Hello

I often find myself opening the Polymarket website to check the latest updates on hot news events around the globe. What are the chances of Greenland being occupied by the USA? Or what does the FDV for Monad look like at launch?

Vitalik uses markets as news tools too, and perhaps a lot of other analysts and people around the world have made this shift now. It won’t be long before we see these markets integrated into our existing news feeds and social apps.

In fact, we have yet to hear updates from the X and Polymarket partnership that happened last year. Just in October last year, as part of its humongous $2 billion strategic investment, the Intercontinental Exchange (ICE) - the parent company of NYSE - announced plans to explore monetising Polymarket’s data.

While these feed integrations are still in the works, prediction markets have already made their way into finance apps like Coinbase and Robinhood. Kalshi is entering web3 apps via the Jupiter super app and the Phantom wallet, while Polymarket has partnered with MetaMask and Rabby Wallet.

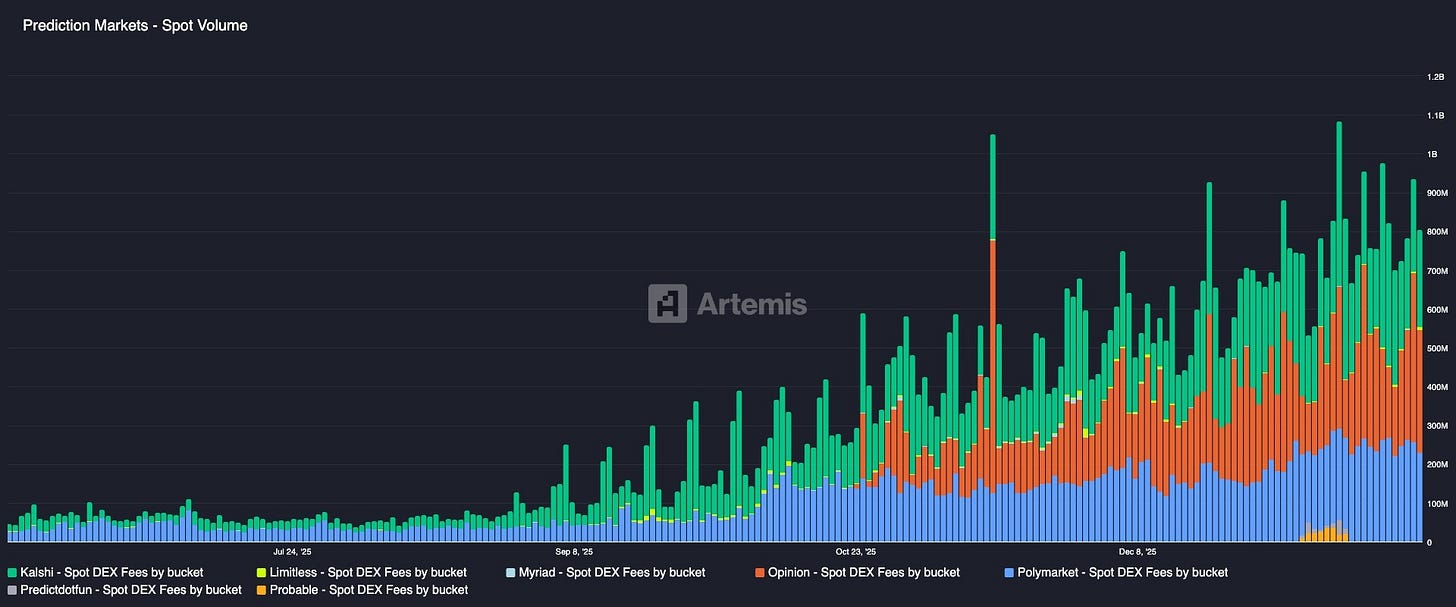

Prediction markets have shown sustained volumes well beyond the election spike. They now handle upwards of $800 million in daily volumes - surpassing Pumpfun’s volumes as of writing, which sits at $775 million.

But today, we are not here to talk about the obvious rise of prediction markets, which should be a given by now. We will be discussing what’s next.

The rise of pump.fun led to an ecosystem of Telegram bots, trading terminals, and a DeFi ecosystem to support the coins. Similarly, we are now seeing the rise of apps that take the idea of prediction markets beyond their current form - lending on prediction market positions, leverage trading of your predictions, opinion markets, decision markets, and much more.

I’m sure all of this sounds strange, but by the end of this article, you will know it all.

Let’s get started!

Galaxy Research recently published “The Shape of Prediction Markets to Come,” which maps out the emerging mechanics beyond basic event prediction and their technicalities. The concepts discussed in their article have inspired this piece, with some personal additions.

Broadly speaking, the next generation of prediction market apps is evolving in three major directions:

Expansion into DeFi through derivatives and lending,

The integration of AI in predicting outcomes and becoming the default interface to interact with them, and

The evolution of prediction markets that go beyond event predictions, including decision-making, opinion-based markets, and markets that predict impacts on asset prices.

DeFi Expansion

Once you have people with varying risk profiles or trading preferences, accommodating all their needs on a single platform becomes challenging. For example, a user who wants to trade or borrow ETH against USDT can’t do so on Uniswap. That’s where Aave or Hyperliquid come in.

Gondor is building a lending platform for prediction market traders. Once funds are deposited, traders can borrow up to 50% USDC against their positions. The borrowed funds are routed directly back to Polymarket and reflected as their “cash balance”.

Through Gondor, traders can unlock otherwise idle equity, maintaining exposure while simultaneously redeploying capital into new trades.

Of course, this comes with rules. The Gondor team manually selects the particular market positions eligible as collateral. These rules ensure that illiquid markets, which are easily manipulated, are excluded from the platform. A few factors determine which markets are whitelisted: the depth of the order book, the clarity of the resolution criteria, and the time until resolution.

The team recently raised $2.5 million in a pre-seed round with participation from Castle Island Ventures, Maven 11, and Prelude. Gondor’s entire existence is a bet that prediction market shares will become a standardised collateral asset class.

Then there’s Space, which enables leverage exposure to event outcomes. Imagine a market for “Will Monad FDV be above $8B at launch” where the “Yes” share price is $0.15 (implying a15% probability). A trader buys 1,000 ‘Yes’ shares – normally this requires $150, but with 5x leverage, only $30 of margin is needed. If the probability rises to 30%, the position will be worth $300, yielding a 500% return on equity on the $30 margin ($150 profit). If the probability falls to 13.33% ($0.13), the trader is liquidated and loses the $30 margin.

Space allows traders to profit even from minor probability shifts. For instance, a person who anticipates a rise in the overall crypto market can wager on the Monad FDV market and profit from a slight increase in its probability.

Not just that, there are many crypto users from memecoin ecosystems, AI coin sagas, and more who trade with the expectation of turning $10 into $1000. For them and for users with strong market knowledge but limited capital to bet, these markets can be an attractive outlet.

AI and Prediction Markets

In his blog on “Info Finance”, Vitalik made some points about using AI in prediction markets.

One of his points was using AI to enable high-quality participation across all micro-markets that would otherwise be too small to attract skilled human traders.

Many of the most interesting prediction markets that can help bring information are on “micro” questions: millions of mini-markets for decisions that individually have relatively low consequences.

Importantly, the incentives to run these agents need not come solely from trading profits. In many cases, agents may be funded by organisations or individuals who value the informational output of the market itself, with trading activity serving as a mechanism for aggregating signals rather than as a standalone revenue source.

This is the type of micro-market where human attention is scarce, but AI attention is abundant. Here, prediction markets begin to look less like gambling products and more like information engines.

AI lowers the cost of participation to nearly zero, allowing markets to produce meaningful signals even when the stakes are tiny. Imagine thousands or millions of small-scale markets operating in parallel, each efficiently priced by AI agents.

The second use of AI is as a default interface layer for prediction markets. As more markets emerge, tracking them across multiple platforms becomes a significant cognitive burden for any trader. AI can instead convert a user’s natural language input into a tradable position. A user could potentially tell the AI that they believe, for example, Silver prices will cross $100/oz by the end of February - and AI can find possible options for the user to profit from this insight - whether it’s silver options or a prediction market for silver prices.

Evolved Prediction Market Designs

Impact Markets

Here’s a weird gap in how markets work today: you can bet on whether something will happen, and you can see what an asset costs right now, but you can’t easily discover what the market thinks that asset will be worth if a specific event happens.

Prediction markets tell you there’s a 60% chance of Trump increasing tariffs in China. Spot markets might show BTC trading at $100,000, but nowhere can you see what the market collectively thinks BTC will trade at, if, and only if, tariffs get imposed.

Impact Markets fixes this. Instead of betting yes/no on events through synthetic tokens, you trade the actual asset in conditional states. You’re basically saying, “I’ll buy BTC at $90,000 (10% below market) if and only if the tariffs get imposed.”

This works for any asset-event pairing. “COIN if Robinhood launches crypto trading,” “Gold if asteroid mining happens by 2030.” You get the idea.

Events and their impacts are fundamentally different things. Prediction markets answer “Will this happen?” Impact Markets answers “What happens to this asset if it does?”

Decision Markets

Decision Markets take this further, from information to action. Instead of just revealing what the market thinks, they let the market decide what an organisation actually does.

This already exists through Futarchy DAOs on platforms like MetaDAO. Here’s how it works:

An organisation proposes a decision - for example, firing its CTO. The market trades two conditional states: Pass and Fail. Each state prices the organisation’s token differently. If the token trades higher in the Pass state, the proposal executes. If it trades higher in Fail, the proposal dies.

The market determines which action maximises expected value. Trades only settle based on the winning outcome.

Opinion Markets

Not every important question has a clean answer. Prediction markets need objective outcomes - “Did X happen?” These outcomes can be verified easily. But many economically relevant questions don’t work that way.

Which Prediction Market has the most mindshare right now? Is sentiment more bullish after Powell’s last speech? These questions influence capital allocation but can’t be resolved with a simple yes/no. That’s where opinion markets come in.

Platforms like Noise.xyz let you speculate on narratives themselves. These aren’t resolved by deterministic oracles or binary rules. They function as continuous sentiment instruments. Prices reflect the market’s collective view at any given moment, not a final “correct” outcome.

You make money if the opinion you bet on rises in price. You lose money if it falls. Simple as that.

Traditional prediction markets are constrained by resolution requirements; questions must be objectively verifiable, unambiguous, and resolvable by trusted data. Opinion markets trade sentiments, which are rather continuous.

The Problems to Consider

Prediction markets are still early, and liquidity runs thin in most markets. You can move share prices 10%+ with a few thousand dollars. When that happens, the probability shown on screen becomes less “what the market thinks” and more “what the last guy with $5,000 thought.”

Only the most liquid markets, such as presidential elections or major sporting events, provide reliable price signals. Everything else is vulnerable to manipulation. Someone with enough capital and conviction can manufacture consensus. When one participates, they can realise it through the constant price swings in some lesser-known markets.

Oracles are another point of failure. Blockchains don’t know what happens in the real world. They need an external infrastructure to feed information into them. Who controls that infrastructure? How do they make decisions? What happens when money depends on their judgment?

This problem surfaced during a Polymarket on ‘Zelensky wearing a suit’. Controversy boiled in the markets when the Oracle ruled it a no despite multiple news agencies reporting he had. The ambiguity arrived in the nature of the suit he had worn, which apparently wasn’t a clear resolution.

Read: When is a Suit Not a Suit?🕴

The people running oracles have financial incentives. Sometimes, those incentives align with accurate reporting. Sometimes, they might not. Or most times, the information itself can turn out to be ambiguous.

As these markets evolve and become mainstream, we will see changes and the platforms maturing to address these issues.

Let’s check back on them in a few months.

Until then, keep predicting,

Nishil

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Brillaint breakdown on where prediction markets are headed. The impact markets concept is genuinely clever because it sidesteps the yes/no limitation and lets people actually price in consequences. I've been tracking conditional market ideas for a while but never seen them articulated this cleanly. The oracle ambiguity problem you flagged is probly the bigges hurdle though.