Hello,

A few weeks ago, I was at a supermarket checkout when the cashier asked the routine question:

“Sir, do you want to redeem your reward points?”

I said yes, expecting a small discount.

She typed for a few seconds, looked up, and said,

“Your points balance is $0.70.”

I had been swiping that loyalty card for nearly a year.

It wasn’t disappointing so much as it was funny. A whole year of groceries, and in return, I had earned… a piece of chewing gum. And not even the big pack.

This moment reminded me of every loyalty program I’ve ever been part of: Airline miles that always seem to fall just short of the amount needed for the one flight you actually want. Restaurant stamps I always forget to carry. Credit card points that proudly tell you that you’ve “unlocked” a $20 voucher after spending nearly $1200. Most of these programs feel like they were designed in a different era, for customers who had infinite patience and no calculators.

The strange part is that loyalty programs are everywhere, coffee shops, airlines, banks, pharmacies, and delivery apps. Yet, none of them are interoperable. Every brand wants you to be loyal, but only within its own ecosystem. So your value stays trapped there, too. Points don’t move, rewards don’t scale, and whatever you earn usually can’t buy anything meaningful.

Meanwhile, the way we pay and move money has changed completely in the background. Everything became faster, more open, and more global, whether it’s instant domestic payments or cross-border transfers. But somewhere in the midst of all this, stablecoins emerged: digital versions of dollars that behave like money, but without the waiting, the borders, or the bank hours.

Somewhere along the way, a new thought began creeping into loyalty discussions: what if loyalty didn’t need to be points at all? Instead of giving you points whose value nobody can explain, what if brands rewarded people with actual, spendable digital dollars? The kind that doesn’t vanish after 90 days, doesn’t require 40 conditions to redeem, and doesn’t force you to buy from the same shop that issued them in the first place.

In this article, we will dive deeper into how stablecoins can completely replace loyalty points. Let’s get to it!

AI Agents that trade, predict, and evolve, on-chain.

DeAgentAI has built the largest AI Agent infra across Sui, BSC & BTC, solving what every AI dev struggles with, Identity, Continuity, and Consensus, the holy trinity for making AI actually autonomous.

Their flagship products?

AlphaX → A crypto prediction engine that hits 9/10 signals.

CorrAI → A no-code quant playground for designing and deploying DeFi trading strategies.

Truesights (launching soon) → InfoFi network that rewards real alpha, not just noise.

Backed by top-tier VCs, and a team from Carnegie Mellon, UC Berkeley, and HKUST, they’re scaling what’s basically the “ByteDance of Web3.”

Except instead of serving you TikToks, their algorithms are training autonomous AI Agents.

Check out DeAgentAI

The funny thing about loyalty programs is that they look really promising on the surface. You earn points, get a few perks, and maybe redeem something once in a while. But underneath, the way these programs are structured hasn’t really kept up with how people spend or how businesses operate today.

For starters, points aren’t rewards; they’re liabilities.

Every point a company issues is recorded as something it owes you later, which means loyalty isn’t just marketing, it’s an accounting commitment. Airlines, for example, manage billions in outstanding miles, which naturally pushes them to keep the system tightly controlled rather than overly generous.

The second issue is that loyalty systems operate on their own isolated infrastructure. Every brand maintains its own ledger, rules, and backend for managing rewards. They don’t share technology, they don’t settle values the same way, and they don’t connect to anything outside their own environment. So, whatever you earn stays exactly where it originated.

And the irony? The whole system survives on breakage.

Breakage = the percentage of points people never redeem. Across industries, most loyalty points never get used. In many industries, 30–40% of all issued rewards simply sit untouched until they expire. Companies factor this into their planning because if everyone redeemed everything they earned, the economics would look very different. But unused rewards don’t create any value while they sit there; they don’t move, they don’t earn, and they don’t strengthen the relationship with the customer. They just sit as obligations. As a result, loyalty becomes something brands maintain out of habit and expectation rather than something that meaningfully works for either side.

How rewards are funded today

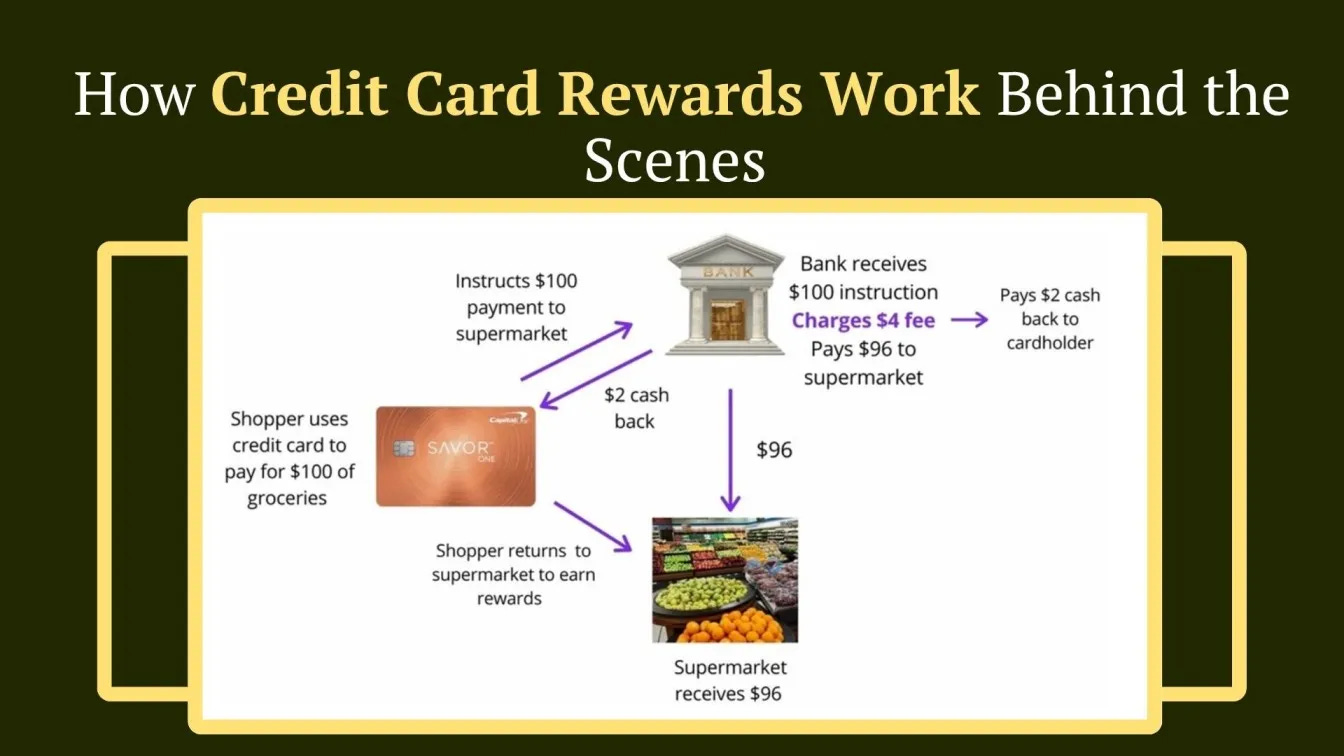

If you look at how rewards are calculated today, you start to understand why loyalty programs behave the way they do. Most loyalty programs - whether it’s a bank, an airline, a retail chain, or a delivery app, are all built on the same simple question: “Where will we find the money to reward people?”

For banks and card issuers, the rewards come from interchange, the fee merchants pay every time a card is swiped. After everyone in the chain takes their portion, whatever is left is what the bank can use for cashbacks and points. If the net margin is 1.5–2%, the bank might decide that 0.5–1% goes back to the user and the rest goes into covering fraud, benefits, and operating costs. This is why card rewards across the world tend to look roughly the same.

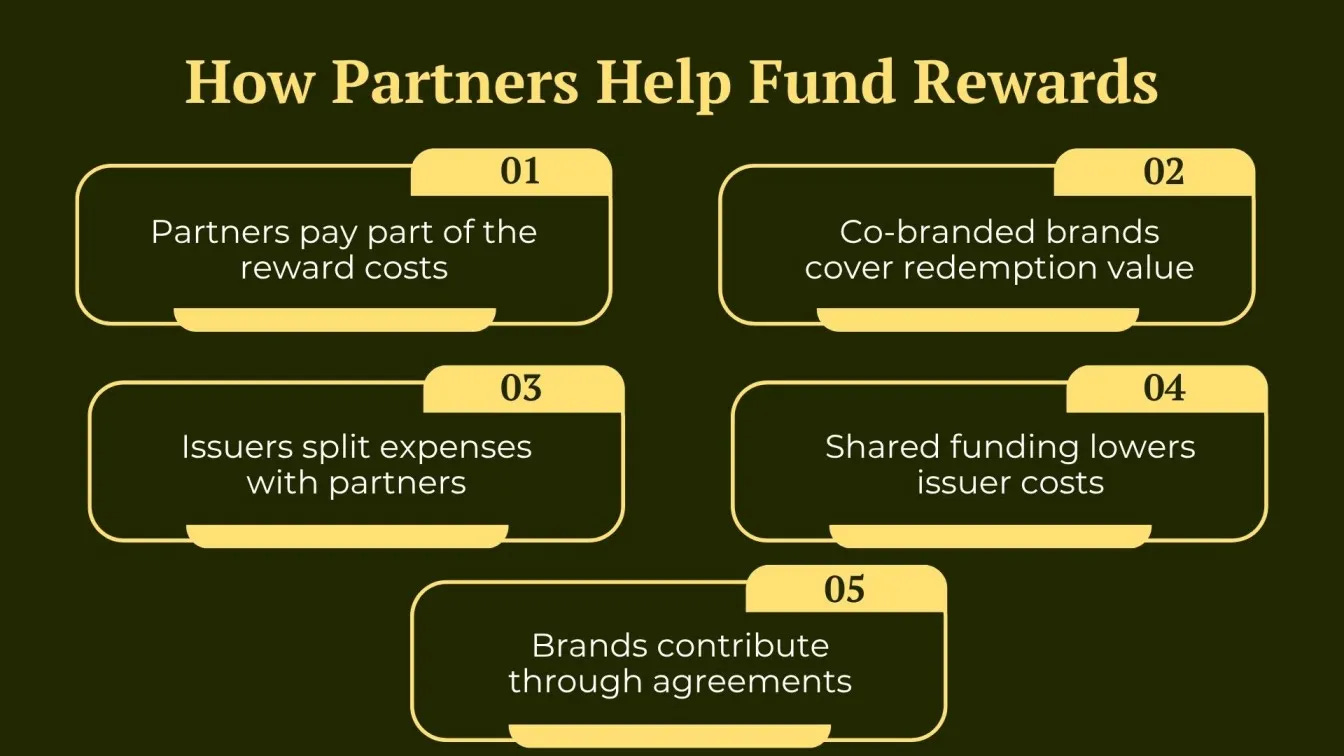

Airlines run a different model, but the constraint is similar. Their loyalty programs aren’t funded by every flight you take, but by the revenue they make from selling miles to credit card companies. Those miles eventually end up in your account, but they begin as a line item in a partnership contract. Because this revenue has to stretch across operations, redemptions, missed flights, and customer service, airlines carefully control how and when those miles can be used.

Retailers and food chains fund rewards out of their margins, which are usually thin. If a grocery store earns a few cents on every dollar sold, it can’t afford to give away very much without erasing its own profit. Coffee shops and restaurants face the same issue. A free drink after ten visits feels nice, but behind the scenes, it only works because the margin on the other nine visits covers the cost.

Apps and marketplaces face a more complex version of this. They operate on razor-thin take rates, so they often split the cost of rewards between themselves and their merchant partners. A food delivery app offering $3 off needs the restaurant to absorb part of it, because the app’s own margin can’t carry the full discount. The result is a system where rewards only work when multiple parties agree to share the burden. If one party steps back, the entire offer falls apart.

Across all these industries, the theme is similar. Rewards come from someone’s margin. They are funded by whatever sliver of economics is left after the business pays for operations, partners, and the payment infrastructure underneath. That’s why loyalty programs, despite being everywhere, tend to feel the same, slow earn rates, limited redemption options, and complicated terms.

Everything you earn is the leftover portion of a long chain of costs. And because every dollar of reward depends on someone giving up a piece of their margin, loyalty can only stretch so far.

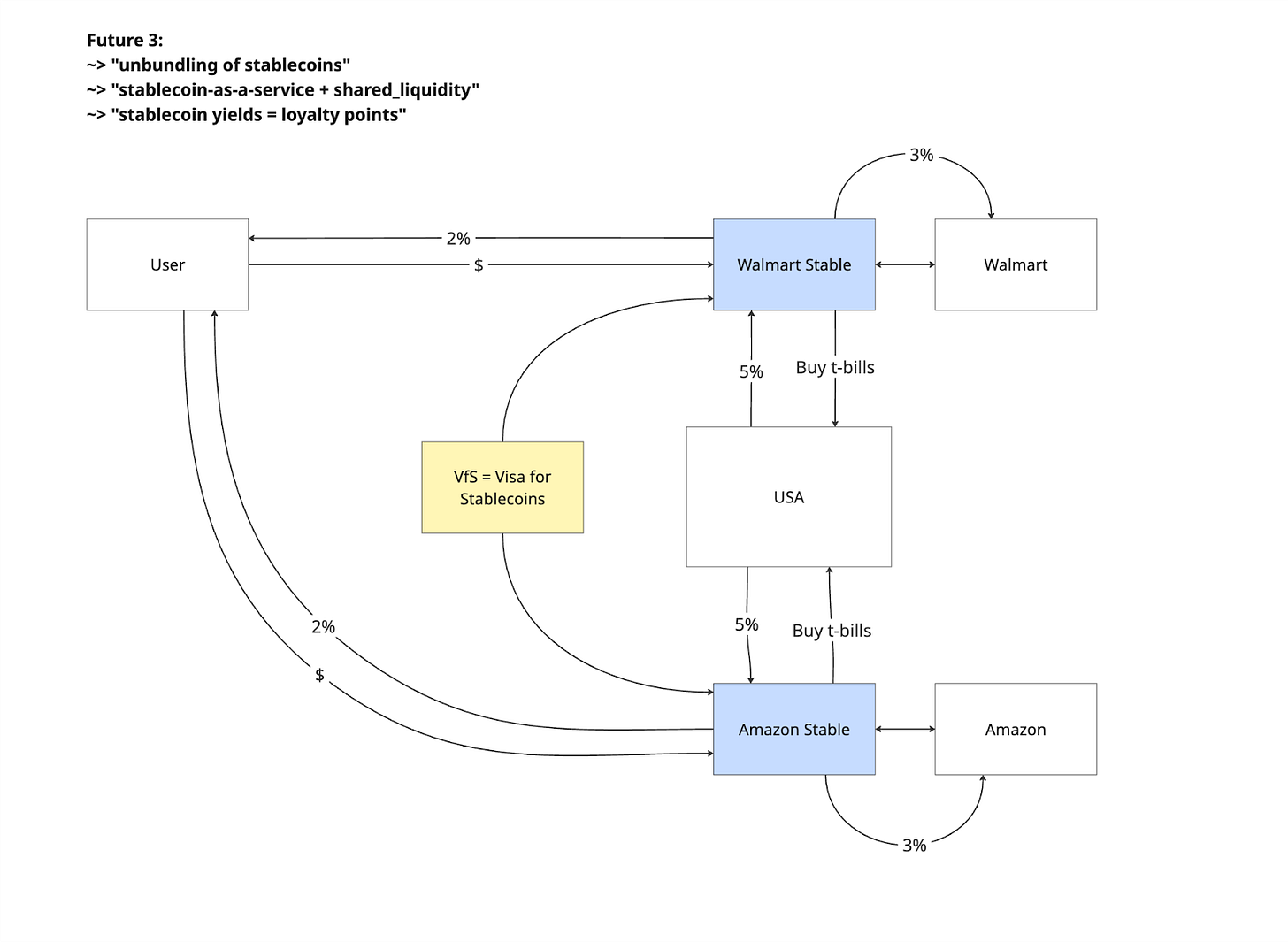

What a new stablecoin-powered reward system looks like

The limitations in today’s loyalty programs come from a very simple place: the money that funds them has to come from someone’s margin. That’s why every industry - banks, airlines, retailers, apps- hits the same ceiling. The system can only be as generous as the economics under it allow. But over the last few years, something has quietly shifted in the opposite direction. The payment rails have started becoming cheaper to operate, faster to settle, and able to carry value without passing through a long chain of intermediaries. When the rails become lighter, the things built on top of them naturally change too.

This is where stablecoins enter the picture, not as a new loyalty gimmick, but as a different foundation for moving money. A stablecoin isn’t issued as a reward. It’s just a dollar in digital form, and that makes the economics around it very different. The reserves behind most large stablecoins sit in short-term U.S. Treasury bills, which currently earn around 4–5% a year. That’s real, predictable yield created by the underlying assets, not from promotions or marketing budgets. And when you’re holding billions of dollars in these instruments, even a single percentage point turns into meaningful income. A small share of that income can be passed back to users, which means the reward doesn’t have to come entirely out of a merchant’s already thin margin.

Source: Cyber Fund

Today, value makes its way through several layers - merchant fees, card networks, processors, and the customer gets whatever is left at the end. In the new setup, the reward starts much earlier in the process. The reserves behind the stablecoin generate yield, and a portion of that yield can support the incentive. Because the payment and the reward move on the same rail, the whole flow becomes simpler. There’s no liability piling up in the background, no dependence on people forgetting to redeem their points, and no need for a web of partners just to make the value usable. The rail itself creates the space for the reward to exist.

Because the rails are open, the value doesn’t have to stay inside one app either. If a customer earns a few dollars in stablecoins, that value can move immediately to a wallet, to another purchase, or into savings, without needing a custom integration or a closed ecosystem. The reward behaves like something the customer already understands, instead of something they have to redeem through a separate interface.

Put together, this model doesn’t replace loyalty. It replaces the need for loyalty to run as a heavy, standalone system. The reward becomes part of the payment flow, not a bolt-on program managed through isolated ledgers. It becomes lighter for companies, clearer for users, and no longer depends on unused balances to survive.

My takeaway

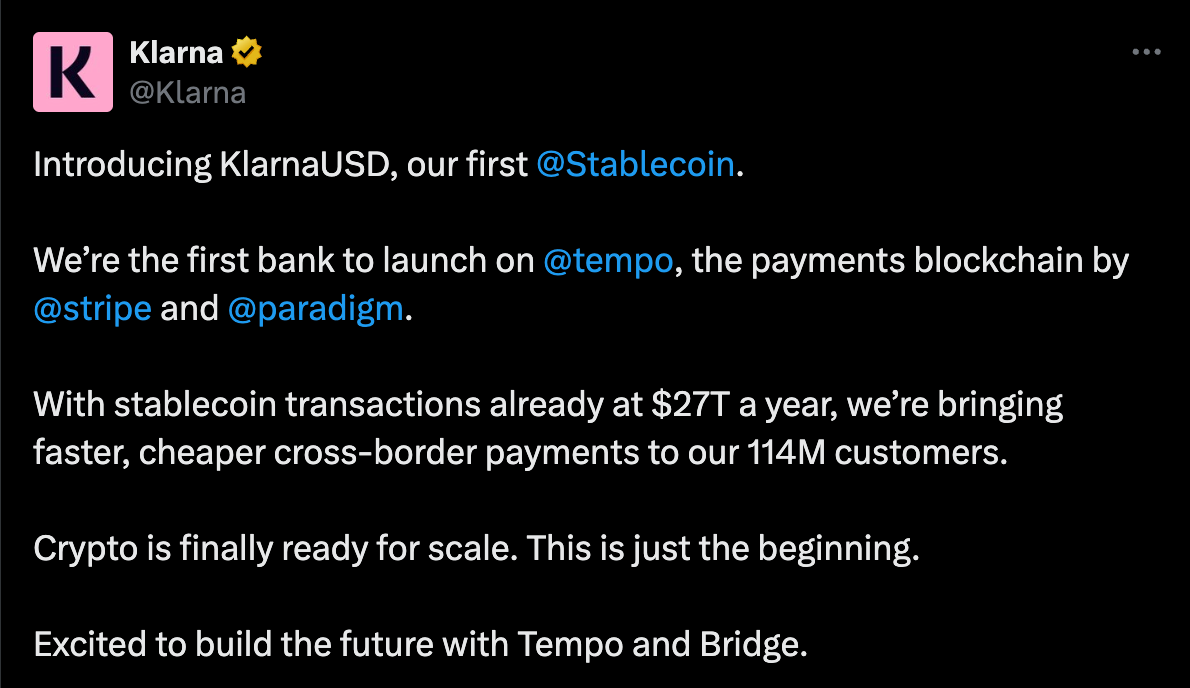

What makes this shift feel real is that it’s no longer just an idea. Companies have already started moving in this direction. Klarna, one of Europe’s largest consumer payment institutions, with more than $80B in annual purchase volume, recently launched its own stablecoin. Soon, its loyalty program can be funded through card-network fees and merchant discount rates, both of which are expensive.

A Klarna-issued stablecoin can completely change this model. Instead of routing transactions through legacy rails, Klarna can settle value cheaply and hold customer balances in an asset that earns 4–5%. That yield can subsidize rewards, lower program costs, and reduce reliance on interchange.

It’s early, but moves like this show the direction things are headed. Once the payment layer itself can generate value, loyalty doesn’t need to sit in a separate system or depend on unused points to make the numbers work. The reward becomes part of the payment flow, the economics become lighter, and customers receive something they actually understand.

If more companies adopt this model, loyalty will simply evolve into something far more useful than those useless points we’ve been conditioned to accept.

That’s the shift. Trapped points, freed dollars.

See you next Sunday.

Until then … stay curious and DYOR,

Vaidik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Solid read indeed, loved the analysis of the loyalty systems today. Myself firmly being not a great crytpo believer, i think this particular use case has definitely risen my belief and curious for all the possibilities.

But credit cards issuers don’t make more money issuing points that expire? And they can invest this float in anything or even in their own growth. Stablecoins, unlike miles, are actually regulated with the Genius Act…