Shayne Coplan: Broke at 21, Billionaire at 27 🔮

When you have nothing to lose, you bet on truth.

June 2020: A broke 21-year-old launches a betting platform from his bathroom during a pandemic.

November 2024: FBI agents raid his apartment, seize his phone, and leave without charging him.

October 2025: The owner of the New York Stock invests $2 billion in his company.

This is Shayne Coplan’s five-year trajectory. From inventorying his Lower East Side apartment to figuring out what he could sell for rent, to becoming the youngest self-made billionaire tracked by Bloomberg.

How does someone with nothing to lose build something regulators want to destroy?

How does a platform banned in its home country become attractive to Wall Street’s most powerful institutions?

These details matter because they reveal the actual mechanics behind improbable. This is why Coplan’s story deserves more than just a timeline, and that’s what we are here for.

The suit-and-tie way to buy Bitcoin.

If you want exposure to crypto but don’t want to touch a wallet, remember 12 words, or worry about rug pulls, Grayscale’s got you.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

The Whitepaper Moment

2019. Shayne Coplan is done with crypto.

Two and a half years after dropping out of NYU, his ventures have gone nowhere. The promised revolution has turned into what he calls “crypto grifts” which are projects designed to extract money rather than create value.

He’s broke, frustrated, and watching an industry he believed in become a casino for scammers.

So he stops hustling and starts reading. Academic papers. Dense research. Specifically, economist Robin Hanson’s work on prediction markets.

The theory is that markets aggregate information better than experts, polls, or any traditional forecasting method. When people put money behind their beliefs, collective wisdom reveals the truth.

Prediction markets had proven this in academic settings. The Iowa Electronic Markets had outperformed traditional polls since 1988. But these platforms remained niche. Academic. Inaccessible to ordinary people.

Coplan saw the gap.

“This is too good of an idea to just exist in whitepapers,” he wrote.

He spent a year studying how prediction markets worked, why they hadn’t scaled, and what conditions would need to exist for mass adoption. A year of research while his bank account drained.

Most people would have gotten a job.

Then COVID-19 shut down the world.

The Bathroom Office

March 2020. The world locks down.

People are stuck at home. Glued to screens. Desperate for information about what happens next. Will schools reopen? Will there be a vaccine? How long will this last?

Traditional institutions such as governments, health organisations,and the media are struggling to provide reliable answers. Everyone has opinions. Nobody knows for sure.

Coplan sees the moment clearly.

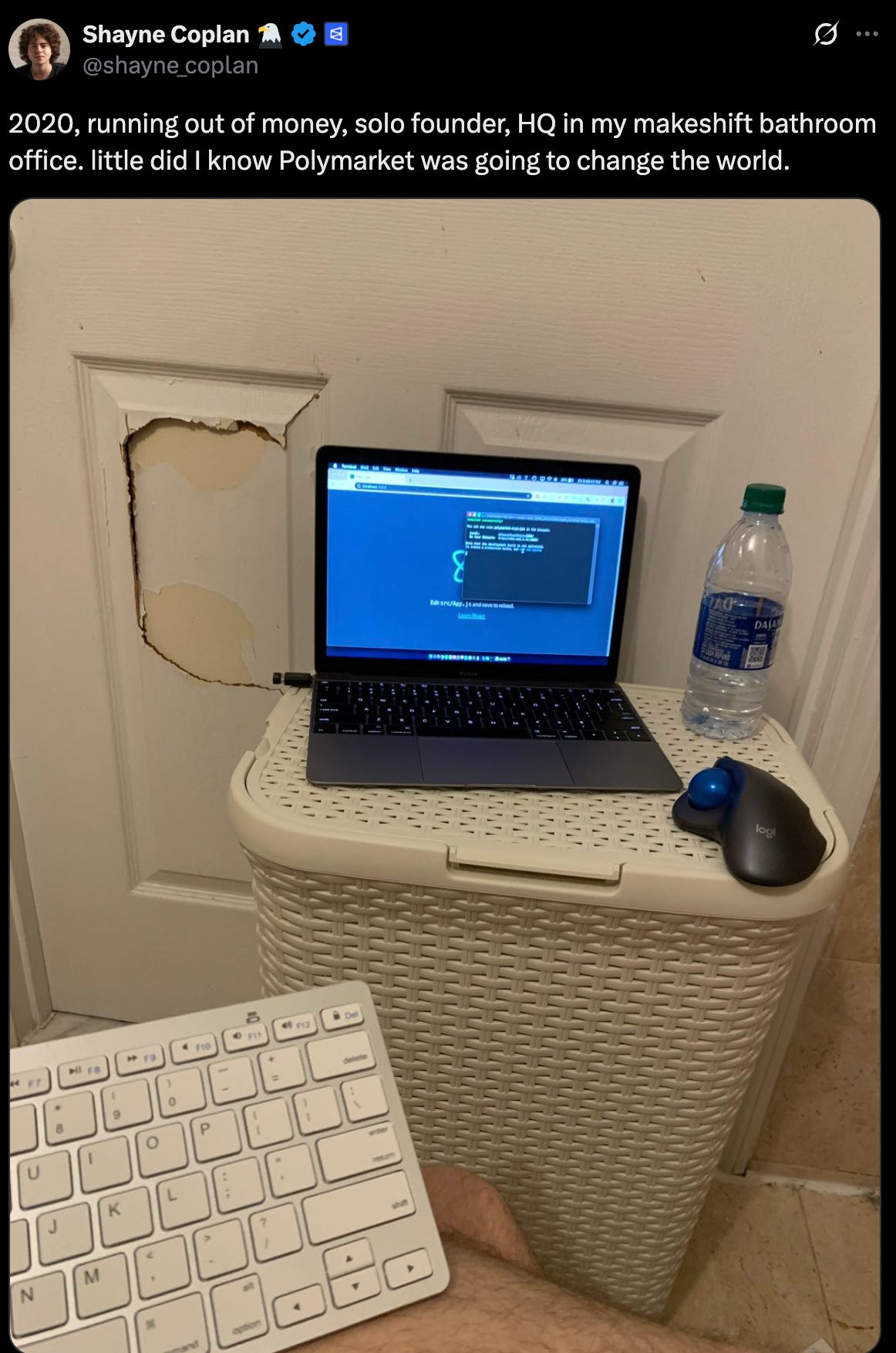

At 21, running out of money, with nothing to show for two and a half years since dropping out, he starts building. From what he would later describe as a “makeshift bathroom office” in his Lower East Side apartment.

June 2020. Polymarket launches.

The platform is simple. Users bet cryptocurrency on real-world outcomes. Each question becomes a market. You buy shares representing “yes” or “no” outcomes. Shares pay $1 if you’re right, zero if you’re wrong. The market price reflects collective probability.

If a share trades at 65 cents, the crowd believes there’s a 65% chance the event happens.

Pure information. No experts. No spin. Just money behind beliefs.

Building a prediction market requires solving technical problems around data feeds, market resolution, and user experience. It requires creating trust between strangers betting on everything from elections to pop culture.

It also requires navigating regulatory gray zones.

Prediction markets look like gambling to some regulators, and like financial derivatives to others. Their legal status is unclear.

Coplan’s approach? Build first and ask for permission later.

The strategy works for two years.

2022. Polymarket has attracted attention.

Trading volume is growing. Users are making predictions on everything from Oscar winners to economic indicators. The platform is gaining credibility as an alternative to traditional forecasting.

Then the Commodity Futures Trading Commission comes knocking.

The allegations: offering illegal trading contracts, and operating as an unregistered exchange. The settlement: $1.4 million, without admitting or denying wrongdoing.

More significantly: Polymarket agrees to block all U.S.-based users.

This restriction creates a paradox, the platform can operate globally but not in America. International users can bet on U.S. elections, but American citizens can’t participate in markets about their own country’s politics.

Regulators suspect the platform continues to host U.S. users anyway.

2024. The presidential election approaches.

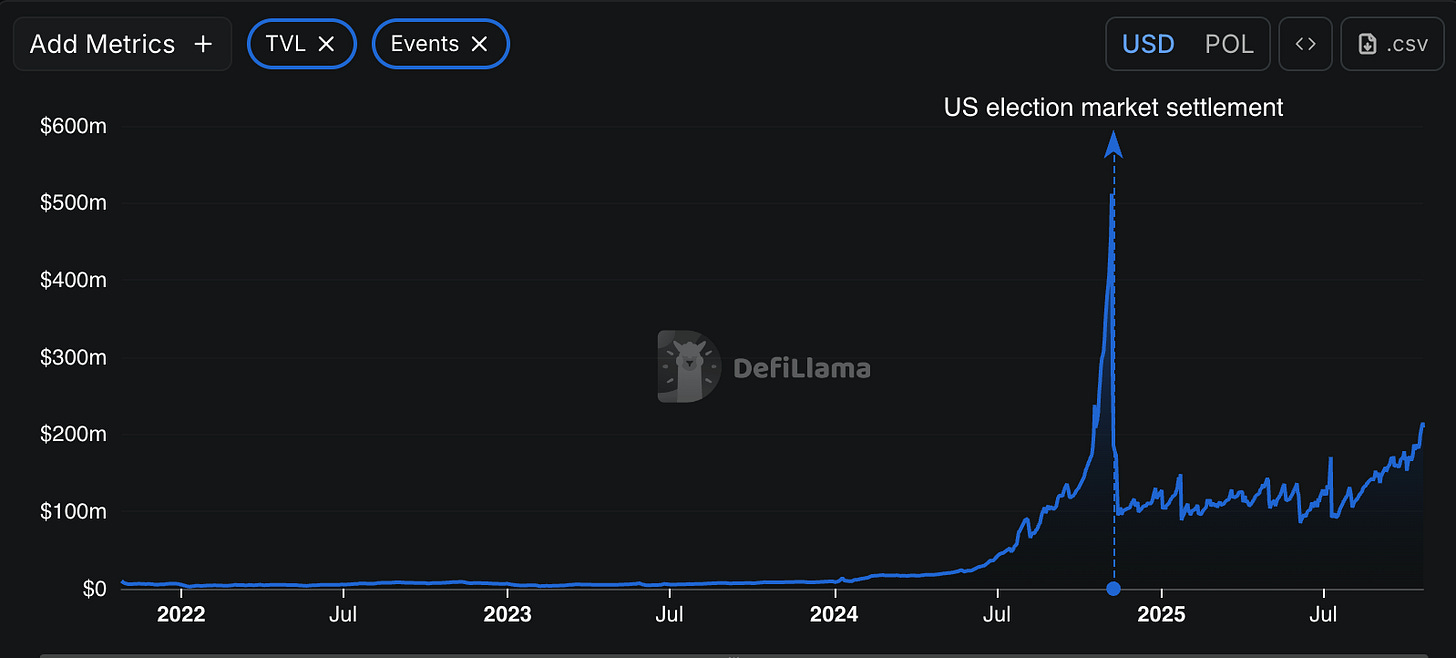

Polymarket becomes impossible to ignore. Users wager more than $3.5 billion on election outcomes. The platform consistently shows Trump ahead while traditional polls show a tight race.

One French trader bets tens of millions on a Trump victory. When Trump wins, the trader reportedly makes $85 million.

The platform’s predictions prove more accurate than conventional polling.

Then comes the raid.

November 2024. One week after Election Day.

FBI agents arrive at Coplan’s New York City apartment before dawn. They seize his cellphone and electronic devices. Coplan, now 26, isn’t arrested. Isn’t charged.

His response on X: “New phone, who dis?”

Polymarket issues a statement: “obvious political retribution by the outgoing administration.”

The Justice Department opens an investigation. So does the CFTC.

The platform that had just proved its forecasting power is now facing federal scrutiny from multiple agencies.

Coplan keeps building.

But circumstances can change quickly in America. The investigations that began under Biden’s administration end under Trump’s.

July 2025. Both the Justice Department and CFTC formally drop their investigations. No charges. No additional penalties.

That same month, Polymarket acquired QCEX for $112 million.

QCEX is a CFTC-licensed exchange and clearinghouse. The acquisition provides what Coplan had been working toward since the 2022 settlement: a legal framework for operating in the United States.

August 2025. Donald Trump Jr., son of President Trump, joins Polymarket as an advisor through his partnership with investment firm 1789 Capital. The company that had been raided under one administration is now advised by the family of the next.

September 2025. Polymarket’s parent company, Blockratize, files documents with the SEC mentioning “other warrants” which is language commonly used by crypto projects before token launches.

Coplan posts “$POLY” on X alongside Bitcoin and Ethereum. The hints are clear and a token is coming.

October 2025. The announcement everyone’s been waiting for. Intercontinental Exchange, owner of the New York Stock Exchange invests $2 billion in Polymarket at an $8 billion pre-money valuation.

ICE’s CEO, Jeffrey Sprecher, is married to Kelly Loeffler. Former senator. Head of the Small Business Administration. Member of Trump’s cabinet.

The deal includes plans for ICE to distribute Polymarket’s data globally and collaborate on financial tokenisation projects.

The bathroom project founded by a broke college dropout has become part of Wall Street’s establishment.

At 27, Shayne Coplan joins Bloomberg’s Billionaires Index as the youngest self-made billionaire.

What Actually Got Built

Polymarket solved problems that previous prediction markets couldn’t.

Earlier platforms like Intrade had proven the concept worked. Intrade successfully predicted the 2008 and 2012 elections before shutting down in 2013. But these predecessors remained niche. They required understanding complex mechanics and felt academic, not mainstream.

Polymarket made prediction markets feel like entertainment.

The interface was simple with questions ranging from serious (Will the Fed cut rates?) to trivial (Taylor Swift and Travis Kelce engaged in 2025?). The mix created engagement.

More importantly, the platform tapped into changing information habits.

Traditional media told you what to think. Polls told you what others thought. Polymarket told you what people believed strongly enough to bet money on.

The distinction mattered to users who’d grown skeptical of institutions.

Now, over 1.3 million users. Around $20 billion in trading volume. Over $1 billion monthly in trades.

The 2024 election proved the platform’s potential. While mainstream polls showed a close race, Polymarket users consistently favored Trump. The prediction proved accurate.

Whether the platform aggregated genuine intelligence or just reflected the demographics of crypto users betting on politics remains debatable. But the outcome validated prediction markets’ core claim: money behind beliefs tends toward truth.

Of course, being a prediction market means Polymarket occasionally has to answer genuinely philosophical questions, like “What is a suit?” In June 2025, bettors wagered nearly $79 million on whether Ukrainian President Volodymyr Zelenskyy would wear a suit before July. When photos emerged of Zelenskyy at a NATO meeting wearing a matching black jacket and pants with a collared shirt — but also trainers — the internet melted down. Is it a suit if the shoes are wrong? Does matching fabric count if the cut is casual? Fashion commentator Derek Guy, brought in as an expert, helpfully declared Zelenskyy’s outfit was “both a suit and not a suit,” which solved absolutely nothing. The market disputed the outcome twice. This is what happens when you create trustless, decentralised verification of real-world events: eventually you need a blockchain oracle to rule on tailoring semantics while $79 million hangs in the balance.

Read: When is a Suit Not a Suit?🕴

What Comes Next

At 27, Shayne Coplan has validated his conviction that prediction markets matter.

The token hints suggest the next phase is beginning. A $POLY token would complete Polymarket’s evolution from experimental prediction market to full crypto ecosystem.

Token holders might gain governance rights, fee sharing, special platform access. The specifics remain unclear. But the trajectory is obvious.

The token strategy carries risks. It could attract new regulatory scrutiny just as Polymarket achieves legitimacy. It could alienate users who view the platform as a forecasting tool rather than a crypto project.

But it also makes strategic sense. Crypto projects issue tokens to distribute ownership, incentivise participation, and create alignment between the platform and its users.

If prediction markets represent the future of information discovery, a token could accelerate adoption while rewarding early believers.

Coplan’s immediate plans are modest.

On Sundays, he watches football and beta-tests the new Polymarket U.S. app.

The work continues. The bets keep coming. The markets keep revealing what people actually believe.

Five years from a bathroom office to a $9 billion valuation.

The next five years will reveal whether prediction markets can become something bigger - new infrastructure for collective intelligence, a marketplace for truth itself.

For now, a 27-year-old billionaire is focused on execution.

The bathroom office is gone. The financial uncertainty is resolved. The regulatory battles are settled.

What remains is the original conviction that drove him to start: prediction markets are too good of an idea to just exist in whitepapers.

The markets proved him right.

Time will tell what comes next.

That’s it about the Polymarket guy. See you next week with another profile.

Until then … stay extremely curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.