SEC's Playing tag?🛝

SEC backs off Ripple bigwigs. What's the next move? Binance Q3 report: Crypto sees rain & shine. New York’s AG targets Gemini & pals. Tim Draper's AI twin on the loose.

Hello, y'all. What song are you FEELING right now? Oh yes, you can know that. Check out 👉 ImFeeling

What we feelin?👇

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Okay, what happened to SEC?

First, didn't appeal Grayscale's court win.

Read - SEC vs / Grayscale⚔️

Now, removes charges against Ripple bigwigs.

SEC has thrown in the towel on charges against Ripple execs, CEO Brad Garlinghouse and Executive Chairman Chris Larsen.

Both had been in the SEC's crosshairs over alleged violations tied to XRP token sales.

In a recent filing with the US District Court for the Southern District of New York, the SEC said it's not pursuing the two execs any longer.

Instead, they're discussing the potential outcomes for Ripple's alleged Section 5 violations concerning its XRP Institutional Sales.

This is what the filing says:

"The SEC and Ripple intend to meet and confer on a potential briefing schedule with respect to the pending issue in the case—what remedies are proper against Ripple for its Section 5 violations with respect to its Institutional Sales of XRP—and respectfully request until November 9, 2023 to propose such schedule to the Court or, if the parties cannot agree, to seek a briefing schedule from the Court on a contested basis."

Stuart Aldeorty, Ripple's chief legal officer, labelled the SEC's move as "a surrender" rather than any kind of settlement.

Ripple echoed the sentiment, calling the decision a "stunning capitulation".

Read Ripple's statement here.

CEO Garlinghouse felt particularly vindicated, noting that the SEC had "targeted" them in a heartless bid to destroy both their personal lives and the company.

Origins of the Ordeal 🔄

This legal tango began back in December 2020 when the SEC came after Ripple, its CEO, and executive chairman.

The primary bone of contention? Sales of XRP tokens, which the SEC declared were securities.

Fast forward to July, and a federal judge countered the SEC, ruling XRP wasn't a security when hawked to the general public.

The Ripple Effect: XRP felt the love, rising around 5%, with the bulk of that ascent coming after the bombshell announcement.

Why the Change of Heart? 💔

Speculations are rife.

Did the SEC's recent losing streak against Ripple influence their decision?

Or is there more to it?

The SEC's playing its cards close to its chest, not spilling any beans yet.

Dropping charges against Garlinghouse and Larsen could be a prelude to the SEC appealing the court's stance on XRP as a security.

"Today, we are legally vindicated and personally redeemed in our battle against a troubling attempt to abuse the rules in order to advance a political agenda to suffocate crypto in America. It is a travesty that we were forced to defend ourselves from an ill-advised attack that was flawed from the day it was filed," Ripple Executive Chairman Chris Larsen said.

The Larger Picture 🖼️

Ripple's not alone. The SEC's got its legal arsenal aimed at other crypto giants too—think Coinbase, Binance, and Tron.

Despite Ripple's recent legal wins boosting morale (and market value!), there's still a long road ahead. The judge did concur with the SEC on one aspect: XRP's sales to institutional bigwigs were illegal unregistered securities offerings.

Grayscale vs SEC

The DC Circuit Court of Appeals is set to issue a potentially industry-shifting mandate regarding Grayscale Investments' battle with the US SEC over its Grayscale Bitcoin Trust (GBTC) converting to an ETF.

The SEC's method of blocking this conversion has already faced legal challenges, and its decision not to appeal suggests change is on the horizon. However, while the court is likely to order the SEC to rethink its refusal, the specifics of the ruling and the SEC's subsequent actions remain uncertain.

Legal experts believe the court may not require the SEC to approve the GBTC conversion but may restrict grounds for future denials.

The imminent mandate, combined with recent developments in ether futures ETFs, hints at potential approvals for spot bitcoin ETFs, including Grayscale's, in the near future.

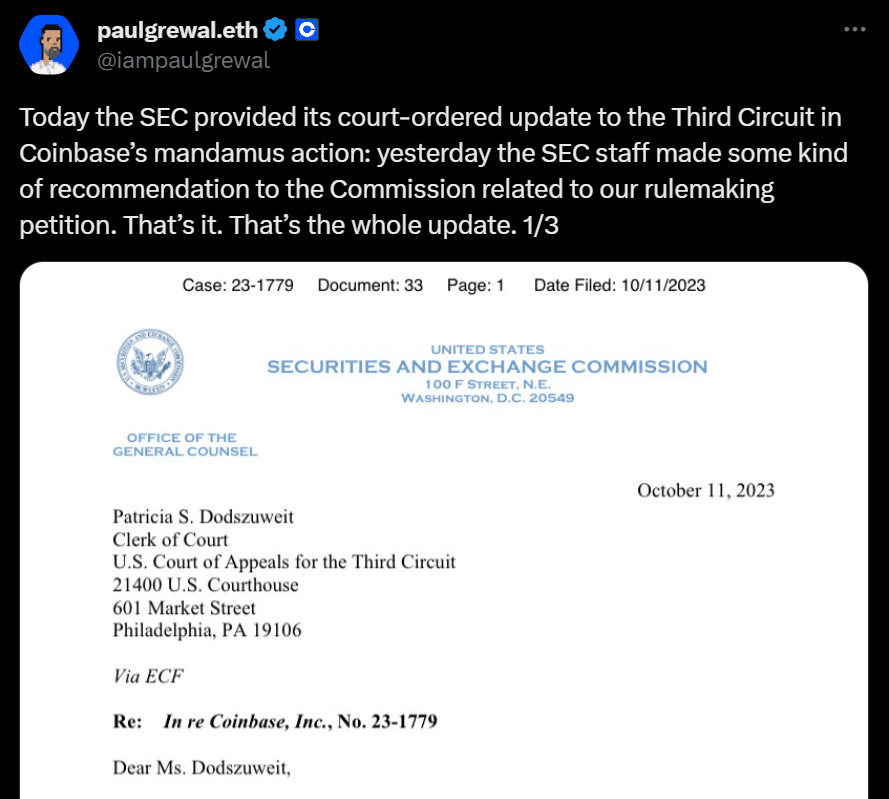

Coinbase Vs SEC

Coinbase just pulled a legal move called a mandamus asking the SEC to make up its mind on their rule-making petition.

The main goal for Coinbase is to get a definitive approval or denial of its petition, and it is now pushing for a response within a month.

The SEC recently offered a recommendation regarding Coinbase's appeal, but did not disclose the details.

TTD Numbers 🔢

$185K

The Crypto Aid Israel collective is making waves, raising a whopping $185K in less than a fortnight and spreading some much-needed love to humanitarian organisations.

The Details 📊

Founded recently, Crypto Aid Israel has already had two rounds of donation distribution, totalling around 200,000 shekels.

Beneficiaries include:

The Foundation for Advancing Citizens of Eshkol Regional Council – aiding in transportation and shelter for those close to Gaza.

Zaka – buying medical essentials and protective equipment for its front-line heroes.

Lev Echad by Or Hanegev veHagalil – supporting at-risk youth by providing food, hygiene products, and clothing for folks living near Gaza who've stuck around to offer protection and assistance.

Latet – undertaking a massive operation to feed and keep hygienic those from southern Israel, whether they've stayed or been relocated. Their adviser, Eyal Gura, highlighted the potential of crypto, saying:

“We believe that while modest initially, the crypto channel is an important, speedy and innovative one and will enable new contributors to join our global ecosystem and support Israel in such an important hour.“

The brains of the operation? The Israeli Web3 community, backed by numerous companies.

Major kudos to global accounting heavyweight KPMG for helping with fundraising and distributing the funds. Other supporters include Zengo, Fuse, Wonderland, Psagot Equity, and more.

Want to chip in? Head over to their website and donate through a multisignature wallet. But keep those eyes peeled: phishing attacks have reared their ugly heads.

TTD Binance 🟡

Binance's Q3 Report

Binance's Q3 "Market Pulse" report confirms that the crypto world has faced some headwinds. Yet, there's also a silver lining as major institutional players like Deutsche Bank, Sony, and PayPal make their entry.

The Details 📊

Overall Market Cap: The crypto world's total market cap saw an 8.6% reduction QoQ. High-interest rate scenarios played a significant role, echoing sentiments of "higher for longer."

Fundraising: The figures were the lowest since Q4 2020, marking a 21.4% dip QoQ. Infrastructure was a rare bright spot, outperforming other sectors.

Blockchain Activity

Near had an activity increase of about 120% QoQ.

BNB Chain experienced a decrease.

Ethereum showed a minor increase.

Solana indicated a slight decrease.

Decentralised Finance (DeFi)

Total Value Locked (TVL) fell by 13.1%.

Ethereum had 55.1% of TVL.

Tether comprised 67.2% of the stablecoin market share.

Liquid staking remains the dominant sector and continued gaining steam with a QoQ growth of 10.5%.

NFTs and Gaming

September was the worst month since January 2021 with sales around $300 million.

Average sale price in September was $38.17.

Gaming tokens led NFT sales but saw a 44.9% price decrease QoQ.

Google’s decision may give NFTs a boost in the gaming market.

Coin Performance

Six out of the top 10 coins showed an increase in value.

Solana had the highest growth at 113.73%.

TON debuted with a 3.11% decrease.

Bitcoin and Ether increased by 63.05% and 39.9% respectively.

BNB decreased by 12.77%.

Bolsters Euro Services

Binance reveals new collaborations with authorised fiat service providers to facilitate Euro-related transactions for European users.

With these partnerships, Binance aims to enhance the suite of services it offers:

Seamless EUR deposits and withdrawals using the Single Euro Payments Area (SEPA) network.

Facilitation of EUR spot trading pairs.

Enable users to purchase and trade digital assets via SEPA, traditional bank cards, or existing fiat balances.

This move is a response to the departure of Binance's earlier euro service collaborator, Paysafe, which ceased its support for the crypto exchange in the previous month.

Executive Exodus

Stéphanie Cabossioras, Managing Director of Binance's French unit, is the latest to resign, marking the fifth major executive departure.

Binance is currently under scrutiny in Europe and the US, leading to service suspensions and setbacks. Binance.US, the exchange's American arm, has seen a significant decline in market share following allegations from the SEC and CFTC.

The company is also facing lawsuits and investigations in various countries, including France, for alleged illicit activities and money laundering.

The FTX Saga 🚨

JP Morgan analysts predict that a Bitcoin exchange-traded fund (ETF) could be approved by the US Securities and Exchange Commission (SEC) before January 10, 2024👇🏻

TTD Sued👩🏻⚖️

New York's Attorney General, Letitia James, isn't just pulling any punches.

She's taking on the big leagues with a sweeping lawsuit against Gemini, Genesis, and Digital Currency Group (DCG), aiming right at the top with CEOs Barry Silbert and Michael Moro in her crosshairs.

But what's the beef?

At the heart of the controversy is a lending program launched in 2021. The Attorney General claims that there wasn’t adequate risk disclosure involved.

Adding fuel to the fire, Gemini is accused of downplaying risks tied to loans made to third parties such as Alameda Research. This ended up causing significant financial losses.

Undisclosed Risks 🚫

James paints a picture of two companies taking advantage of the largely "under-regulated" crypto space, leading to significant investor losses.

One major claim? Genesis gave false assurances to Gemini about regularly auditing its borrowers' financial health. But upon investigation, no records of these audits were found for two whole years!

Genesis is also in hot water for allegedly concealing its real financial predicament with a huge $1.1 billion promissory note.

Meanwhile, Gemini reportedly turned a blind eye, failing to alert its customers about the lurking financial issues with Genesis.

This isn't just about pointing fingers. James aims to stop Gemini, Genesis, and DCG from providing investment services in New York.

On top of this, she’s pushing for investor restitution and the return of the alleged unlawful profits made by these companies.

Potential Repercussions for Gemini

The timing of this lawsuit couldn’t be worse for Gemini. The exchange is already under the microscope of the US Securities and Exchange Commission (SEC) for potential violations related to Gemini Earn.

A little back story: Gemini's Earn program involved customers depositing money into Gemini, which Genesis would then loan out to third parties, promising a lucrative 8% annual return.

As for Genesis, it's been a tough year. After some major crypto companies (like Three Arrows Capital and Voyager Digital) crumbled, Genesis was left in the lurch, trying to recover its loans. Their financial woes deepened with over $100 million in losses from Babel Finance.

TTD Warning 🚨

It looks like the fabulous world of AI is not just being used for fun TikTok videos or helping you order your pizza.

Now, it seems AI might be saying, "Hold my bytes, and watch this," as it tries to mimic voices of big shots in the crypto realm.

Tim Draper, prominent venture capitalist and sometimes crypto-fortune teller, just rang the alarm bells. There are scammers running wild using an AI-generated voice that sounds eerily like him.

Draper went live on X to give his quarter-million followers the 411.

In a nutshell: If you think Timmy D's calling you to transfer some Bitcoin, think twice. Maybe thrice!

Deja Vu: Remember when FTX's roof metaphorically caved in? Yep, AI was there too! Scammers made a digital puppet show with a deepfake video of Sam Bankman-Fried. And who can forget the virtual Elon Musk imposter from May 2022?

A Quick Flashback: Now, for those needing a refresher, Draper was the guy who made a bold prediction about Bitcoin hitting $250,000 by 2023. He’s been around the crypto-block, even experiencing a heartbreak losing 40,000 BTC when Mt. Gox did its dramatic exit. But like a trooper, he's still here, rooting for digital coins and warning us about sneaky scams.

TTD Surfer🏄🏻

Two Reddit moderators allegedly sold off a large number of Moons before the announcement of the termination of Reddit's Community Points program.

Lightning Labs, a company working on Bitcoin's Lightning Network, has launched "Taproot Assets" on the mainnet.

The US Treasury Department is seeking to label crypto "mixers" as national security threats due to concerns about money laundering.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋