September 9, 2024.

Sol Strategies, still operating under its original name, Cypherpunk Holdings, had not yet undergone its rebranding. It was still trading on the Canadian Stock Exchange, a market typically reserved for small and micro-cap firms. Just a few months earlier, the company had brought on Leah Wald, former CEO of Valkyrie, as its new CEO. At that point, Cypherpunk was flying under the radar, with minimal investor attention.

Meanwhile, Upexi focused on moving consumer products for direct-to-consumer brands, specialising in sectors like pet care and energy solutions on Amazon. The competition for clicks in this crowded marketplace was fierce. DeFi Development Corp (DFDV), still operating under its old name, Janover, was preparing to launch a marketplace aimed at connecting real estate syndicators with investors. Sharps Technology, on the other hand, was in the business of producing speciality syringes for healthcare providers, an extremely niche medtech play that rarely caught the eyes of investors.

These companies, at the time, were small — both in size and ambition. Collectively, they held fewer than $50 million worth of Solana (SOL).

Fast forward one year, and things have changed dramatically.

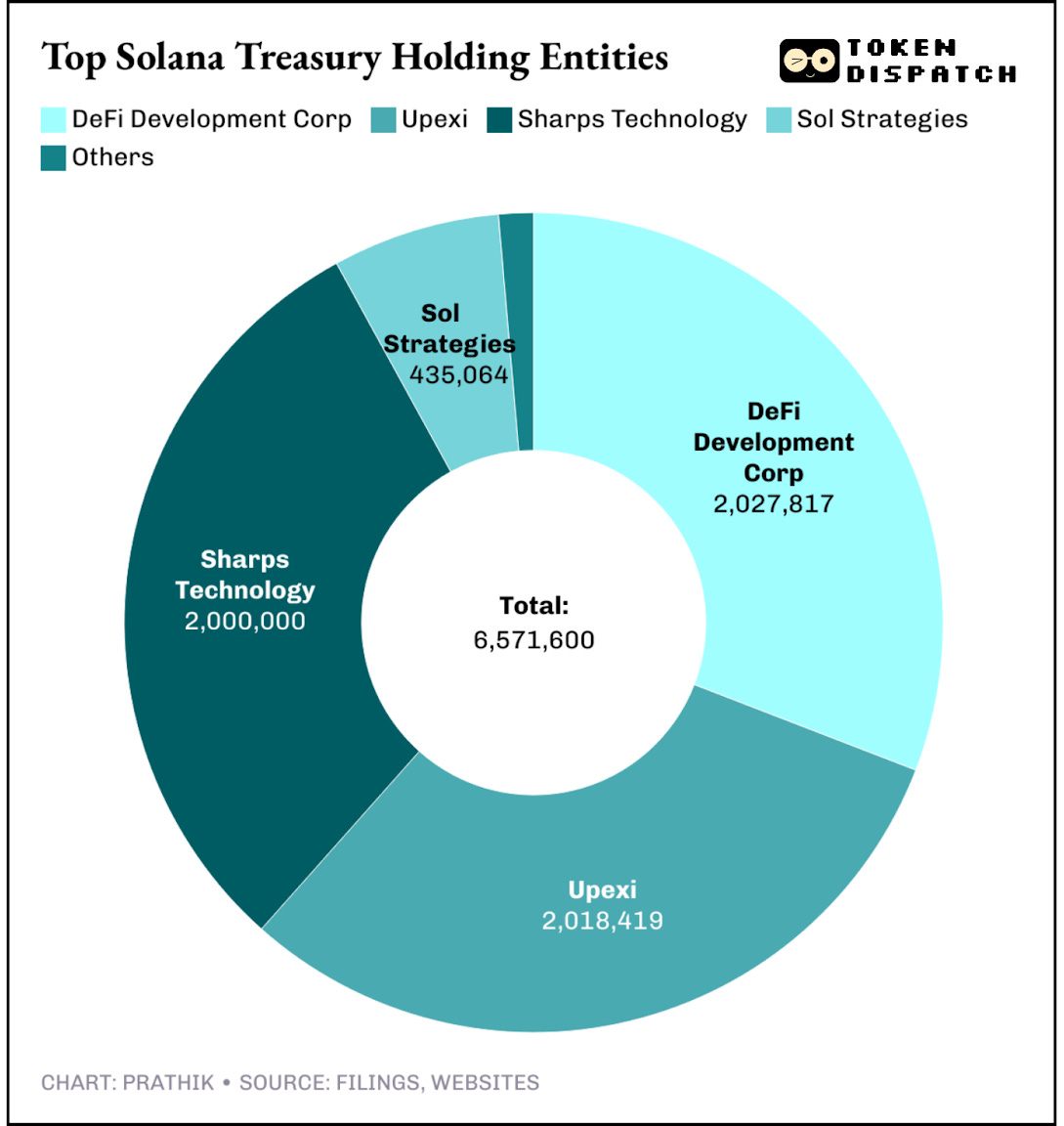

Today, they stand proudly on Nasdaq — the world’s second-largest stock exchange — holding over 6 million SOL, valued at a staggering $1.5 billion. That’s 30x the value they had from their Solana holdings just a year ago.

Metamorphosis 2025: Where Web3 Meets AI.

Picture this: 1,000+ attendees, 50+ speakers, 25+ panels, and two full days of high-energy sessions, dealmaking, and networking with some of the sharpest minds in crypto and AI.

This is more than a conference; it is a gathering of decision-makers and innovators.

75% of attendees are C-level executives, meaning you’ll be speaking directly with the people who move the industry forward

A packed agenda of panels, fireside chats, and curated networking events

The chance to build connections and partnerships that go beyond the event itself

Metamorphosis is setting the stage for India’s biggest Web3 × AI conversations. Don’t just read about it later, be in the room.

📍 Sept 27–28 | Le Meridien, Gurgaon

🎟 Special TTD reader perk: 35% OFF on tickets

This week, on Tuesday, the ringing of Nasdaq’s bell in New York wasn’t the only event marking Sol Strategies’ listing on the exchange. A virtual bell also rang, the same milestone: STKE had officially begun trading.

The company invited community members to join the ceremony by visiting stke.community and ‘ringing the bell’ through a Solana transaction. This action would permanently record their participation in this historic moment. It was, in many ways, a graduation for Sol Strategies — a company that had previously traded on the Canadian Securities Exchange (under the symbol “HODL”) and on the OTCQB Venture Market (under “CYFRF”), which is an equity market for mid-tier companies.

I call it a graduation because gaining access to Nasdaq’s Global Select Market isn’t a simple feat. Known for its rigorous standards, it is typically reserved for blue-chip companies. Passing this test has provided Sol Strategies with something that most crypto companies desperately seek but few achieve — legitimacy.

That’s also what makes Sol Strategies’ listing important, although institutions seeking Solana exposure on Wall Street already had Upexi and DeFi Development Corp to invest in.

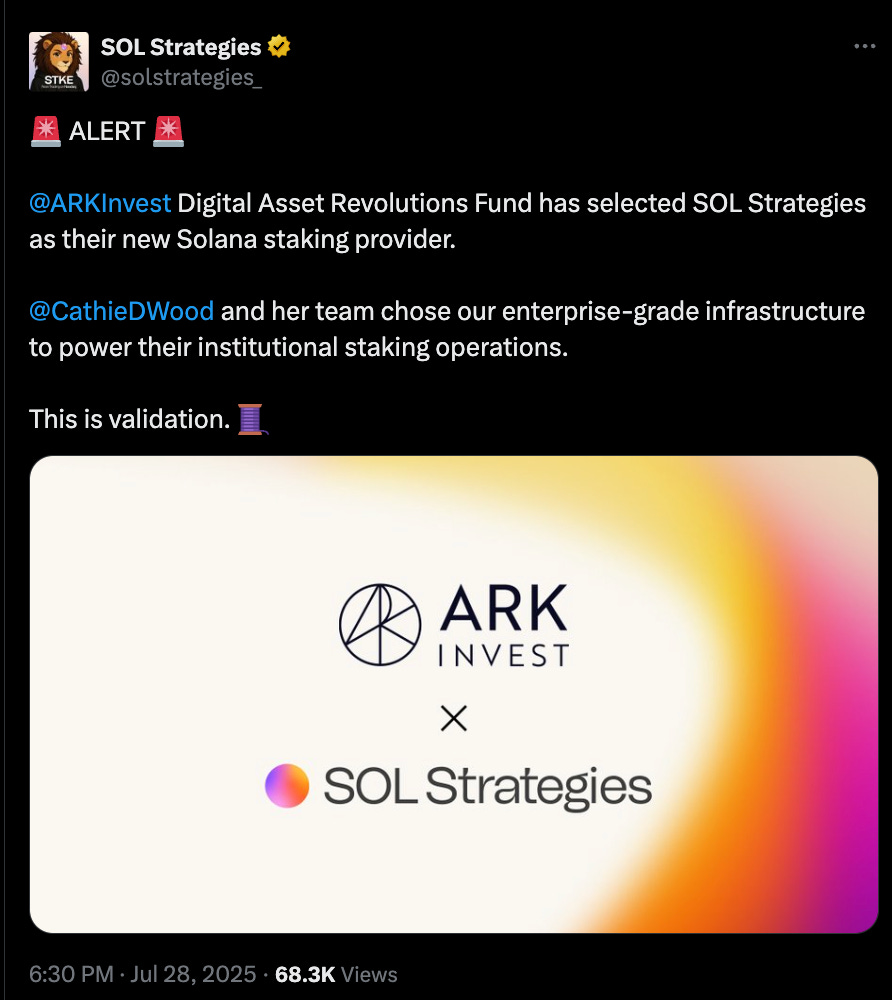

Unlike Upexi and DeFi Dev Corp, both of which were already listed entities before they pivoted into Solana treasuries with two million-plus SOL each, Sol Strategies took the slow road. It built validator operations, earned institutional mandates like ARK’s 3.6 million SOL, passed a SOC 2 audit, and strategically positioned itself on Nasdaq’s Global Select Market — the exchange’s top-tier market.

While the other firms simply hold SOL, Sol Strategies is actively running the infrastructure that supports it, turning those holdings into a viable business.

I delved into Sol Strategies’ balance sheet to understand the story behind the numbers.

For the quarter ending June 30, Sol Strategies reported revenue of C$2.53 million (approximately US $1.83 million). While the figure itself may seem unremarkable, the real story lies in the fine print. This revenue was generated entirely from staking around 400,000 SOL and operating validators that secure the Solana network — rather than from selling a traditional product. A non-crypto, re-commerce business weighs down Upexi, while DFDV leans heavily on constant capital raises to drive growth and still earns 40% of its revenue through its non-crypto real-estate business.

By offering validator-as-a-service, Sol Strategies has carved out a new revenue stream from its Solana treasury business. This approach provides recurring income without the burden of growing debt or legacy overheads.

Read: The Validator Advantage 🔐

Sol Strategies delegates SOL on behalf of its institutional clients, including a 3.6 million SOL mandate it received from Cathie Wood’s ARK Invest in July. The commission on these delegations generates a steady income stream. Call it yield, call it fees, but in accounting terms, it’s revenue — something many crypto treasuries can’t show.

A typical Solana validator charges a commission of around 5%–7% on staking rewards. With base staking yields hovering around 7%, those delegated tokens generate approximately 0.35%–0.5% of their notional value for the validator every year. On 3.6 million SOL (over $850 million at current prices), that translates to over $3 million of annualised fee revenue, even before a single dollar of price appreciation or yield from Sol Strategies’ own treasury. That is effectively an extra revenue stream, more than half of the staking rewards on its own 400,000 SOL holdings, created entirely from other people’s capital.

Yet, Sol Strategies’ bottom line for Q3 showed a net loss of C$8.2 million (~ US$5.9 million). But if you strip away one-time expenses, such as amortisation of acquired validator IP, share-based compensation, and listing costs, the operations themselves were cash-flow positive.

What truly sets Sol Strategies apart from its competitors is how it views Solana. For the company, the product isn’t just the Solana token; it’s rather the Solana ecosystem. This unique perspective is both innovative and strategic, distinguishing Sol Strategies from its peers in the space.

The more delegators Sol Strategies attracts, the more secure the network becomes. As its validators are recognised as reliable, this draws even more delegations. Each wallet that directs its stake to a Sol Strategies node becomes both a customer and a co-author of its revenue, transforming community engagement into a measurable driver of shareholder value. This approach makes every participant feel invested in the company's success.

This is the single most significant factor that will likely give Sol Strategies an edge in competition with its peers, who hold significantly more Solana tokens.

Collectively, at least seven public companies now control 6.5 million SOL, valued at approximately $1.56 billion, which represents about 1.2% of the total supply.

In the race for Solana treasuries, each company is fighting to be the proxy investors' choice for Solana exposure. Each has a slightly different flavour: while Upexi has discounted acquisitions of SOL, DFDV has bet on global expansion, all this while Sol Strategies bets on diversified war chests. The game is the same: accumulate SOL, stake it, and sell Wall Street a wrapper.

Bitcoin’s path to Wall Street adoption was paved by companies like MicroStrategy, which transformed from a software business into a leveraged BTC treasury company, and via highly successful spot ETFs. Ethereum followed a similar path, with companies like BitMine Immersion, Joe Lubin’s SharpLink Technologies, and, more recently, spot ETFs. For Solana, I foresee the adoption happening primarily through operating companies within the network. Businesses that not only hold assets but also run validators, earn fees and staking rewards, and publish quarterly earnings. This model is closer to an active manager than an ETF.

It’s this blend of NAV appreciation and real cash flow that will likely convince investors to invest through this route. If Sol Strategies can make this work, it could become the BlackRock of Solana.

The future hints at an even closer relationship between Wall Street and Solana.

Sol Strategies is already exploring the possibility of tokenising its own shares on-chain. Imagine STKE stock existing not just on Nasdaq but as a Solana-based token, swappable in DeFi pools, settled instantly alongside USDC. A Nasdaq-listed equity that also trades on-chain would be a bridge no ETF can cross. It’s speculative for now, but it’s headed towards erasing the line between public equity and crypto assets.

It won’t be a walk in the park, though. The Nasdaq graduation introduces new challenges, including greater responsibilities for Sol Strategies.

Running a validator poorly or missing a governance step could result in immediate feedback from investors. Sol Strategies’ decision to bet on Solana, the ecosystem, rather than just Solana, the token, may involve greater risks along with proportionate rewards. Solana itself has faced network hiccups and competition from emerging chains. If equity investors see the stock trading too far below NAV, arbitrageurs will likely sell, ignoring the fundamentals.

Still, I think Sol Strategies’ Nasdaq listing represents Solana’s best shot at claiming a front row seat on Wall Street. Can you take an on-chain treasury, package it into a wrapped investment product, and integrate it into Nasdaq? Sol Strategies now holds that difficult responsibility.

That’s it for today’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Excellent Prathik!