Recap: The Yield Is The Virus 💸

When money becomes programmable, everyone wants to control the code

Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

We are in that soft, slightly unreal week of the year where the Christmas lights are still on, nobody is fully sure what day it is, and every “back to work” plan somehow involves lying on the sofa with a screen nearby. The markets are open, but our brains are very much on holiday hours.

In my head, this week always looks a bit like Home Alone on TV for the hundredth time. The house is chaotic and overfull, everyone is talking over each other, and then suddenly it is quiet and chilly and you are just… there, wandering around with too much time and too many thoughts. The burglars and paint cans are optional. The feeling of being accidentally left alone with your own house – and your own mess – is not.

So for the last few days of 2025, we are doing a little “home alone with our stories” thing at Dispatch. Revisiting a few pieces from this year that still feel important, checking what changed since, and asking what they might mean for 2026.

Which brings me back to one of my favourite pieces of the year: The Yield Is The Virus.

Back then I argued that once you show people the yield on stablecoins, it behaves like a contagion. If T-bills are throwing off 4–5%, nobody wants to hold a dollar that pays zero. Issuers want the spread, platforms want the spread, banks want the spread, users want “rewards”. The real game is not about technology, it is about who gets to keep the interest on the float.

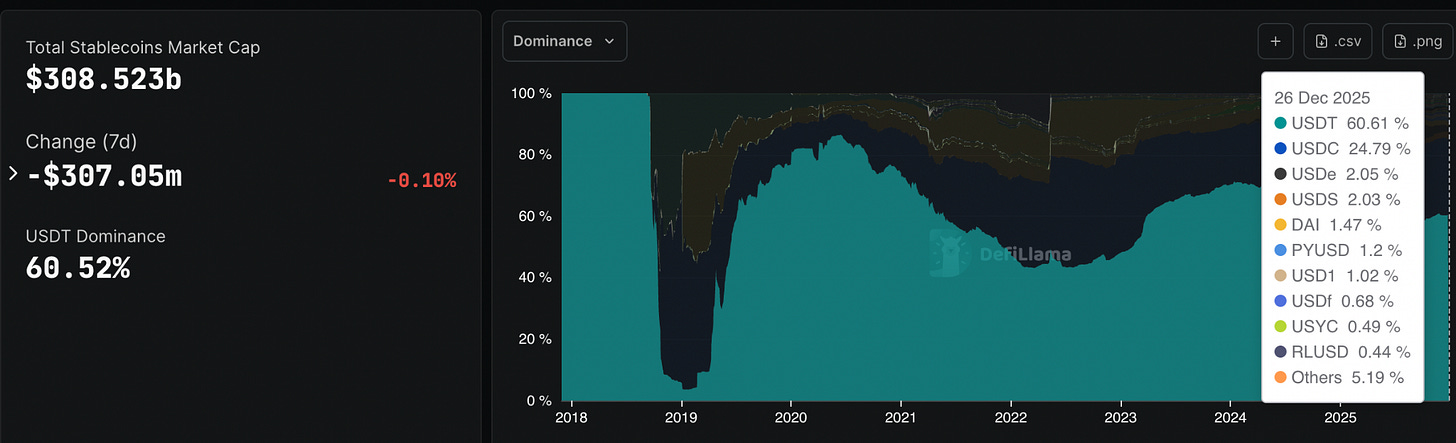

While banks and regulators fight over the wording of “interest”, the market has shifted. Tether and Circle’s combined market share peaked at about 91.6% of all stablecoins in March 2024. By December 2025, it is closer to 85% – roughly 60.6% USDT plus 24.8% USDC – even as total supply climbs above $308B.

The reason is not just yield coins like USDe and USDS. Issuing a stablecoin has become cheaper and more modular, and with the FDIC now proposing a formal process for banks to issue payment stablecoins through subsidiaries, every serious platform and a growing number of banks can mint their own branded dollars and nibble at the duopoly.

Since that piece, the yield fight has moved from subtext to headline. The Blockchain Association is rallying against efforts to extend the GENIUS Act’s interest ban to platforms and “rewards”, arguing that would just gift an advantage to legacy banks. Bank lobbies, meanwhile, want Congress to close the “loophole” that lets exchanges share reserve income with users. And over in legal-land, academics are already poking at the Circle–Coinbase revenue-share, suggesting that paying Coinbase a slice of USDC reserve interest because it is the legal “holder” might violate the GENIUS Act’s prohibition on interest to stablecoin holders.

So, going into 2026, the core question from that story still holds, just louder.

Stablecoins will pay something, one way or another. The only real unknown is which stack gets to capture the yield – issuers, exchanges, or FDIC-approved banks with a token wrapper and a nicer Christmas ad campaign.

That’s it for the yield recap. See you soon with another one.

Happy Holidays. Don’t forget to keep the Christmas lights on.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.