Recap: The Money Lives Where Your Wealth Lives

On blockchain rails, proprietary control, and the $68 trillion infrastructure trick

Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

It is 31st December, which means two things are happening at once. One part of your brain is thinking about resolutions and outfits, the other part is quietly opening every app that has ever held your money this year. Exchange, neobank, card, DeFi dashboard, that one random yield thing you swore you would close after “just a month”.

If 2024 was about “number go up”, 2025 was very much about “where does my money actually live now”. Not in a single bank account, but scattered across cards, wallets, points, restaking, yield boxes, and “cash” balances that are suspiciously invested in T-bills.

Crypto neobanks are probably my favourite narrative of 2025, even though I am still a little sceptical of all of them. They sit right in the middle of this mess. One app that promises to be your account, your card, your bridge between chain and rent. A nicer front end for the question everyone is asking today anyway: where does my wealth sleep at night, and what is it secretly doing while I am out watching fireworks?

So for the last Dispatch of the year, it feels right to rewind to that story: The Money Lives Where Your Wealth Lives.

In that piece, I argued that most people like spending money to sit near their wealth. If your net worth lives at a brokerage, your “cash” quietly lives there too. If more of your wealth lives on-chain, you want a card, an app, and a “checking account” that speaks that language. Crypto neobanks are just productising that mental accounting.

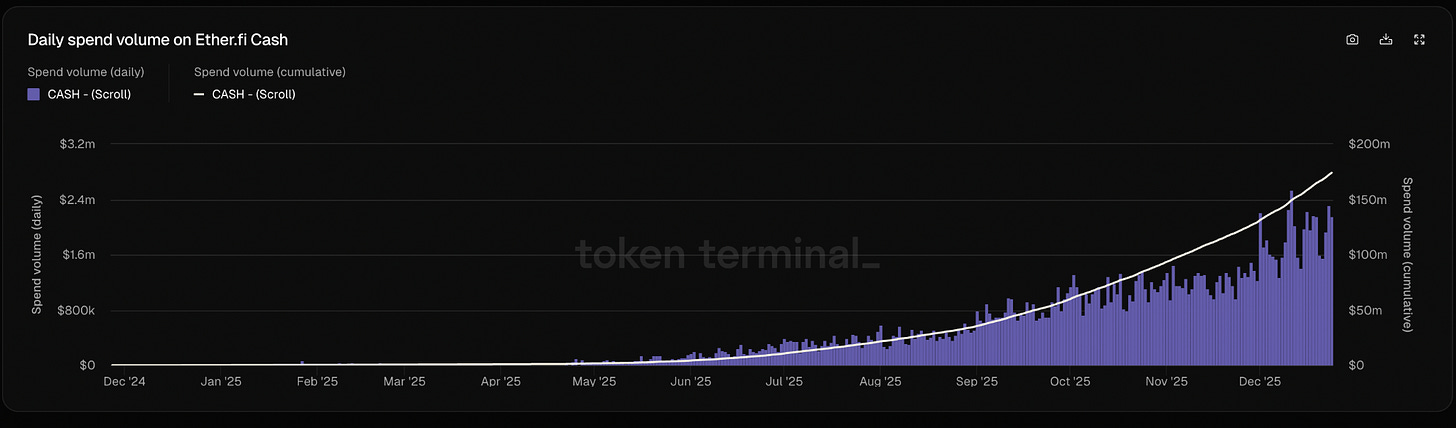

Since then, the idea has stopped being a vibe and turned into numbers. EtherFi Cash is now the poster child for “DeFi neobank”: non-custodial wallet on one side, normal card rails on the other, and restaked ETH humming underneath. As of late December, EtherFi Cash is doing around $13.9 million in weekly spend and has processed roughly $174 million in total volume, with the curve still bending up.

Zoom out beyond crypto and the whole neobank category is doing its own hockey stick. Recent industry forecasts put the global neobanking market at roughly $382.8 billion in 2025, heading to about $552 billion in 2026, with transaction values on track to push toward $10 trillion by 2028. Nearly 400 million people are expected to be using neobanks by then, and about two-thirds of revenue is already coming from business and SME accounts rather than cute consumer cards.

Crypto industry forecasts now talk about blockchain neobanks managing up to $3 trillion in assets by 2030, treating them as a distinct segment rather than a side quest. Crypto-first banking startups are raising serious money at multi-billion valuations to become the “stable, regulated, crypto-friendly” home for companies that no longer trust traditional banks to keep their accounts open. And consumer-facing apps are converging on the same template. Stablecoin balances that feel like checking accounts, yield products that feel like savings, instant cards on top, and a quiet assumption that your real wealth sits on-chain underneath.

So, how is it going now. The line from that original piece – that “the money lives where your wealth lives” – looks more true on 31 December than when I wrote it. I am just not sure yet whether these neobanks will end up genuinely belonging to users, or whether they slowly resolve into the same old stack of card networks, Treasuries and a small group of very powerful intermediaries wearing nicer UX.

That is what I will be watching in 2026. See you soon with another Recap.

Happy New Year’s Eve.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.