There’s a specific kind of friction that defines modern money. You earn dollars but live in Brazil. You hold USDC but need to pay rent in pesos. You want to send your family money, but Western Union takes 8% and three days. The global financial system, for all its digitisation, still operates like a patchwork of incompatible pipes.

RedotPay is betting that stablecoins can fix this.

The Hong Kong-based company offers a crypto payment card, a multi-currency wallet, and cross-border payout rails that let you hold Bitcoin or USDT and spend it at any Visa merchant, or send crypto and have someone receive local currency in their bank account within minutes. It sounds simple. In practice, it’s trying to solve one of the hardest problems in fintech: making digital assets as liquid as the cash in your pocket.

By the end of 2025, RedotPay had 6 million users and was processing over $10 billion in annualised payment volume. It’s profitable. It just raised $107 million at over a $1 billion valuation. And it’s doing all of this in a space where most crypto cards have either failed compliance checks, shut down due to regulatory pressure, or remained niche products for crypto enthusiasts who don’t mind explaining what a “gas fee” is to a confused cashier.

So what’s different here?

Why this exists

The problem RedotPay is solving is not new. We know that. It’s just gotten worse.

If you live in Argentina and get paid in dollars for freelance work, you can’t easily spend those dollars without converting them through a bank at a punitive exchange rate. If you’re a migrant worker in the UAE sending money home to the Philippines, you’re paying 5% to 10% in remittance fees. If you’re holding stablecoins because your local currency is inflating at 40% annually, you still can’t use them to buy groceries.

Traditional finance has had decades to fix this and hasn’t. Cross-border payments are still slow and expensive because they route through correspondent banking networks that were designed in the 1970s. Local banks don’t want to hold crypto. Crypto exchanges don’t want to deal with local banking regulations. The result is that your money gets stuck in the middle, and you pay for the privilege of moving it.

RedotPay adopted the thesis that stablecoins are the missing piece. They settle instantly. They’re borderless. They’re denominated in dollars, which most of the world still wants to hold. And if you can build the rails to convert them into local currency at the point of spend or the point of receipt, you can bypass most of the legacy system entirely.

What It Actually Is

RedotPay is a custodial platform. You deposit crypto into their wallet, and they manage it for you.

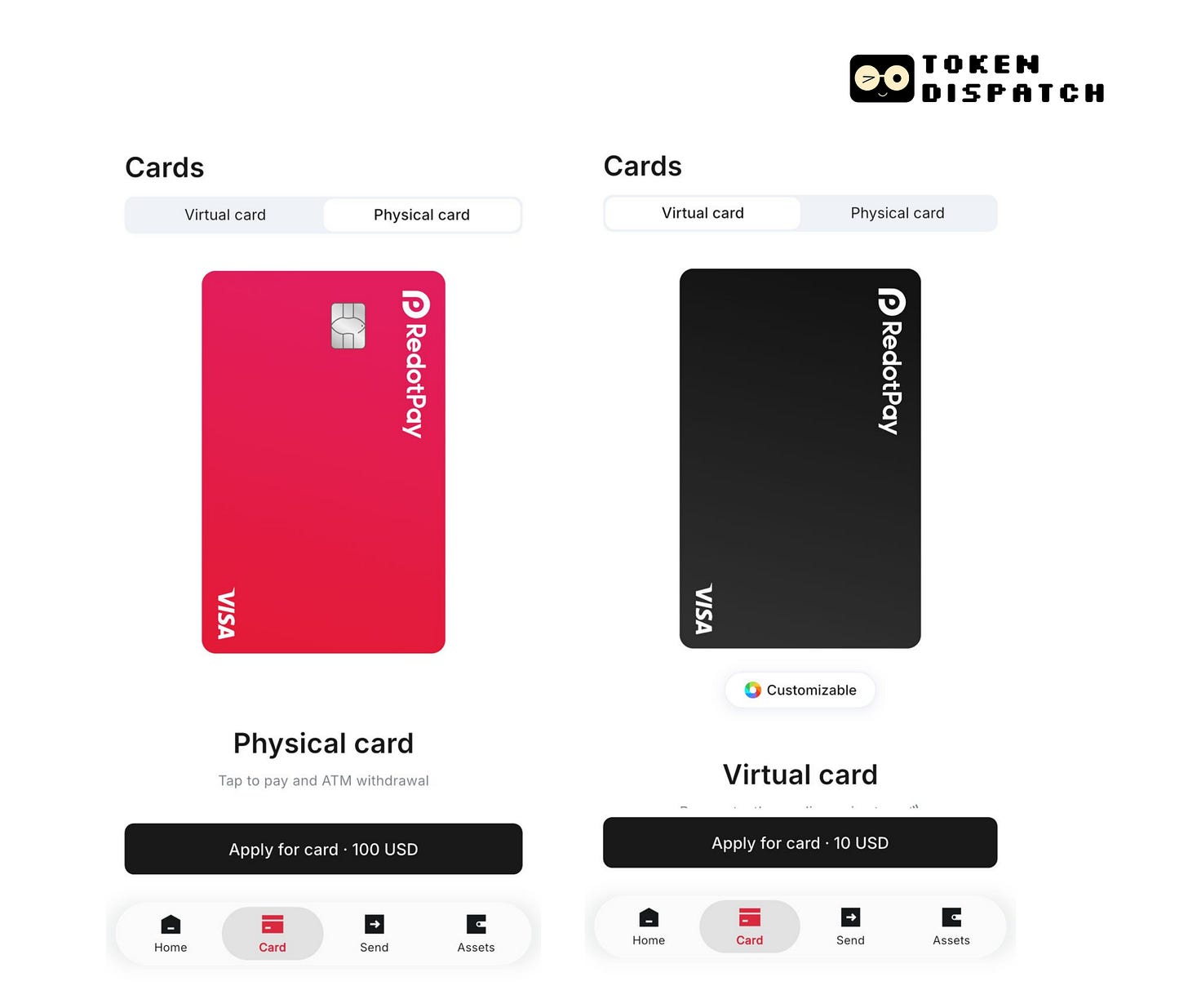

The core product is a Visa card. You can get a virtual card instantly after passing identity verification, or order a physical card for $100 that works at ATMs and point-of-sale terminals globally. When you swipe the card, RedotPay converts your crypto into the local fiat currency in real time and settles the transaction through Visa’s network.

The merchant never sees crypto. They see a normal card payment.

The wallet supports Bitcoin, Ethereum, USDT, USDC, and a handful of other major assets. You can hold these alongside fiat balances in over 50 local currencies. The app lets you swap between them, send them to other users, or use them to fund your card.

Then there’s the payout feature. You can send USDT to someone in Brazil, and they receive Brazilian reais in their local bank account within minutes. No intermediary exchange. No lengthy KYC process on their end. RedotPay partners with local payment processors to handle the fiat conversion and deposit. I’m not going to call it technically groundbreaking. It’s the infrastructure that didn’t exist in a usable form until recently.

There’s also a peer-to-peer marketplace where users can buy and sell stablecoins directly with each other using local payment methods. This is how people in regions with restrictive banking systems get on-ramp access without needing a traditional exchange account.

How People Use It

Let’s say you’re a software developer in Nigeria. You get paid in USDC by a US client. You could sell that USDC on a local exchange, withdraw naira to your bank account, and then spend it. That process takes a day, costs 2% to 3% in fees, and exposes you to exchange rate volatility during the wait.

Alternatively, you can load USDC into your RedotPay wallet and use the card to pay for your phone bill, groceries, and Netflix subscription. RedotPay converts the USDC at the moment of purchase. You pay a 1% conversion fee and a 1.2% foreign exchange fee if you’re spending in a non-dollar currency. It’s not free, but it’s faster and you control the timing.

Now say you want to send money to your family in a different city. You send them USDT from your RedotPay wallet, and they receive naira in their bank account. RedotPay’s payout rails handle the conversion. The transfer settles in under an hour. Your family doesn’t need a crypto wallet. They just see money appear in their account.

Or consider a different user: someone holding Bitcoin who doesn’t want to sell but needs liquidity. RedotPay offers a credit account where you can pledge your crypto as collateral and get a dollar-denominated credit line. The loan-to-value ratio is 90% for stablecoins, 60% for Bitcoin. Interest accrues daily at about 18% APR, which is high but not absurd compared to unsecured consumer credit in many markets. You spend against that credit line using your card, and your Bitcoin stays untouched. If the price goes up, you pay back the loan and keep the gains. If it crashes, you get liquidated. It’s a leveraged bet, but for some users it’s preferable to selling.

These aren’t hypothetical. RedotPay’s user base is concentrated in Latin America, Southeast Asia, the Middle East, and parts of Africa. These are regions where traditional banking is either expensive, unstable, or inaccessible. The product is designed for people who are already comfortable holding stablecoins or who have been forced to become comfy with them because their local currency is a worse option.

The Design Choices and Trade-Offs

RedotPay is not trying to be decentralised. It’s trying to be compliant.

The company is licensed as a Virtual Asset Service Provider in Lithuania and Argentina. It holds a Money Lender license and a Trust or Company Service Provider license in Hong Kong. It’s registered as a Money Services Business in Montana. These licenses matter because they allow RedotPay to operate legally in regulated markets and to partner with banks and payment processors who won’t touch unlicensed crypto platforms.

This compliance focus also explains why RedotPay is custodial. Non-custodial wallets are harder to regulate. They don’t fit neatly into existing anti-money laundering frameworks. By holding user funds and controlling private keys through multi-party computation technology provided by Fireblocks, RedotPay can meet Know Your Customer requirements and monitor transactions for suspicious activity. It’s a trade-off. You give up self-custody in exchange for the ability to spend your crypto like normal money.

The reliance on stablecoins is also deliberate. Bitcoin and Ethereum are too volatile for everyday payments. If the price swings 5% while your transaction is processing, either you or the merchant is taking a loss. Stablecoins eliminate that risk. They’re pegged to the dollar, so the value is predictable. This makes them useful as a medium of exchange, even if they’re not particularly interesting as an investment.

The payout rails are where things get more interesting. Traditional remittance companies like Western Union make money by moving dollars slowly and charging high fees. RedotPay is using stablecoins to cut out the middleman. When you send USDT to someone in Mexico and they receive pesos, RedotPay is converting that stablecoin into local currency through a partner bank or payment processor on the receiving end. The settlement happens on blockchain rails, which are faster and cheaper than correspondent banking networks. The recipient never touches crypto. They just see money in their account.

This only works because RedotPay has built relationships with local financial institutions in dozens of countries. Those relationships are the moat. Anyone can send stablecoins across a blockchain. Not everyone can turn them into pesos, naira, or rupees on the other end.

Why This Matters Now

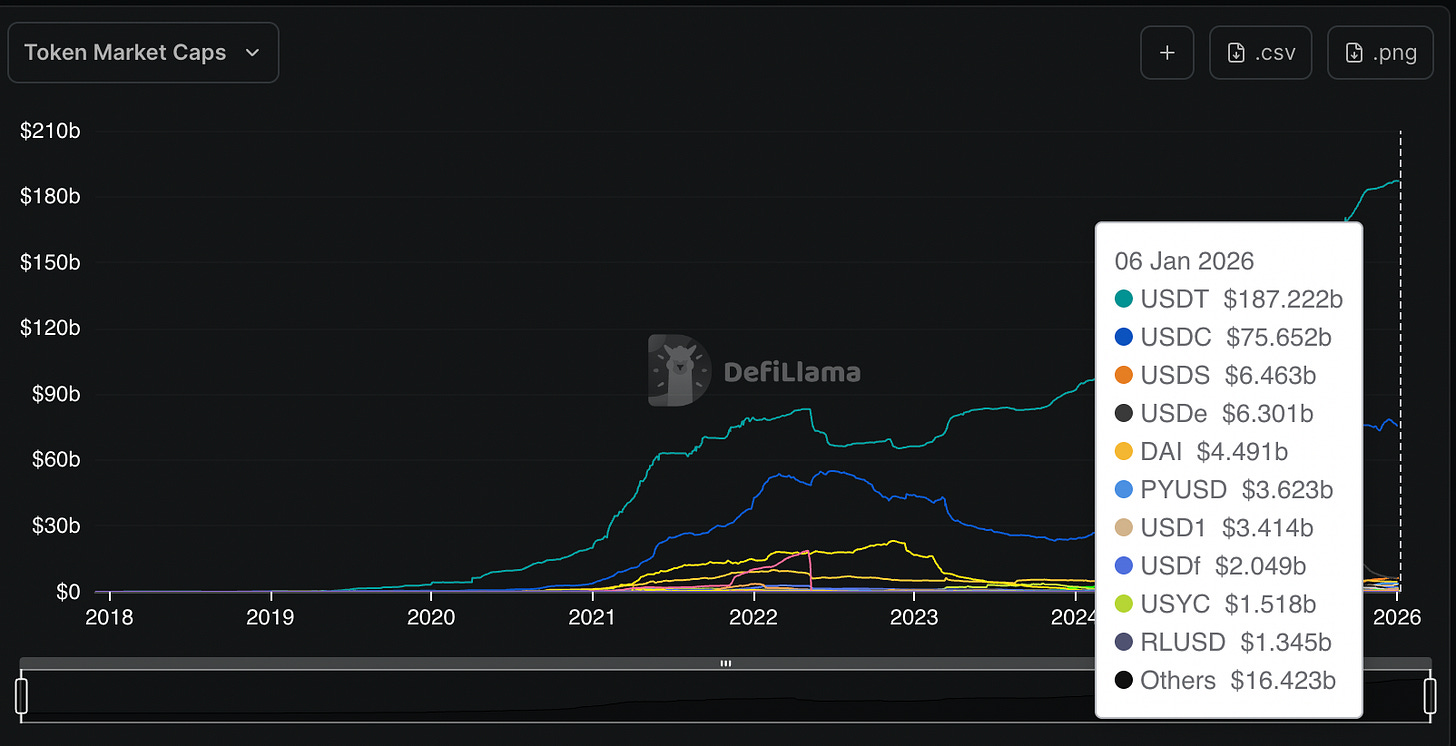

Stablecoins are having a moment. Circle’s USDC has a market cap of over $50 billion. Tether’s USDT is over $140 billion. Together, they process more transaction volume than Visa in some regions. The US government just passed the GENIUS Act, which legalises stablecoins under federal oversight. Banks like Citi are exploring tokenised deposits. You can clearly see that this is no longer a fringe experiment.

For users, the appeal is straightforward. Stablecoins are faster and cheaper than bank transfers. They’re accessible to anyone with a smartphone. And in countries with weak currencies or unstable banking systems, they’re a way to hold dollars without needing a U.S. bank account.

For institutions, stablecoins are interesting because they’re programmable money. You can build payment rails on top of them that settle instantly and operate 24/7. You can integrate them into apps and platforms without dealing with the legacy infrastructure of ACH or SWIFT. And if those stablecoins are issued by regulated entities like Circle or backed by US Treasuries, they start to look less like risky crypto assets and more like a new form of digital cash.

But here’s what RedotPay and platforms like it actually represent, which is, the death of the off-ramp as we know it.

For years, the model was circular. Buy crypto on an exchange, hold it in a wallet, sell it back to fiat when you need to spend, and withdraw to your bank. That round-trip cost 1% to 3% in fees, took one to three days, and required trusting multiple intermediaries. The friction was high enough that most people just left their crypto on exchanges.

RedotPay collapses that cycle. You don’t off-ramp anymore. You just spend. The stablecoin stays on-chain until the exact moment you swipe, then converts to fiat only for the purchase amount. No intermediate step. No waiting for banks to clear.

This treats stablecoins as the default state of money, not a temporary holding pattern before converting back to “real” currency. If that model works, if millions of people start holding USDC the way they hold dollars in a checking account, the concept of an off-ramp becomes obsolete.

That shift matters because it redefines what infrastructure looks like. If stablecoins become the primary form of money for a significant population, the platforms connecting them to local currencies become the new financial system. Not parallel. Not an alternative. The system.

The race is about who locks in the regulatory approvals and banking relationships before the window closes. Technology is secondary. What matters is who can move fast enough to become essential infrastructure before stablecoins are boring.

We’re watching the early stages of that transition. The fees are still high. Coverage is uneven. The experience is not seamless. But the direction is clear. Stablecoins are not speculative assets anymore. They’re plumbing. And the companies building the bridges to everyday commerce are defining what the next decade of finance looks like.

How RedotPay Compares to Other Crypto Cards

RedotPay is not alone in trying to make stablecoins spendable. A handful of other platforms are attacking the same problem with different trade-offs.

KAST is the closest analog. It’s custodial like RedotPay, supporting USDC and USDT via Visa across 160 countries. The difference is rewards: KAST offers 2% to 8% points, Solana staking boosts, and 4.5% yield on deposits. It charges zero conversion fees, making it cheaper for frequent spenders. KAST has 500,000 users and is growing fast among Solana holders who want cashback without needing RedotPay’s high limits or credit features.

Gnosis Pay is self-custodial, built on Gnosis Chain for users who won’t hand over private keys. You spend directly from a Gnosis Safe smart account, with funds deducted on-chain at the point of sale. It supports EURe, GBPe, and USDC with zero conversion or FX fees, pays up to 5% cashback in GNO tokens, and offers business APIs and SEPA integration. The catch is geography: Europe, Brazil, and the UK only.

Payy Card is the privacy option. It’s self-custodial and uses zero-knowledge proofs to shield transaction data via shielded UTXO settlements on the Payy Network blockchain. No one can link your card spend to your wallet balance. It charges no transaction or top-up fees, only Visa FX for non-USD. But it’s limited to the U.S. and Argentina, with no cashback yet.

The comparison is simple. RedotPay wins on high limits, credit, and global payouts. KAST wins on rewards and fee structure. Gnosis Pay wins on self-custody and DeFi integration. Payy wins on privacy.

RedotPay’s edge is operational, not technological. It has the licenses, banking relationships, and payout rails to work in over 100 countries. The others are geographically constrained or focused on narrower use cases. RedotPay is trying to be the universal solution, and it’s the only one with the scale to make that claim stick.

Where This Sits In The Real World

RedotPay is not trying to replace your bank. It’s trying to be the thing you use when your bank doesn’t work. When you need to send money home and Western Union wants 8%. When you’re holding stablecoins because your local currency is collapsing. When you want to spend crypto without selling it first.

The product is a bridge, and bridges are useful precisely because they connect two places that are otherwise hard to reach. On one side is the world of crypto: fast, borderless, permissionless. On the other side is the world of everyday commerce: slow, local, regulated. RedotPay sits in the middle and tries to make both sides work together.

Whether it succeeds depends on how fast stablecoins become normal. If using USDC to pay for groceries or send remittances feels as unremarkable as using Venmo, then RedotPay’s infrastructure becomes essential. If stablecoins remain a niche tool for crypto enthusiasts and people in failing economies, then the addressable market stays small.

For now, the bet is that the pipes are finally ready. The stablecoins are stable. The licenses are in place. The card networks are willing to play along. What’s left is convincing millions of people that their money doesn’t need to move through a bank to be real.

That’s it about RedotPay. See you soon with another view.

Until then… stay curious!

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.