Rayls Brings Banks to Blockchain ⛓️

The infrastructure that connects $100 trillion in traditional finance to DeFi

There’s a specific kind of friction that costs the global financial system billions of dollars every year, and most bank users have no idea it exists.

When you wire money internationally, it doesn’t actually move. Not in the traditional sense. Instead, it’s a multi-day game of telephone between correspondent banks, each maintaining their own separate ledger, each adding their own fees, each introducing their own delays. Your money sits in limbo while SWIFT messages ping back and forth, while compliance officers manually check sanctions lists, while settlement systems that were built in the 1970s slowly reconcile who owes what to whom.

This is how the system was designed. Every bank runs its own database. Every transaction between banks requires reconciliation. Every cross-border payment involves multiple intermediaries because banks in different countries can’t see each other’s ledgers. The infrastructure works, technically. It’s just incredibly, expensively, and dangerously slow.

The blockchain pitch has always been - we can fix this. One shared ledger. Instant settlement. No intermediaries. Just put everything on Ethereum and watch the friction disappear.

Except banks can’t do that. They can’t put customer deposits on a public blockchain where anyone can see transaction amounts. They can’t route payments through a network where a sanctioned wallet might be the next validator. They can’t operate on infrastructure where gas fees swing wildly based on NFT mania or DeFi liquidation cascades. They can’t explain to regulators why they’re trusting billions of dollars to a system secured by pseudonymous validators in unknown jurisdictions.

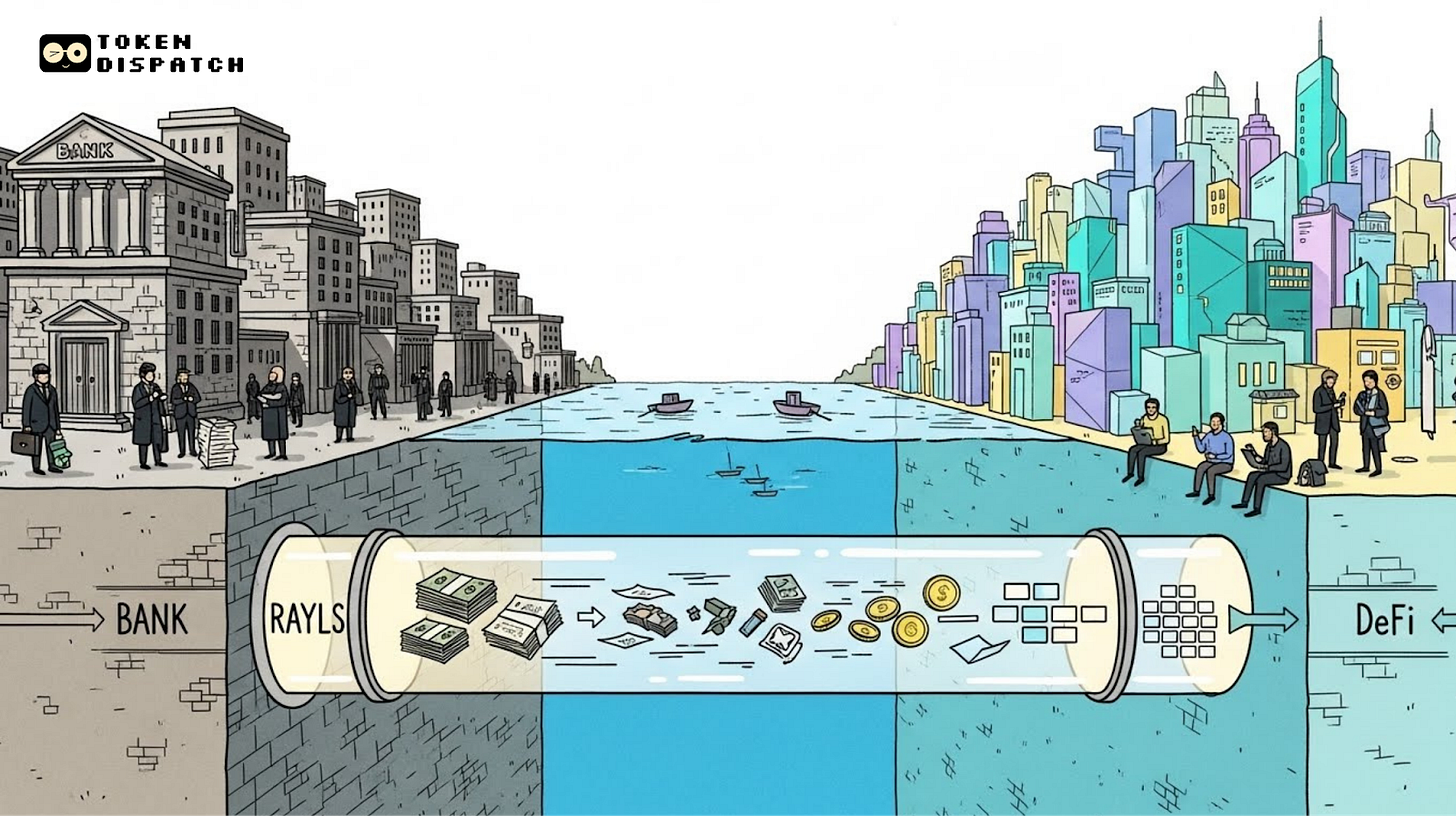

So we’ve spent a decade in a stalemate. Blockchain developers built incredible technology that banks won’t touch. Banks ran proof-of-concept pilots on private blockchains that never connected to anything. The $100 trillion sitting in traditional finance stayed trapped in the old system, while liquidity in DeFi remained siloed in its own ecosystem.

Rayls thinks it’s figured out how to end the standoff.

When Privacy Isn’t Optional

The core problem isn’t technical. Blockchains work. The problem is that what makes a blockchain useful for DeFi (transparency, permissionlessness, shared state) is exactly what makes it unusable for banks.

Put differently, a bank can’t operate on Ethereum mainnet for the same reason you wouldn’t conduct surgery in a public park. It’s not that the park is badly designed. It’s that r surgery requires conditions like “sterile environment,” “privacy,” and “controlled access,” none of which a park provides.

Banks have similar non-negotiable requirements. When JPMorgan settles a $500 million bond trade with Goldman Sachs, they can’t broadcast the transaction details to the entire world. When Citibank moves dollars for a corporate client, they can’t reveal the client’s cash position to competitors. When a central bank pilots a digital currency, it absolutely cannot expose monetary policy operations or systemic liquidity flows to public inspection.

This isn’t about banks being old-fashioned or paranoid. This is about the law. Bank Secrecy Act. GDPR. Sanctions compliance. Securities regulations. The entire regulatory framework of modern finance assumes that sensitive information remains private.

Previous attempts to solve this fell into two camps, both failures. The first camp tried to build bank-specific blockchains: Hyperledger, R3 Corda, JP Morgan’s Quorum. These systems gave banks the privacy they needed but they recreated the original problem, which is isolated databases that don’t communicate with each other. You’d end up with thousands of private chains, each a walled garden, each requiring custom integration, each missing the whole point of blockchain’s shared state.

The second camp tried to bolt privacy onto public chains after the fact: Tornado Cash. Aztec. Secret Network. These had the opposite problem, they connected to shared liquidity, but the privacy mechanisms were add-ons, afterthoughts, often incomplete or legally suspect. Regulators banned Tornado Cash. Institutions stayed away.

Rayls’ answer is architecturally different. It starts with privacy as the foundation, then connects to public markets as the final step.

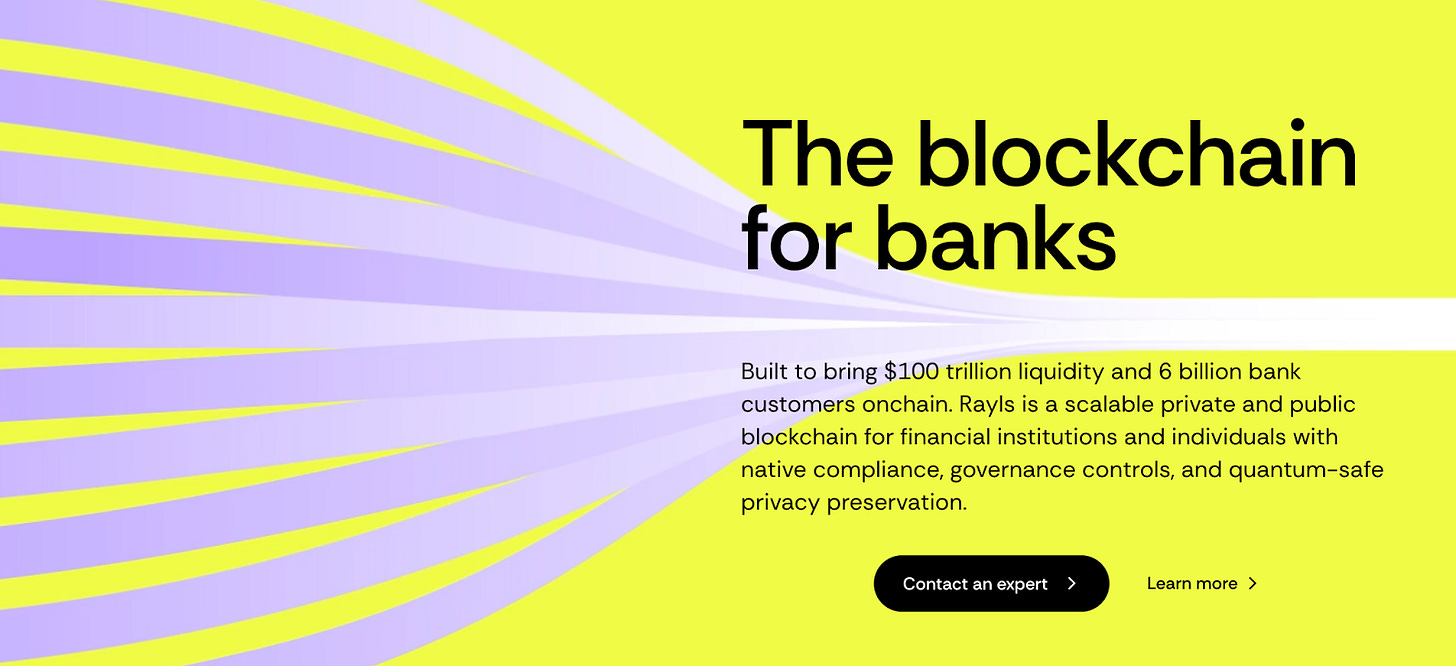

What Is Rayls?

Rayls is a blockchain ecosystem purpose-built for financial institutions to operate on-chain while maintaining the privacy, compliance, and control they legally require.

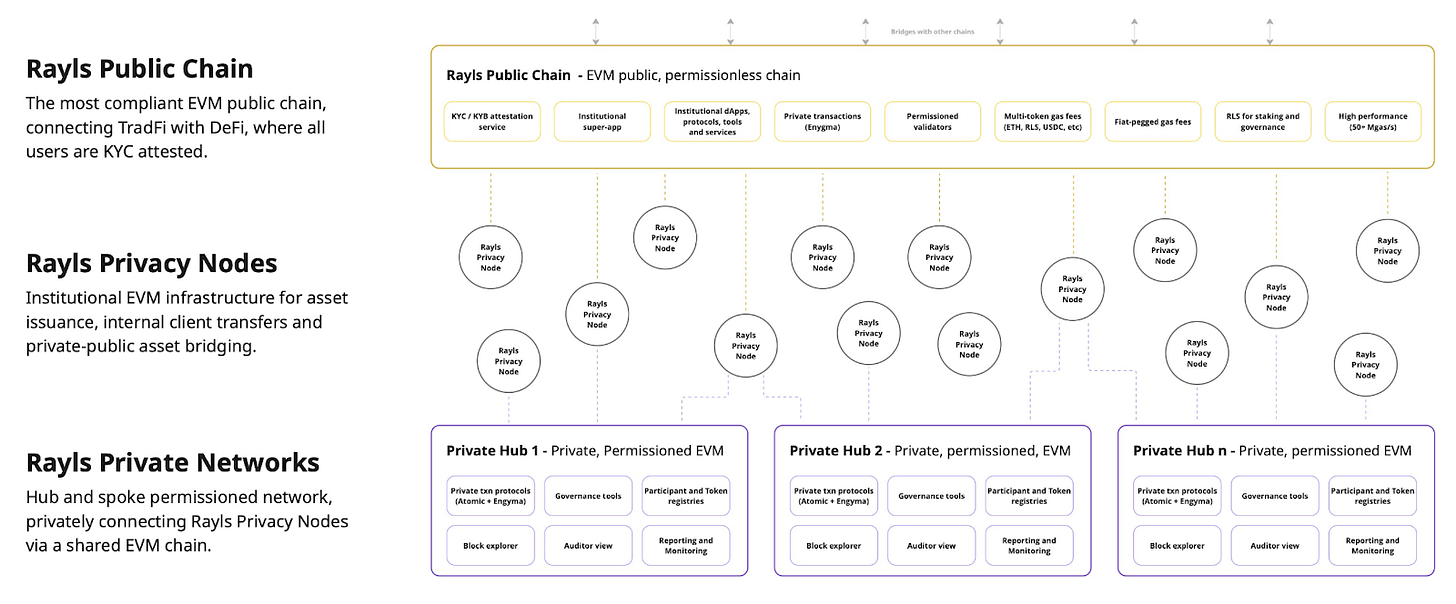

A three-layer system:

Layer 1 - Privacy Nodes: Each bank gets its own private blockchain running inside their infrastructure. They tokenise assets, manage customer accounts, and handle internal operations exactly like they do today, except everything’s programmable and on-chain. Nobody outside the bank sees this data.

Layer 2 - Private Networks: Multiple banks connect their Privacy Nodes into permissioned networks for interbank transactions. Ten banks want to settle payments among themselves? They form a private consortium where only members can see activity, but they all share one ledger for instant settlement.

Layer 3 - Public Chain: The Rayls public blockchain connects everything to the broader DeFi ecosystem. When institutions want to tap global liquidity, issue assets to retail investors, or access DeFi protocols, they bridge through here. But unlike Ethereum, every participant on Rayls must pass KYC verification.

All three layers run on EVM, so standard Ethereum tools and smart contracts just work. But the architecture is designed specifically for institutions rather than being a public chain trying to bolt on compliance afterward.

Rayls gives banks a path to modernise without disrupting their compliance frameworks.

For banks: You can tokenise everything. Customer deposits become programmable tokens. Bonds, loans, receivables, all on-chain, instantly transferable, while maintaining complete privacy from competitors and full regulatory compliance.

For DeFi users and protocols: Institutional money has mostly stayed on the sidelines because public chains can’t meet compliance requirements. Rayls changes that. Banks bringing tokenised treasuries, corporate bonds, and yield-bearing assets on-chain means DeFi users can finally access regulated, lower-risk instruments that have never been available globally.

The use cases are already live:

Núclea (Brazil’s largest financial market infrastructure) is using Rayls to tokenise commercial receivables, with over 10,000 assets registered weekly. These are real invoices from real businesses, now tradeable on-chain with complete fraud prevention because ownership is immutably recorded.

Central Bank of Brazil selected Rayls for their CBDC pilot program (DREX). Sixteen of Brazil’s largest banks are using Rayls to test digital currency settlement with privacy intact. When Bank A trades with Bank B, other banks in the network can’t see the transaction details, but the central bank maintains full oversight.

Cielo (largest payment acquirer in Latin America) is tokenising merchant settlements. Instead of waiting days for card payments to clear, merchants get instant tokenised value they can use immediately or trade for liquidity.

The Quantum-Safe Privacy Layer

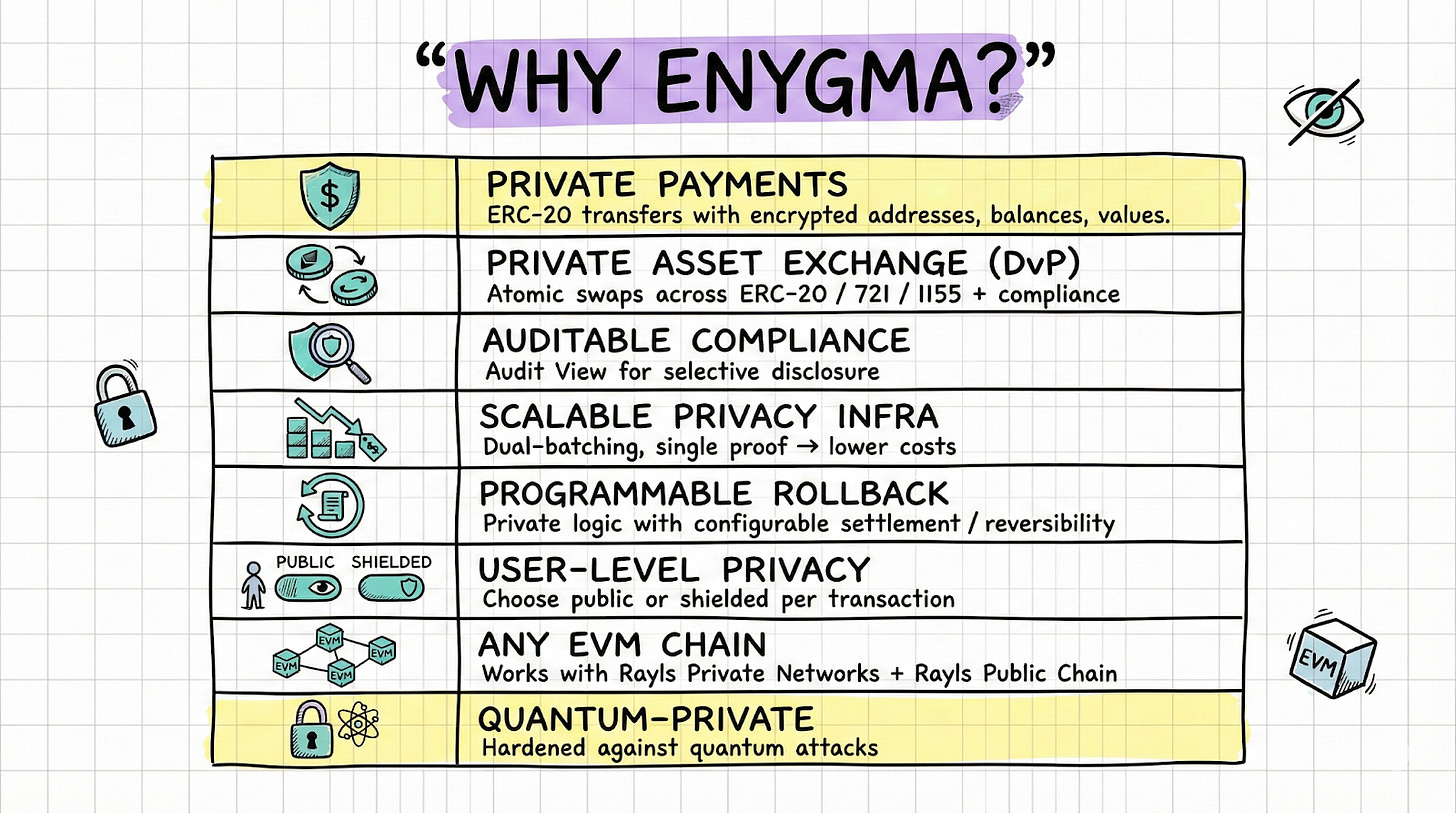

Most discussions about blockchain privacy focus on hiding transaction amounts or wallet addresses. Rayls goes several layers deeper with something called Enygma, which is a privacy protocol designed specifically for institutional requirements.

Enygma combines zero-knowledge proofs with homomorphic encryption, which means a smart contract can verify that Bank A has sufficient funds to make a payment without knowing Bank A’s total balance. A regulator can audit whether transactions comply with AML rules without seeing individual customer details.

Here’s the detail that reveals how seriously Rayls is thinking about institutional timelines - Enygma is quantum-resistant. Most blockchains use elliptic curve cryptography, which works great until quantum computers become powerful enough to break it. For a bank issuing a 30-year bond, this matters. The bond’s terms can be public, but the ownership records, trading history, and settlement details need to stay confidential for decades. You can’t tokenize long-duration assets on infrastructure where a future quantum computer could expose who bought what, when, and for how much.

The protocol also includes selective disclosure, which solves a problem that’s killed previous privacy solutions. With Tornado Cash, transactions were completely opaque. With public Ethereum, transactions are completely transparent. Banks need something in between. Enygma lets institutions generate view keys that allow specific parties (auditors, regulators, counterparties) to view transaction details without breaking privacy for everyone else.

The Token Economics

Most utility tokens introduce volatility that makes them unusable for enterprises. If Ethereum gas costs $5 today and $50 tomorrow due to a DeFi liquidation cascade, you can’t run predictable operations on top of it.

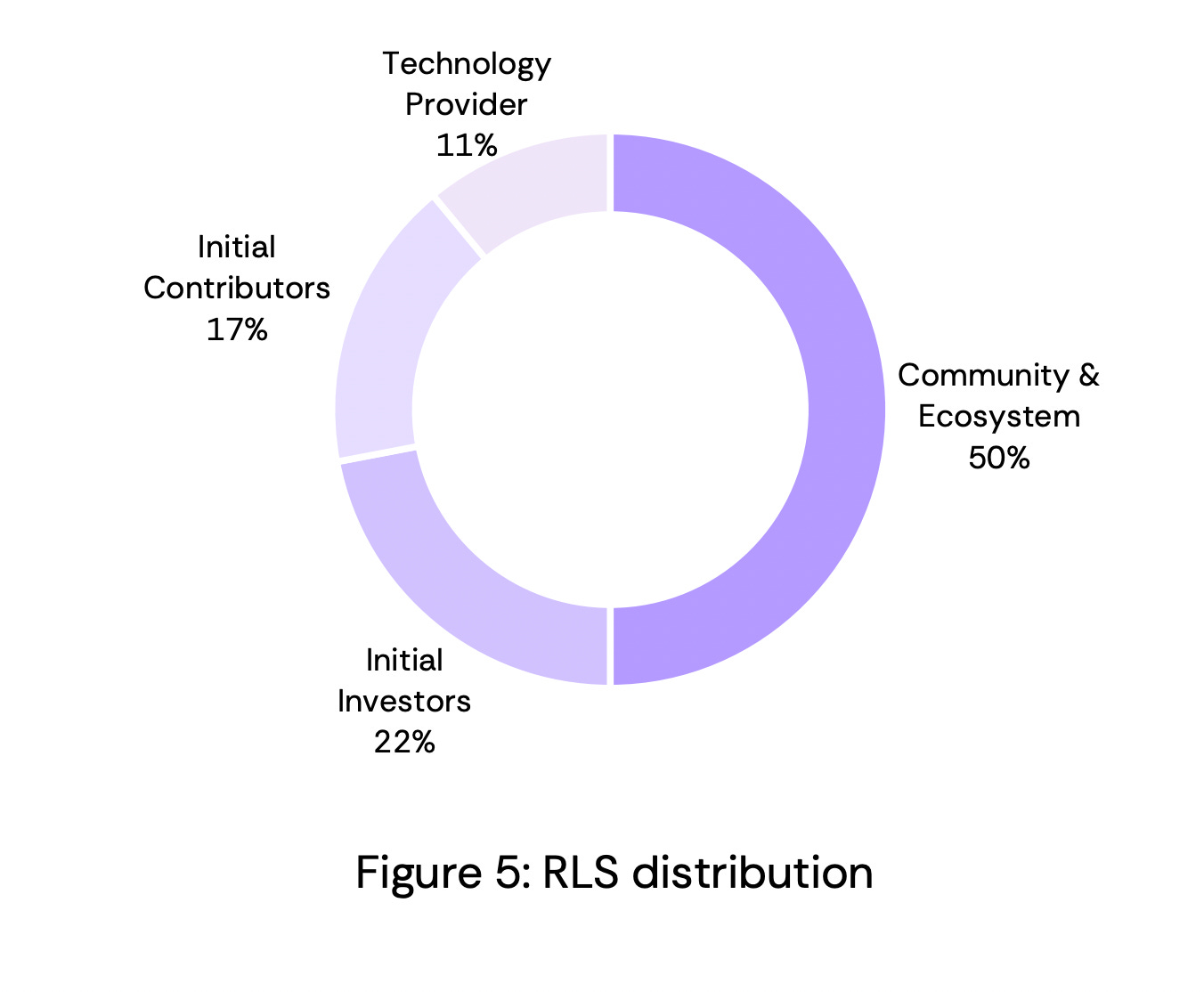

Rayls solves this with a dual-token system. Users pay transaction fees in USDr, which is pegged to the dollar. A transaction costs $0.01, not “0.01 RLS” where RLS might be worth $0.01 today and $0.03 tomorrow. This provides institutions with the cost predictability they need.

Behind the scenes, USDr payments are converted into RLS, the native token. The protocol buys RLS on the open market with collected fees, then burns 50% immediately. The remaining 50% goes to validators. Every transaction creates buy pressure for RLS while reducing the total supply. More usage equals more demand plus less supply.

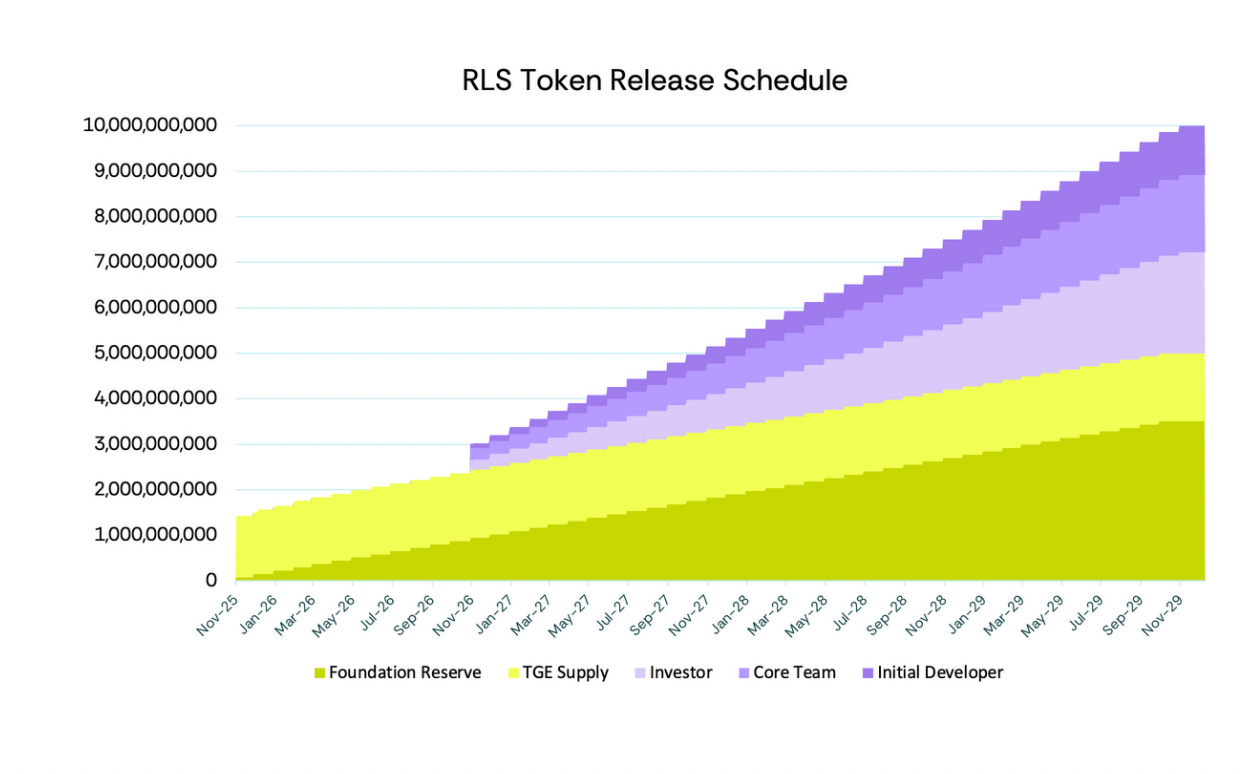

RLS has a fixed supply of 10 billion tokens. No new tokens can be minted. As transaction volume scales, the burn accelerates. Even Privacy Node transactions, though “gasless” from the institution’s perspective, must be settled in RLS on the public chain. Every bank running a Privacy Node is effectively a buyer of RLS.

From an investor’s perspective, this creates an interesting asymmetry. You’re not just betting on DeFi users adopting another Layer 1. You’re betting on banks adopting private blockchain infrastructure and connecting it to public markets. The more institutional adoption happens behind closed doors, the more it benefits public token holders.

Why This Might Actually Work

Enterprise blockchain has been “coming next year” for a decade. Most pilots went nowhere. Rayls has a few things working in its favor that previous attempts didn’t.

First, it’s already in production with Núclea, Animoca Brands and Cielo, partnering with.

Second, the timing is better. BlackRock’s BUIDL fund has scaled to over $1 billion. The tokenised fund market has quadrupled in the past year to over $7 billion. Major institutions are asking which infrastructure to use.

Third, the regulatory environment is shifting. The US just legalised stablecoins through the GENIUS Act. The EU is implementing MiCA. Central banks in Brazil, Singapore, and Switzerland are actively piloting CBDCs. Rayls was designed to fit inside this emerging regulatory framework from day one.

Fourth, the team isn’t crypto-native founders trying to understand banking. It’s bank executives who learned blockchain. The CEO spent 25 years at BTG Pactual, Latin America’s largest investment bank. They built Rayls to pass institutional procurement, not to win hackathons.

The skeptical read is that this is still trying to bridge two incompatible worlds. That banks will never fully embrace public blockchains no matter how much privacy you add. That regulatory capture will neuter anything interesting about the technology.

The bullish read is that we’re watching the early infrastructure for a genuine convergence. That the $100 trillion in traditional finance will eventually migrate on-chain because the efficiency gains are too large to ignore. That when it does, it’ll happen on infrastructure that connects both worlds, and Rayls has a legitimate shot at being that infrastructure.

That’s Rayls. The bridge banks can actually use.

Until next time, keep building.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.