Hello

Last week, I witnessed different species of impatience at my flight-boarding gate. One queue for the old-school travellers still clutching onto paper print-outs of their boarding passes, another for the digital check-in crowd waving phones at scanners and a third marked priority lane where people with the right card or cabin class breezed through. All three lines led to the same narrow door.

Crypto is not very different. Every new network promises to build a faster gate, a cleaner funnel or a smoother queue. Yet, somehow, we end up waiting more often than not for confirmations, bridges and the next layer that’s supposed to abstract it all away.

Monad claims to have finally solved that. It promises to offer a throughput of 10,000 transactions per second (TPS) and finality in under a second with a near-zero gas fee. All this while being Ethereum Virtual Machine (EVM)-compatible.

In a little over two weeks, Monad’s claim is set to meet reality. Its mainnet and token are about to go live roughly nine months after its testnet launch.

Monad’s team built a parallelised EVM that runs like a trading engine. It was designed by ex-Jump quants who know latency like the back of their hands. What also came up in the run-up to the launch is an airdrop list that rewarded some wallets over others. This choice tells us that there is more to the future of Monad than just throughput metrics.

In today’s story, we look at the bigger picture that will dictate what lies ahead for Monad.

On to the story now,

Prathik

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

When I looked at the three boarding queues in the airport, I realised the problem isn’t the door but the hierarchy leading up to it. Monad is trying to rebuild this hierarchy at one-second finality.

To understand how Monad is placed to achieve that, we need to look at where it came from. Like many other crypto things, this was born out of frustration and a desire to solve a nagging problem. The kind only a high-frequency trader could feel.

Read: Blockchains’ Long Quest for Speed

Its founders came from Jump Trading, the Chicago firm whose computers placed buy-and-sell orders faster than most people blink. For years, they watched blockchains waste time, just like airports did.

So they set out to build a chain that wouldn’t have to wait. Monad’s idea seemed straightforward: keep everything developers already know about the EVM, but rebuild the engine from scratch so it could run like a supercomputer.

How would you achieve that? Monad is breaking down the EVM into separate components and optimising it for scalability.

Instead of executing transactions one after another, Monad re-architected the EVM to process them in parallel. It paired that with pipelined consensus, optimistic execution, and a new storage layer called MonadDB that writes directly to SSDs. All that engineering complexity boiled down to one promise — speed without shortcuts.

At least that was the pitch when the testnet launched early this year. Its mainnet is now weeks away. Its native token, MON, already trades on the perpetuals market with a pre-launch FDV estimate of around $6 billion on Hyperliquid.

The test it faces now, though, is that of loyalty and sorting the distribution. The same testnet volunteers who kept Monad alive are learning that many of them were left out of the launch party when the airdrop was announced. Over 230,000 wallets made the airdrop list. Only a fraction were ever in its Discord for its community.

Early adopters expect airdrops to feel like justice. A little dividend for the early faith shown by those who hung around through the bugs in its initial phase. But that’s not what Monad feels.

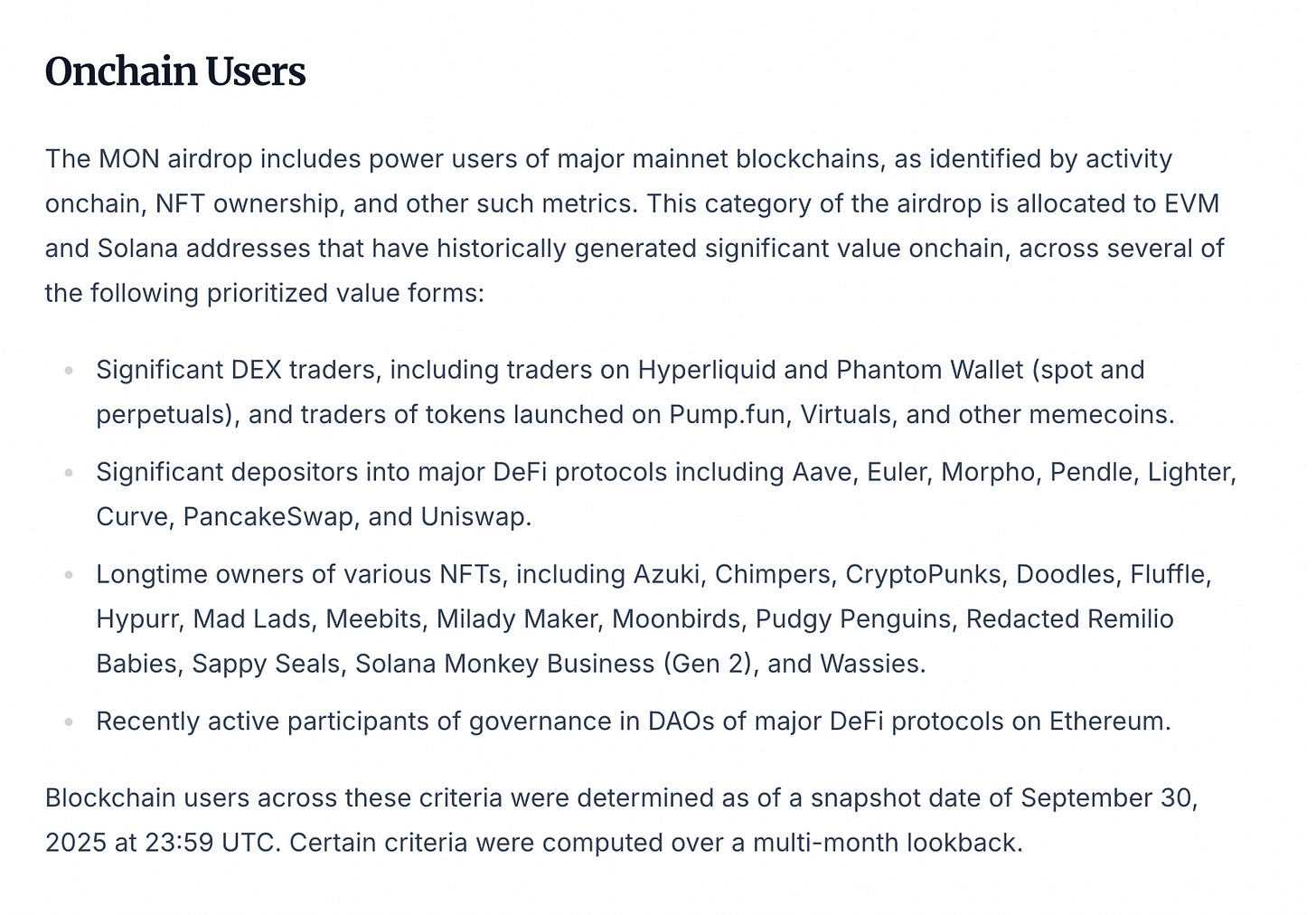

Their logic seems alright. Don’t reward bots and grinders who run ten wallets for every protocol, and avoid the scenario where half the supply ends up in Sybil farms — groups where a single entity uses fake identities to gain disproportionate influence on a network. Instead, Monad’s airdrop mechanism wanted to reward “real” users with on-chain history, meaningful DeFi exposure and maybe an NFT habit.

Monad’s whitelist included crypto’s upper middle class — traders with deep pockets, whales who had farmed real yields and influencers who had tweeted at the right time — who it hopes will bring in liquidity at the launch.

And this triggered some discontent. On X, posts with #MonadScam were trending, where people claimed that those who spent hours on Monad’s testnet were left ineligible for airdrops. Some found their names replaced by “power users” that Monad wanted to import.

In trying to fight fake engagement, Monad opted for the capital that moved fast instead of the one that stays loyal. Many would have the one big question lurking in their minds: did all testnet users deserve to be rewarded for their loyalty?

A user on X addressed the concerns with rewarding every early adopter.

“Personally, even though there are some testnet users who bring real value, 98% are farmers who simply extract value from a project. Of course, it would be nice to reward the right people, but probably there weren’t enough means or resources for that.”

However, the user felt Monad should have rewarded the top ranks of each project’s leaderboard. “...those were mostly people who truly knew the project, devoted a huge amount of time to it, and even if they used scripts, their engagement was far deeper,” the user posted on X.

Why does who you choose to reward matter? It helps the chain kick off on the right note and sets the tone for what gets built first, what kind of capital flows in and who sticks around.

Monad’s airdrop tilted toward traders and DeFi power users because early liquidity matters more than the users who stick around or leave based on the incentives they get. The chain needs users who can test throughput under real market pressure and keep pools active from day one.

It’s a rational starting choice, even if it feels selective.

You can already see that culture forming. The projects that are lining up for mainnet are markets like Uniswap, Hyperliquid and NFT exchanges, and not social apps or games.

Beyond the early user profile, the run-up to Monad’s launch has some green flags that are hard to ignore. The developer experience is familiar and boasts a robust ecosystem stack with Uniswap, Magic Eden, MetaMask and Phantom.

This line-up offers a day-one liquidity that most Layer-1s can only dream of. Monad’s backers feature top players of the space, including Paradigm and Coinbase Ventures.

It’s not the first one to try and pull off something like this.

Aptos promised to fix Solana’s downtime, and Sei tried to fix traders’ latency. Each ended up proving how hard it is to engineer behaviour.

Aptos launched well but stumbled when mainnet TPS dipped below double digits. Sei started with good order books and memes but saw liquidity dwindle once rewards dried up. Solana clawed through outages and rose above embarrassing jokes to find footing not just because of its speed but because builders saw it as a platform worth staying for.

Monad is aiming to beat Solana’s speed and emulate Ethereum’s familiarity. The intent might be honest, but the risks are real, too. When you emulate a bunch of inspirations, it is challenging to avoid inheriting their ghosts. Monad will also have to deal with VC-chain whispers, mercenary capital and validator centralisation. I think Monad’s edge could be that it isn’t trying to be another ETH-killer but is selling a smoother version of it.

If by the end of its first month, finality still clocks under a second and validators haven’t needed a restart, we’ll know the parallelism holds in the real world outside the lab.

Monad might succeed in changing things in the crypto space. Maybe sub-second finality will feel democratic, but it will be interesting to see who it benefits. When my last flight finally boarded, the three lines merged at the same door, and everyone slowed to the same pace. The bottleneck was the people. Monad has its task cut out to decide who it wants to build for.

That’s it for this week’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.