Sendit's Bet on Bankless Selling 📩

One entrepreneur's journey through the evolution of online commerce

We've been looking at an interesting product at the intersection of the creator economy and stablecoins over the past few days.

The space is full of ambitious promises. But every so often, you find someone building something that makes sense. Someone who understands the problems because they've lived them. Basil from Sendit Markets is one of those builders.

I had a chance to speak with him about how he got here, and this article is what came of it. His story starts in an unexpected place.

The first lesson in online commerce came from a teenager who beat Basil Naser at FIFA and then stole his virtual players. Instead of getting angry, Naser asked how he did it.

That conversation led to a day flipping $300 worth digital soccer coins on eBay, which led to paying for college through drop shipping, which eventually led to building Sendit Markets. A platform where creators earn in stablecoins instead of traditional banking systems.

At 16, Naser has learned that getting scammed teaches you something about finding gaps in digital marketplaces.

His latest venture bets that enough people want to hold dollars outside traditional banks to support an entirely new type of commerce infrastructure.

The FIFA University

Moving from New York to North Carolina as a teenager, Naser needed money for college. His single mother didn't make much, and he wanted to afford tuition. He spent hours playing FIFA, building teams and buying player packs. One day, another player beat him in a game and offered to teach him a trick.

"He said if we trade players at the same time, it glitches and you get your players back and my players," Naser recalls. "I did it. He got my players, and then he didn't send me his trade."

Instead of getting angry, Naser was impressed. The scammer told him about C2C offer, a Chinese website where you could buy Xbox accounts and FIFA points for a fraction of what Xbox charged. Something that cost $65 from Xbox was $6-10 on the platform, with room to negotiate.

Naser started buying FIFA coins for $6-10 and listing them on eBay for $30. Within 10 minutes of his first listing, someone bought it. He made $300 on his first trade using his mother's PayPal account since he wasn't old enough for his own.

When eBay banned him for selling digital items, he found a workaround. He'd sell a paperclip with the title "paperclip plus free gift FIFA one million FIFA coins." Buyers got a tracking number for the paperclip and received the FIFA coins as "gift."

This led him to the broader world of reselling through C2C platforms. He scaled up his operation and paid for college through drop shipping between 2012 and 2014. When family pressure pushed him toward becoming a doctor, he got a biochemistry degree but quit medicine the day after graduation.

In 2016, Naser discovered Shopify through YouTube videos promising "$10,000 a month drop shipping." He spent his savings of $10,000-15,000 on Facebook ads that didn't work until one weekend when everything clicked.

His breakthrough ad was a meme on a T-shirt. The ad cost $100 and brought in $5,000 that Saturday.

The business eventually grew to 35,000 customers before he sold it. He repeated the process with other e-commerce businesses, flipping them until 2021.

During COVID, when everyone was on their phones shopping, business boomed. But Naser grew bored. He was making money selling to customers he didn't care much about, automated through virtual assistants, wondering what was next.

Naser's understanding of why traditional banking fails comes from personal experience. From 2016-2019, he lived in Lebanon, running his online businesses while enjoying the low cost of living. Lebanon was unique, the only country that let residents deposit USD and maintain USD accounts.

In 2019, everything changed. The Lebanese currency lost 98% of its value when banks defaulted on government loans. Naser's father, like many Lebanese, had saved in dollars in local banks. When he went to withdraw his money, the bank would only give him $300 per month, regardless of his actual balance. To get that $300, they deducted $1,500 from his account as a fee.

"It doesn't matter if you're poor or rich, if you have a million dollars or $10,000. You were living the same life as everyone. Everybody got 300 bucks a month,” Naser says.

During the recent war in Lebanon, his father faced another problem: he had cash hidden at home but couldn't travel with it. Naser suggested converting it to stablecoins. "That way you can put the USB drive in your pocket and you're taking your money wherever you go."

Finding Crypto

In 2021, Naser moved to Lisbon, the first country to reopen after COVID lockdowns. He intended to stay two weeks but ended up remaining longer after meeting someone in crypto on his first day. Six weeks later, they organised a conference for 800 people in the Cosmos ecosystem, building it from scratch with no prior event experience.

"We didn't make any money, but we didn't care," he says. The event worked, leading to conferences in Colombia, Istanbul, and Dubai with over 10,000+ attendees in over four years. More importantly, it introduced him to the technical side of crypto and blockchain payments.

By 2022, he was collecting payments in stablecoins for the conference business. Sponsors from different countries could send funds to a single address without dealing with multiple banking systems. "Which sponsorship package do you want? Send funds here. Done."

His e-commerce friends started asking if there was a way to convert their Shopify sales into stablecoins. They wanted same-day payouts without going through Stripe or PayPal, but traditional processors required opening US entities even for non-Americans.

Building Sendit

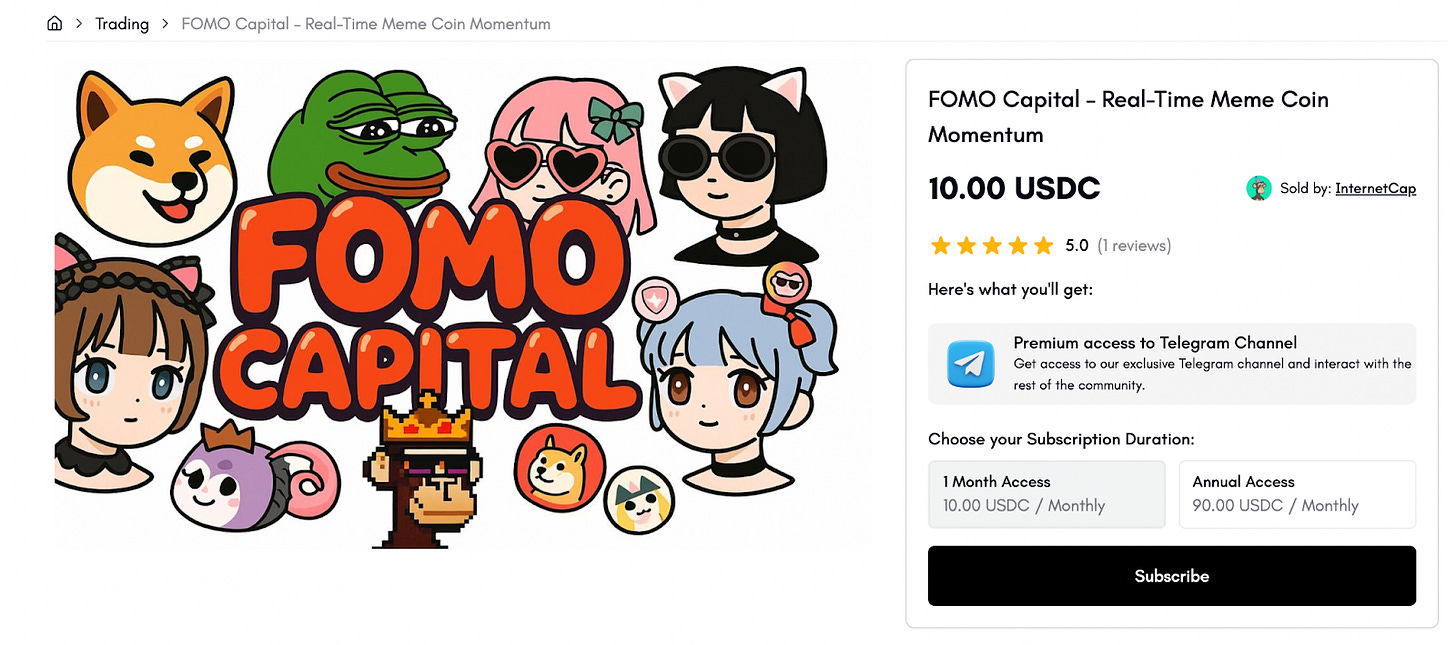

Naser launched Sendit Markets as "infrastructure for e-commerce where creators can earn in stablecoins." The platform focuses on digital products like courses, templates, software, and community access that can be delivered instantly without physical shipping.

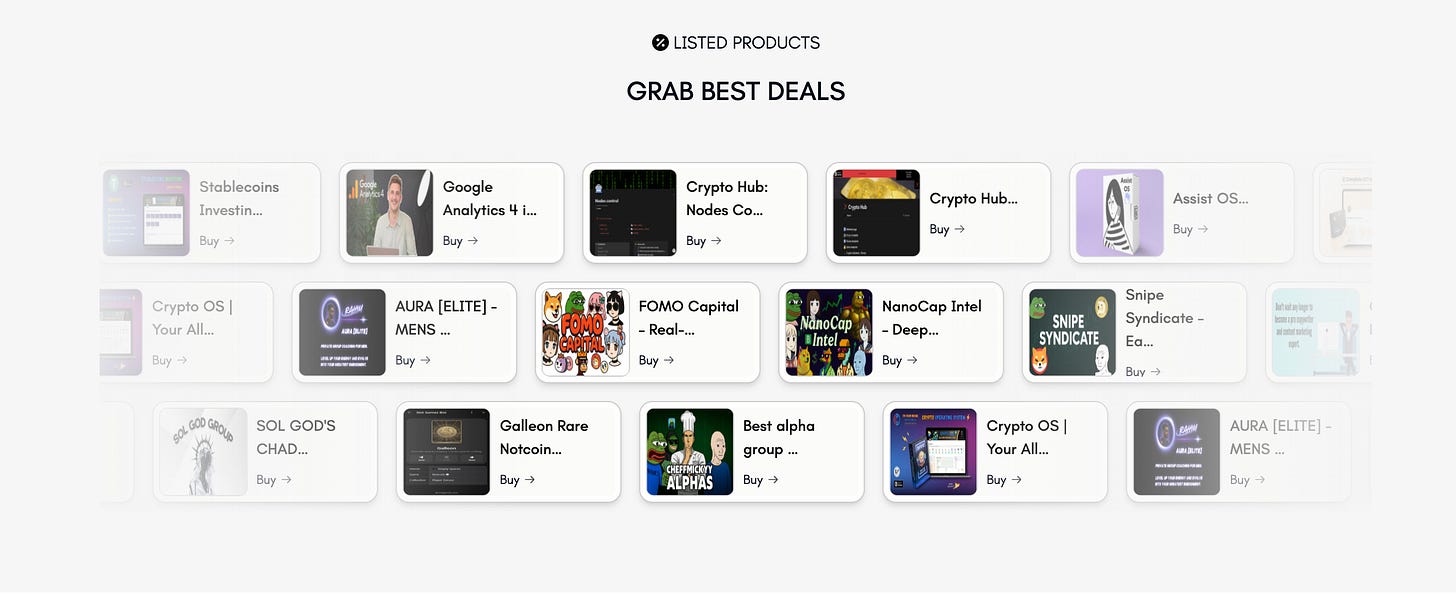

Walk into Sendit's digital marketplace and you'll find the kind of hustle economy Naser knows well: trading bots that promise to decode crypto markets, Notion templates for productivity obsessives, Discord groups where traders share signals, and courses teaching everything from Google Analytics to passive income strategies.

Instead of waiting two weeks for Stripe to release the $200 earned by selling a course, sellers got paid instantly in USDC. No bank account required. No utility bills with your business name. No explanation to a payment processor about why people are buying your "Advanced DeFi Strategies" PDF.

The transaction flow works like traditional e-commerce with one key difference: everything runs on Solana's blockchain. A customer clicks buy, confirms the payment from their wallet, and the seller's balance updates immediately. For digital downloads, the file delivery is automated. For private communities or consulting calls, customers are granted automatic access after purchasing..

Naser's bet? There are enough creators frustrated with traditional payment systems to build a marketplace around avoiding them entirely.

Sendit uses Solana's "Blinks" technology, which lets people buy things directly from social media posts. See a Twitter thread about a new trading strategy? Click a button in the tweet, confirm the payment, own the strategy guide. No need for account creation, leaving Twitter, or setting up a crypto wallet.

Sendit creates wallets automatically using just an email address. The platform handles the blockchain complexity while users click buttons and download files, like they would do anywhere else on the internet. Payment processor integrations in development will let customers pay with credit cards while sellers still receive stablecoins.

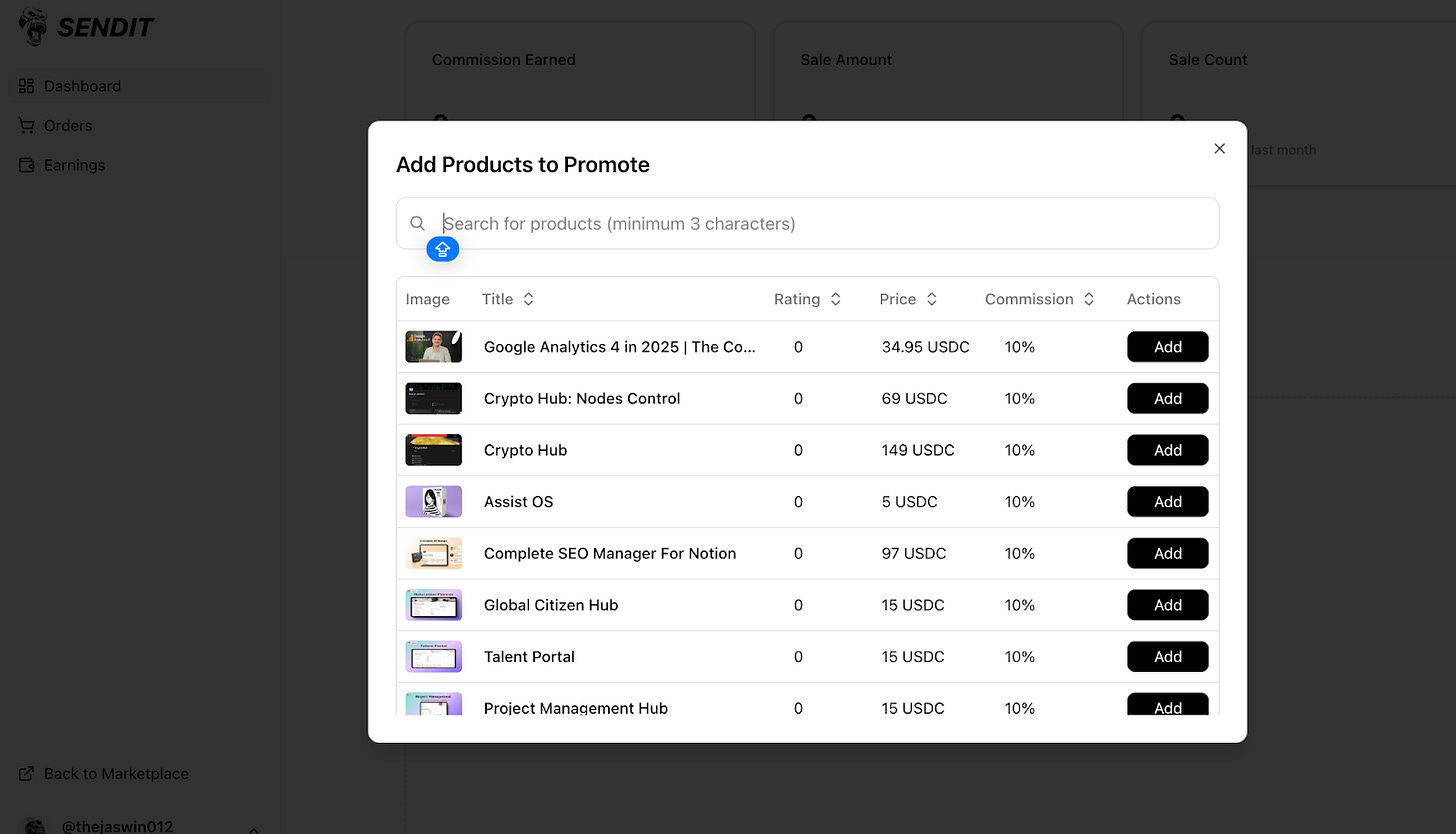

The affiliate system turns anyone into a potential salesperson. Browse the marketplace, grab referral links for products you like, earn 10% commissions paid instantly when someone buys through your link. There’s no approval process or minimum payouts.

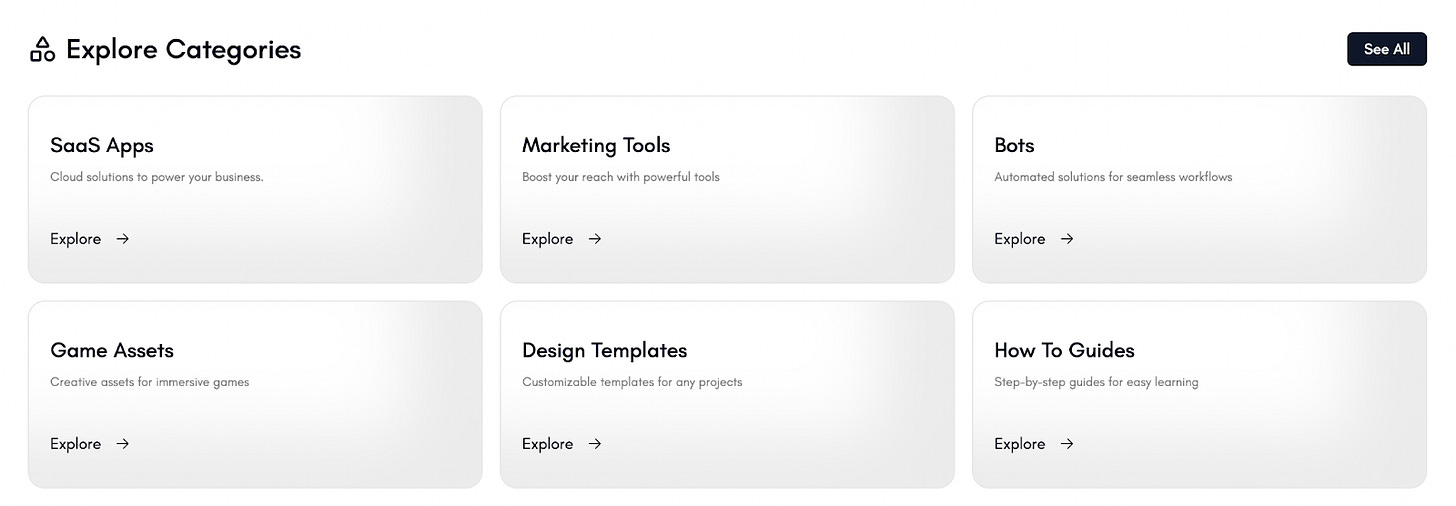

The marketplace spans six main categories: SaaS Apps, Marketing Tools, Bots, Game Assets, Design Templates, and Private Communities. Pricing varies widely. A basic Notion template might cost 5 USDC while comprehensive trading courses sell for 200 USDC.

Sellers can create bundles, offer time-limited discounts, and set up subscription-based access for ongoing services. The tokenisation feature protects digital products from unauthorised copying by creating blockchain-based ownership records, though the effectiveness of this protection remains to be tested at scale.

Beyond individual sales, Sendit implements a revenue-sharing model where active community members earn from platform-wide activity. Buyers can earn rewards for leaving detailed reviews. Sellers receive dividends based on overall platform performance. The goal is creating network effects where everyone benefits from the platform's growth.

The social features include creator profiles, customer reviews, and community forums organised around different product categories. Sellers can build followings, cross-promote products, and collaborate on joint offerings.

Looking Forward

Over the next year, Naser plans to complete the fiat-to-crypto payment processing integration, launch the services marketplace, implement pre-approved loans for sellers, and build out the affiliate system. The goal is creating a flywheel where every part of the platform drives usage of other parts.

"More people who believe in the vision of this interconnected dollarisation and access to dollars, and building sustainable passive income, those are the people I'm looking for," he says.

Sendit positions itself against traditional platforms like Gumroad, Etsy's digital section, and Shopify for digital goods. The value proposition centers on faster payouts, lower geographic restrictions, and protection from payment processor shutdowns that can freeze creator accounts.

The emphasis on utility over speculation represents Naser's reaction against what he calls the "elaborate schemes" he witnessed in crypto from 2021-2023.

Whether this positioning resonates depends largely on how many creators value crypto payouts over the simplicity of traditional systems. The target market includes international creators who face banking restrictions, those burned by payment processor account freezes, and crypto natives who prefer holding stablecoins.

That’s it for today’s deep dive. Stay tuned for the next one.

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.