Pump.fun could evolve to be everything wrong with crypto. A casino where 99% of tokens died and creators vanished with whatever money they could grab.

Something strange happened when they started paying creators to stick around. The platform discovered how to align incentives in ways that "serious" Web3 projects are still struggling with.

This isn't a redemption story about Pump.fun getting respectable. It’s about:

Why chaos might be the best teacher for platform economics

The surprising lessons from paying creators in a speculation economy

What Pump.fun's success reveals about Web3 incentives

It's a case study in how the most chaotic environments often produce the clearest lessons about human behaviour and platform design.

🎭 What Happens When You Pay the Speculators?

Evolution.

Let me start with a confession: I thought Pump.fun was a net negative for crypto. A platform where anyone could launch a token in 30 seconds, most of which would promptly dump to zero? It felt like digital gambling with extra steps.

Read: When Pump.fun Is No Longer Fun 🥵

Turns out they've been tinkering with the formula.

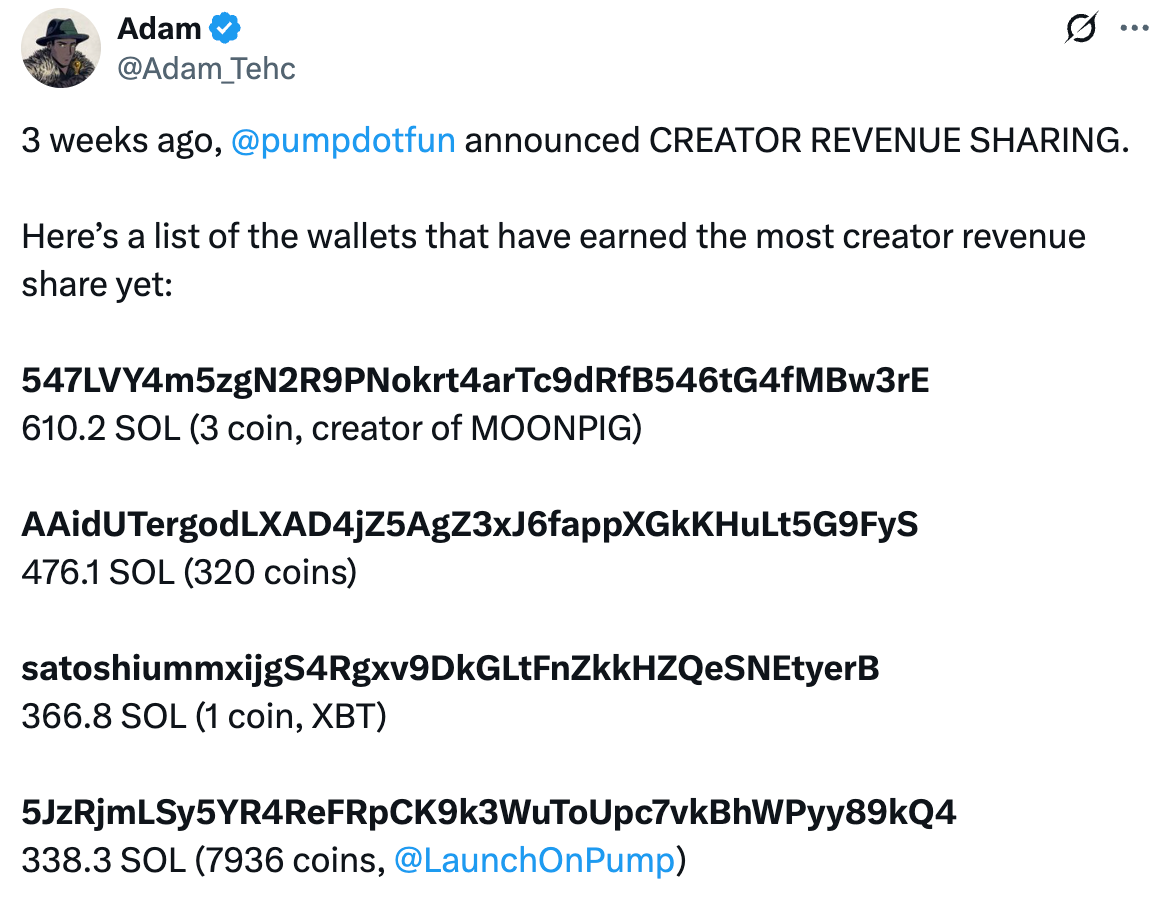

Pump.fun has quietly been building something more interesting than a memecoin slot machine. Since launching creator revenue sharing in May, they've distributed $3 million to token creators in just three weeks.

That's not "we're changing the world" money, but it's "we might have fixed our rug pull problem" money.

The numbers are what they are:

Creators get 0.05% of all trading volume on their tokens

Top creator earned $93,780 in three weeks from a single token (MOONPIG)

Even spam creators are making decent money—one wallet launched 320 mostly failed tokens and still earned $73,300

Here's the thing: Pump.fun didn't set out to build a creator economy. They built a casino, and when the house realised that constant rug pulls were bad for repeat customers, they started paying dealers to stick around longer.

Whether this actually solves anything remains to be seen.

🚀 The Uncomfortable Truth

Most Web3 platforms start with grand theories about decentralisation, community ownership, and revolutionary economics. They spend months crafting tokenomics that look perfect on paper and fail spectacularly in practice.

Pump.fun took the opposite approach: they built a crude casino and iterated based on what actually happened when thousands of people started using it. The result is more honest about human nature than most "thoughtfully designed" platforms.

But here's the timing issue: Pump.fun is launching their $PUMP token just as memecoin mania shows signs of cooling off.

This feels familiar—Blur launched their token right at the peak of NFT volume in February 2023, watched it spike to $5, then crash below $1 as the NFT market collapsed. History has a habit of repeating itself, and platform tokens launched at market peaks rarely end well.

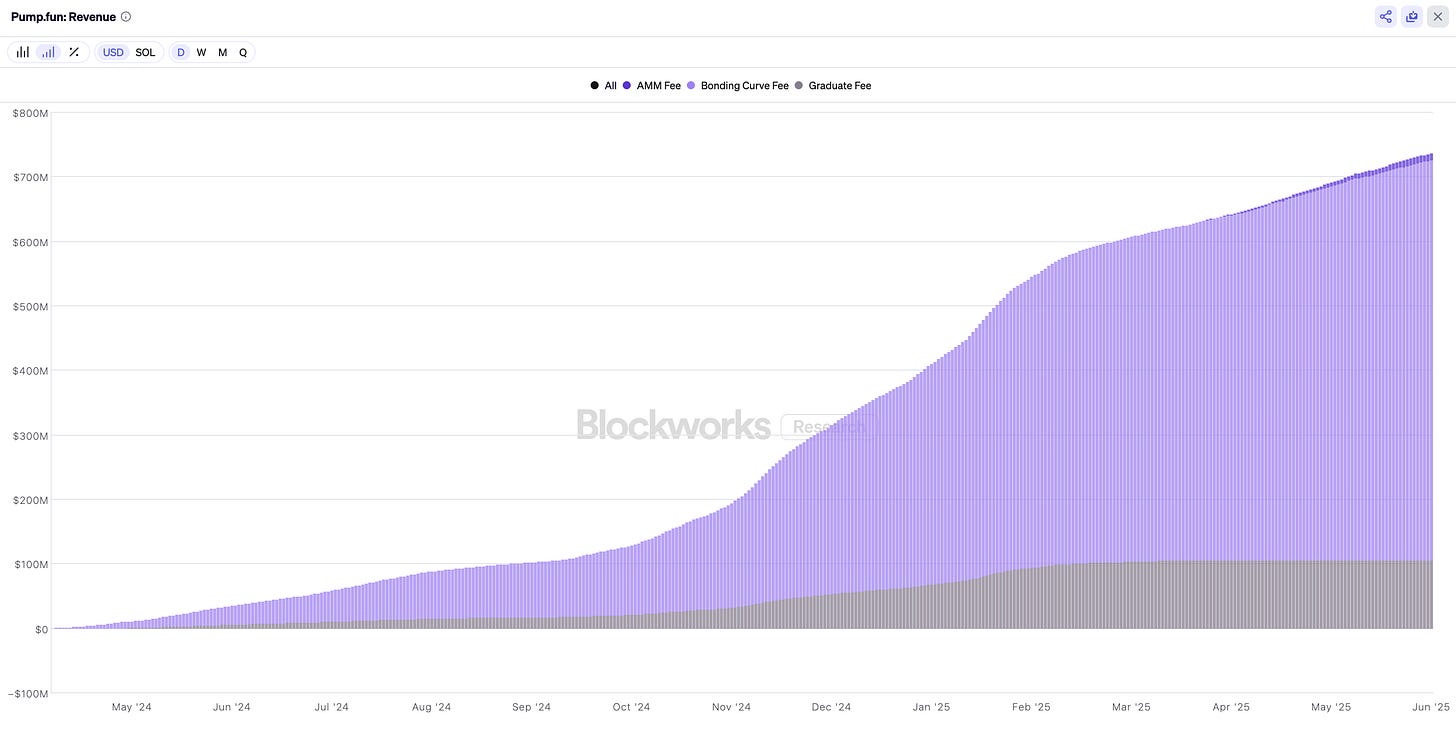

Consider what they've learned by watching $700 million flow through their system: creators need ongoing incentives, not just upfront rewards.

Communities form around shared financial outcomes. Quality matters less than timing and marketing. Simple mechanics work better than complex ones.

Not revolutionary insights, but they're insights that emerged from real behaviour rather than theoretical models. The platform has become an laboratory for studying how people actually interact with token economies when the stakes are real but not life-changing.

📊 The Incentive Experiments

Every change they've made reveals something about human behaviour in crypto markets.

August 2024: Eliminated the $2 token creation fee, shifting the cost to the first buyer instead of the creator.

Result: token creation volume exploded because the barrier to experimentation dropped to zero.

March 2025: Launched PumpSwap, their own DEX. Tokens now automatically migrate there after completing bonding curves.

Result: they gained control over the entire token lifecycle and could capture more value from successful projects.

April 2025: Re-launched live streaming with heavy moderation after dangerous content forced a shutdown.

Result: they learned that giving people cameras and financial incentives requires guardrails, no matter how "decentralised" you want to be.

May 2025: Introduced creator revenue sharing: 0.05% of all trading volume goes to token creators.

Result: creators now have incentive to maintain communities rather than just dump and disappear.

June 2025: Planning to launch $PUMP token with a $1 billion raise at $4 billion valuation. Result: TBD, but it's the ultimate test of whether they can apply their platform learnings to their own token without becoming what they've been profiting from.

Each change was a response to observed behaviour, not philosophical principle. The platform evolved by watching what happened and adjusting accordingly.

But what’s really happening?

Pump.fun has created a system where speculation and creator economics exist in symbiosis rather than opposition.

Traditional creator economy thinking says you need to eliminate speculation to build sustainable communities. Pump.fun suggests the opposite might be true. That speculation can actually fund creator economies if you structure the incentives correctly.

Take the case of NEET coin community funding a Wall Street protest with their creator fees. The speculative trading on their token generated real money that the community used for real-world activities. The speculation wasn't separate from the community building—it was funding the community building.

Or consider the creator who launched 320 mostly failed tokens and still earned $73,300. Traditional thinking would call this spam. But from a platform perspective, this creator provided liquidity, experimentation, and volume. They performed a service even if 99% of their tokens failed.

This challenges the assumption that quality should be rewarded over quantity in early-stage markets. Maybe quantity is quality when you're trying to discover what works.

🎯 The Lessons

The most valuable thing about Pump.fun is what their model reveals about platform design in crypto:

Embrace chaos as data: Instead of trying to prevent "bad" behaviour, design systems that make bad behaviour expensive and good behaviour profitable. Let the market teach you what works.

Align incentives with reality, not ideals: Creators want to make money. Traders want to speculate. Communities want entertainment. Design for what people actually want, not what you think they should want.

Simple mechanics compound: Giving creators 0.05% of trading volume is trivially simple but creates complex emergent behaviours. Complex tokenomics usually create simple behaviours (people dump and leave).

Iteration beats optimisation: Pump.fun's model works not because they designed it perfectly, but because they designed it adaptably. They can experiment with fee structures, creator incentives, and platform features because the core system is simple enough to modify.

The broader lesson is that Web3 platforms might be trying too hard to be respectable. The most interesting innovation often happens in the spaces that traditional finance would consider disreputable.

Most Web3 projects are still trying to build perfect systems. Pump.fun built an imperfect system that learns. In a space moving as fast as crypto, the ability to learn might matter more than the ability to optimise.

That's a lesson worth considering, even if you'd never touch a memecoin with someone else's wallet.

Got questions about a hot crypto topic that you want help understanding? Ask your question using the form and our crypto experts may answer it along with your name in our weekly News Rollups.

The Week That Was 🗓️

Meta is partnering with defense contractor Anduril to develop AI-powered mixed-reality headsets for the US military.

Crypto gaming startup Orange Cap Games (OCG) has acquired the intellectual property (IP) for the Moonbirds, Mythics, and Oddities NFT collections from Yuga Labs.

Polygon-based NFTs have achieved over $2 billion in all-time sales volume, showing consistent monthly growth throughout 2025.

A Manhattan federal court has temporarily frozen approximately $57.65 million worth of USDC stablecoin, allegedly tied to the controversial Libra memecoin.

Bubblemaps has launched the public version of its v2 product with new tools to help detect insider activity and prevent memecoin scams.

Performance art duo Operator is using NFTs to make "movement collectible" as an art object.

Guests and registrants of the recent Trump memecoin gala dinner received limited-edition Solana-based NFTs as "historic collector's items."

Art of the Day 🖼️

Voronoi Variegata by autoeclectus

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.