include additional digital assets in the future, subject to regulatory approval.

This filing follows Hashdex's recent application for a similar ETF, to hold a diversified portfolio of spot cryptocurrencies.

Even though postponed by the regulators, there is a growing institutional interest in crypto investment products.

The Surfer 🏄

Tron becomes the 2nd largest blockchain in stablecoin market share, holding $61.1 billion (37.9%) of the total $161.1 billion, according to Coin Metrics. A 158% year-to-date increase in transfer volume, reaching $58.75 billion.

WazirX has restored investor balances following a $234 million hack. Has not clarified when users can withdraw their funds, leading to growing dissatisfaction from users demanding immediate access to their funds.

Nigerian court has frozen nearly $38 million in crypto donations tied to protests against rising living costs, following a request from the Economic and Financial Crimes Commission. Country’s inflation hits a 28-year high of 33.2%.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋