Sculpting Speculation 🖼️

How Wall Street learned to stop worrying and monetise the memes of production

Exchange-traded funds (ETFs) were born from the crisis.

The Dow Jones crashed over 20% in a single day on Black Monday in 1987. Regulators and market participants realised they needed better tools. Mutual funds could only be traded at the end of the day, leaving investors helpless during market panics.

ETFs emerged as the solution. Baskets of securities that traded like individual stocks, providing instant liquidity when markets turned ugly.

ETFs simplified index investing, offering broad market exposure with low fees and tax efficiency. They were designed to be hands-off and transparent - just tracking an index without trying to beat it. The first successful ETF, launched in 1993 as the SPDR S&P 500 (SPY), became the world's largest fund by doing exactly what it promised: tracking the S&P 500, nothing more, nothing less.

They started as a genuinely good idea. You wanted to buy "the stock market" but didn't want to research individual companies or pay a fund manager to do it for you.

In September 2025, Wall Street crossed a new threshold: packaging memecoins into a regulated investment product and charging 1.5% annual fees for the privilege.

TOKEN2049 Happy Bird Ends Friday!

In two weeks, the global crypto community converges at Marina Bay Sands for the world’s largest crypto event: TOKEN2049 Singapore. You can still save US$400 off your tickets.

The unmatchable speaker lineup includes Eric Trump and Donald Trump Jr. (World Liberty Financial), Tom Lee (Fundstrat CIO), Vlad Tenev (Robinhood Chairman & CEO), Paolo Ardoino (Tether CEO), and Arthur Hayes (CIO, Maelstrom), with many more to be announced.

Join 25,000+ attendees, 500+ exhibitors, and 300 speakers as the entire venue transforms into a festival-style pop-up city, featuring a rock-climbing wall, zipline, pickleball courts, live performances, wellness sessions, and more.

Don’t miss your chance to be part of the defining crypto event of the year.

Are we witnessing a transformation of what ETFs were supposed to be?

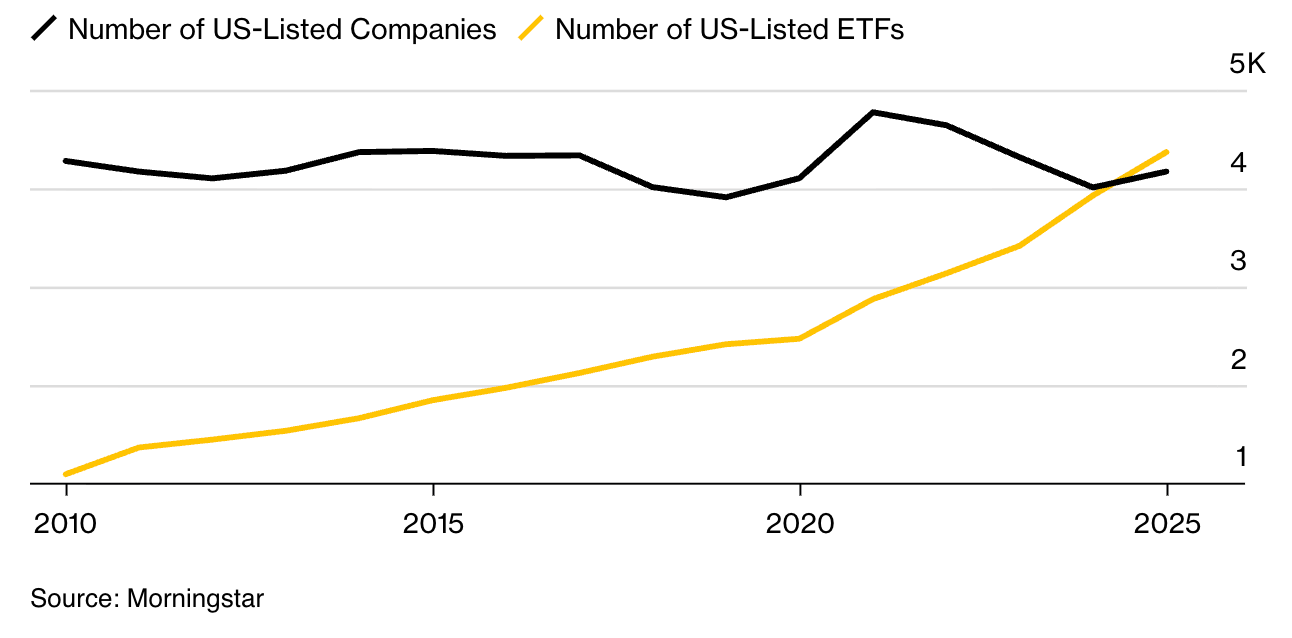

ETFs have evolved from simple tools that made investing easier into complex vehicles that can package literally any strategy you can imagine. There are infinite ways to combine, hedge, time, or structure investments, but only a finite number of actual companies to invest in.

There are now more than 4,300 exchange-traded funds compared to roughly 4,200 publicly traded companies. ETFs account for about 25% of all investment vehicles, up from 9% a decade ago. For the first time in market history, there are more funds than actual stocks.

This creates what I see as a fundamental problem - choice overload that paralyses rather than empowers investors. We now have funds for every conceivable theme, trend, or political viewpoint. The line between serious long-term investing and entertainment has completely blurred. It's become nearly impossible to distinguish between products designed to build wealth and products designed to capitalise on whatever's trending on social media.

Stop. This hand-wringing misses the point entirely. The Dogecoin ETF isn't a perversion of crypto's mission.

For fifteen years, crypto has been dismissed as fake internet money backed by nothing. Traditional finance called us degenerate speculators playing with worthless tokens. They said we'd never build anything real, never get institutional adoption, and never deserve serious regulatory treatment.

Now they're trying to capture value from assets we created as jokes.

The crypto industry created an entirely new category of value that traditional finance couldn't ignore, couldn't kill, and ultimately couldn't resist monetising. Dogecoin getting an ETF before half the Fortune 500 have comprehensive crypto strategies is the most brutal demonstration of crypto's cultural dominance possible.

Alright, now that we've gotten the victory lap out of the way, let's examine what we actually just celebrated.

Why Would Anyone Pay 1.5% for Something They Can Buy for Free?

The economics of memecoin ETFs make no sense for the investor, but make perfect sense for Wall Street.

You can buy Dogecoin directly on Coinbase in five minutes with zero ongoing fees. The REX-Osprey Dogecoin ETF charges 1.5% annually for the same exposure - that's $150 per year on a $10,000 investment. Bitcoin ETFs charge 0.25%. So why would anyone pay six times more for a memecoin than for digital gold?

The answer reveals who these products really target. Bitcoin ETFs serve institutional investors and sophisticated wealth managers who need regulatory compliance but understand crypto. They compete on fees because their customers have alternatives and know how to use them.

Memecoin ETFs target retail investors who see Dogecoin trending on TikTok but don't know how to buy it directly. They're paying for simplicity and legitimacy, not market exposure. These investors don't compare shops - they just want to click "buy" in their Robinhood app and get exposure to the meme they keep hearing about.

The issuers know this is absurd. They know their customers could buy Dogecoin cheaper elsewhere. They're betting most won't figure that out, or won't want to deal with crypto exchanges and wallets. The 1.5% fee is essentially a tax on financial illiteracy, packaged as institutional legitimacy.

What Makes Something ETF-Worthy?

Traditional ETF definition: A regulated investment fund that holds a diversified basket of securities, trades on exchanges like a stock, and provides investors with broad market exposure while maintaining professional oversight, custody standards, and transparent reporting.

The classic model tracks an index like the S&P 500, holding hundreds of companies across multiple sectors. Even single-sector ETFs like technology or healthcare funds hold dozens of stocks within their focus area. The diversification reduces risk while providing exposure to market trends.

Now consider what Dogecoin actually is: A cryptocurrency created in 2013 as literal satire by copying Litecoin's code and adding a meme dog logo. It has no development team, no business plan, no revenue model, no technological innovation. Its supply increases by 5 billion coins annually, making it inflationary by design as a joke about Bitcoin's scarcity.

The token serves no economic purpose. You can't build applications on it, or stake it for yield. Its only function is existing as an internet meme that sometimes gets pumped by celebrity tweets.

What Regulatory Loophole Makes This Possible?

The path to market reveals how financial innovation actually works: regulatory arbitrage that circumvents the spirit of law while technically complying with its letter.

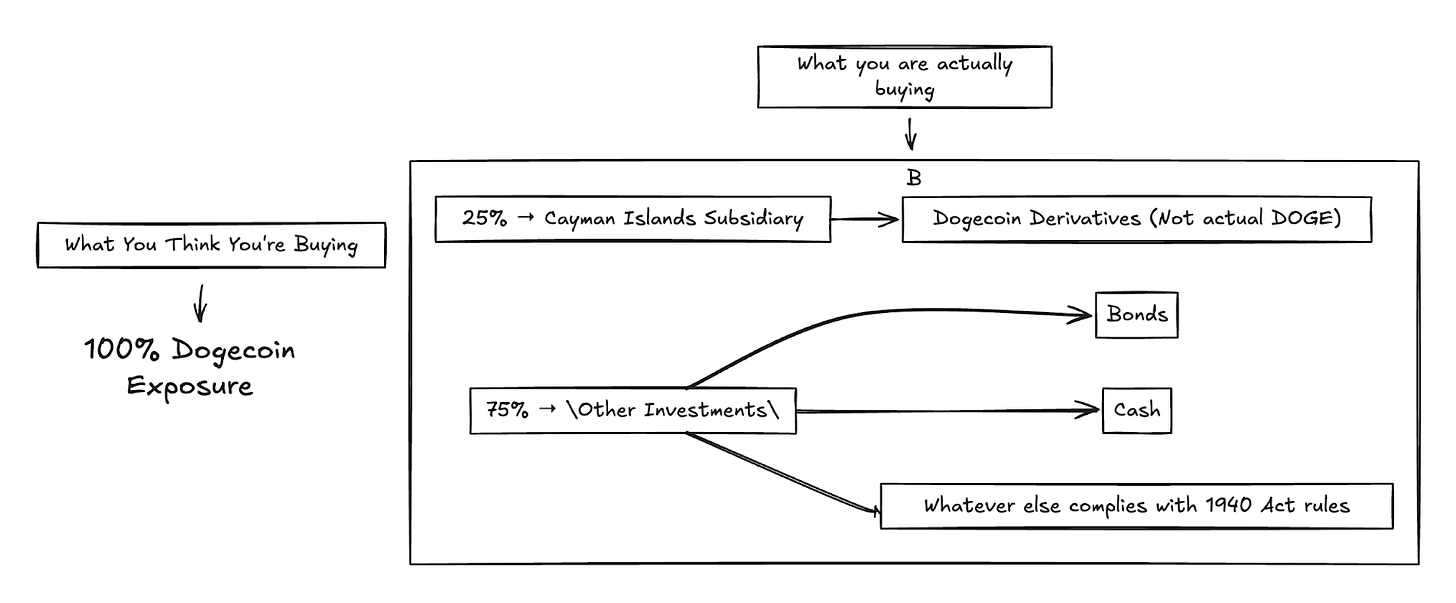

The REX-Osprey Dogecoin ETF (DOJE) launched under the Investment Company Act of 1940, not the Securities Act of 1933 that governs commodity ETFs like Bitcoin funds. This choice matters enormously. The 1940 Act provides automatic approval after 75 days unless the SEC objects, creating a regulatory shortcut. The catch? The 1940 Act was designed for diversified mutual funds that spread risk across multiple assets, not single-asset speculation on abandoned memes.

To comply with diversification requirements, DOJE can't hold Dogecoin directly. Instead, it gains exposure through a Cayman Islands subsidiary using derivatives, with holdings capped at 25% of assets. This creates the absurd situation where a Dogecoin ETF can be at most 25% exposed to Dogecoin.

It fundamentally changes what investors are actually buying. When an ETF holds assets directly, it tracks their price precisely. Using derivatives through offshore subsidiaries introduces tracking errors, counterparty risks, and complexity that can distort performance. The fund's returns become disconnected from Dogecoin's actual market movements.

The regulatory workaround creates a transparency problem. Retail investors buying the Dogecoin ETF expect straightforward exposure to the meme they keep seeing on social media. What they actually get is a complex derivative product where three-quarters of their investment has nothing to do with Dogecoin price movements. Their returns get diluted by whatever else fills the remaining 75% of the fund.

Even worse, the structure inverts the 1940 Act's original protective intent. Congress wrote diversification rules to reduce risk by spreading investments across multiple assets. Wall Street found a way to use those same rules to package high-risk speculation into regulated vehicles with less oversight than intended. Instead of protecting investors from risk, the regulatory framework now obscures new risks behind institutional legitimacy.

To compare with Bitcoin ETFs, most Bitcoin ETFs, like ProShares BITO or Grayscale’s spot Bitcoin ETF attempts, often use the Securities Act of 1933 or other frameworks designed for commodity-based funds, allowing more direct or futures-based Bitcoin exposure without the strict 25% asset caps.

Bitcoin ETFs typically hold futures contracts directly or seek direct custody of Bitcoin (when approved), enabling closer tracking of Bitcoin’s underlying price.

The Dogecoin ETF represents the perfect storm of regulatory arbitrage. It's an ETF that's mostly not invested in the thing it's supposed to track, holding an asset that proudly serves no purpose, using 1940s laws designed to prevent exactly this kind of speculation. It's financial engineering at its most cynical - exploiting regulatory loopholes to create speculative products under a veneer of investor protection.

What's With the Yield Obsession?

Wall Street has abandoned the pretense of caring about fundamentals and gone all-in on yield chasing, regardless of asset quality.

State Street data shows institutional portfolios are overweight equities at the highest levels since 2008. Investors are pouring money into options-income ETFs that promise monthly payouts, high-yield junk bonds, and crypto-linked yield products offering double-digit returns through derivatives.

Capital flows chase returns first, ask questions later. When interest rates spiked, investors rotated aggressively into high-yield corporate debt over safer investment-grade bonds. Thematic ETFs focusing on AI, crypto, and meme assets are launching at a record pace, catering to speculative demand rather than long-term value.

Risk appetite indicators are flashing green. The VIX stays low despite macro uncertainty. Defensive sectors briefly attracted flows after early 2025 volatility, but money quickly rotated back to industrials, tech, and energy - the high-risk, high-reward plays.

Wall Street has essentially decided that in a world of infinite liquidity and constant innovation, yield trumps everything else. If something pays a premium return, investors will find a way to justify buying it, regardless of underlying fundamentals or sustainability.

Are We Creating a Bubble?

What happens when there are more investment products than actual investments?

We've crossed the Rubicon where there are more ETFs than stocks. It's a fundamental market structure change. We're essentially creating synthetic markets on top of real markets, with each layer adding fees, complexity, and potential points of failure.

Matt Levine states:

"So as ETFs become more popular and technology makes them cheaper to implement, more trades that were once bespoke and handcrafted will become standardised ETFs. And there are many, many, many, many more potential trades than there are stocks... In the long run the possible universe of ETFs is capped by the (infinite) number of trades, not by the (dwindling) number of stocks."

The memecoin ETF phenomenon accelerates this trend. Rex-Osprey has filings for Trump coin ETFs, Bonk ETFs, plus traditional ones for XRP and Solana. There are 92 crypto ETF applications sitting with the SEC. Each successful launch creates demand for the next one, regardless of underlying utility.

This resembles the CDO-squared problem from 2008, where Wall Street created derivatives of derivatives until the financial products became completely disconnected from underlying reality. We're doing the same thing with attention and cultural phenomena instead of mortgages.

Markets appear more liquid than they actually are because there are multiple products trading around the same underlying assets. But in a crisis, all these products tend to move together, and the "liquidity" evaporates simultaneously.

What Does the Memecoin ETF Mean?

The deeper story is about finance evolving into a comprehensive attention-capture mechanism that can monetise literally anything that generates price movements.

The ETF launch creates its own momentum through network effects. Dogecoin's price rose 15% in the month leading up to DOJE's debut, driven by anticipation of institutional flows. Higher prices attract more attention, which in turn attracts more memes, leading to increased cultural relevance, which justifies more financial products. Success breeds imitation.

Traditional finance monetised productive assets like factories, technologies and cashflows. Modern finance monetises anything that moves prices: narratives, memes, social momentum. The ETF wrapper transforms cultural speculation into institutional products, extracting fees from communities that created the phenomena in the first place.

The broader question is whether this represents innovation or extraction. Does financialising memes create new value, or does it simply extract value from organic cultural movements by adding institutional overhead?

Internet culture already generates massive economic value - advertising revenue, merchandise sales, platform engagement, and creator economies.

I think it's time to "soft launch" my affair with internet culture.

Look, I've been trying to understand what drives billion-dollar valuations in 2025, and somewhere along the way I found myself ordering matcha from Mitico Coffee Roasters in Bangalore just to feel like I'm part of something. Not because I particularly love the taste of ground green powder, but because matcha has become this ritualistic signal of productivity and quiet luxury that somehow makes you feel more connected to a global wellness aesthetic.

This is what internet culture has become: a series of participation fees disguised as lifestyle choices. And the monetisation opportunities are everywhere, from the straightforwardly ridiculous to the genuinely clever.

Take 2025's greatest hits. We had the Coldplay "Kiss Cam" incident that turned two people's awkward moment into a corporate resignation scandal, complete with Gwyneth Paltrow somehow becoming a "temporary spokesperson" for the fallout. We watched the entire internet lose its collective mind over whether 100 men could defeat one gorilla (spoiler: experts say yes, but barely). The Labubu craze turned $30 blind-box collectables into status symbols that people literally fight over in stores.

Then there's the language barrier I can't seem to cross. Gen Z keeps evolving their slang. Someone called my outfit "bussin'" last week and I genuinely didn't know if I should be offended or flattered. Apparently it's good? My nephew tried to explain that something has "rizz" when it's charismatic, but then he started talking about "skibidi" this and "Ohio" that, and I realised I'm completely cooked. No cap, fr fr - I'm trying to keep up, but honestly, I'm starting to feel cheugy just attempting to use these words properly. It's giving millennial trying too hard, and that's not the vibe I'm going for.

And then Taylor Swift got engaged to Travis Kelce, and within minutes, the entire marketing universe pivoted. Brands from Walmart to Lego to Starbucks dropped everything to insert themselves into the conversation.

The point is, this cultural momentum is an economic engine. When Katy Perry takes an 11-minute space flight and the internet spends a week debating whether it was "gluttonous," that's engagement that translates to advertising revenue, brand mentions, and cultural capital that can be monetised a dozen different ways. When everyone starts calling their friends "pookie" because of one TikTok couple, suddenly there's a whole ecosystem of pookie playlists, pookie ribbons, and pookie merchandise.

Internet culture generates massive economic value through creator economies, merchandise sales, platform engagement, and movements that can shift stock prices faster than quarterly earnings reports. If a single Elon tweet can add billions to Dogecoin's market cap, if Tesla's valuation moves more on cultural momentum than fundamentals, then cultural phenomena are legitimate economic forces that deserve the same institutional packaging as any other asset class.

The ETF wrapper doesn't extract value from these communities - it formalises value that already exists and makes it accessible to people who were previously locked out. A retiree in Ohio can now access internet culture through their 401(k) without needing to learn about crypto wallets or navigate Discord servers.

The flip side is that the same retiree can also lose a significant portion of their retirement savings on an abandoned internet joke. The 1.5% annual fee alone will eat $1,500 yearly on a $100,000 investment, regardless of whether Dogecoin goes up or down. And since the ETF can only be 25% exposed to Dogecoin due to regulatory requirements, that retiree might not even be getting the cultural exposure they think they're buying. Financial accessibility without financial education can be dangerous. Making speculative assets easier to buy doesn't make them less risky - it just makes the risks less visible to people who might not understand what they're purchasing.

Financialising memes might actually strengthen these communities rather than exploit them. When cultural movements have institutional investment backing, they gain stability and resources.

If internet culture moves prices, internet culture becomes an asset class. If social momentum creates volatility, social momentum becomes tradeable. The ETF wrapper is just the delivery mechanism for transforming cultural energy into institutional products.

That’s it about today’s deep dive. See you next week with another one.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.