Stable and Stronger💪🏽

Stablecoin adoption rising beyond trading. Beats Visa in transactions. Fed Guv Waller bats for stablecoins. Tether USDT $120B market cap. Stripe buys Bridge for $1.1B, the largest crypto acquisition.

Hello, y'all. FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket👇

Stablecoins are proving all its critics wrong.

How?

More adoption across use cases.

Says who? State of Crypto 2024 report by a16z crypto.

They are not just silencing their critics, but also competing with traditional financial rivals and beating them in their own game.

In Q2 2024, stablecoins recorded $8.5 trillion in transaction volume across 1.1 billion transactions.

How much is that?

More than double Visa's $3.9 trillion. Plastic giant, who?

What else?

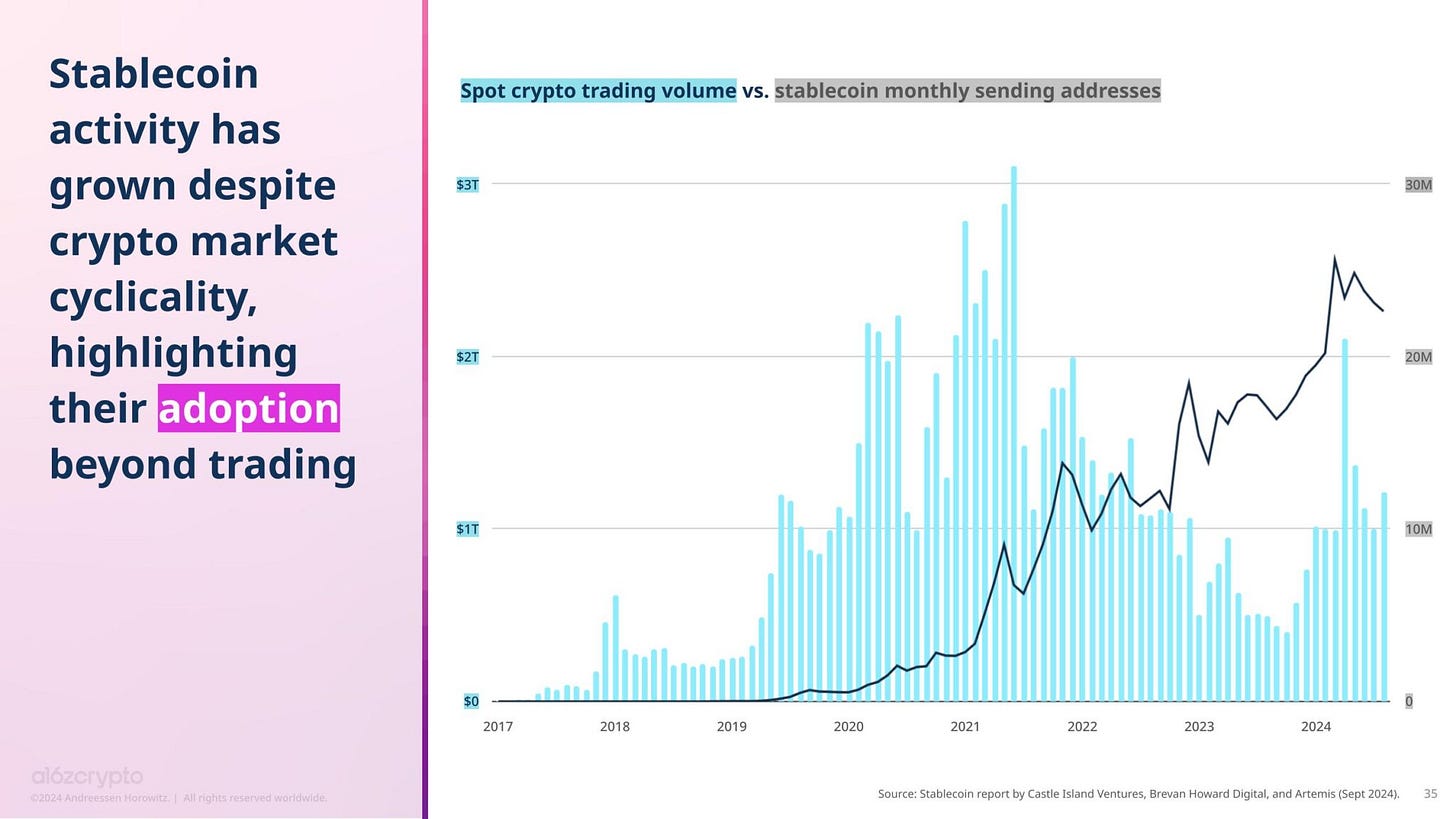

Stablecoins are being used for more than just trading.

How do we know? The number of monthly stablecoin-sending addresses has continued to increase even as spot crypto trading volumes have declined.

And there’s more.

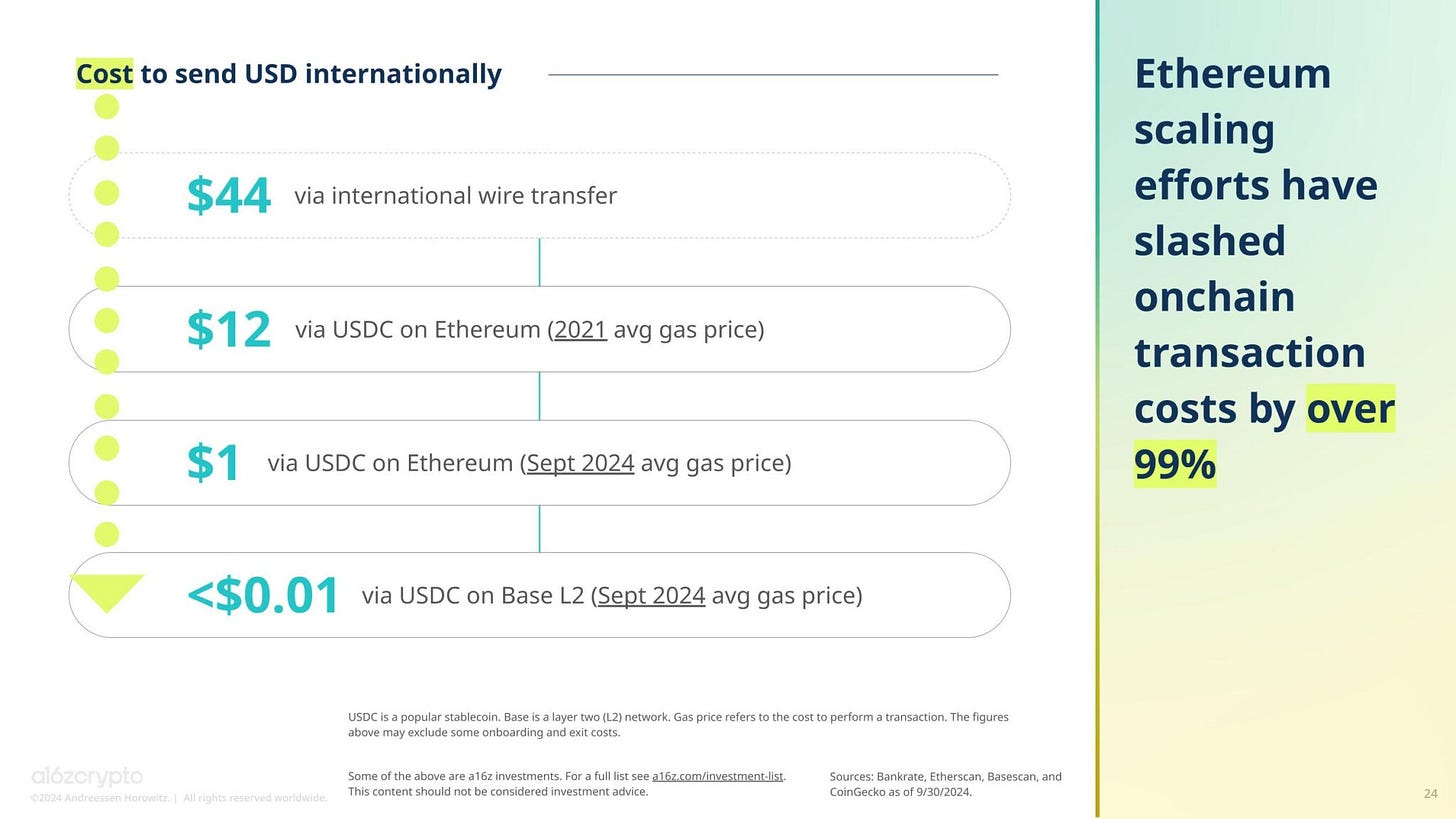

Probably one of the more obvious ones - cheap global payments.

The cost transactions using stablecoins have come down massively, in some cases by over 99%.

Scaling efforts on Ethereum has made it even better.

Transactions involving USDC, a US dollar-pegged stablecoin, over Ethereum cost on average $1 in gas fees this month, down from $12 on average in 2021.

Doing the same thing, on Base, Coinbase’s popular L2 network, costs less than a cent on average.

Now, compare these fees to the $44 on average that it costs to send an international wire transfer.

Unbelievable, right?

Probably why Rep Ritchie Torres called stablecoins:

"The greatest experiment in financial empowerment humanity has ever undertaken."

Living up to the hype? Totally.

And that’s not all.

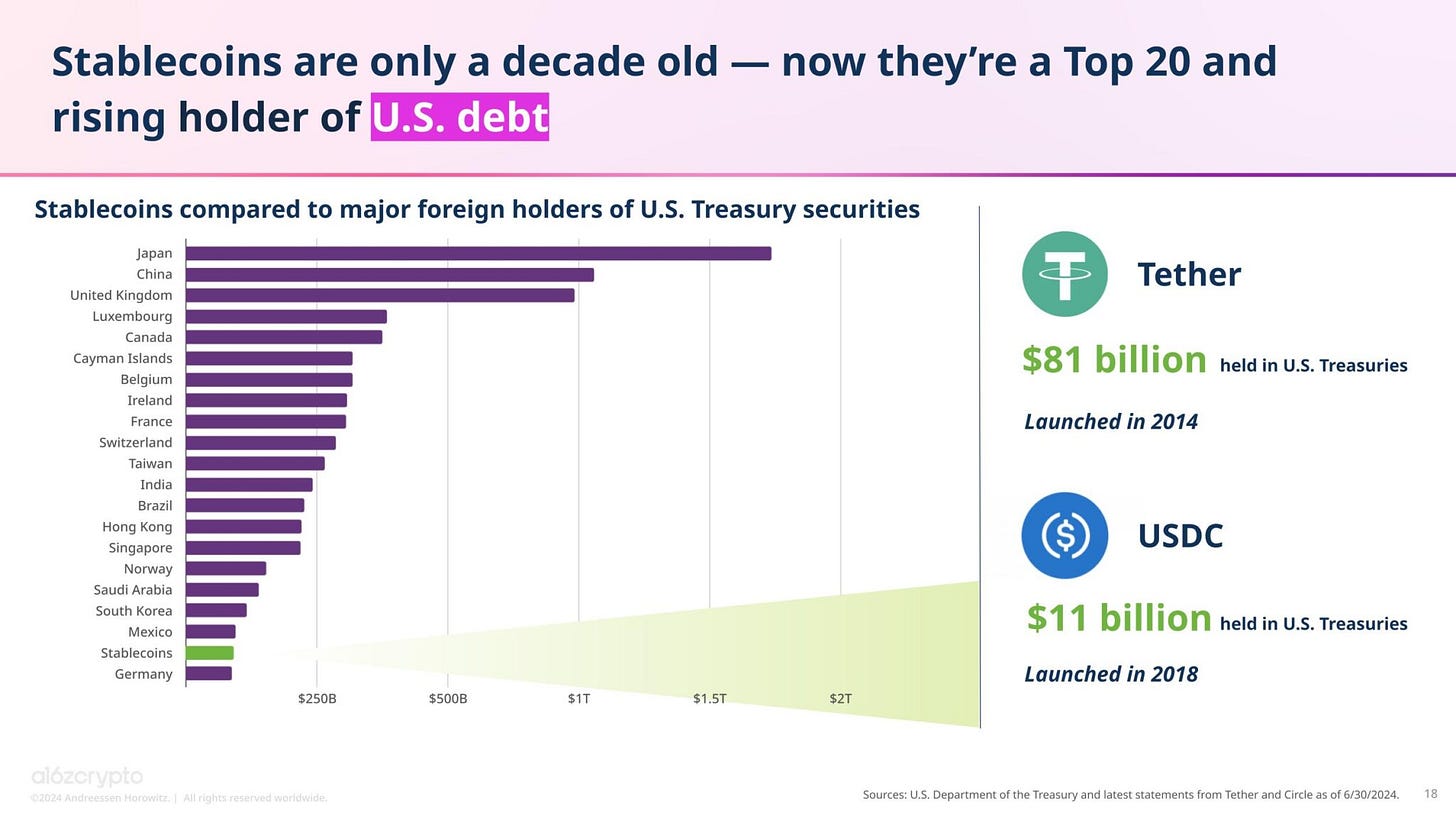

Since 99% of stablecoins are pegged against US dollar, experts expect them to strengthen the global positioning of US dollar.

Currently, they've become a top 20 holder of US debt, moving past Germany.

Regulators following suit

Who’s caught note of all this momentum? Policymakers.

US may see a bipartisan legislation around stablecoins.

Senator Hagerty's draft legislation is expected to set a precedent.

What does the bill have? Provisions for issuers exceeding a $10 billion threshold to remain under state jurisdiction while maintaining reserves on a one-to-one basis with US currency.

But not all stablecoins are faring well.

UK, Singapore, Japan and UAE are all forming regulations around stablecoin to support fiat-backed stablecoins.

EU's MiCA framework, too, is saying bye-bye to algorithmic stablecoins!

Advantage USD-pegged stablecoins?

🎙️ Block That Quote

Federal Reserve Governor Christopher Waller

"…then stablecoins may have benefits in payments and by serving as a safe asset on a variety of new trading platforms."

The Governor said during his speech at the Institute of Advanced Studies about how stablecoins could benefit financial system.

He believes in the single biggest reason justifying stablecoins use-case: cross-border payments.

“Stablecoins can reduce the need for payment intermediaries and thereby reduce costs of payments globally.”

And there’s more.

Technological innovations using DeFi complement centralised finance.

A Fed top official showing a thumbs up to one of the largest bridges connecting the traditional finance with the crypto world.

Let that sink in.

But, of course, not without sounding some caution.

"If appropriate guardrails can be erected to minimise run risk and mitigate other risks, such as their potential use in illicit finance, then stablecoins may have benefits in payments and by serving as a safe asset on a variety of new trading platforms."

The Home for All the Music Lovers

Muzify - With close to 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

In The Numbers 🔢

$1.1 Billion

The monies payments company Stripe splurged to buy stablecoin platform Bridge in crypto's largest acquisition ever, TechCrunch founder Michael Arrington said on X.

Bridge’s valuation shot up to $1.1 billion, up 450% from its earlier net worth of $200 million.

It had previously raised $58 million from investors, including a $40 million Series A round, according to Forbes.

Bridge offers software tools that help companies accept payments in stablecoins.

Why buy Bridge? Stripe is not new to crypto world.

In 2014, it was the first major traditional payments company to support Bitcoin payments.

But falling demand and high transactions fees pushed it to halt Bitcoin payments in 2018.

Earlier this month, Stripe re-enabled payments in crypto for its US business users allowing them to accept USDC via Ethereum, Solana and Polygon.

What does the Bridge buyout by a traditional payments company mean?

Perhaps a massive vote of bullish sentiment in stablecoins.

Read: Stablecoins: Can the traditional players beat Tether? 🏋️

Will Tether’s USDT Drive Uptober? 🚀

Tether’s USD-denominated stablecoin, USDT, just surpassed a market cap of $120 billion.

And the whole crypto community is excited about what could follow.

Why?

Well, for starters, it’s a bullish signal.

We all know how stablecoins are the bridge between DeFi and traditional finance.

And USDT accounts for a lion’s share in the overall stablecoin market.

Almost 70% dominance, to be precise.

Some of this Tether USDT is likely to convert into demand for Bitcoin and Ethereum, driving up their prices.

Says who? History.

High stablecoin reserves have preceded crypto price surges in the past.

In August, Tether minted $1.3 billion of USDT after Bitcoin hit a five-month low, and drove a 21% recovery in Bitcoin's price shortly after.

So, more Tether means more liquidity with investors to invest in cryptocurrencies.

And how does all this matter to Uptober?

October has been the second best month for Bitcoin in the past decade

Average returns of 21%

November averages over 46%

In the last halving year (2020), Bitcoin rose over 27% in October

Recent treasury flows from Tether show significant transfers to major exchanges.

Over $66 million sent to Binance

More than $20 million sent to Kraken

This signals a likely buying pressure leading to increased prices.

Analysts suggest that Bitcoin needs to close above $68,700 this week to confirm a breakout from its current stagnation.

Hodlers closely tracking Tether’s USDT movement? Very likely.

The Surfer 🏄

Tarek Mansour, founder of Kalshi, says that prediction markets, including Polymarket, are not manipulated, countering concerns about skewed odds favouring Trump.

The Minneapolis Fed suggests that to maintain permanent budget deficits, governments may need to tax or ban Bitcoin. The reasoning? Bitcoin creates a "balanced budget trap," complicating the government's ability to run deficits with nominal debt.

Ethereum co-creator Vitalik Buterin suggested solutions to tackle staking and block production centralisation issues in Ethereum's roadmap phase called the “Scourge.”

Pump.fun announces plans for a future token release during an Oct. 19 X Spaces event, though no launch date is specified. The upgraded trading platform, "Pump Advance," features mini-charts, top holder data, and social indicators to assist traders in navigating the memecoin landscape.

Japan's Democratic Party for the People (DPP) leader Yuichiro Tamaki proposes a 20% tax cap on crypto gains in his election policy pitch. Currently, Japan taxes crypto gains up to 55% as they are classified as miscellaneous income.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

I like how stablecoins are evolving beyond just crypto trading. The fact that Stripe is making moves in this space shows how serious traditional companies are taking them. If stablecoins become mainstream for everyday payments, we’re looking at a whole new level of financial efficiency.

The idea that stablecoins could strengthen the USD’s global positioning is really interesting. If 99% of stablecoins are pegged to the US dollar, they could become a strategic tool for maintaining the dollar’s dominance internationally, especially as traditional payment systems lag behind.