Self-custody Wins 😋

The Bitcoin v self-custody drama. Saylor's tongue slip and Vitalik's response. Saylor plans to follow Satoshi's footsteps? Peter Todd is not so happy with the fame. Tesla still a HODLer.

Hello, y'all. FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket👇

The MicroStrategy boss, who owns more Bitcoin than the governments across the world, just sparked a little drama.

And we weren’t expecting that. Were we?

Because Saylor is one of our favourites: Saylor's Trillion-Dollar Dream 💰

We were waiting for his Bitcoin Bank to launch ASAP.

Then what happened?

Saylor decided to take a swing at "paranoid crypto-anarchists" who prefer self-custody.

The same guy who's been Bitcoin's biggest cheerleader just threw shade at one of its core principles.

His take?

Big banks should hold your Bitcoin.

Self-custody folks are too paranoid.

"Too big to fail" banks are safer.

Government seizure risk increases with self-custody.

Rewind to November 2022, post-FTX collapse, when Saylor sat on the other side.

“In systems where there is no self-custody, the custodians accumulate too much power and then they can abuse that power. If you can’t self-custody your coin, there’s no way to establish a decentralised network.”

So what changed?

Follow the money trail.

MicroStrategy wants to be a "Bitcoin bank."

Aims for trillion-dollar valuation.

Plans to issue Bitcoin-backed securities.

Needs traditional finance on board.

When you're planning to build a Bitcoin bank, maybe you don't want people keeping their own keys? And you might want regulatory browny points?

Or are we just connecting the dots way too much?

The community reacted

And then ... Vitalik entered the chat.

Another favourite guy for the crypto folks: Evolution of Crypto ft. Vitalik Buterin 🎙️

What did he say?

"I'll happily say that I think Saylor's comments are batshit insane"

Buterin was responding to Casa co-founder and CTO Jameson Lopp

“Bitcoin self custody isn't just about being a paranoid mountain man. There are many long-term negative ramifications to convincing people to trust third-party custodians.”

Why's everyone so heated?

Well, imagine telling car owners they shouldn't keep their own car keys because "professional parking lots" are safer.

The core of the debate

Self-custody = Your keys, your coins.

Third-party custody = Someone else holds your keys.

Risk trade-off: Personal responsibility vs institutional trust.

Again, remember FTX? (Saylor, obviously doesn’t).

Yeah, that's why this matters 👀

What does self-custody actually mean?

Complete control over your crypto.

No third-party dependencies.

Direct blockchain interaction.

True ownership of assets.

What are the risks?

Lost keys = Lost funds.

Security responsibility.

Technical knowledge needed.

No customer support to call.

But then again ... third-party custody means

Someone else controls your funds.

Potential freezes or seizures.

Dependency on institution's security.

"Trust us bro" banking model.

🎙️ Block That Quote

Michael J. Saylor, CEO of MicroStrategy

"I support self-custody for those willing and able, the right to self-custody for all, and freedom to choose ..."

Yes, damage control.

24 hours later, Saylor did a complete 180°.

Why? Because the stakes are huge.

MicroStrategy isn't just any company.

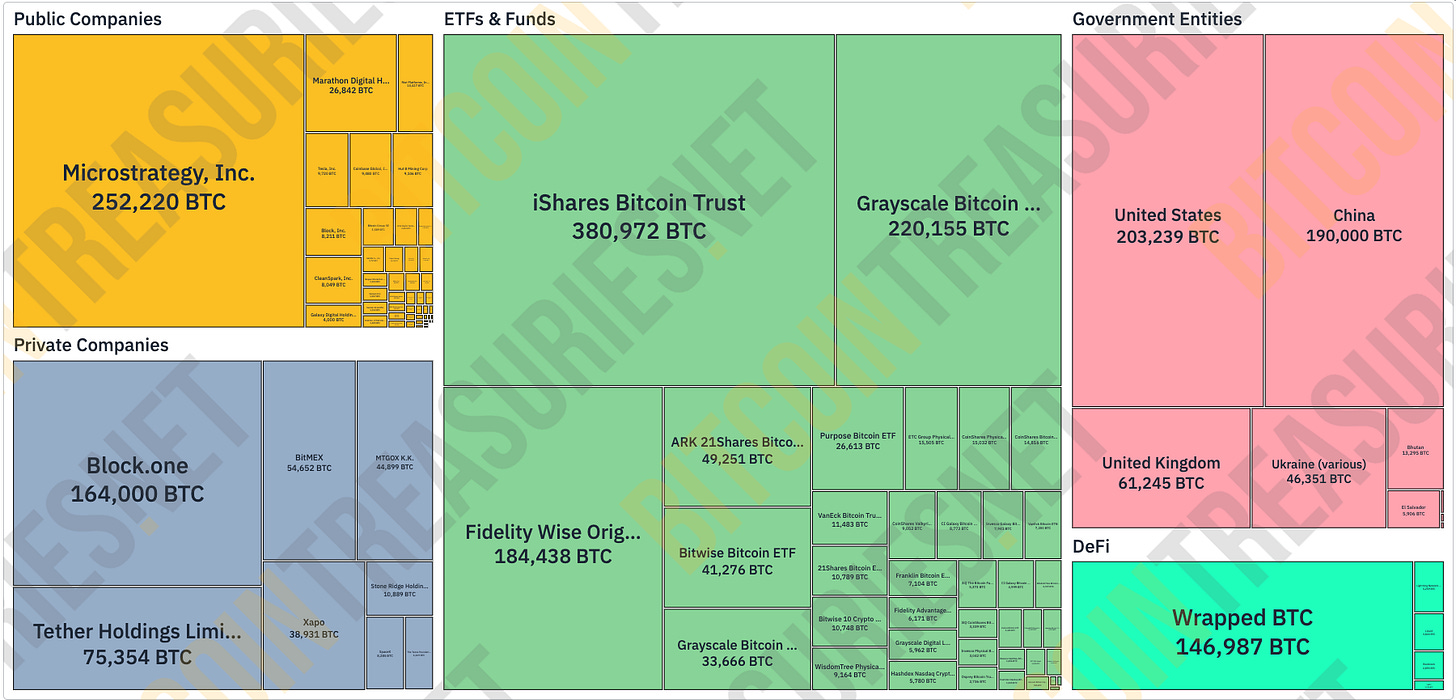

owns 252,200 Bitcoin

Worth $16 billion

1% of all Bitcoin that will ever exist

Plans to become a "Bitcoin bank"

Their Evolution

$1.5B → $40B market cap in 4 years

Software company → Largest corporate Bitcoin holder

Traditional finance → Crypto pioneer

Aiming for trillion-dollar valuation

"We saw Bitcoin as a big tech monetary network,”…“like Google for money, or Facebook for money” - he said.

Read: Should You Invest in MicroStrategy’s Bitcoin Bet? 🍔 🤔

The Home for All the Music Lovers

Muzify - With close to 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

Saylor's Satoshi-Style Legacy

Remember Satoshi's disappearance, leaving behind a fortune in Bitcoin?

Well, Saylor's planning to follow those footsteps.

What did he say?

"I'm a single guy, I have no children — when I'm gone, I'm gone. Just like Satoshi left a million Bitcoin to the universe, so I'm leaving whatever I've got to the civilisation," he told The New Zealand Herald.

"It won't fly you, won't cure your cancer, won't make you happy, won't solve your mental issues, and won't make your children love you."

Still ... with MicroStrategy holding 252,200 BTC ($16B), that's quite a gift to civilisation?

Is Saylor just trying to one-up Satoshi?

Anyway, seems like some Bitcoin will outlive us all.

That reminds us about the Satoshi suspect.

The Satoshi Hunt Goes Wrong

HBO's latest documentary "Money Electric: The Bitcoin Mystery" claimed to solve crypto's biggest whodunit by pointing fingers at Bitcoin developer Peter Todd.

Documentary airs on October 9.

Claims Todd is Satoshi.

Uses a "gotcha" moment from 2010.

Director Cullen Hoback stands firm.

Guess what? Todd’s not enjoying the spotlight.

His response? "I'm not Satoshi" 💔

He called allegations dangerous and reports harassment.

"Not only is the question dumb, it's dangerous. Satoshi obviously didn't want to be found, for good reasons, and no one should help people trying to find Satoshi."

Why so serious? Well, being "outed" as Satoshi means a lot …

Target on your back

$67B fortune questions

Potential security threats

Unwanted attention

The numbers bring us to Tesla’s Bitcoin holdings … another big BTC holder.

In The Numbers 🔢

$184,000,000

That's the value of digital assets Tesla is still HODLing strong through Q3 2024, marking five straight quarters without selling any crypto.

The recent drama?

On October 15, crypto community went into panic mode.

Why? Arkham Intelligence spotted movement in Tesla's Bitcoin wallets.

These wallets had been sleeping since 2022.

Suddenly, BTC started moving to unknown wallets. Crypto Twitter went wild with speculation

FUD started spreading about Tesla dumping.

Turns out, those were just internal transfers.

Q3 report confirms: Tesla didn't sell a single sat.

Zero Bitcoin sales in Q3

11,509 BTC still in Tesla's wallets

Valued at ~$750.7M at current prices

Represents major institutional confidence

Q3 Performance?

Revenue: $25.18B (slight dip from Q2)

Net income: $2.18B (↑ from Q1's $1.5B)

Automotive sales: Small decline

Leases: Slight increase

The Surfer 🏄

Bitcoin miners are currently trading at a 90% discount compared to AI data centres, according to Bernstein analysts. This discount may narrow as miners pivot to capitalise on the growing demand for energy from AI providers.

London's Lord Mayor Michael Mainelli criticised central bank digital currencies (CBDCs) for threatening user privacy during an event hosted by digital pound advocates.

Blockchain.com is facing prosecution in the UK for failing to file its financial accounts since 2020, with a court hearing scheduled for November 25.

A China-based OTC trader, Yicong Wang, has allegedly laundered over $17 million in stolen cryptocurrency for the North Korean Lazarus Group, known for major hacks like the $600 million Ronin bridge exploit.

zkLink Core DAO has postponed its token vesting schedule by six months, affecting 40.5% of the total ZKL token supply, originally set to begin on October 22.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

The analogy about parking lots and car keys is perfect. You wouldn't hand over your keys unless absolutely necessary, so why do the same with your crypto? Education on self-custody is still lacking, but it’s crucial for true financial independence.

Saylor positioning MicroStrategy as a Bitcoin bank is interesting. It makes sense from a business perspective, but I hope he doesn’t completely abandon the principles that attracted so many people to Bitcoin in the first place. Big institutions and decentralization don’t always mix well.