Say hello to SEI🎈

Trading volumes for newly launched SEI token clocks $1B+ on day one. BTC-friendly El Salvador bond returns soar to 70% in 2023. Arbitrum to unlock $1.2B ARB in March 2024. Gary Gensler has AI on radar

Hello, y'all. Make sure you've claimed your collectible on Asset, and don't forget to give your books a »» Muzify «« spin? 🙌

Degens, I tell you👇

This is The Token Dispatch, you can hit us on telegram 🤟

Sei Network has had a big listing day.

What is Sei?

A Layer 1 trading blockchain that hit a fully diluted valuation of $1.8 billion.

It's native token » SEI.

Leading exchanges like Binance, Bybit, Huobi, and Kraken listed the token on August 15. With Coinbase to join soon.

Technical advantages and design

The network can finalise transactions within an astonishing 0.5 seconds and accommodating up to 20,000 transactions simultaneously.

The platform's foundation is built using the Cosmos software development kit, which facilitates the scalability and efficiency required by decentralised exchanges (DEXs).

The incorporation of a sophisticated matching engine and order front-run prevention tools enhances Sei's potential to augment DEX trading capabilities.

Token supply and structure

Sei Network's SEI token is backed by a total supply of 10 billion units.

The initial offering comprised 1.8 billion SEI tokens.

Sei operates as a decentralised “Proof of Stake” blockchain, powered by the SEI token.

The SEI token serves several functions on the network:

Network Fees: Pay for transaction fees on the Sei blockchain.

DPoS Validator Staking: SEI holders have the option to delegate their holdings with validators or stake SEI to run their own validator to secure the network.

Governance: SEI holders can engage in future governance of the protocol.

Native Collateral: SEI can be used as native asset liquidity or collateral to applications built on the Sei blockchain.

Fee markets: Users can pay a tip to validators to get their transactions prioritised, which can be shared with users that are delegating to that validator.

Trading Fees: SEI can be used as fees for exchanges built on Sei blockchain.

Mainnet launch and Alpha Phase success

On the same day as the token listing, Sei Network introduced the beta phase of its mainnet.

The platform's alpha phase achievements included over 400 million transactions and the creation of 7.5 million test wallets.

These figures underscore Sei's capability to handle a substantial transaction load and its growing user base.

Future applications and partnerships

Jeff Feng, a co-founder of Sei Labs, emphasised the shortcomings of current Web 3 infrastructure, citing scalability, congestion, and speed issues.

Sei Network aims to address these limitations with 30 Sei-powered applications slated for launch by the end of the year.

DEX SushiSwap intends to introduce a perpetual futures exchange leveraging the Sei protocol.

Ecosystem development and funding

Developers aligned with Sei Network benefit from a substantial $120 million ecosystem development fund.

This fund's establishment is partially attributed to a $20 million contribution from MEXC Global in January.

Sei secured $50 million in April, investments from Bitget and venture capital firm Foresight Ventures.

A recent funding round garnered $30 million, elevating Sei's valuation to $800 million.

The company's journey started with a seed round that successfully raised $5 million in August 2022.

TTD Adoption🎙️

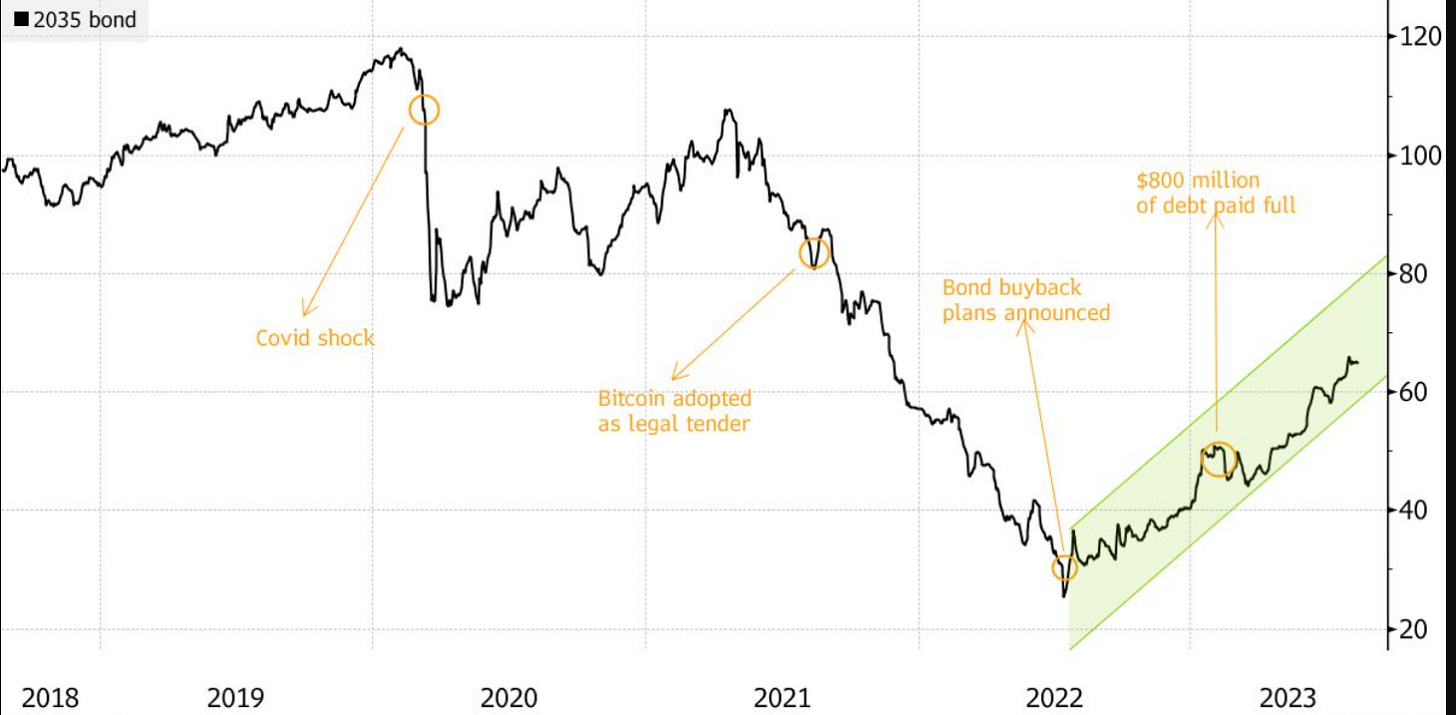

El Salvador's adoption of Bitcoin (BTC) as legal tender in 2021 initially raised concerns among investors, leading to doubt about the country's financial stability. But then, the narrative has shifted significantly since then.

In 2023, El Salvador's dollar-denominated bonds have outperformed many emerging markets, delivering a remarkable 70% return.

This impressive rally has captured the attention of institutional heavyweights such as JP Morgan, Eaton Vance, and PGIM Fixed, signalling renewed investor confidence in the country's financial policies.

Institutional interest is not confined to the giants alone; Lord Abbett & Co LLC, Neuberger Berman Group LLC, and UBS Group AG have also invested in El Salvador's debt securities.

This surge in demand for the country's bonds contrasts sharply with the skepticism seen after the BTC adoption. The adoption had led credit rating agency Fitch to downgrade El Salvador's long-term Issuer Default Rating due to policy uncertainty and concerns over Bitcoin adoption.

However, El Salvador's subsequent payment of an $800 million debt in full, coupled with the passing of a progressive crypto bill and plans for a Bitcoin-backed Volcano bond, have restored investor confidence.

The bond's robust performance in 2023 reflects the market's shift in perception.

TTD Numbers 🔢

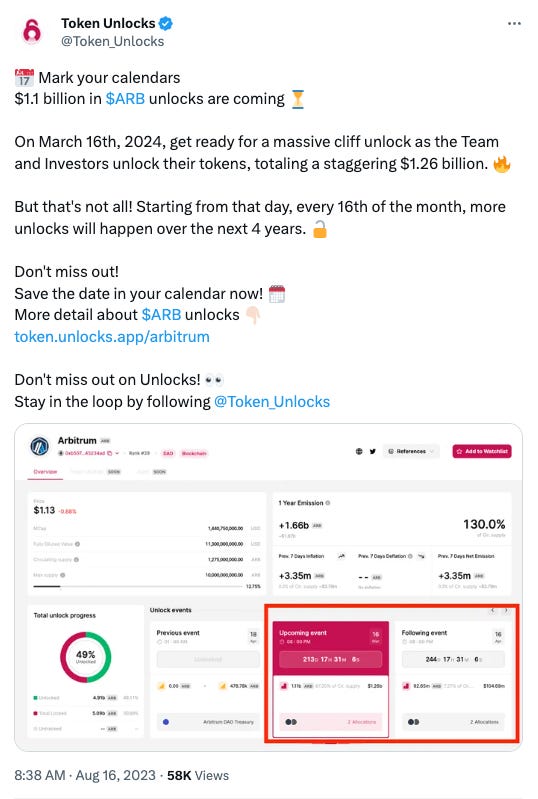

$1.1 billion

Worth tokens will be released by Ethereum layer 2 scaling solution Arbitrum in March next year.

A four-year period of staggered unfreezing of its native digital asset, according to Token Unlocks.

TTD AI📍

The US House of Representatives' New Democrat Coalition has established a 97-member AI working group on Aug. 15. The group aims to collaborate with President Biden's administration, stakeholders, and bipartisan lawmakers to create sensible policies addressing AI's impact. It will address utilising AI for growth while safeguarding jobs of workers affected by AI-induced changes.

ChatGPT-4 cuts content moderation time from months to hours

OpenAI is promoting AI, particularly its GPT-4 model, for content moderation on social media platforms.

The company claims GPT-4 can significantly speed up content moderation, enhancing labelling consistency and reducing mental stress on human moderators.

OpenAI aims to improve prediction accuracy by integrating chain-of-thought reasoning and is focused on identifying unfamiliar risks.

TTD Blockquote 🎙️

Gary Gensler, SEC Chair.

"Under the securities laws, fraud is fraud. We SECGov are technology neutral"

It isn't just crypto. He has got AI on his radar. And the unwavering commitment to combating fraud and protecting investors and market integrity under existing securities laws.

The convergence of blockchain and AI has led to the emergence of AI cryptocurrencies, as crypto firms leveraged AI's popularity. These tokens, like The Graph, Render, Injective, Oasis Network, SingularityNET, and Fetch.ai, integrate AI and blockchain for applications spanning AI-driven trading algorithms, supply chain automation, and more.

Gary is concerned about the "bad actors" leveraging AI to manipulate capital markets, and the SEC's role in safeguarding against micro and macro challenges posed by AI applications.

Gary has got a whole thread on it. Do read.

TTD Surfer 🏄

Two private banks in Uzbekistan — Kapital Bank and Ravnaq Bank — acquired approval from the National Agency for Perspective Projects (NAPP) to issue plastic crypto cards powered by Mastercard.

Since January 2020, almost 300 crypto companies have applied for registration with the British Financial Conduct Authority, 38 of which were approved. That's 13% of applications approved.

Coinbase has been cleared to offer regulated crypto futures to eligible US customers, that comes two years after filing an application with the National Futures Association.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋