Hello

Welcome to our weekly macro-economic column.

It was supposed to be the week of the pivot. The US Federal Reserve had cut interest rates by 25 basis points, marking its first cut since December 2024, bringing the range down to 4-4.25%. As anticipated, the market’s reaction was as expected - nothing more, nothing less.

Fed Chair Jerome Powell was careful in his press conference. The labour market is weakening, inflation remains above target, and the committee is divided on the extent of future rate cuts. One member even voted for a 50-basis-point cut, but the median view was clear: the Fed is easing cautiously.

The September 17 rate comes after three earlier trims in late 2024: a surprise 50bps cut in September, followed by 25bps each in November and December. Back then, markets cheered. Equities surged through Q4, gold pushed steadily higher, and even Bitcoin rode the wave — climbing from ~$63,000 in mid-September to over $106,000 by year-end. Liquidity mattered, and crypto behaved like a high-beta extension of risk assets.

But the script has shifted this time.

We find out as we dive into week 38 of 2025: September 15-21.

Crypto Investing Sans Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

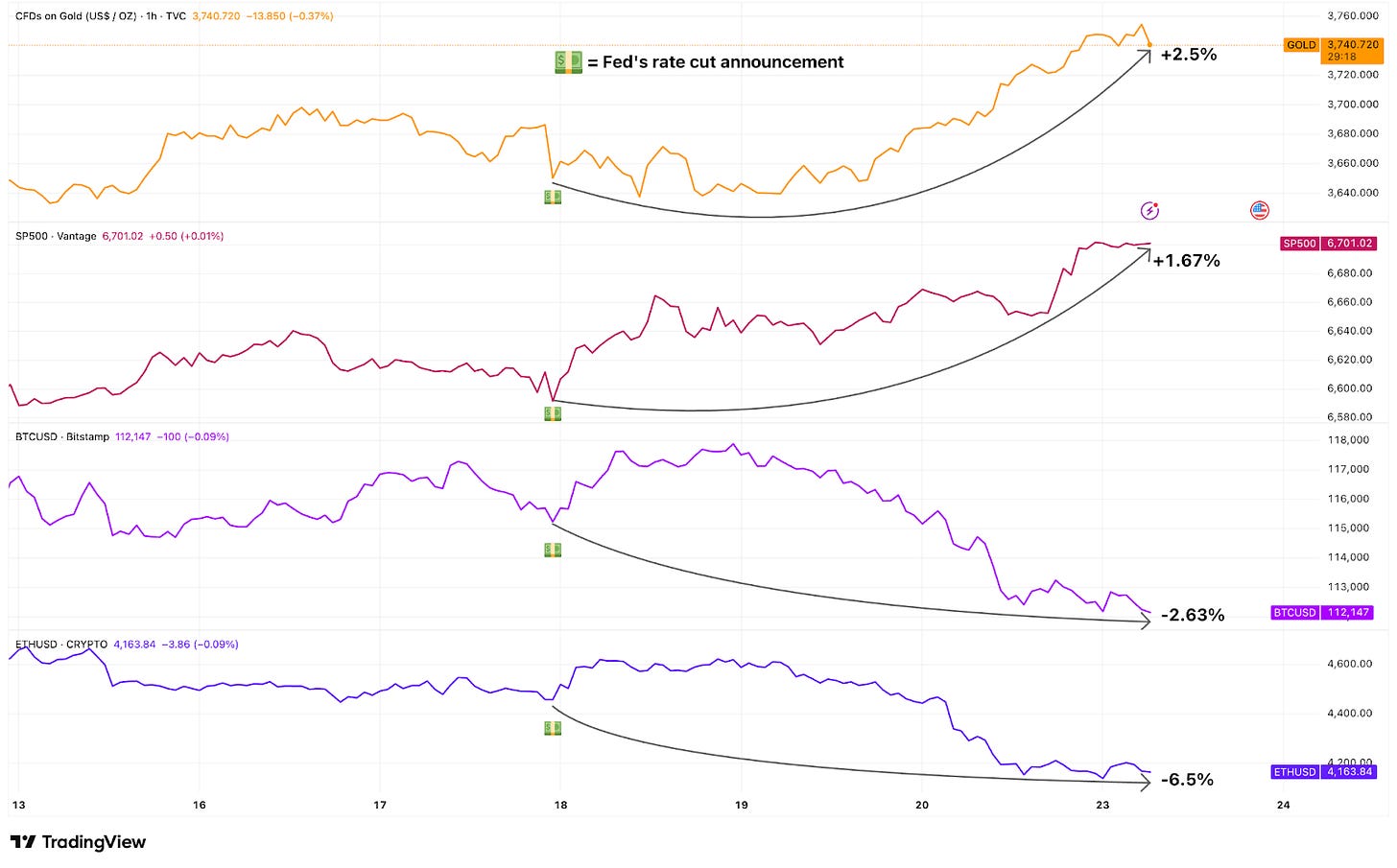

I have seen rate cuts as rocket fuel for risk assets. Wall Street seemed to get the message: equities hit record highs, and gold surged higher. Bitcoin, however, didn’t quite catch the bus.

The contrast becomes sharper when you lay today’s reaction against those earlier episodes: in 2024, rate cuts unleashed risk appetite across the board. In 2025, crypto alone has slipped into reverse gear.

I want to express Bitcoin’s journey last week more effectively. I will try.

Both the S&P 500 and Nasdaq rallied after the rate cut announcement last Wednesday and have since surged to new all-time highs. While Gold initially slipped 1% in the 24 hours after the cut, it has since rallied 3% to $3,752/ounce, setting a new record. It was one of those rare weeks where both risk assets and safe havens rallied together, except for crypto.

Investors across asset classes became optimistic about liquidity loosening. Bitcoin and Ether initially responded by rallying in the first 24 hours following the rate cut. However, they soon diverged. As gold and equities continued to climb through the rest of the week, bitcoin and Ether pulled away. By Monday, bitcoin had dropped more than 2.5%, while Ether was down over 6%.

Interestingly, the assets with the highest beta to liquidity actually lagged.

On the equities and traditional assets front, we saw a textbook response — lower rates and record highs. However, for crypto, the market seems to have lost momentum. Crypto didn’t just stumble — it actively sold off when the rate cut should have buoyed it.

So, what could explain the divergence?

Sell the News?

The Fed’s move wasn’t really a surprise. The CME FedWatch tool had predicted a 95% probability of at least a 25 basis-point rate cut leading up to the Federal Open Market Committee (FOMC) meeting. Markets had already moved. Equities, too, had rallied in anticipation. Both the Nasdaq and S&P 500 had climbed over 2% in the first two weeks of September. Bitcoin had moved from $108,000 to over $117,000 in the same period. By the time the rate cut came, there was little shock.

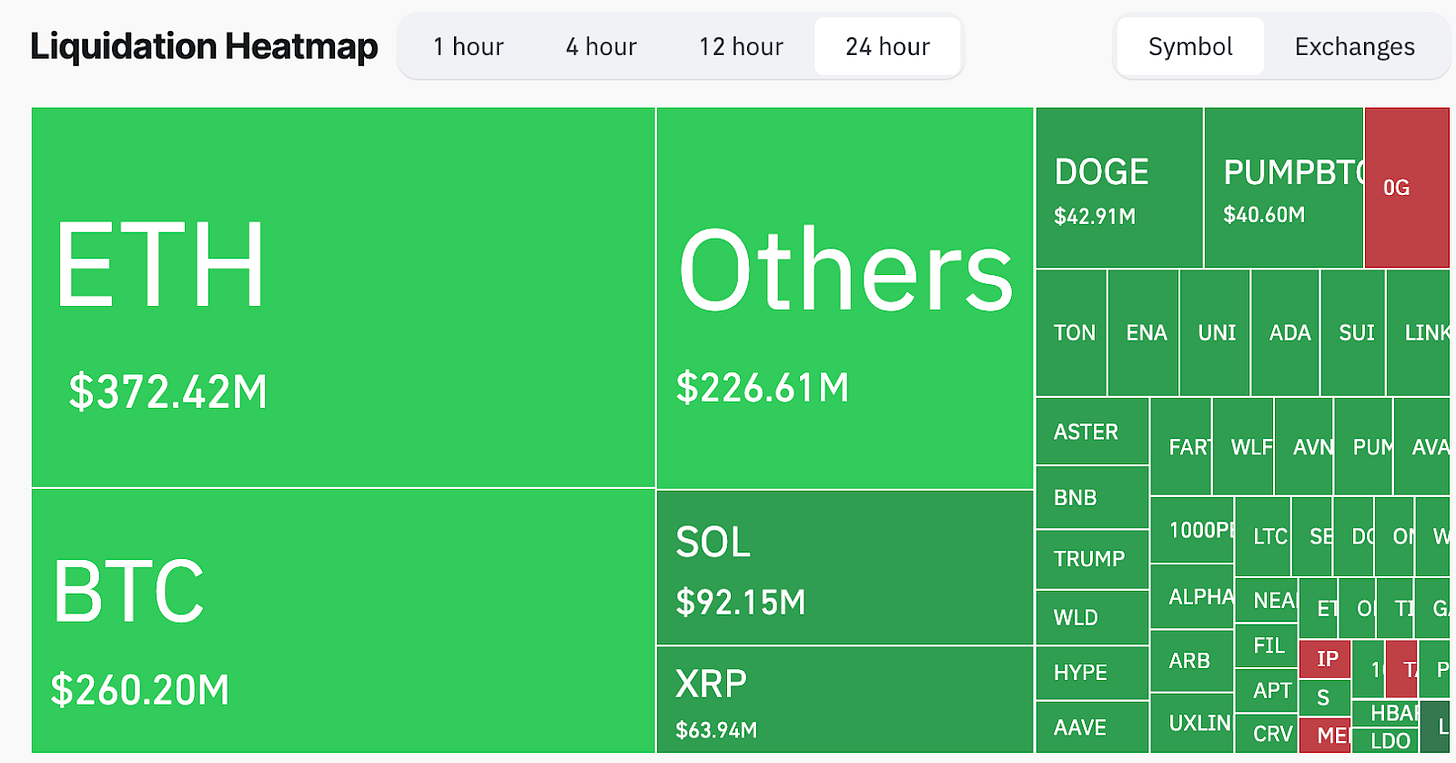

Yet, while equities’ rally lost little momentum, the crypto markets across Bitcoin, Ethereum, and Solana broke down into a sell-off. In the last 24 hours, crypto liquidations totalled $1.44 billion with over 350,000 traders’ positions being wiped out.

The divergent response to the rate cut is not limited to crypto and traditional markets — it is also present within the crypto market itself. Institutions have continued to pour in, with both Bitcoin and Ethereum ETFs seeing net positive flows last week, despite experiencing outflows on the day of the rate cut announcement.

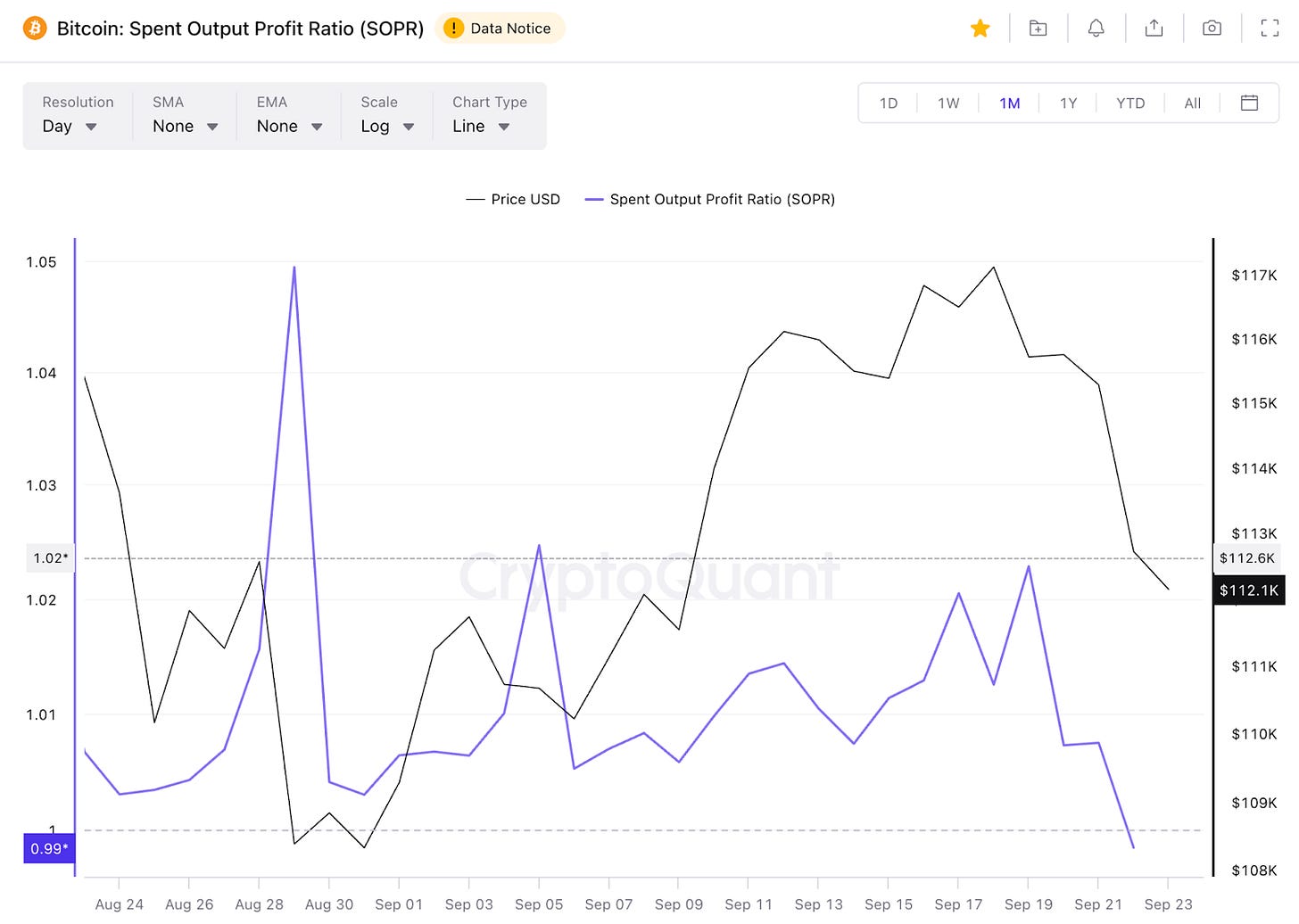

On-chain data also shows a cautious picture.

The Spent Output Profit Ratio (SOPR) slipped below 1, meaning coins are being sold at a loss — a very different backdrop from late 2024, when SOPR was comfortably above 1 as holders realised steady profits.

However, as Bitcoin dropped from $117,000 to $112,000, SOPR fell back below one on Monday, signalling that the ability to sell at a profit is fading. Long-term holders, who had been distributing into strength earlier in the month, are now less active. The market finds itself in an awkward middle ground: neither distressed nor showing firm conviction.

This stands in stark contrast to gold, where conviction seems to get stronger.

Gold prices rose as a hedge against long-term uncertainty, especially after Powell acknowledged weak jobs data and persistent inflationary pressures. This explains why bullion pushed higher even as crypto lost momentum.

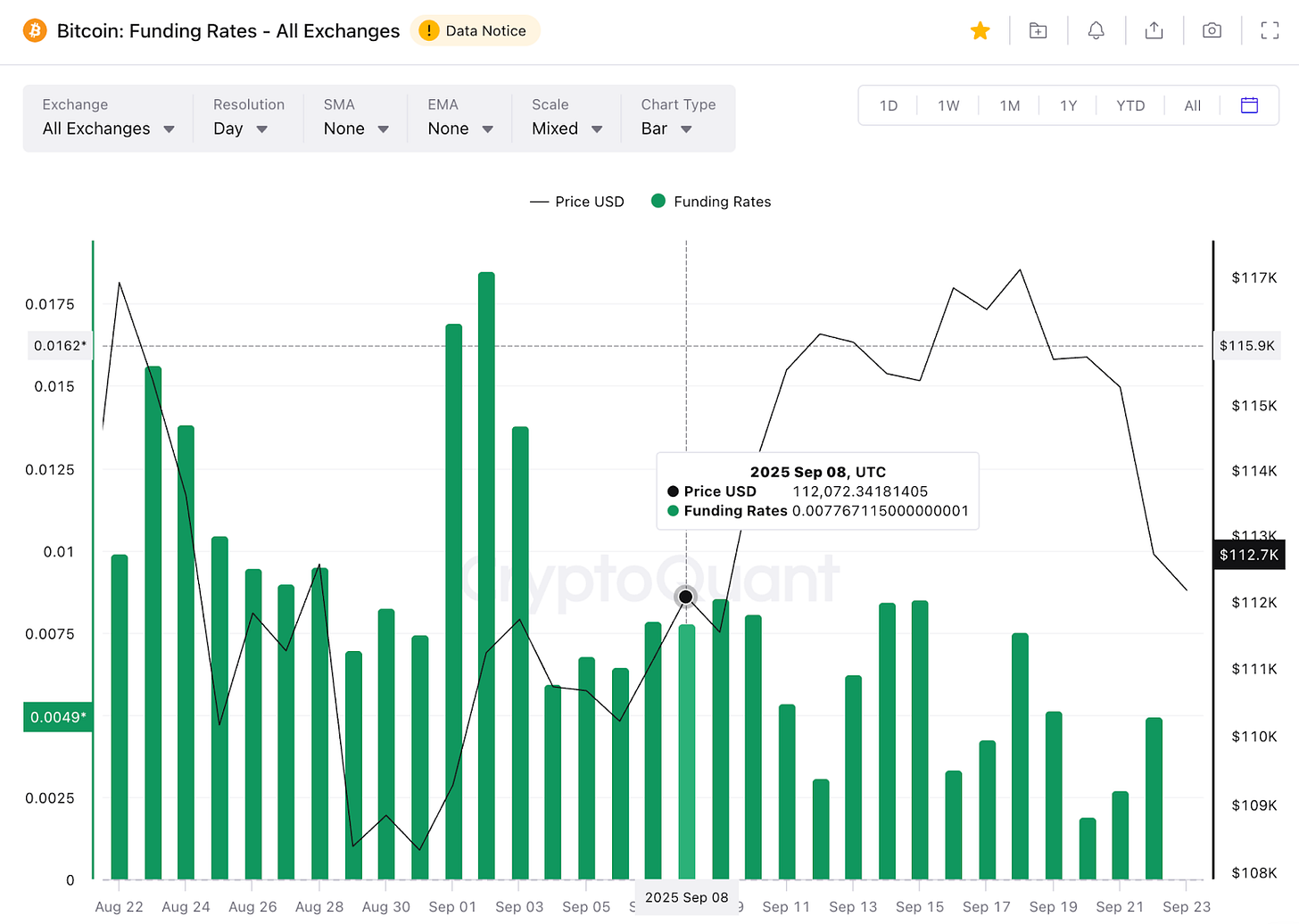

The caution is equally evident in derivatives.

Funding rates, which reflect how much traders are paying to hold leveraged positions, cooled sharply after the Fed’s decision.

The same macro catalyst, lower rates, is meeting a different microstructure. In late 2024, crypto still had room to run. In late 2025, it looks more like a market digesting exhaustion.

When we look at the fading SOPR, declining funding rates, and cascading liquidations, it paints a clear picture of weakening momentum. The institutional bid remains active in ETFs, but the speculative layer that typically amplifies these flows is absent. This explains why Bitcoin looks heavy at $117,000 while gold continues to ascend.

The sudden crypto sell-off is intriguing, but not entirely unexpected in terms of its behaviour.

Each time headlines about new trade restrictions rattled equities in the past quarter, the S&P and global risk appetite showed slight jitters. Gold played its role as a hedge. But Bitcoin held its ground, triggering conversations around decoupling. Now, comparing it with last week’s response, we see similar unexplained anomaly behaviour from the crypto market.

None of these explanations is entirely convincing. Maybe we don’t fully understand what’s driving the sell-off. But what we cannot contend with is the on-chain and off-chain data. ETF flows were positive but lower after the rate cuts last week. This week started with significant outflows for both Bitcoin and Ethereum Spot ETFs. The on-chain metrics we discussed earlier have also worsened this week.

Meanwhile, equities and gold continued their ascent on Monday. Fed Chair Powell’s speech on Tuesday could provide further clarity and direction to the overall markets.

Also, keep an eye on the data for the Personal Consumption Expenditure (PCE) index and initial jobless claims due this week.

That’s it for this week’s macro and news analysis.

I’ll see you next week.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.