SEC Corners Uniswap 🫷

SEC sends Uniswap Labs a Wells Notice. Founder Hayden Adams says he is ready to fight. US inflation data causes Bitcoin price swing. GBTC ETF hits record daily outflow low of $17.5M. Solana speeds up.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

DeFi exchange Uniswap is in hot water.

The SEC sent Uniswap Labs a Wells Notice, indicating a potential lawsuit.

Why? The SEC believes Uniswap's offerings might be securities, which would require them to register with the SEC.

Uniswap founder Hayden Adams is not happy. He accuses the SEC of "attacking good actors" and is "ready to fight."

What's this about? The SEC seems to be cracking down on DeFi, an area they view as unregulated and risky.

What's next? Uniswap has a chance to defend itself before the SEC makes a final decision.

Uniswap isn't alone. Last year, competitor SushiSwap faced a similar situation.

This could be a big deal for DeFi. A lawsuit against a major player could set a precedent and impact the entire industry.

Uniswap Price? UNI is down 16%.

The regulator is targeting Uniswap, but experts say it's unlikely to go after individual UNI holders.

The Industry Reacts

Block That Quote 🎙️

Hayden Adams, founder of Uniswap.

“People often ask me why we stay in the US and my answer is simple: I believe that blockchain is incredibly powerful technology. Like the internet, it’s here to stay. So someone needs to figure it out, and it might as well be us.”

Hayden took to X, to express his disappointment and willingness to fight.

Uniswap argues they are not dealing with securities: They say tokens are a file format and not inherently securities.

Most tokens traded are not securities according to Uniswap.

“Taking into account the SEC’s ongoing lawsuits against Coinbase and others as well as their complete unwillingness to provide clarity or a path to registration to those operating lawfully within the US, we can only conclude that this is the latest political effort to target even the best actors building technology on blockchains."

Bitcoin Swings To Inflation Tune

Inflation came in higher than expected, spiking 3.5% year-over-year.

This is raising concerns about the Fed raising rates instead of cutting them.

Bitcoin price: Bitcoin fell as much as 2.5% after the CPI report.

Fell below $68k, only to rebound to $71K.

Investors initially sold off Bitcoin after the inflation report, fearing interest rate hikes.

But Bitcoin recovered all its losses, outperforming stocks and gold.

This resilience suggests strong underlying demand for Bitcoin, with some investors seeing dips as buying opportunities.

Rate cut hopes dashed: Market bets on a June rate cut shrunk from 45% to just 20%. September is now the new target.

Bitcoin ETF inflows slow: Investors seem cautious now despite the upcoming Bitcoin halving.

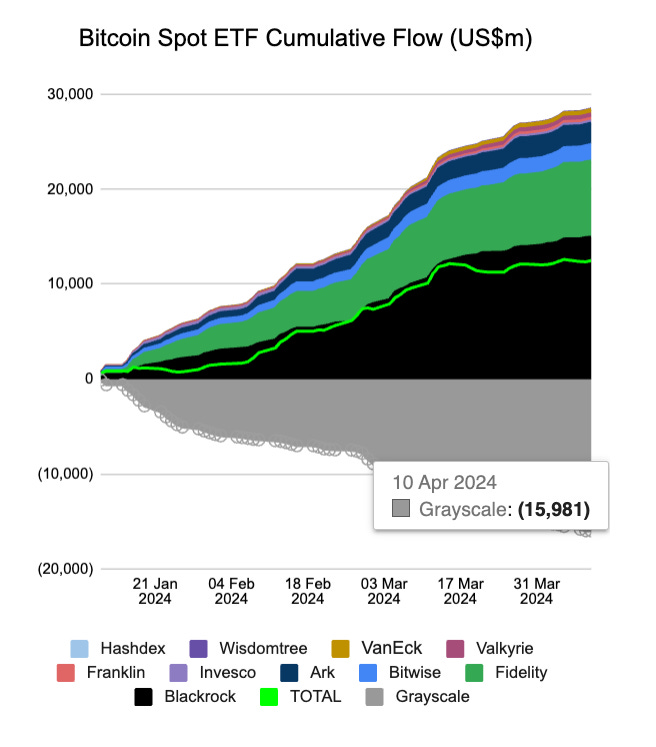

In the Numbers 🔢

$17.5 million

New record low of daily outflows from the Grayscale Bitcoin Trust (GBTC) on April 11.

The total net inflow of Bitcoin spot ETFs was $123 million yesterday.

This follows a period of heavy selling, close to $16 billion in the past three months.

Grayscale CEO Michael Sonnenshein believes the outflows are finally stabilising, suggesting the market might be reaching an "equilibrium." This could be due to a combination of factors, including:

Major liquidation events, like the FTX bankruptcy, may have run their course.

Investors could be regaining confidence in GBTC.

Solana Speeds Up Transactions

Thanks to a new system called Timely Vote Credits (TVC).

Here's the deal: Before, validators could game the system and slow down voting to earn more rewards. This made transactions sluggish.

The fix? TVC rewards validators for faster votes, making it pointless to wait around. This should lead to speedier transaction confirmations.

The Solana community overwhelmingly approved TVC. Why? Solana's been experiencing high congestion lately, with slowdowns lasting over a day. Bots have also been causing issues.

The Surfer 🏄

Crypto exchange Bitget's Q1 report boasts $1.6 trillion in trading volume. Futures hit a whopping $1.4 trillion, while spot trading reached $160 billion – both significantly higher than Q1 2023. The exchange continues to attract new users, reaching over 25 million.

Imagine getting £100 in "LONDON tokens" to spend around the city. That's mayoral candidate Brian Rose's plan. He wants to tax London's financial giants to create a £1 billion pool for this new crypto. These tokens would work on public transport and potentially for other things too.

Dubai's Virtual Asset Regulatory Authority (VARA) wants to ease the burden on small crypto firms. VARA CEO Matthew White acknowledges that crypto regulations are not perfect and is seeking ways to improve them.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋

You're not "decentralized" if a government can sue you.