Sandeep Nailwal: From Delhi Slums to Building Polygon ♾️

The distance between survival and success is measured in decisions nobody wants to make.

Sandeep Nailwal’s father would disappear for days at a time.

When he returned, the monthly salary of $80 would be gone. Lost to alcohol and gambling debts.

The family lived in the settlements along Delhi’s Yamuna River, an area locals dismissively called “Jamna-Paar,” which roughly translates to “the other side.” It wasn’t a compliment.

Young Sandeep would stand outside his classroom, unable to enter because his parents hadn’t paid the school fees. He was 10 years old when his younger brother had a serious accident, and his childhood effectively ended. His father’s addictions meant someone had to step up. That someone was Sandeep.

Today, Nailwal runs Polygon, a blockchain infrastructure company that processes millions of transactions daily and has partnered with JPMorgan, Stripe, and Disney. The journey to building technology used by Fortune 500 companies spans just three decades.

But the path wasn’t linear, and the scars from those early years shaped every decision he made.

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

Sandeep Nailwal was born in 1987 in Ramnagar, a farming village in the Himalayan foothills with no electricity. His parents, both illiterate teenagers when they married, moved to Delhi when he was four, searching for opportunities that didn’t exist in their village.

They found the slums instead.

The settlements on the eastern banks of the Yamuna River were crowded, dirty, and violent. Illegal guns and knives as the preferred tools for settling disputes. His family squeezed into whatever housing they could afford, moving constantly as circumstances changed.

His parents didn’t understand how education worked. They didn’t know children could start school at age three or four. Sandeep didn’t begin attending until he was five, simply because nobody told his parents otherwise. This late start meant he was always the oldest kid in his class by two years, which was a constant reminder that he was behind.

The trauma of poverty wasn’t just about missing meals or shabby clothes. It was about the shame of standing outside the classroom when your father gambled away the school fees. It was about watching your mother struggle with an alcoholic husband while trying to keep the family fed.

It was about understanding, at an impossibly young age, that nobody was coming to save you.

The Entrepreneur at Sixth Grade

Sandeep’s response to poverty was work. In sixth grade, he started tutoring younger students, earning Rs 300 per month. He also found a friend who owned a pen shop and started buying pens at cost, then selling them to classmates at a markup.

The amounts were tiny. The lesson was huge: you could create value, capture some of it, and use that money to change your circumstances.

He dreamed of attending the Indian Institutes of Technology, the prestigious engineering schools that serve as a ticket out of poverty for ambitious students. But IIT required expensive coaching to compete against a million other applicants for 5,000 spots. His family couldn’t afford it.

Instead, Nailwal enrolled at Maharaja Agrasen Institute of Technology, a second-tier engineering school. He took out student loans to pay for his education. Sometimes he used that loan money to pay off his father’s gambling debts instead of buying textbooks or a computer.

The decision to study computer science came from watching Mark Zuckerberg on Indian television. Facebook was getting hyped globally, and young Sandeep thought: “I want to build my own Facebook.”

He admits now it was naive. But naivety combined with desperation creates a particular kind of determination.

After finishing his engineering degree, Nailwal pursued an MBA at the National Institute of Industrial Engineering in Mumbai. There he met Harshita Singh, who became his wife later. After graduating, he quickly repaid both his own student loans and his father’s debts working as a consultant at Deloitte.

Nailwal moved through several corporate positions. Software developer at Computer Sciences Corporation, consultant at Deloitte, Chief Technology Officer at Welspun Group’s e-commerce division. He was good at his job. He got promoted. He made decent money.

But he couldn’t shake the entrepreneurial itch.

In Indian culture, there’s pressure to buy a house before marriage. A man without property is a man without prospects. Nailwal felt this pressure acutely. He had a good job. He could get a home loan. He could settle down.

Harshita told him something that changed everything: “You will never be happy this way. I don’t care about my own house. We can stay and rent.”

In early 2016, Nailwal quit his job. He borrowed $15,000, which is the money he’d planned to use for a wedding someday and started Scope Weaver, an online marketplace for professional services. The idea was to standardise India’s fragmented services industry, creating something like Alibaba but for Indian service providers instead of Chinese manufacturers.

The company did okay. It generated revenue. But Nailwal realised he was becoming a bottleneck. Clients wanted a face, someone to blame when things went wrong. He was turning into just another service provider, except now he had employees to pay.

The business wasn’t scalable. After a year, he started looking for his next move.

The $800 Bitcoin Bet

Nailwal first heard about Bitcoin in 2010. A friend suggested they mine it together. Nailwal didn’t have a laptop. The conversation ended there.

He encountered Bitcoin again in 2013 while pursuing his MBA. This time he set up a miner, but his laptop was too weak. He tried reading about Bitcoin, got through two paragraphs, saw “not backed by anything,” and concluded it was a scam. He walked away.

In 2016, Bitcoin resurfaced. Nailwal was exploring “deep tech” opportunities after realising Scope Weaver wouldn’t become the business he’d envisioned. He considered AI but found mathematics beyond his current abilities.

Then he read the Bitcoin white paper. Really read it this time.

“Oh, this is big,” he thought. “This is the next revolution of humanity.”

Either conviction or recklessness, depending on your perspective, Nailwal took the $15,000 he’d borrowed for a wedding and put it all into Bitcoin at $800 per coin.

He admits:

“The level of FOMO I had, it would have been exactly the same if I was one year late. I would have done the same thing at $20,000, and I would have lost all that money.”

But he didn’t lose it. Bitcoin rose. More importantly, Nailwal discovered Ethereum and its programmable smart contracts. This was a new computing platform that could run applications without central control.

He was hooked.

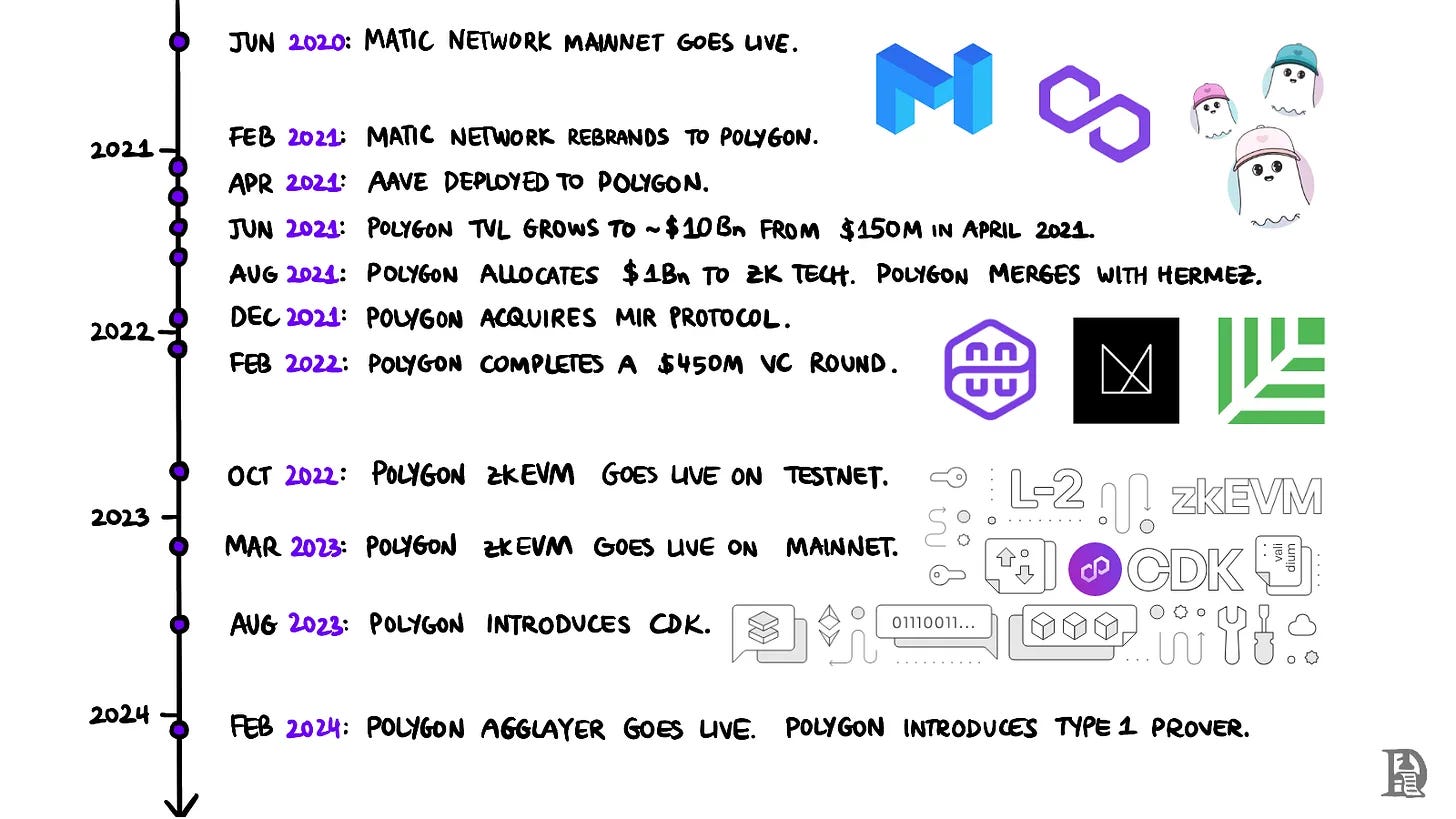

In 2017, Nailwal met Jaynti Kanani through online Ethereum communities. Kanani proposed solving Ethereum’s scaling problems. The network was choking on its own success. CryptoKitties had caused transaction fees to spike 600%.

Kanani and Nailwal, joined by co-founders Anurag Arjun and Mihailo Bjelic, started working on Matic Network in early 2018. They raised $30,000 in seed funding. Their plan was build a working product first, then raise money through an ICO.

This principled approach nearly killed them. By the time they had a working testnet, the crypto market had crashed. Nobody wanted to fund projects, especially ones from India. Two recent Indian crypto projects had been exit scams.

“Nobody believed that there could be a protocol coming from Indian co-founders,” Nailwal recalls.

The team survived on $165,000 total for their first two years. Founders took salaries of a few thousand dollars per month. Multiple times, they came within three months of running out of money. Nailwal remembers begging other crypto founders for $50,000 just to keep going another quarter.

The low point came right before his wedding in 2018. A Chinese fund had committed to investing $500,000. Two days before his wedding, Bitcoin crashed from $6,000 to $3,000. The Chinese fund called: “We were going to invest 100 BTC. Now the value is half, so we are not investing.” Worse, Matic’s treasury was in Bitcoin. It had also lost half its value.

His wedding went ahead. Friends celebrated. But Nailwal knew they might not have a company in three months.

In early 2019, Binance approved Matic for a $5.6 million raise through its Launchpad program. The due diligence had taken eight months. The raise gave Matic breathing room. But acceptance remained elusive. The team attended countless hackathons, visiting developer desks one by one, explaining their technology.

The team attended countless hackathons, visiting developer desks one by one, explaining their technology. Growth came slowly at first, then accelerated in 2021 as Ethereum’s fees made the network nearly unusable for smaller transactions. Developers migrated to Matic.

Originally launched as Matic Network, it was a single-chain scaling solution that operated as a sidechain and combined Plasma and Proof-of-Stake mechanisms. In 2021, Matic Network underwent a major rebranding to Polygon, reflecting a shift from a single chain to a broader multi-chain ecosystem aimed at providing diverse scaling solutions across Ethereum-compatible chains.

Market responded to the rebranding. Polygon’s market cap surged from $87 million at the start of 2021 to nearly $19 billion by December.

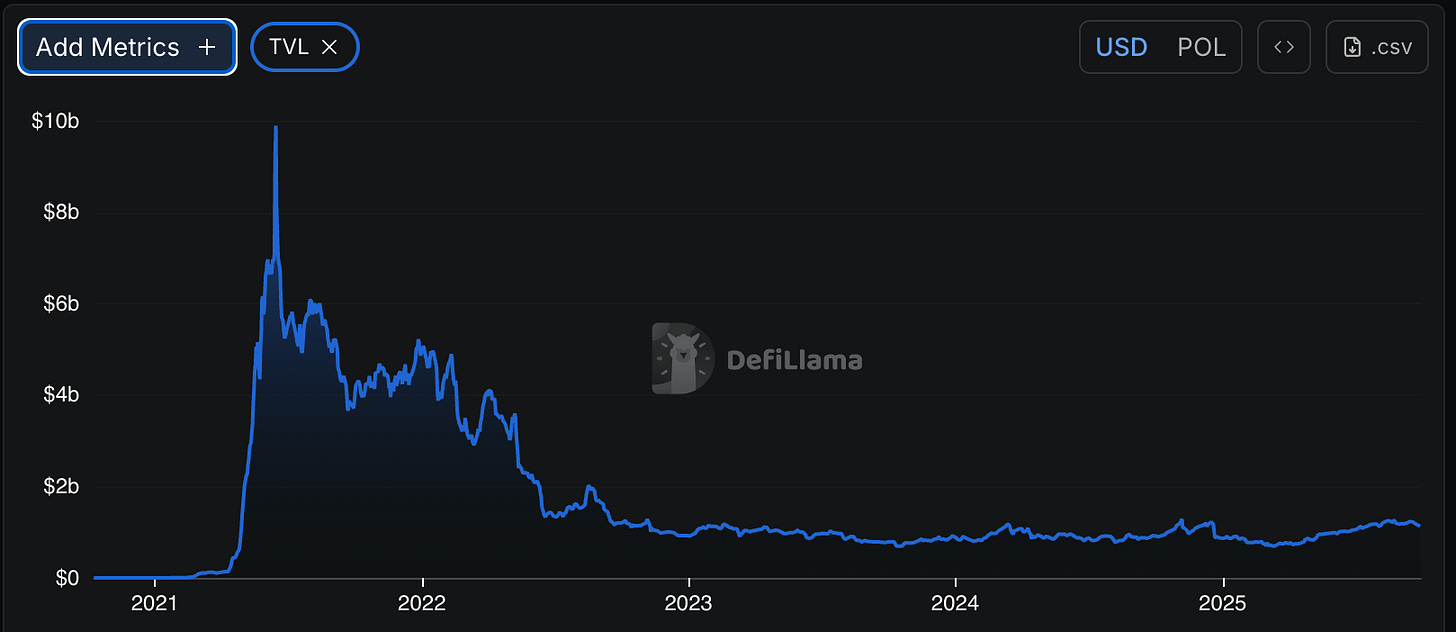

Developers migrated to Matic, and the total value locked on the network climbed to $10 billion at its peak.

Alongside this, the native token also transitioned from $MATIC, which secured the original Polygon PoS chain, to $POL, which is designed to support the whole Polygon ecosystem, especially with upcoming upgrades such as the Staking Hub that aim to consolidate and enhance security and governance across multiple chains. This token migration was a critical step, although it caused some temporary uncertainty among holders and liquidity fragmentation during the transition period.

Polygon Labs also made a bold strategic pivot towards Zero-Knowledge (ZK) rollups, acquiring key ZK-focused teams to develop zkEVM, which enables Ethereum-equivalent execution with the scalability advantages of ZK proofs. While optimistic rollups (ORs) initially gained traction due to simpler design and earlier launches, Polygon’s emphasis on ZK rollups represents a long-term bet on the ultimate layer-2 scaling solution for Ethereum. The zkEVM technology aims to combine high security, scalability, and full compatibility with Ethereum’s existing tooling, potentially enabling Polygon to lead in the future multi-chain architecture.

The COVID Pivot

In April 2021, COVID-19’s second wave devastated India. Hospitals overflowed. Oxygen supplies ran short. Nailwal’s family in India all contracted COVID. He was in Dubai, helpless.

“At that point in time, it was very clear that our family will not be 100%,” he says. “Not everyone will survive.”

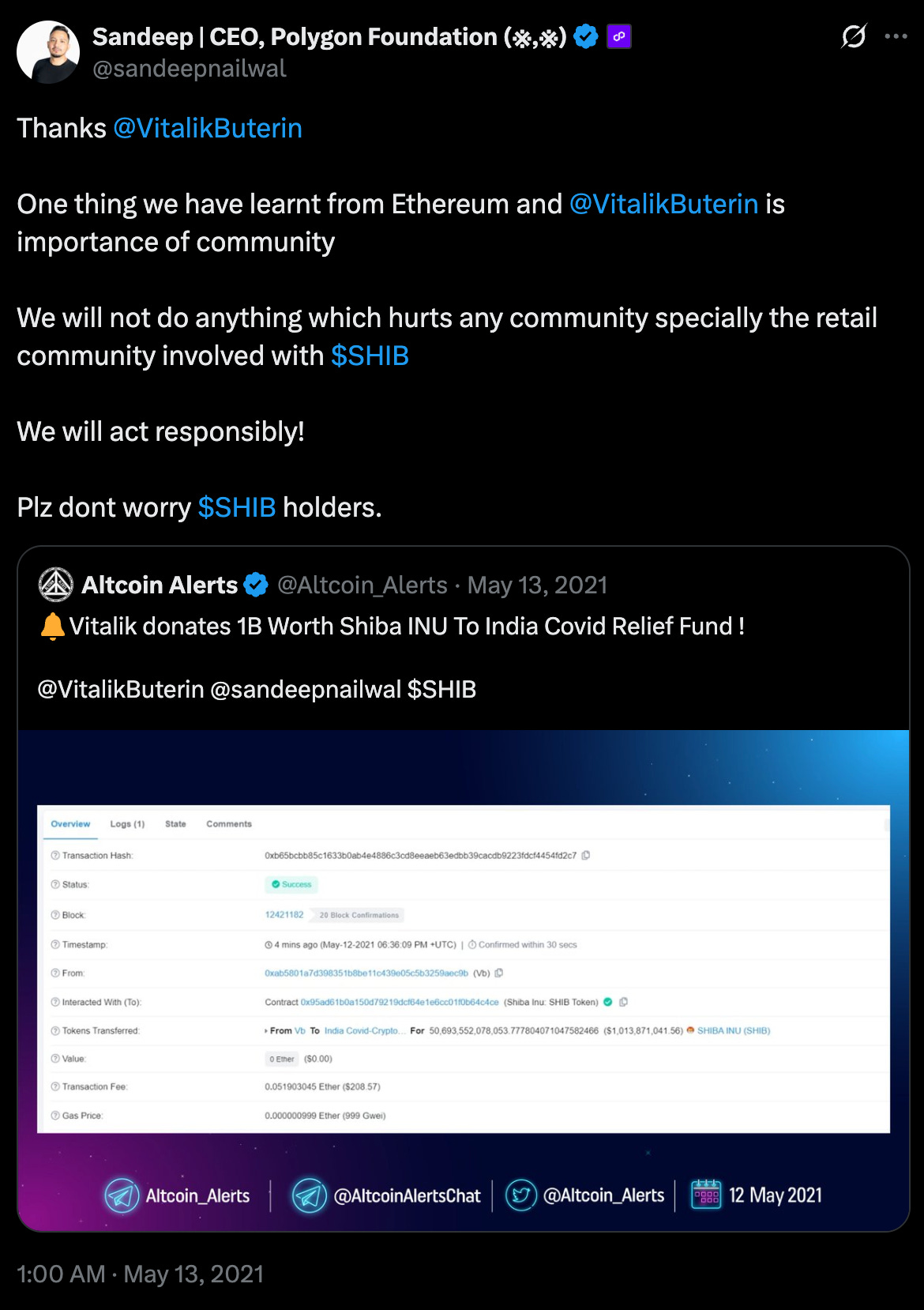

He tweeted that he couldn’t take the crisis lying down. He set up a crypto multisig wallet for donations, expecting maybe $5 million total. Within days, donations reached $10 million. Then Ethereum founder Vitalik Buterin donated $1 billion worth of Shiba Inu tokens.

The practical challenge was: how do you liquidate a billion-dollar meme coin position without crashing the market?

Nailwal worked with market makers to slowly sell over several months. The Shiba Inu community, initially panicked about a massive sell-off, calmed down after Nailwal promised careful execution. In the end, he netted $474 million, far more than Buterin had expected.

The Crypto Covid Relief Fund deployed $74 million in India during the emergency. Nailwal returned $200 million to Buterin, who donated it to U.S. biomedical research. And the remaining $200 million was kept for Blockchain for Impact’s long-term initiatives.

Building Character Through Adversity

By mid-2025, Polygon faced new challenges. $POL had fallen more than 80% from its peak. Competing layer-2 solutions from Arbitrum and Optimism were capturing market share. The company had grown to 600 employees during the boom, creating cultural problems and organisational bloat.

Read: How Beam, Aevo & Others Nailed Token Migration Strategy

Nailwal made hard decisions. Two rounds of layoffs cut staff back to a more cohesive team. Multiple projects that had consumed months of engineering time got scrapped when they no longer fit the strategy.

In June 2025, Nailwal took over as Polygon Foundation’s first CEO, consolidating leadership that had been distributed across co-founders and board members. Three of his four co-founders had stepped away from active roles. He was the last one left.

“When push comes to shove, most founders are not able to take those hard decisions,” he said in one of the interviews, “Doing the GTM in a hard way, firing people who are not fitting the current strategy, scrapping projects where they have invested a lot of time and emotional resources.”

Those decisions feel different when you’re cutting projects you personally championed or letting go of people who believed in your vision during the hard times.

Under Nailwal’s sole leadership, Polygon refocused on AggLayer, an interoperability protocol designed to unify blockchain networks. The technical vision is to create infrastructure that makes thousands of separate blockchains feel like a single, seamless network to end users.

“By 2030, you will probably have between 100,000 to a million chains,” Nailwal predicts. “All the activity will move to these app chains.”

It’s a bold claim. Whether it proves correct depends on execution over the next several years.

The Long Game

Nailwal thinks in decades, not quarters. When discussing Polygon’s competition or DePIN’s future, he constantly references 10-year and 50-year timelines.

“If you gave me 10 years, I can 100% tell you that this is the endgame architecture of how crypto becomes mass market,” he says about AggLayer. “But whether it’s Polygon’s version or somebody else comes in and builds something like this, that nobody can predict.”

He believes deeply in this vision for blockchain infrastructure. Whether Polygon executes it or someone else does matters less than seeing it built.

“If you gave me 10 years, I can 100% tell you that this is the endgame architecture of how crypto becomes mass market. But whether it’s Polygon’s version or somebody else comes in and builds something like this, that nobody can predict or some other project builds this and it will be great but I am more committed to this architecture like whoever builds it I would love to you know cheer them from the sides also uh as far as it is like uh web3 to aligned and ethical team I would love to support them.”

With Blockchain for Impact, he’s shifting from emergency relief toward “inspirational” philanthropy. He’s planning something like a Nobel Prize of India to inspire the next generation of scientists and engineers.

“I want to get like $2 trillion output from this $200 million BFI,” he explains, describing leverage ratios that sound absurd until you remember he turned $30,000 in seed funding into a company that briefly hit $30 billion in market cap.

Yet Polygon faces headwinds. Competitors like Arbitrum and Base have captured more market share, offering simpler user experiences and stronger backing. Polygon’s bridge remains technically complex, and its transition from MATIC to POL has created uncertainty. The company’s developer-focused messaging hasn’t translated to mass retail adoption the way rivals have achieved. Whether Nailwal’s long-term infrastructure bet pays off depends on execution in an increasingly crowded market.

What’s already certain is that Sandeep Nailwal traveled further from his starting point than most people can imagine. Yet to see whether the infrastructure he’s building will lift others the way crypto lifted him.

From a village with no electricity to building the internet of value. The destination remains uncertain. The journey continues.

That’s it about the Polygon guy. See you next week with another profile.

Until then … stay calm and DYOR,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

This is such an inspiring story, especially the SHIB donation part. Liquidating $1 billion worth of a memecoin without tanking the market is an insane logistical challenge that most people don't apreciate. The fact that Sandeep managed to net $474 million and then returned $200 million to Vitalik while the Shiba Inu comunity stayed calm shows incredible trust building and transparent execution. What really stands out to me tho is how he redirected from emergency relief to long term philanthropic initiatives with the remaining funds. His thinking in decades rather than quarters is what separates builders from opportunists. The AggLayer vision for making 100,000 to a million chains feel seamless is ambitious, but given how far he's come from standing outside classrooms because his father gambled away school fees, I wouldn't bet against him. The Polygon story is a reminder that sometimes the most improbable journeys produce the most transformative outcomes.

OMG, what an inspirational story! Thank you for this, and your exquisite writing style that makes the nuances of crypto and the crypto pantheon of innovators almost understandable to a well educated but nontechnical human.

To get the story of decency, fairness, and compassion in the crazy world of crypto makes me want to be a better person...and also invest in Poly...

Rudi Hoffman, Port Orange, FL