Hello

Today, we are diving deep into Strategy's (formerly known as MicroStrategy) Q2 2025 earnings, the company's first net-positive quarter under fair-value Bitcoin accounting that delivered one of the largest quarterly profits in corporate history.

TL;DR

Strategy's Bitcoin treasury strategy delivered $10.0 billion net income (vs $102.6 million loss in Q2 2024) driven entirely by a $14.0 billion unrealised Bitcoin gain under new accounting rules

Software operations remain stable but secondary with $114.5 million revenue (+2.7% YoY) with narrower margins contributing roughly $32 million to underlying operating income

Aggressive capital raising continues with $6.8 billion raised in Q2 through equity and preferred offerings, expanding Bitcoin holdings to 597,325 BTC, 3% of circulating supply, worth ~$64.4 billion

Strategy stock fell 8% from $401 to $367 as the $4.2-billion STRC at-the-market share sale news followed the earnings; the stock has since recovered to above $370

Strategy shares trade at a 60% premium to net Bitcoin NAV, meaning investors pay $1.6 for each $1 of underlying BTC value

Investment Thesis: Strategy’s Bitcoin treasury strategy works as long as Bitcoin appreciates and capital markets remain accessible, but introduces massive earnings volatility and dilution risks that render traditional software metrics irrelevant. Yet, its early entry into the treasury game has given Strategy significant breathing room to prepare for a Bitcoin price crash.

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

Financial Performance: BTC Key Driver

Strategy reported $10.02 billion in net income for Q2 2025, in line with the Generally Accepted Accounting Principles (GAAP), a stark reversal from the $102.6 million net loss a year earlier. Diluted EPS reached $32.60 versus a $0.57 loss in Q2 2024.

This 9,870% year-over-year surge of net income stems almost entirely from a $14.0 billion unrealised Bitcoin windfall gain recognised under fair-value accounting adopted in January 2025. This marks a departure from the old accounting regime that required firms to value their BTC holdings at cost-less-impairment value, where a Bitcoin price appreciation was not allowed to be accounted for, while any downward price movement had to be provided for as impairment.

The magnitude of this accounting impact becomes even clearer when you look at it alongside Strategy’s operating business income. Strategy's total quarterly revenue was just $114.5 million, meaning the company reported a net profit margin exceeding 8,700%, an anomaly driven entirely by cryptocurrency revaluation.

Excluding the Bitcoin revaluation, underlying operating income was approximately $32 million, a healthy ~28% margin on software revenues but negligible relative to the crypto windfall.

GAAP operating income hit $14.03 billion, a significant improvement from the prior-year $200 million operating loss that included heavy Bitcoin impairment charges under the old accounting regime.

The quarterly volatility has been extreme. Q1 2025 saw a $4.22 billion GAAP net loss due to Bitcoin's dip to ~$82,400 by March. With Bitcoin's recovery to $107,800 by June, Q2's $10.0 billion profit marked a sequential turnaround exceeding $14 billion.

Management acknowledged that fair-value accounting makes earnings "extremely sensitive" to Bitcoin's market price. Strategy's profitability now fluctuates primarily with cryptocurrency markets, not software sales.

Adjusted net income (excluding share-based compensation and minor items) was ~$9.95 billion versus -$136 million a year earlier, essentially unchanged from GAAP since Bitcoin-related adjustments dwarf traditional add-backs.

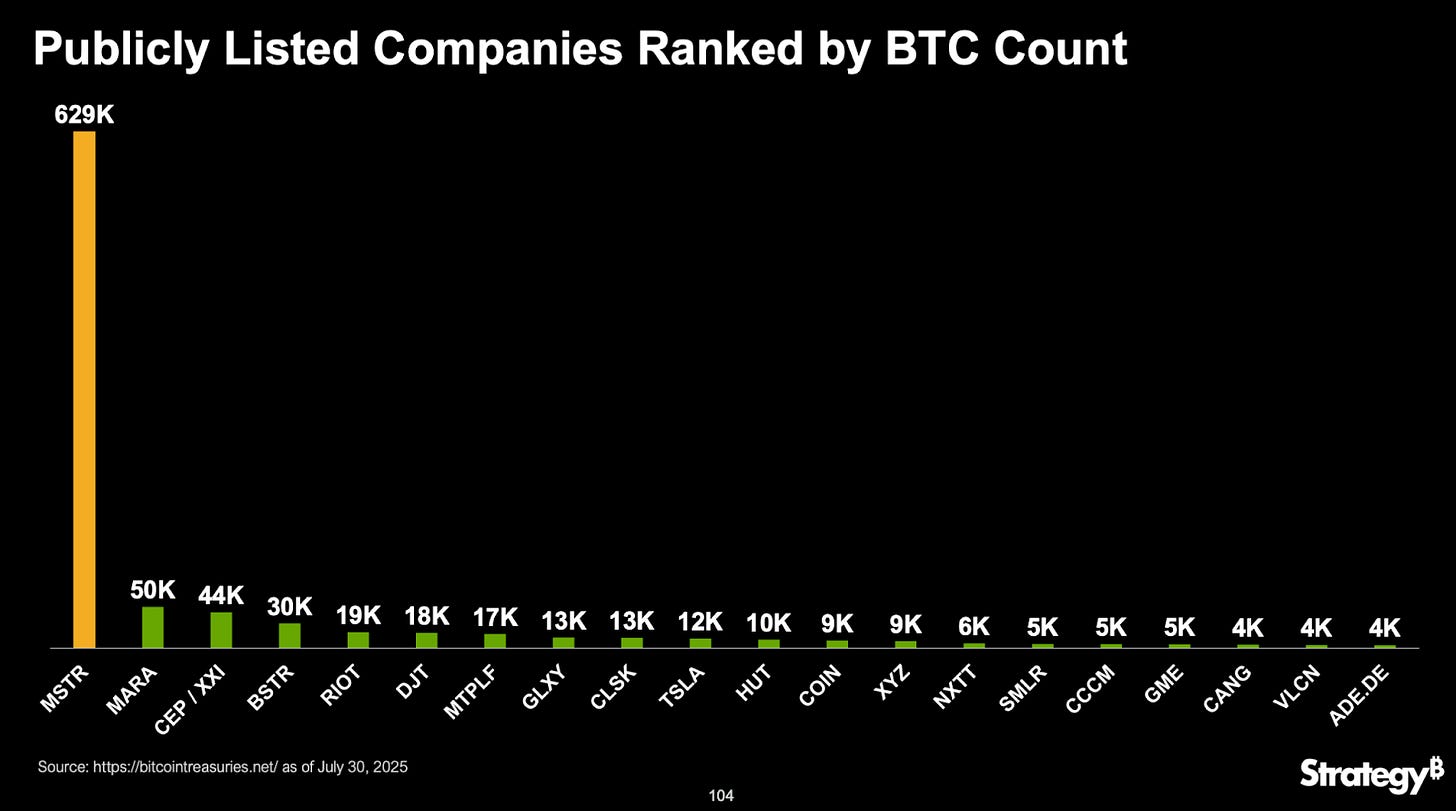

Funding the Treasury

Strategy held 597,325 bitcoins as of June 30, 2025, over 2.5× the 226,331 BTC held a year earlier. Today, holdings have reached 628,946 BTC through additional Q3 purchases. The total cost basis was $46.094 billion (averaging $73,290 per BTC), while market value approximated $74.805 billion, amounting to ~$29 billion in unrealised gains currently — more than double of what was reported in Q2 results.

During Q2, Strategy acquired 69,140 BTC for ~$6.8 billion, equalling the amount of capital the firm raised during the quarter. The average Q2 purchase price was around $98,000 per BTC, indicating that the firm accumulated steadily as prices climbed from the lows of April. No Bitcoin sales occurred, sticking to its chairman Michael Saylor’s "HODL" strategy with no realised gains.

The financing structure has evolved into a complex capital markets operation:

Common Stock ATM Program: Raised $5.2 billion in Q2 by issuing ~14.23 million shares at-the-market, with another $1.1 billion raised in July. Approximately $17 billion capacity remains under this program.

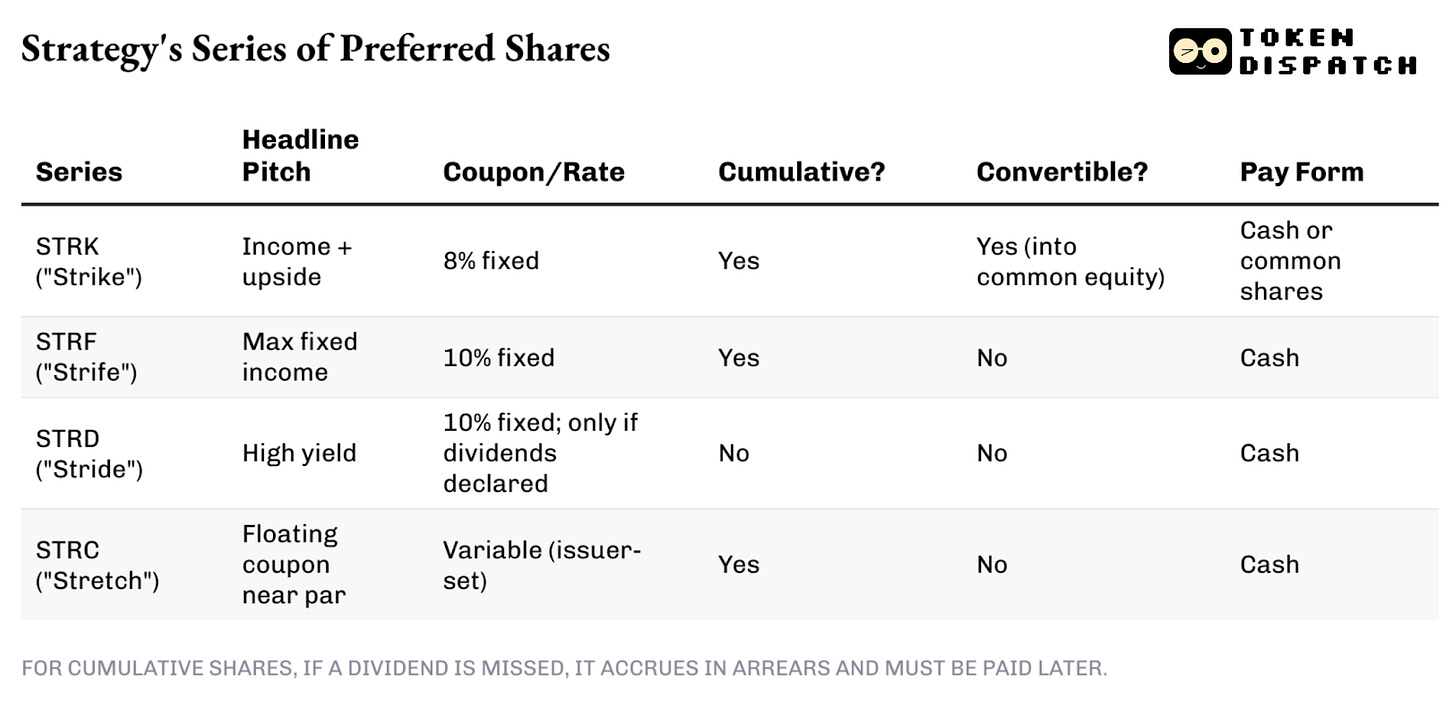

Preferred Equity Series: Strategy has innovated multiple perpetual preferred stocks to keep raising cash for Bitcoin buys in any market environment, while also limiting dilution of common shares. Different series offer varied yields and terms, letting them match funding costs to investor appetite at the time.

Convertible Notes: Strategy issued $2.0 billion of 0% Convertible Senior Notes due 2030 in February with $433.43 conversion price. While these notes offer zero interest, they give bondholders an option to convert them into Strategy’s shares of class A common stock if the stock price exceeds $433.43. While the conversion to equity will further dilute existing shareholders, it will eliminate Strategy’s debt obligation. The company retired $1.05 billion of 2027 converts in Q1 through this route into equity.

This capital structure enables continuous Bitcoin accumulation but introduces significant fixed costs. The preferred stocks carry substantial dividends (8-10% coupons totaling hundreds of millions annually) that must be paid regardless of Bitcoin's performance. Strategy maintains a ~20-30% leverage ratio (debt relative to BTC assets), meaning equity/preferred issuance funds most purchases rather than debt.

Software Operations: Steady but Secondary

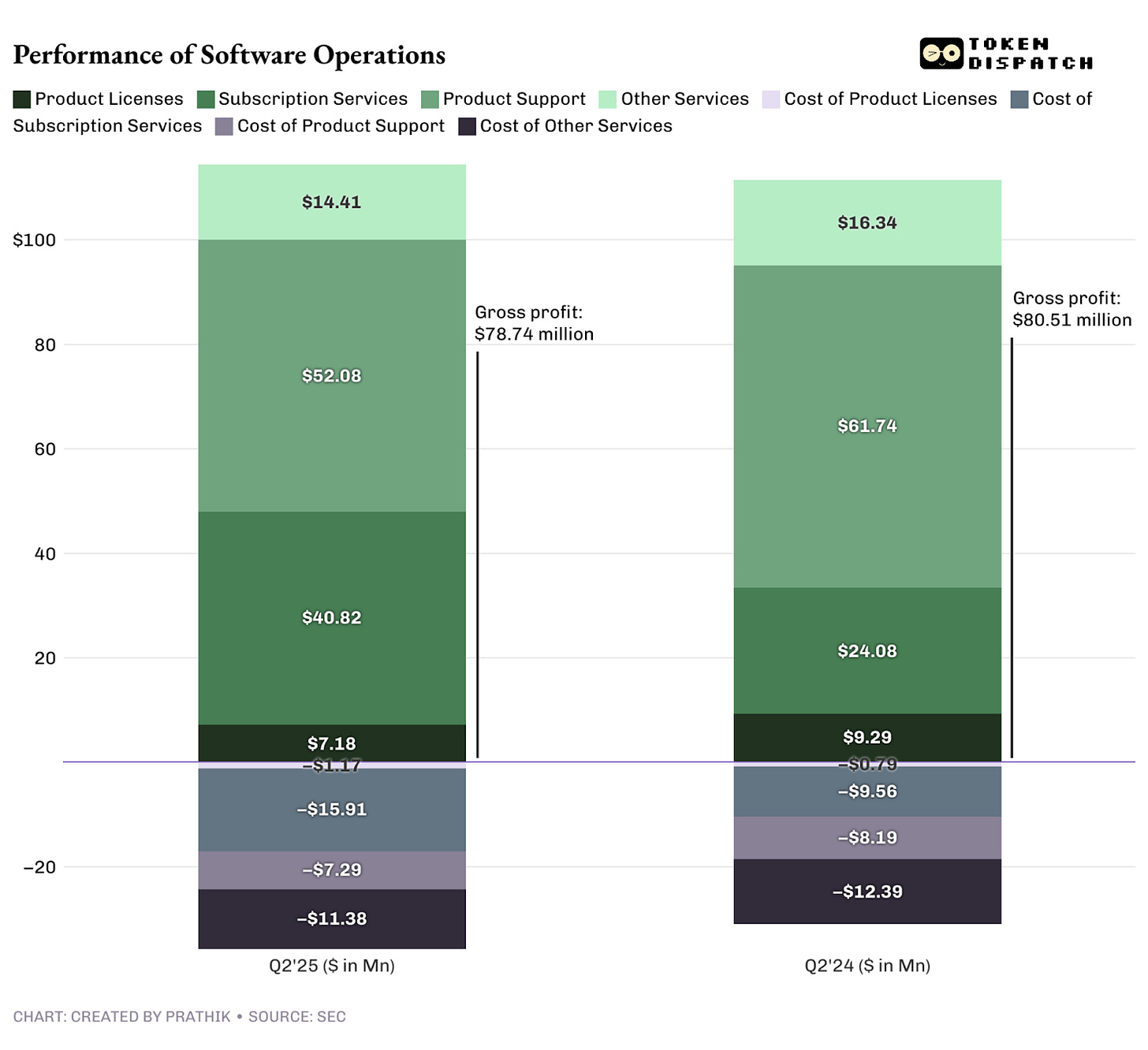

The legacy analytics business generated $114.5 million revenue in Q2 2025, up 2.7% year-over-year, a return to growth after Q1's 3.6% decline. The revenue mix continues shifting toward subscriptions:

Subscription Services: $40.8 million (+69.5% YoY), now ~36% of total revenue versus ~22% a year ago

Product Licenses: ~$7.2 million, down ~22% as customers migrate to cloud

Product Support: $52.1 million (-15.6% YoY) as maintenance revenue erodes during cloud transitions

Other Services: $14.4 million (-11.8% YoY) reflecting lower consulting demand

Software gross profit was $78.7 million (68.8% margin) versus $80.5 million (72.2% margin) in Q2 2024.

The margin compression is due to higher subscription service costs (cloud hosting, customer success) and the loss of high-margin support revenue.

Operating expenses historically approximated gross profit levels, yielding minimal software operating income. The ~$32 million of non-Bitcoin operating profit in Q2 suggests the core business achieved modest profitability after years of cost reduction. This software contribution helps cover interest obligations ($17.897 million) and a part of preferred dividends ($49.11 million) but represents less than 1% of total company profit.

Expect Strategy to run its business analytics operations similarly in the coming quarters, as it remains the only cash-generating activity that is earning the company any realised gains, given its Bitcoin ‘buy, hold but not sell’ strategy. Yet management commentary focuses on Bitcoin accumulation rather than product roadmaps, which shows that while software services may continue to persist, it may no longer be a meaningful growth driver or valuation component.

Cash Flow Quality and Sustainability

Operating profits and other things on a company's financials can be gamed with clever accounting statements. What can’t be gamed are the cash flows. If the cash flows are not reflecting what the company is saying, then there’s a problem.

Strategy's cash flow profile underscores the low quality of reported earnings. The $10 billion net income generated virtually no cash when you strip off the $14 billion unrealised gain. The company's cash balance rose by just $12.0 million in two quarters of 2025 despite reporting $5.75 billion GAAP net income.

Operating Cash Flow: The software business likely produced modest positive operating cash flow, just enough to cover basic expenses. True cash earnings from operations were close to breakeven after accounting for non-cash items like depreciation and stock compensation.

Investing Cash Flow: Dominated by ~$6.8 billion in Q2 Bitcoin purchases, funded entirely by financing activities rather than operations.

Financing Cash Flow: $6.8 billion net provided through equity and preferred issuance, immediately deployed to Bitcoin with minimal cash retention.

This pattern of negative investing, positive financing, minimal operating cash flows clearly show Strategy as an asset accumulation vehicle rather than a cash-generating business.

The company incurs rising fixed costs from debt interest (~$68 million annualised) and preferred dividends (~$200 million annualised). If Bitcoin stagnates or declines while capital markets tighten, Strategy might face liquidity pressure requiring Bitcoin sales or equity issuance that will dilute ownership even further.

Market Reaction and Valuation

Despite record earnings, Strategy's stock declined following the Q2 announcement as markets had already factored in the Bitcoin-driven windfall. The $4.2-billion STRC at-the-market share sale news that followed pushed the share price further down. The reaction also reflects investors’ understanding that these weren't operating earnings but mark-to-market adjustments that could reverse.

However, the share price has been closely moving with BTC’s price movement.

Strategy currently trades at roughly a 60% premium to Bitcoin Net Asset Value, which means that MSTR investors are paying $1.6 for every $1 of Bitcoin value on Strategy’s balance sheet

Why pay the premium when you can buy the same Bitcoin directly? The premium is for:

Exposure to upside in Bitcoin Per Share metric through corporate structure

Michael Saylor's strategic execution and market timing

Scarcity value as a liquid Bitcoin proxy in equity markets

Option value on future accretive capital raising

This premium enables the self-reinforcing strategy: issuing shares above NAV to buy more Bitcoin, potentially increasing Bitcoin-per-share for existing holders. If Strategy's stock trades at $370 while its Bitcoin NAV is $250 per share, the company can sell new shares at $370 and use that cash to buy Bitcoin worth $370. Existing shareholders now own more Bitcoin per share than before the dilution. Strategy's "Bitcoin Per Share" metric increased 25% year-to-date despite massive dilution, validating the approach during Bitcoin bull markets.

Strategy’s BTC bet demands investors to evaluate it using an unconventional approach since traditional valuation metrics are meaningless. Why?

Strategy’s Q2 revenue ($114 million) shows an annualised revenue run-rate of $450 million against its current enterprise value of $120.35 billion. This shows that Strategy’s stock is trading at over 250× revenue, which is astronomical earnings multiple in traditional sense. But the catch is that when investors buy a Strategy stock, they aren’t betting on its software analytics. The market is pricing Bitcoin appreciation potential amplified by corporate leverage and continuous accumulation.

Investment Perspective

The quarterly results reflect Strategy’s complete transformation from a software company to a leveraged Bitcoin investment vehicle. The $10 billion quarterly profit, while massive, represents unrealised appreciation rather than operational success. For equity investors, Strategy offers high-octane Bitcoin exposure with significant leverage and active accumulation, but at the cost of extreme volatility and dilution risks.

The strategy works well during Bitcoin bull markets as it is a conducive time for accretive capital that funds additional purchases while reported earnings soar from mark-to-market gains. However, the model's sustainability depends on continuous market access and Bitcoin appreciation. Any significant crypto downturn would quickly reverse the Q2 results while fixed obligations by way of debt interest and preferred dividend payments continue.

Yet, among all the Bitcoin treasuries, Strategy is the best-placed to absorb such unexpected shocks. It started stacking Bitcoin more than five years ago and has systematically been accumulating at a much lower cost than others.

Today, Strategy holds 3% of the total Bitcoin to ever exist in circulation.

Strategy's premium valuation reflects belief in Michael Saylor's Bitcoin vision and execution capability. Investors are betting on both Bitcoin's long-term trajectory and management's ability to leverage corporate structures for maximum accumulation.

With Bitcoin holdings now representing over 99% of economic value, traditional software metrics have become less-relevant footnotes to the cryptocurrency story that defines Strategy's future.

That’s all for Strategy’s Q2 earnings’ coverage. We will be back with another one soon.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

The real bet Saylor is making has two parts, and most folks only notice one - namely, the Bitcoin long. The Stable of preferreds, the converts, and the common ATM all allow the BTC/share to grow and for Saylor to accumulate BTC at a discount. But the genius of the preferreds is Saylor gets the bitcoin today in exchange for tomorrow's devalued dollars. In effect, he is creating a (non-callable) short position on the US dollar with every preferred. If you are a believer in BTC, then Saylor's system will leverage the Bitcoin returns. All these folk claiming the Mnav should be 1x, fail to account for the inevitable profit his two-pronged strategy of a bitcoin long combined with a dollar short will produce.