Recap: Decentralisation, But Make It BlackRock 🪨

On blockchain rails, proprietary control, and the $68 trillion infrastructure trick

Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

We are still in that sparkly limbo where the lights are up, the year is technically ending, and everyone is half-working, half-watching some background movie they have already seen ten times. If last day was Home Alone energy, this one feels more like The Holiday. Two very different houses, everyone doing a life swap, and only realising halfway through what they actually signed up for.

It is a good time to think about tokenisation. On paper, it is a cosy “house swap” story: your boring cash gets a new life funding vital infrastructure, you get a cute dashboard and a better yield, everyone wins. In practice, as I argued in this piece, it looks more like handing the keys of both houses to BlackRock and hoping they send you nice photos.

So today’s rewind is: Decentralisation, But Make It BlackRock.

Back in November, I wrote about BlackRock’s tokenisation push as a kind of dystopian genius. The thesis was simple: take a technology that was supposed to route around giant asset managers, then use it to centralise even more of the flow through one stack. Put boring, illiquid infrastructure on proprietary “blockchain” rails, slice it up, call it liquid, and watch retail savings trickle into 30-year projects they would never have touched directly.

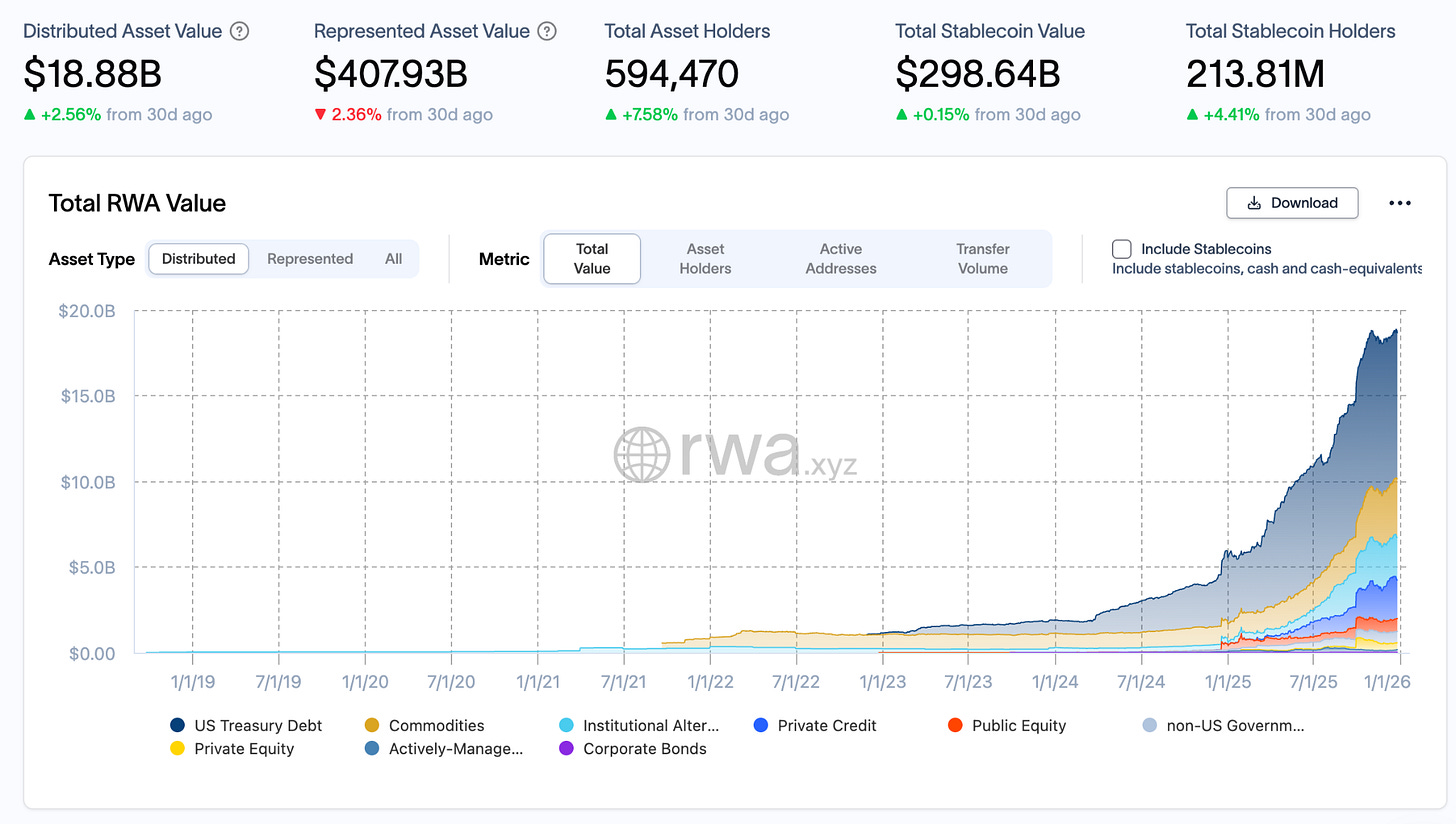

Since then, the “how’s it going” answer is: disturbingly well. BlackRock’s BUIDL fund has become the dominant tokenised Treasury product, crossing roughly $2.9 billion in AUM by mid-2025 and helping push total tokenised RWAs from under $1 billion in early 2024 to well over $10–18 billion in TVL.

In November, BlackRock and Securitize even expanded BUIDL to BNB Chain using Wormhole, framing it as “interoperability” while keeping the core machinery firmly in their own orbit.

At the same time, Larry Fink and Rob Goldstein now talk about tokenisation as a present reality rather than a future maybe, pointing to a 300% surge in on-chain RWAs over twenty months. Real-world asset reports are casually throwing around $500B–$3T tokenisation forecasts for 2030, and infrastructure, private credit and funds are always at the top of the list.

So going into 2026, tokenisation is happening, and BlackRock is not just “participating”, it is writing the rails, the rulebook and the index rules. The decentralisation is in the marketing. The power is still very much in one very large counting house.

That’s it from me for today’s rewind. I’ll be back soon with another 2025 throwback.

Until then, happy holidays.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.