Hello,

Every time stablecoins trend, I see people declaring that “stablecoins will kill Visa and Mastercard.” Crypto Twitter and other media outlets talk about traditional finance rails being replaced by new ones. Many nod at this argument, but I find it cute and naive. Aspirational, at best.

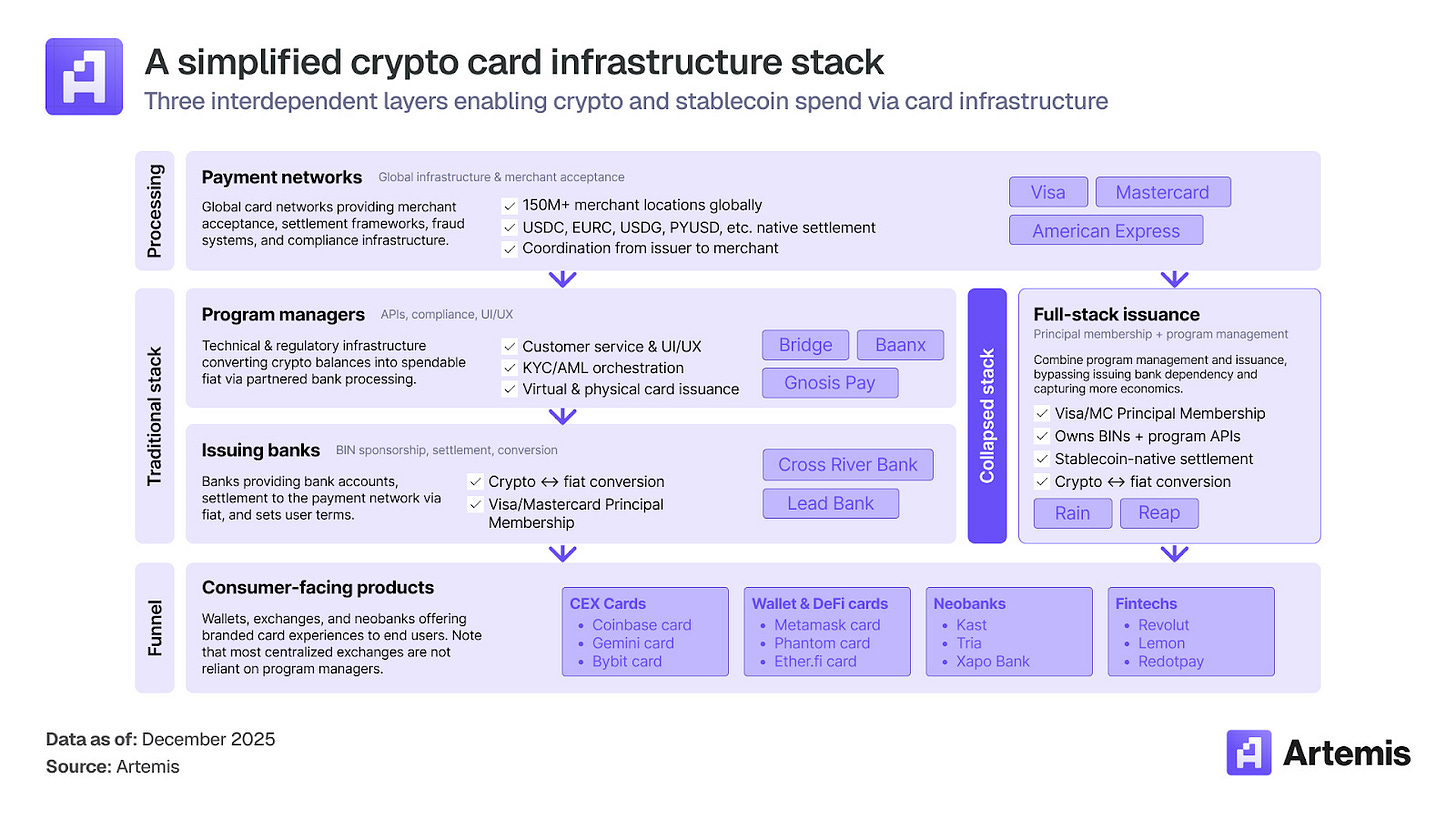

This week, I read Artemis’ latest report on stablecoins and card payments. It reinforced the idea that stablecoins are scaling on the existing infrastructure set up by legacy financial cards like Visa and Mastercard, not around them.

The report illustrates how stablecoin payments are scaling rapidly by leveraging distribution and consumer credit, both of which crypto doesn’t naturally have a moat in.

It’s clear from the report that crypto cards are bridging the gap between stablecoin balances and everyday transactions. However, there’s another important story here.

In today’s quantitative analysis, I delve deeper to show why cards, specifically credit cards, offer the biggest opportunity to scale this shift.

On to the story,

Prathik

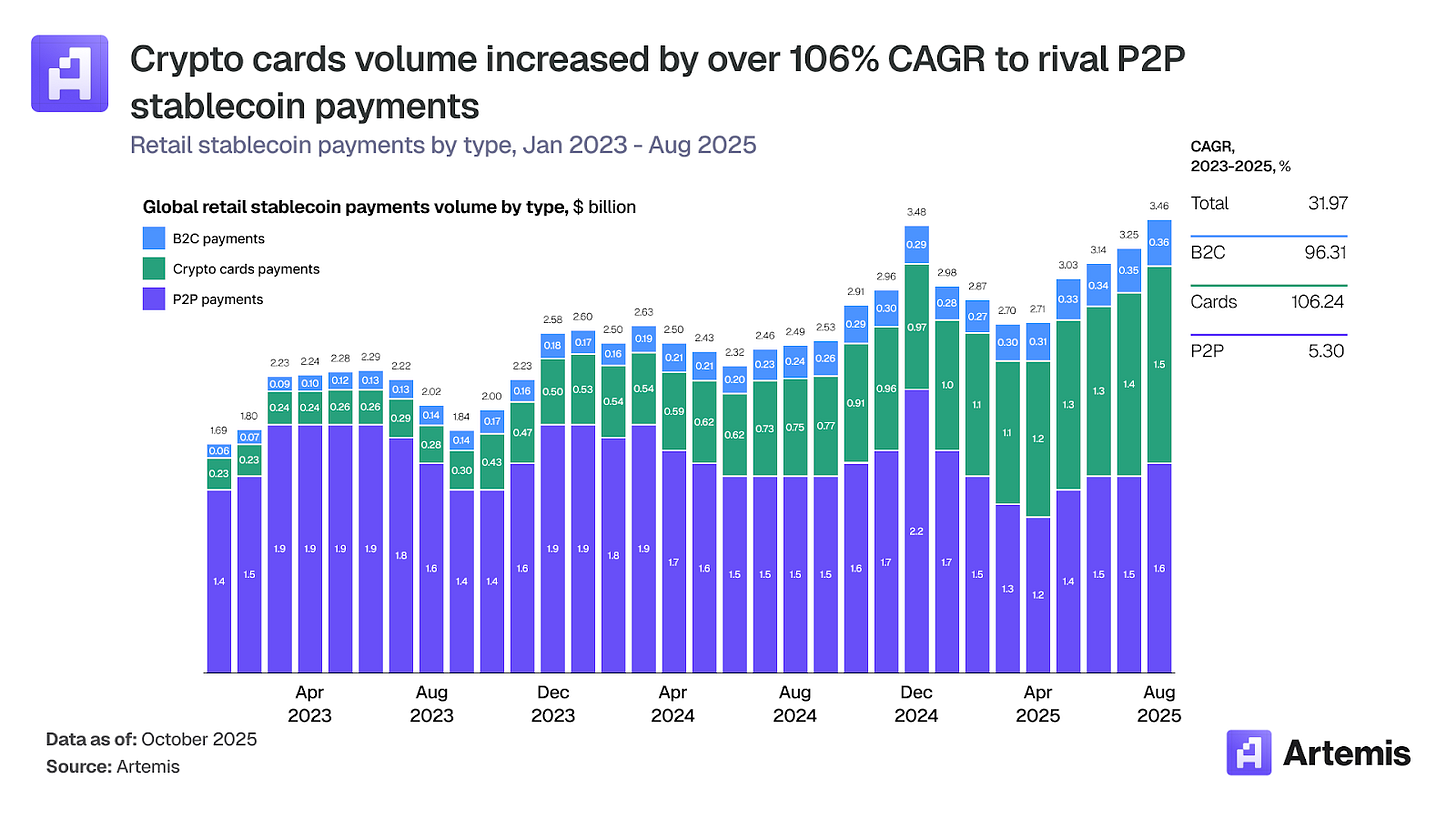

Retail stablecoin payments have grown from $1.7 billion in January 2023 to $3.5 billion in August 2025. However, this growth hasn’t been driven by merchants accepting stablecoins at checkout. About 75% of this growth came from leveraging existing consumer behaviour - specifically swiping a card.

Crypto card payments grew to over $1.5 billion in August 2025, five times (5x) the volume in August 2023 ($0.28 billion). The average monthly volume shot up from $250 million in early 2023 to over a billion dollars in 2025. During the same period, P2P stablecoin payments remained stagnant at an average monthly rate of $1.5 billion.

The growth of card payments might seem surprising, but they scaled by riding on the two card benefits that users love most: tap-to-pay distribution and rewards.

P2P stablecoin transfer volume stagnated because it is driven by need. People use them to overcome capital constraints, banking downtime, and remittance friction. Once these urgent use cases are addressed, there’s little room for these transfer categories to grow. That’s because making these transfers still requires users to understand how stablecoins and crypto wallets work.

But cards can move the entire spending activity, including shopping for toys and television sets and paying for subscriptions, to stablecoin channels. This doesn’t require people to understand stablecoins. They can tap-to-pay via stablecoins, just as they do with fiat currency.

Distribution Beats Brand

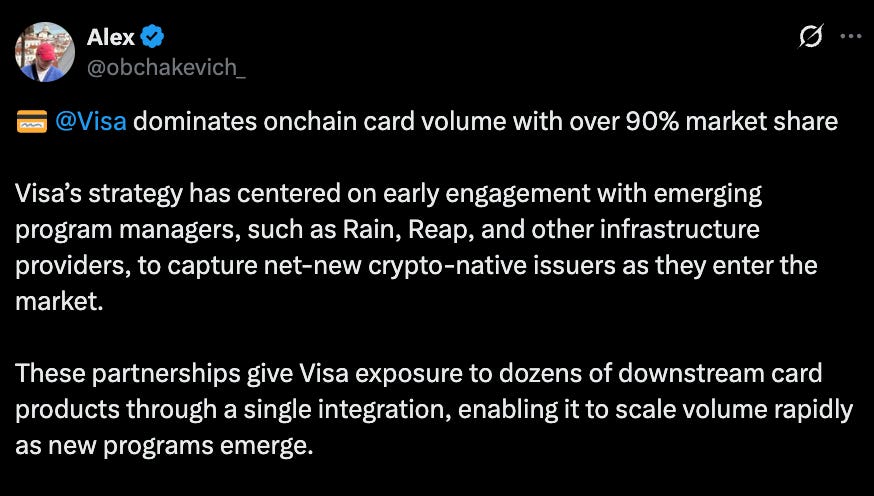

The Artemis report also shows that brand matters less than the infrastructure they integrate into. It shows that both Visa and Mastercard support over 130 crypto card programmes each, yet Visa captures over 90% of on-chain card volume.

That’s because volume follows the network that integrates best with the middle layer of the infrastructure, including issuers, processors, programme managers, and compliance-heavy operations teams that make the card experience frictionless for users.

In this case, Visa partnered early with the middle layer, while Mastercard initially focused more on partnering with exchanges. A relationship with a major issuer can lead to dozens of card programmes and unlock an entire pipeline of launches.

Through Visa and Mastercard, stablecoins can be adopted by millions of users.

Once the network for transferring and processing conversions between stablecoins and fiat has been established, both users and merchants will experience minimal friction when paying and accepting stablecoins via cards.

But why should people wake up one day and just move to stablecoin payments? They probably won’t. How do you fix that, then?

The Rewards Moat

This is where the inherent feature of cards, via subsidies and rewards, comes into play.

Both merchants and users become ready to shift to stablecoin payments when you make it economically irresistible for them to do so.

Think cashback, reward points, lounge access, no-cost EMIs, surcharge waivers, and other small perks. They all add up, making it easier to form a new habit.

Although this turns out to be a net negative for card issuers, they don’t view cards as a single business line.

Crypto card issuers have followed the playbook to acquire customers. Gemini, EtherFi, Coinbase One, and other crypto cards serve much more than merely enabling payments. Through the rewards they offer, they act as an acquisition funnel, bringing in new transacting users and retaining a chunk of them as active users. The issuers then cross-sell other services, such as lending, trading, subscriptions and yield products.

But I see greater potential here to increase stickiness.

The Credit Opportunity

In the majority of today’s crypto cards, users still have to hold either stablecoins or fiat currency in their crypto cards before they spend. Like a debit card. Pre-funding means friction. It requires either the users to hold a new kind of money - stablecoins, or the merchants to be integrated into the stablecoin infrastructure. That’s a big ask when it comes to expecting people to change how they hold, spend, or receive their money on a daily basis.

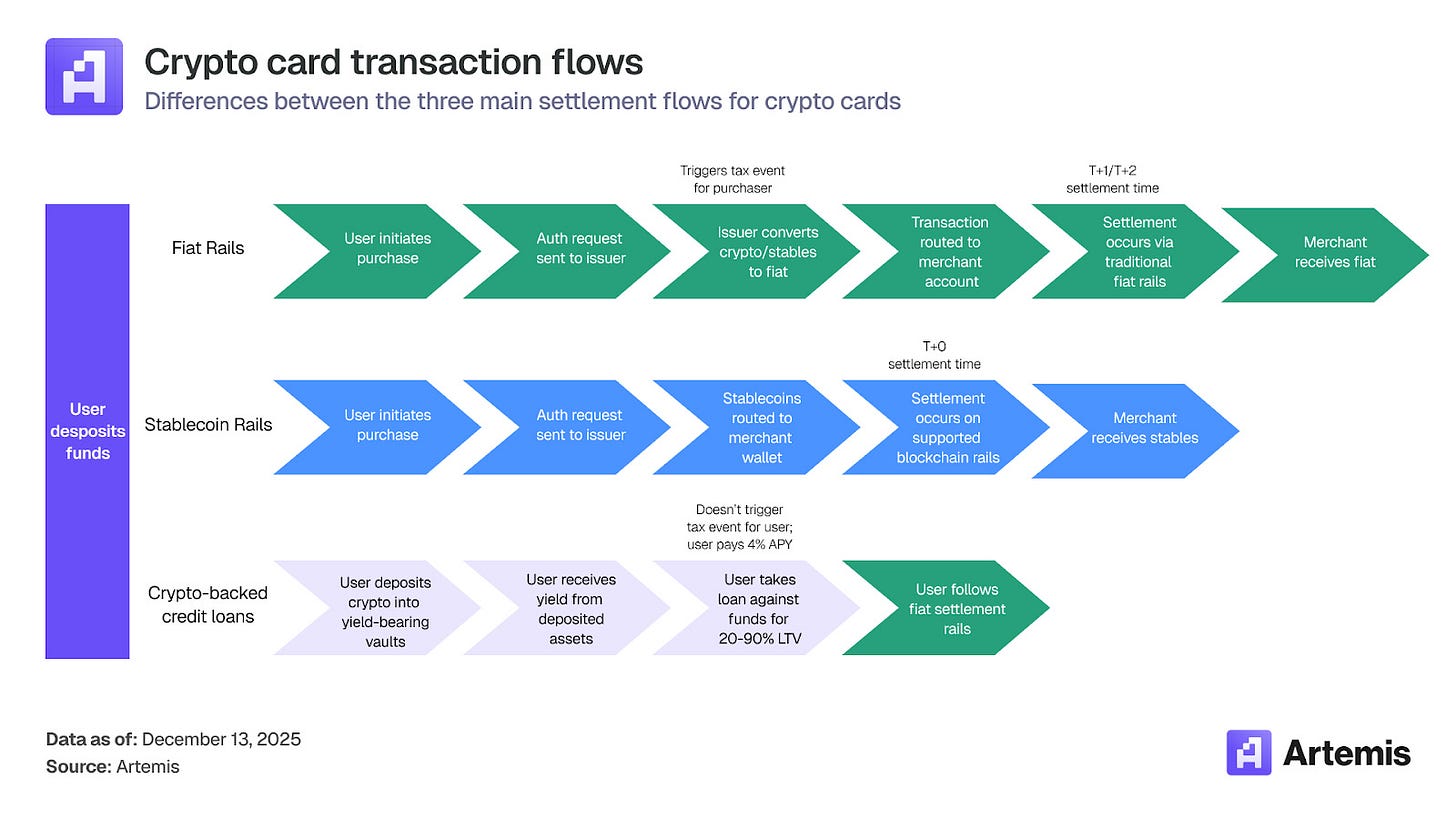

But what if, instead of expecting users and merchants to transact in stablecoins, settlement is handled via fiat infrastructure? The user can deposit whatever crypto they own into a yield-bearing vault, earn interest on that collateral, and take a fiat loan against those funds. It works like a credit card at checkout – spend now, settle later. Here, the credit limit isn’t set by a bank; instead, it is a secured credit line backed by the crypto parked in the vault, expressed as a loan-to-value (LTV). If the collateral drops, your borrowing capacity could shrink. The remaining transaction will then be settled as any other fiat-based transaction between the user and the merchant. Spend now, settle later.

This credit wrapper (third option in the graphic above) brings back the convenience of credit to the spending journey without requiring either the user or the merchant to hold stablecoins. It feeds on consumer behaviour without expecting them to change their spending habits.

Let me show you how with a personal experience.

When India launched the Unified Payments Interface (UPI) to digitise payments on mobile phones, I was late to the party. It worked great, no doubt. But it didn’t appeal to the credit lover in me. Of course, I still used it occasionally for its convenience or when I didn’t have my wallet. But that changed in 2022 when it started letting me pay via my RuPay credit card. Once it allowed me to link my credit card to any payments app, such as Google Pay or PhonePe, it married UPI’s ease of use with the convenience of paying with credit cards. I could use my credit limit and accumulate reward points even without physically swiping the card.

Numbers show the impact.

As of November 2025, RuPay accounted for 38% of all credit card transactions in India by volume and 8% by value, up from 10% and 1.8%, respectively, a year ago. RuPay credit card transactions through UPI almost doubled to $7.4 billion between April and October 2024, from $3.89 billion between April 2023 and March 2024.

The Artemis report shows how stablecoin growth is becoming less about the stablecoins themselves and more about how they are wrapped and distributed. The report shows numbers on distribution partnerships, incentive budgets, and credit design. But what excites me the most is watching credit-led products that remove the entire crypto settlement process from the user experience.

Stablecoins will likely become an invisible part of the infrastructure, while familiar processes like underwriting, risk controls, and rewards become the user-facing products.

Throughout this process, expect Visa and Mastercard to continue their usual business and support the entire payment infrastructure as they seamlessly move money — crypto or otherwise.

That’s it for this week’s quantitative analysis. I will be back with the next one.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.