Hello

I spent the past week analysing the businesses of two distinct types of Bitcoin believers. One raises debt and equity to acquire bitcoin (BTC), while the other burns energy to mine it. The former is the largest corporate holder of bitcoin, while the latter is the largest miner of bitcoin.

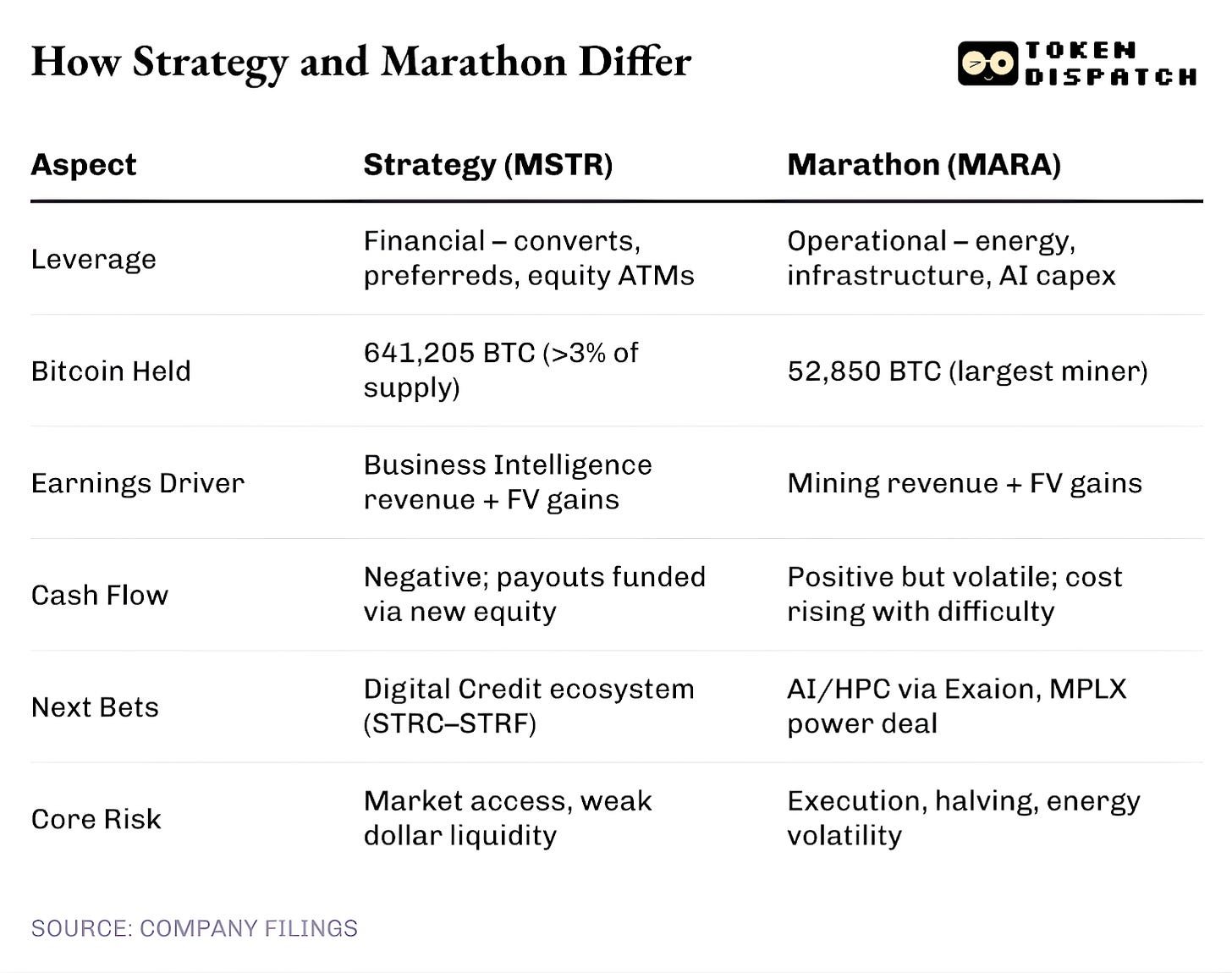

What I understood was that Strategy (formerly MicroStrategy) and Marathon Digital are like the yin and yang of corporate crypto. Although they both claim to be “long bitcoin forever”, how that motto translates into their businesses couldn’t be more different.

One is financialising its faith with products less than half a decade old, while the other is industrialising it with a mechanism that’s been tested over the last 16 years of bitcoin’s life. Yet both earn millions and billions (on paper), operate under different forms of leverage, and have found a way to make holding bitcoin feel like a compelling business case for their investors.

All this got me thinking about what happens when your earnings depend on a coin you can’t control. Are you still running a business, or an extremely loyal cult?

In today’s piece, I look at the earnings of two public companies that have built giant empires on the same cryptocurrency and examine where they differ and where they don’t.

On to the story now,

Prathik

Ready to Turn Predictions into Profit?

The best entry point into Limitless is the Hourly Prophet Challenge - a short-term price prediction competition built around 30-min & 1-hour markets on crypto and stocks.

You compete on two leaderboards simultaneously:

1. Individually, based on your own positive trades

2. As a team, where the collective performance multiplies your upside

Prize pool

Individual leaderboard: 10,000 LMTS tokens

Top teams receive points multipliers, directly boosting their position ahead of the airdrop (Pssst, next airdrop is worth $6 million)

What are you waiting for? Choose the team and start trading.

Two Rooms, One Coin

In West Texas, the air ripples with heat from mining rigs, while in Virginia, it’s the fluorescent glow of Bloomberg terminals. Both rooms are betting on the same asset - Bitcoin.

Michael Saylor’s Strategy and Fred Thiel’s Marathon sit at the top of the corporate bitcoin treasury, collectively holding over 690,000 BTC. That’s worth more than Starbucks made from coffee sales in 2023 and 2024 combined.

What’s more interesting is how these two companies got here and what they do with their bitcoin.

Saylor’s company issues debt. It then buys bitcoin with the funds it raised, only to hoard it, like a central bank stacks gold. Thiel’s energy company operates in both worlds — it mines some BTC like any other commodity, but with computers replacing conventional mining materials. And then buys some more off the market, like Strategy does.

Both of them earn from the same coin, though it is not always in cash.

Strategy reported $3.9 billion in operating income and $2.8 billion in net profit. However, the entire gain came from an accounting approach that allowed Strategy to record unrealised appreciation of its BTC holdings after it adopted fair-value reporting earlier this year. Not a single satoshi was sold. Not since the company started stacking sats in 2020.

Strategy currently holds 641,205 BTC, over 3% of all bitcoin that will ever exist, at an average cost of around $74,000 per coin. With each increase in BTC’s price above this mark, Strategy books an on-paper profit by marking the price of its holdings to market.

Since adopting fair-value accounting in January this year, Strategy’s net income has moved almost tick-for-tick with Bitcoin’s chart.

It suffered losses when it dipped below $85,000 in March, followed by profits in Q2 and Q3 when BTC closed above $107,000 and $114,000 on June 30 and September 30, respectively. The business now operates in complete sync with Bitcoin’s price cycles, buying consistently, but never selling.

Borrowing Belief

To sustain its never-sell philosophy, Strategy powered its BTC-buying strategy through a financing model.

It raises capital by issuing convertible debt with low or no interest, along with preferred equity that pays steady dividends rather than pursuing growth. Investors continue to buy in, convinced that as long as BTC price rises, the embedded equity upside will far exceed the coupon interest they forgo.

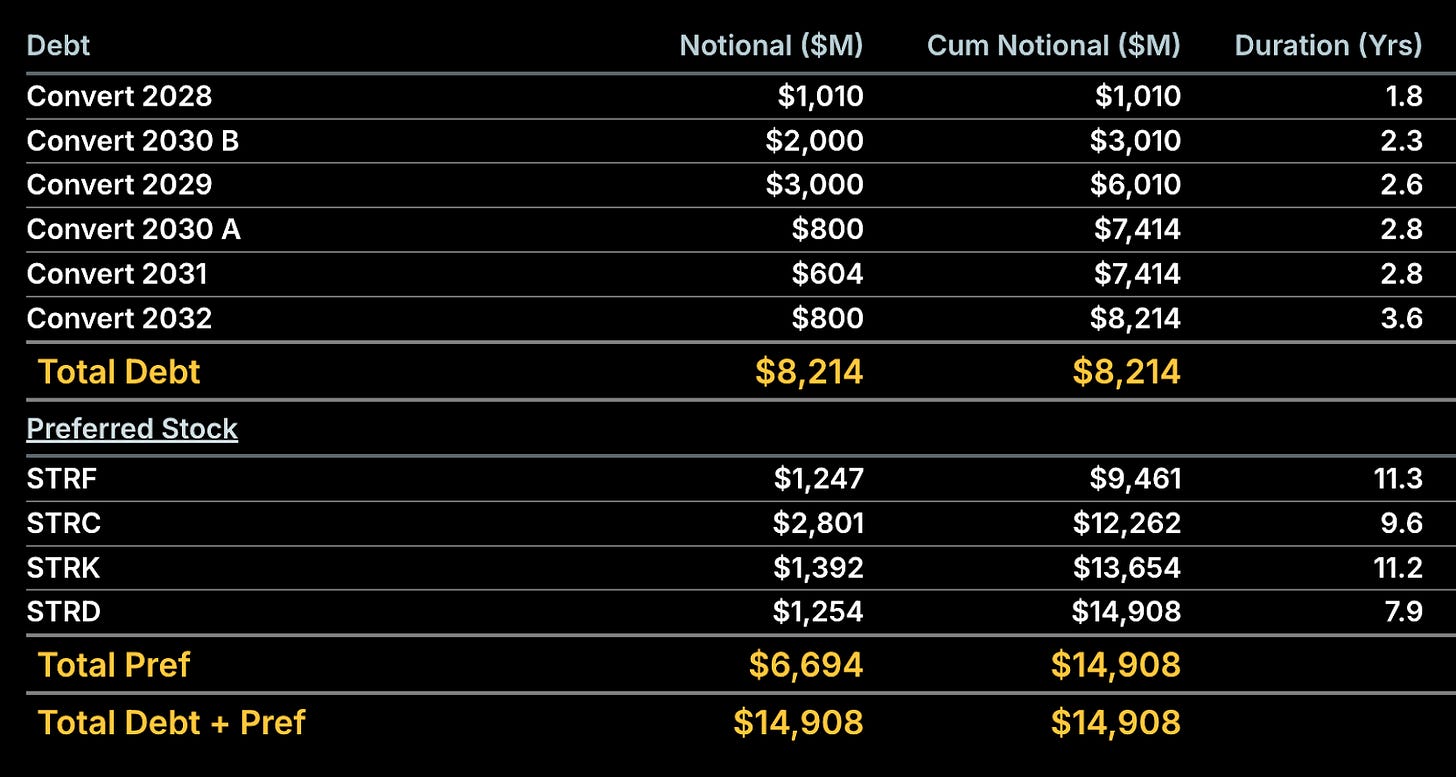

As of October 24, Strategy has raised $8.2 billion in low-coupon convertible debt, with the earliest maturity in 2028, conveniently far enough to maintain its “buy more BTC” narrative.

Besides convertible debt, Strategy is dependent on what it calls a ‘Digital Credit ecosystem.’ Through this, it offers a suite of perpetual preferred stock (STRC, STRF, STRK, and STRD), allowing investors to choose their preferred type of BTC exposure through dividend-bearing classes.

As of October 24, Strategy has raised $6.7 billion in perpetual preferred equity.

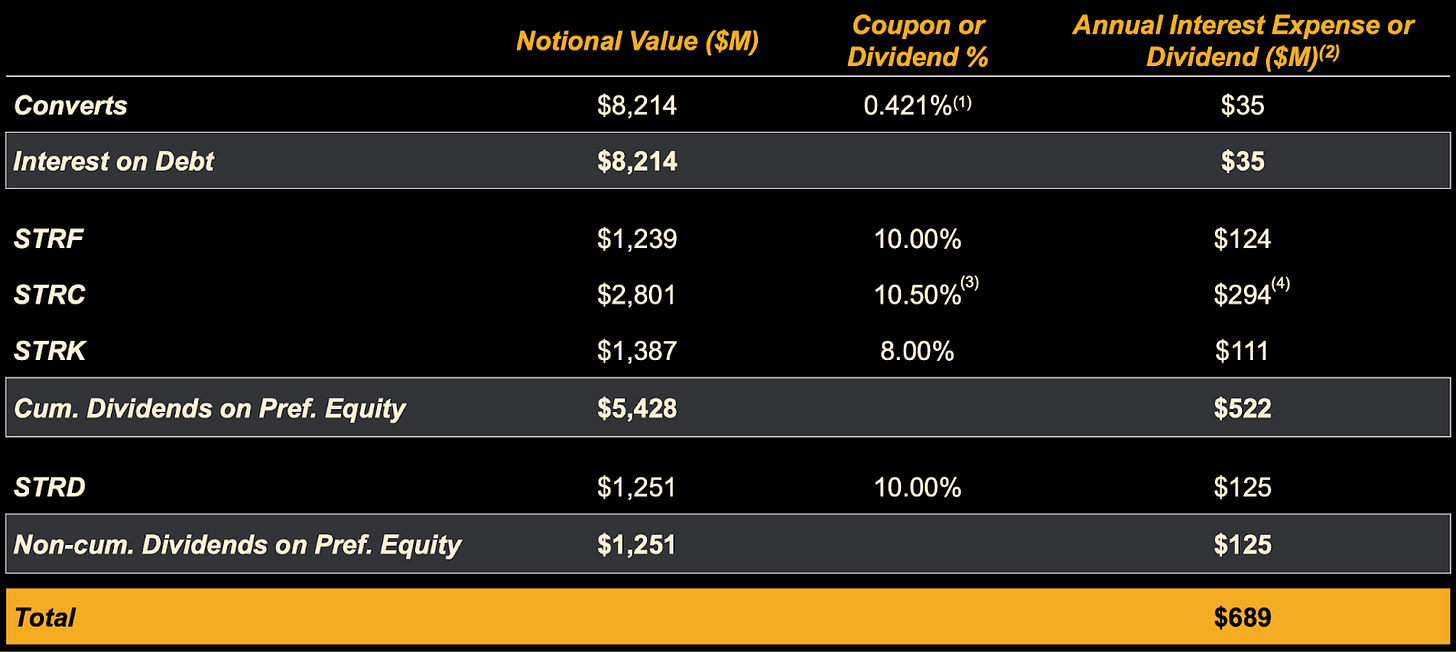

Collectively, the cost of convertible debt and equity requires Strategy to pay about $689 million in annual interest and dividends.

So, where does it get the cash to pay this? From new investors. Strategy raises capital continuously through at-the-market equity programmes, selling new shares when investor enthusiasm is high.

All this financial modelling leads to a loop: raise funds to consistently buy BTC, which helps with dollar-cost averaging. With each upward price movement, the company revalues its holdings and shows a profit. These gains are then used in earnings reports to win trust and issue more stock. The exercise is then repeated all over.

The entire loop works well until it doesn’t.

Despite a ~$65-billion BTC treasury, Strategy makes no income from hoarding the cryptocurrency. At least, not yet. Its legacy operations, which involve selling product licences and subscription services for business intelligence, generated $128.6 million in revenue and $90.6 million in gross profit this quarter. The revenue rose 10% year-on-year and beat analyst estimates by 10%, yet not nearly enough to cover their recurring $689 million in dividend and interest payments.

Strategy’s share price rose 8% a day after it reported its earnings to touch an intra-day high of $276 apiece, but has given away all the gains since then to close at $255 on November 5.

As for its cash balance, Strategy had about $56 million as of September 30.

Collectively, these are red flags that the investors will have to take note of.

Last week, S&P Global gave Strategy a junk ‘B-’ credit rating, its first ever. While it provided a stable outlook for the company, the agency called out the firm for the same issues I mentioned above: its high bitcoin concentration, weak risk-adjusted capitalisation, and low US dollar liquidity.

Operating cash flow for the first half of the year was negative. This means that if capital markets turn risk-averse, its strategy of financing recurring payments with fresh capital could fall flat.

Industrialisation of Bitcoin

While Strategy proudly claims to be the world’s largest Bitcoin Treasury company, Marathon Digital explicitly states “We are not a bitcoin treasury company,” in its shareholder letter for the quarter ending September 30, 2025. This is despite the company running the largest public BTC mining fleet in the world and holding more bitcoin than any other miner.

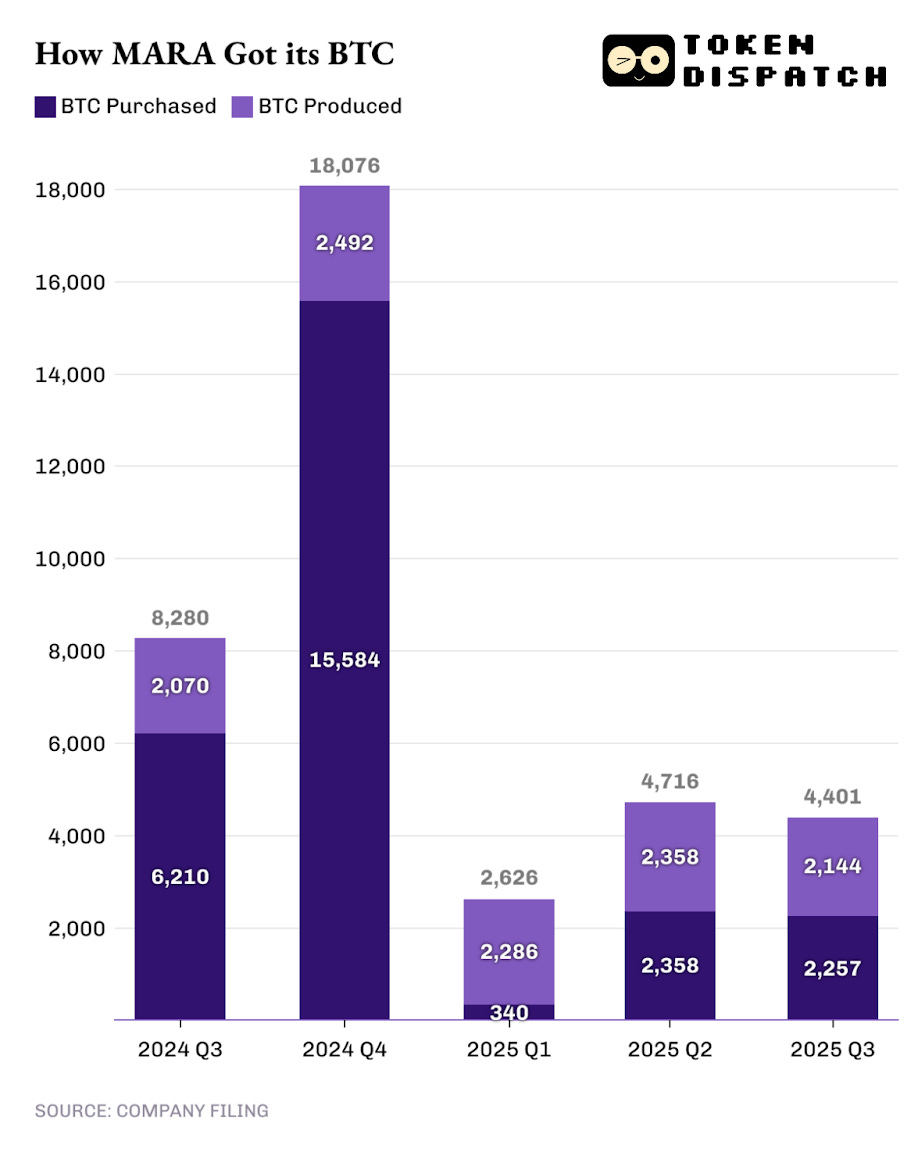

In contrast to Strategy, Marathon acquires its BTC through both mining and open-market purchases. In Q3 2025, MARA mined 2,144 BTC and purchased 2,257 BTC from the market.

Where MARA also differs from Strategy is in how it deploys its BTC stack to generate consistent revenue.

About a third of MARA’s 52,850 BTC has been loaned out, pledged as collateral, or deployed in various strategies. In Q3 2025, Marathon earned $9.6 million in interest income by lending out 10,377 BTC. This is a significant cash flow for a company whose net income would fall into the red when on-paper profits are ignored.

That’s another reason Marathon should extend its focus beyond just mining, buying, and holding BTC.

Diversifying Risk And Reward

Marathon’s recent business activity hints at how the miner plans to expand its revenue lines across different businesses by doubling down on its computing prowess.

In August, MARA signed an agreement to buy a 64% stake in Exaion, which develops and operates high-performance computing (HPC) data centres and provides secure cloud and AI infrastructure. The $168 million deal will extend MARA’s presence in Europe’s enterprise AI cloud business, an industry expected to be worth a trillion dollars by 2031.

On November 4, Marathon also signed a letter of intent with MPLX LP, an energy infrastructure and logistics assets provider. The collaboration will involve MPLX supplying natural gas to MARA’s new 400MW power generation facility and data centre campuses in West Texas.

I see these announcements as hedges against the volatility and risks that are unique to corporates that bet exclusively on bitcoin. While Strategy’s BTC acquisition approach works because of its low purchase cost, MARA and other corporates acquiring BTC don’t have that luxury. That exposes them to greater risks of liquidation and a loss of investor confidence if the BTC price falls below the purchase cost.

For Marathon, these business expansions are both crucial and timely, given its current financial position.

Although MARA’s Q3 revenue surged 92 % year-on-year (YoY) to $252 million, and its net income shot up 200% to $123 million, these figures included a $343 million fair-value gain by marking its BTC holdings at market price. It reported an earnings per share (EPS) of $0.27, far surpassing the forecasted loss of $0.10 per share. Yet, its stock price declined from $17.81 to $17.13 since it reported its earnings.

In this context, Marathon’s evolution from a BTC miner to a vertically integrated energy-to-AI conglomerate becomes an inevitable move.

Faith And Fair-Value Profits

There is an interesting paradox in storytelling using numbers. While the world trusts them for being objective, different storytellers can interpret the same set of numbers differently.

Accounting statements are one place we see companies using the same set of numbers to tell myriad different stories. Here, the financials of both Strategy and Marathon reflect heavy on-paper profits, suggesting the businesses are at the peak of their financial health. Yet, these numbers hide challenges that, if unacknowledged, could bring these businesses and their strategies down.

Strategy calls BTC “digital capital” and uses it to issue perpetual preferred equity that behaves like yield-bearing bitcoin bonds. Marathon uses its computing infrastructure not only to mine and earn yield from BTC, but also to expand its revenue lines across AI and enterprise cloud businesses.

Both will eventually face different challenges if they become overly dependent on BTC. If interest rates rise or liquidity tightens, Strategy’s perpetual offering may not look as lucrative to investors. If energy prices rise or network difficulty accelerates faster than hash revenue, MARA’s margins might get squeezed out. There’s also the looming inevitability of the halving of block rewards in 2028.

One company is betting that BTC will always be worth more than its debt, while the other is hoping the cost of mining BTC will remain lower than its market value.

For now, Strategy’s spreadsheets and MARA’s servers are moving in sync with BTC’s chart. It will be interesting to see how their businesses evolve once BTC starts moving unfavourably for a prolonged time.

That’s it for today. I’ll see you with the next one.

Until then … stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.