Hello,

Bill Pulte announced that the FHFA will "look at crypto holdings" to consider the eligibility for mortgages. Crypto-backed mortgages will mark a landmark event and benefit those without traditional credit history. What's the catch?

Check out Wednesday edition to know more.

Secure Your Life ... But in Bitcoin

Yeah, we didn’t think those words went together either. But here comes Meanwhile flipping the script.

With Meanwhile, you pay your premium in Bitcoin, then borrow against it later without selling. Yup, no tax, no selling pressure, no drama.

Here’s the alpha

You lock in BTC today

It moons tomorrow 🚀

You borrow against it, no capital gains tax

You stay insured, and stay winning

It's like hodling with benefits.

👉 Check out Meanwhile, your future self (and wallet) will thank you.

Ryan Cohen had done it again. Moved without warning, without explanation, without asking permission.

The SEC filing landed on a Tuesday in May 2025, tucked between routine corporate disclosures that most investors ignore. Four words in GameStop's 8-K form: "Bitcoin purchase totalling 4,710 coins."

The same CEO who'd dragged a failing video game retailer back from bankruptcy had just parked over $500 million of company cash in Bitcoin. No press release. No investor call. Just the bare minimum disclosure required by law.

When David Bailey from BTC Inc finally cornered him with the question everyone was asking, Cohen's response cut through months of speculation.

"Has GameStop bought Bitcoin?"

"We have. We currently own 4,710 bitcoins."

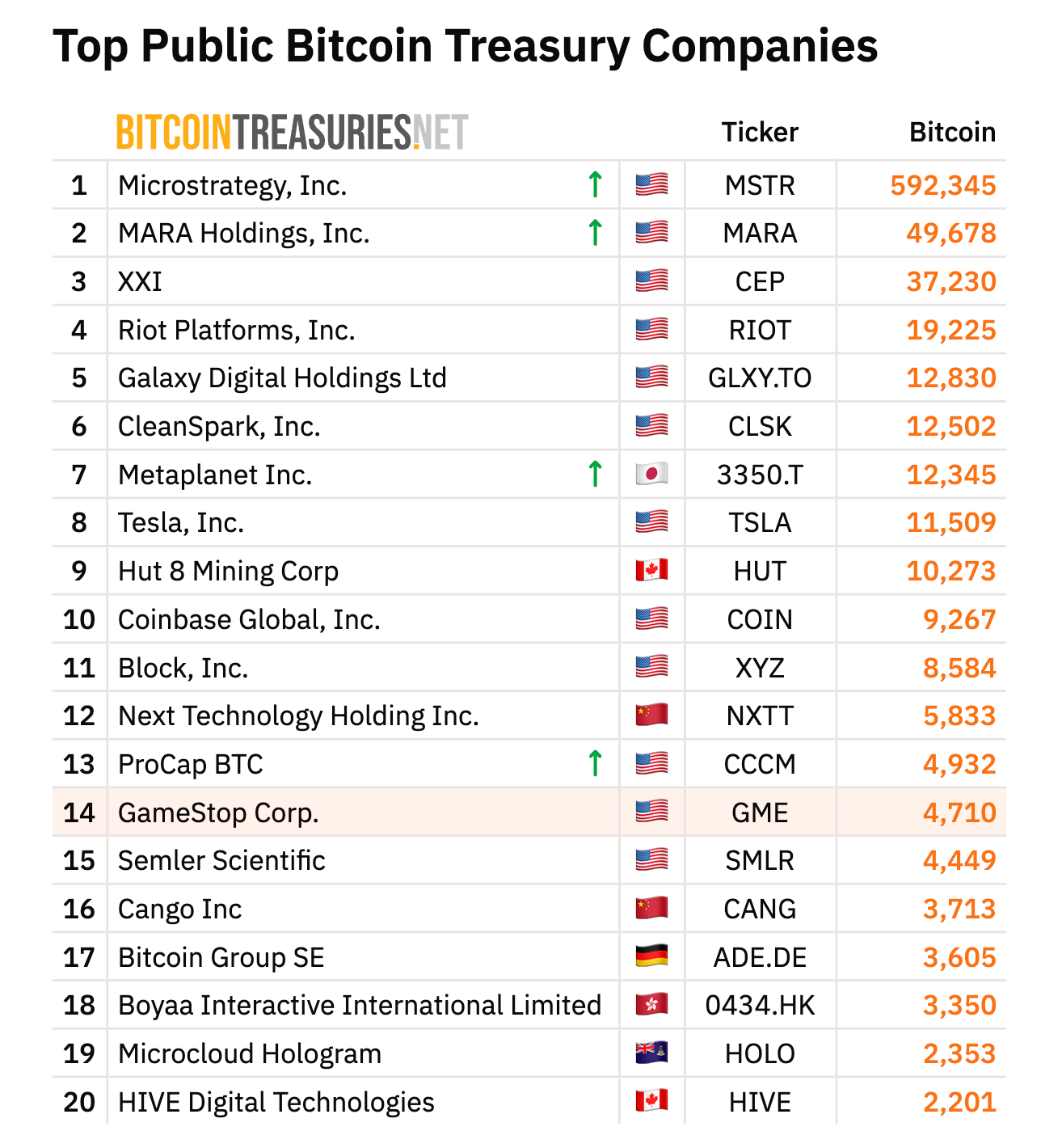

That was it. Cohen had turned GameStop into the 14th largest corporate Bitcoin holder with the same casual efficiency he'd used to build Chewy from nothing into a $3.35 billion exit.

The move shouldn't have surprised anyone who'd been paying attention. This was the man whose involvement inspired millions of retail investors to bet against some of Wall Street’s most sophisticated hedge funds.Who'd taken a company that experts said was doomed and turned it into something that defied every traditional valuation model.

Cohen's path to this moment, from a college dropout selling pet food online to the unlikely architect of a new kind of corporate playbook, started with a teenager in Florida who understood that the best opportunities hide in places everyone else has written off.

The Apprentice's Beginning

Ryan Cohen's entrepreneurial education began long before he could legally drive.

Cohen was born in 1986 in Montreal to a teacher mother and Ted Cohen, who ran a glassware importing business. His family moved to Coral Springs, Florida, when he was young. At 15, Cohen was already running his own operation, collecting referral fees from various e-commerce sites.

By 16, he had expanded beyond simple referrals into more structured e-commerce operations, learning the fundamentals of online business when most people still thought the internet was a fad.

His father, Ted, became his most important mentor, teaching lessons about delayed gratification, work ethic, and the importance of treating business relationships as long-term partnerships rather than one-time transactions.

Ryan made the decision to drop out of the University of Florida to focus entirely on his business ventures. He had already proven he could generate revenue and acquire customers. College felt like a detour from what he was meant to do.

The Pet Food Revolution

In 2011, the e-commerce landscape was dominated by Amazon, which seemed unbeatable in every category it entered. Most entrepreneurs avoided competing directly with Jeff Bezos' empire.

Cohen, 25, decided to compete by not competing directly.

Instead of trying to beat Amazon on selection or logistics, Cohen identified a category where customer relationships mattered more than operational efficiency: pet supplies. Pet owners were caring for family members, not just buying products. They wanted advice, empathy, and someone who understood that a sick dog wasn't just an inconvenience, it was a crisis.

Chewy launched with a simple premise: combine Amazon's logistics with Zappos' customer service philosophy, then tailor everything specifically for pet owners. The company would sell pet supplies online, but more importantly, it would build relationships with customers that went far beyond individual transactions.

The early execution was methodical and customer-obsessed. Chewy's customer service team didn't just process orders; they sent hand-written holiday cards, commissioned pet portraits for loyal customers, and sent flowers when beloved pets passed away. These gestures cost money and couldn't be easily scaled. Here’s a tweet that went viral:

But building emotional connections didn't pay the bills, and for the first two years, Cohen faced a problem that would have killed most startups. Nobody wanted to fund a pet food company competing with Amazon.

A Hundred Rejections

The pitch meetings became a form of entrepreneurial torture.

Cohen approached over 100 venture capital firms between 2011 and 2013, explaining why pet supplies represented a massive opportunity for a customer-focused company. Most VCs saw the same thing: a venture run by a college dropout with no traditional business credentials, trying to dent a small market dominated by an unbeatable competitor.

In 2013, Volition Capital finally provided the breakthrough: $15 million in Series A funding. The validation allowed Cohen to scale Chewy's operations while maintaining its customer-obsessed culture. By 2016, the company had attracted additional capital from BlackRock and T. Rowe Price, reaching $900 million in annual sales.

Chewy's customer retention rates were exceptional, their average order values kept increasing, and most importantly, customers were becoming evangelists who recommended the service to other pet owners.

By 2018, Chewy was generating $3.5 billion in annual revenue and preparing for an IPO. That's when PetSmart made an offer. $3.35 billion for the entire company, the largest e-commerce acquisition in history at that time.

At 31, Cohen was worth hundreds of millions of dollars. He could have retired, invested in startups, or started another company in a different industry.

Instead, he walked away from Chewy to focus on his family.

The Family Intermission

In 2018, at the peak of his professional success, Ryan Cohen made a choice that mystified the business world.

He stepped down as CEO of Chewy to spend time with his pregnant wife and prepare for fatherhood. A complete departure from the company he had spent seven years building. Cohen had achieved financial independence, and he was going to use that freedom to be present for the most important moments of his personal life.

He sold most of his Chewy shares and focused on being a husband and father. For someone who had been intensely focused on growth and competition since his teenage years, the transition to domestic life might have felt jarring. Instead, Cohen embraced it completely.

Even during this family-focused period, he remained an active investor. His portfolio included positions in Apple (where he became one of the largest individual shareholders with 1.55 million shares), Wells Fargo, and other blue-chip companies.

The family foundation he established with his wife Stephanie supported education, animal welfare, and other charitable causes.

The break lasted three years. Then he discovered GameStop.

The GameStop Gambit

September 2020. While most investors saw GameStop as a dying brick-and-mortar retailer being killed by digital downloads and streaming services, Ryan Cohen saw something different: a company with powerful brand recognition, a loyal customer base, and management that had no idea how to leverage either asset.

His investment vehicle, RC Ventures, disclosed a near-10% stake in the struggling video game retailer, making Cohen the company's largest individual shareholder. The move puzzled Wall Street analysts who couldn't understand why someone with Cohen's track record would invest in a "legacy" retail business.

Cohen's thesis was characteristically contrarian. GameStop was more than a retail chain. It was a cultural touchstone for gaming communities. The company had relationships with customers who cared deeply about gaming culture, collectibles, and the social aspects of video game experiences. They were passionate enthusiasts willing to pay premium prices for products that connected them to their interests.

The problem was management that treated the company like a traditional retailer instead of a community-driven platform.

When Cohen joined GameStop's board in January 2021, the announcement triggered a buying frenzy among retail investors who recognised Cohen from the Chewy success story. Within two weeks, GameStop's stock price increased 1,500%, creating one of the most famous short squeezes in market history.

While the financial media focused on the "meme stock" phenomenon and battles between retail investors and hedge funds, Cohen was focused on a more fundamental change.

The Transformation

Cohen rebuilt GameStop the same way he'd built Chewy.

When he took over, "the company was a piece of crap and losing a lot of money."

He gutted the leadership team first. Ten board members left, replaced by executives from Amazon and Chewy who actually understood e-commerce. If you were going to compete digitally, you needed people who'd done it before.

Then came the cost cuts. Cohen eliminated inefficiencies everywhere: redundant positions, underperforming stores, expensive consultants, but kept anything that touched customers. The goal was profitability even if sales dropped.

Let’s look at the numbers: 2020 (pre-Cohen) vs 2024 (post-Cohen).

Revenue & Profitability:

Revenue: $5.1 billion (2020) → $3.8 billion (2024) = 25% decline

Gross Profit: $1.26 billion (2020) → $1.11 billion (2024) = Maintained despite revenue drop

Gross Margin: 24.7% (2020) → 29.1% (2024) = 440 basis point improvement

Operating Performance:

EBIT (Operating Income): -$237.8 million loss (2020) → -$26.2 million loss (2024) = 89% improvement

EBITDA: -$254.7 million (2020) → -$16.5 million (2024) = 93% improvement

PAT (Net Income): -$215.3 million loss (2020) → +$131.3 million profit (2024) = $346.6 million swing

Cohen inherited a company losing over $200 million annually on $5.1 billion in revenue. After three years of systematic restructuring, he delivered GameStop's first profitable years (2023-2024) in the past five years. Despite shrinking revenue by 25% through store closures, he improved gross margins by 440 basis points and turned a $215 million annual loss into a $131 million profit — proving that smaller can be significantly more profitable.

The bet was on digital transformation. Physical stores would survive, but only the best ones. GameStop's future was online, serving gaming enthusiasts who wanted more than just video games - collectibles, trading cards, merchandise, anything connected to gaming culture. Cohen also stockpiled cash and secured authority to make strategic investments. On September 28, 2023, he became CEO while staying Chairman. His salary: zero. His compensation was tied entirely to the stock price, which meant he got paid only if shareholders did.

Then came the crypto bet.

GameStop's first venture into digital assets reflected both the promise and perils of emerging technology adoption.

In July 2022, the company launched an NFT marketplace focused on gaming-related digital collectibles. Initial results seemed promising: over $3.5 million in trading volume within the first 48 hours suggested genuine demand for gaming NFTs.

But the NFT market's collapse was swift and brutal. Digital asset sales dropped from $77.4 million in 2022 to just $2.8 million in 2023. Citing "regulatory uncertainty in the crypto space," GameStop discontinued its crypto wallet in November 2023 and shut down NFT trading functionality in February 2024.

The failure could have ended GameStop's cryptocurrency involvement entirely. Instead, Cohen learned from the experience and developed a more sophisticated approach to digital assets.

The Bitcoin Bet

May 28, 2025. While markets obsessed over Fed policy, GameStop quietly bought 4,710 Bitcoin for $513 million.

Cohen's rationale was characteristically measured:

"If the thesis is correct, then Bitcoin and gold can be a hedge against global currency devaluation and systemic risk. Bitcoin has certain unique advantages compared to gold — the portability aspect of it, it's instantly transferable across the globe whereas gold is bulky and very expensive to ship. The authenticity is instantly verified via the blockchain. You can easily secure Bitcoin in a wallet whereas gold requires insurance and it's very expensive. There's the scarcity element as well — there's a fixed supply of Bitcoin whereas with gold, certain technological advances mean the supply is still uncertain.”

The move positioned GameStop as the 14th largest corporate Bitcoin holder.

Read: Can GameStop’s BTC Bet Save the Day? 🎮

The company funded its Bitcoin purchases through convertible notes rather than leveraging its core capital, while still maintaining a robust cash reserve of over $4 billion. This strategy reflects diversification and prudence, not desperation—positioning Bitcoin as a side bet rather than a core business imperative.

"GameStop is following GameStop strategy. We're not following anyone else's strategy.”

The stock dropped after the announcement. Cohen didn't seem to care. He'd never optimised for quarterly reactions.

On June 25 GameStop raised an additional $450 million through a greenshoe option exercise, bringing their total convertible debt offering to $2.7 billion.

A greenshoe option (or over-allotment option) is a provision in an offering agreement that allows underwriters to sell up to 15% more shares than originally planned if demand is strong. Exercising this option gives the company a chance to raise additional capital while helping stabilise the stock price after the offering. In GameStop’s case, this meant issuing more convertible notes to increase the total funds raised.

The capital would be used for "general corporate purposes and making investments in a manner consistent with GameStop's Investment Policy," which explicitly includes acquiring Bitcoin as a treasury reserve asset.

Cohen has the Ape Army. The most unusual part of Cohen's GameStop story - the millions of retail investors who refuse to sell.

They call themselves "apes," and they don't behave like normal shareholders. They don't trade based on earnings reports or analyst upgrades. They hold because they believe in Cohen's vision and want to see what happens next.

This creates “patient capital”, which is almost unheard of in public markets. Cohen can focus on long-term strategy without worrying about quarterly volatility because his core investor base isn't going anywhere.

Token Dispatch View 🔍

Will Bitcoin actually create value for GameStop shareholders, or will crypto volatility wipe out any gains? Cohen's disciplined approach suggests he understands the risks, but Bitcoin's future is anyone's guess.

GameStop acquired 4,710 BTC at an average price of $108,837, and with Bitcoin now trading near $107,200, the position is closely tracking its original cost basis, underscoring just how unpredictable Bitcoin’s future remains

Can the retail army that powered GameStop's transformation stay engaged as the company becomes more conventional? Keeping grassroots enthusiasm while executing institutional strategy is a trick few CEOs have mastered.

How will traditional investors value a company that's part retailer, part investment vehicle? GameStop's hybrid model may create valuation problems that limit access to certain types of capital.

Ryan Cohen has built a career on seeing opportunities others miss. At fifteen, he spotted the potential of online commerce. At twenty-five, he identified pet supplies as Amazon's blind spot. At thirty-five, he recognised that GameStop's community was more valuable than its stores.

Each move built on the previous one while expanding into new territory. The GameStop transformation may be his most significant achievement, not because of the financial returns, but because it proves that dedicated communities can support business models that traditional finance doesn't understand.

Cohen has shown that customer obsession, operational discipline, and strategic patience create value in unexpected places. That retail investors, properly engaged, provide patient capital for long-term thinking. That companies can evolve beyond their original business models while keeping their core identity.

At 39, Cohen sits on billions in cash with a proven track record and a unique position at the intersection of retail and digital innovation. The college dropout who learned customer service from pet owners may have found the formula for building businesses that last: combine operational excellence with community engagement, maintain financial discipline while staying open to new opportunities.

Whether that formula can transform GameStop into something extraordinary remains to be seen. But watching Cohen navigate the challenges will be worth the price of admission.

See ya, next Friday, with another profile.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.