Sup Binance? 🤔💭

Binance US is playing musical chairs. Gensler's SEC talk, two words: "Fraud's fraud. The "Bitcoin killer" that only killed dreams. Vitalik's Twitter (X) went rogue - SIM Swap.

Hello, y'all. Dig out your Wednesday song 👉 ImFeeling

A platform that understands your emotions and crafts the perfect soundtrack for them. Let music be your companion 🙌

This is The Token Dispatch, you can hit us on telegram 🤟

What's up in Binance US? CEO shuffle, Job-o-calypse. And?

Brian Shroder, CEO of Binance.US, has resigned from his position. In the interim, Chief Legal Officer Norman Reed is set to take the reins of the company.

And with the heightened scrutiny from the SEC, Binance.US is reportedly cutting around 100 jobs - one-third of the company's entire workforce.

Speculation Rises

Shroder's departure and workforce reduction have caused ripples of speculation within the crypto community. Some insiders believe these events might foreshadow a potential scaling down or even a complete shutdown of Binance.US operations.

BNB Takes a Hit

Binance's native crypto, BNB, hasn't been spared from the recent tumult. It has registered a decline of roughly 8.7% over the last month, with its current price hovering around $212 (at the time of writing).

The SEC Lawsuit

Binance is playing court tag with regulators globally. From tussles with the CFTC over trading rule violations to a face-off with the SEC, CZ has had a busy year.

Accusations include operating an illicit exchange, peddling unregistered securities, breaking commodities rules, and not playing nice with customer funds. As a result, Binance.US hit the pause button on dollar deposits, only to return as a crypto-only exchange temporarily.

The USD channels resurfaced thanks to a timely alliance with MoonPay.

BUSD Drama: Due to the SEC's stern gaze, Binance is bidding farewell to the BUSD stablecoin.

NFT Shake-up: By month's end, Binance's NFT platform will only dance with NFTs based on Ethereum, BNB Chain, and Bitcoin. Polygon's unique tokens? They've been shown the exit door.

The company said in a statement.

"The actions we are taking today provide Binance.US with more than seven years of financial runway and enable us to continue to serve our customers while we operate as a crypto-only exchange. The SEC's aggressive attempts to cripple our industry and the resulting impacts on our business have real world consequences for American jobs and innovation, and this is an unfortunate example of that."

The New Filing

Binance.US has responded to the SEC's motion to compel, calling most of the requests "unreasonable" and "unduly burdensome." The cryptocurrency exchange's attorneys argue that the SEC's demands for additional details and depositions are overly broad and beyond the scope of the consent order. They claim that the SEC has no evidence to support its allegations of asset diversion and that the requested discovery is disproportionate to the needs of the case. Binance.US has offered alternative witnesses who can provide more insights into its operations.

The Relief Fund

Crypto exchange Binance has pledged $3 million in BNB tokens to aid relief for victims of the recent earthquake in Morocco. The earthquake, which caused thousands of fatalities, particularly in Marrakech, prompted Binance to offer support to those affected.

Binance plans to airdrop $100 worth of BNB directly to users in the most affected region, while users outside of that area will receive $10 in BNB.

The exchange also created a public wallet address to accept additional contributions in various crypto. This is not the first time Binance has provided aid through crypto, as it previously helped victims of earthquakes in the Turkey-Syria border region.

Polygon Delisting

Binance also announced the delisting of Polygon Network from its NFT Marketplace. Users will not be able to stake LAND NFTs on the Polygon Network to earn SAND rewards on Binance NFT Marketplace after September 26, 2023. All currently staked LAND NFTs will be automatically unstaked and returned to users' Binance accounts.

The last SAND rewards will be distributed to users' Spot wallets. Users should withdraw their NFTs via the Polygon Network from Binance NFT Marketplace by December 31, 2023. After September 26, users may not be able to buy, deposit, offer, or list NFTs from the Polygon Network on Binance NFT Marketplace.

TTD Blockquote🎙️

Gary Gensler, The SEC Chair

"Fraud is fraud."

Gensler's Senate Banking Committee testimony is out!

Gensler found himself in the hot seat during Tuesday's Senate Banking Committee hearing, answering questions about the SEC's intensified regulatory focus on crypto and his stance on AI and ETF.

So, he labelled AI-driven deepfakes a "real risk" to market stability.

"I think we have good laws, but these new technologies will challenge these laws. If you're using AI and you're doing deepfakes in the market, that's a real risk to the markets."

Highlighting the emerging concern, Gensler even mentioned a personal experience: someone used deepfake technology in the summer to create a convincing counterfeit of him, attempting to sway stock or crypto prices.

About ETFs? Pressed by Senator Bill Hagerty (R-TN) about the criteria for ETF approval, Gensler kept his cards close to his chest. He highlighted the myriad of applications under review and voiced his anticipation for the SEC staff's recommendations.

"Still reviewing that decision. We have multiple filings around Bitcoin exchange-traded products, so it's not just that one you mentioned, but it's multiple others who we're reviewing. I'm looking forward to the staff's recommendations."

A Point of Contention

Sen. Steve Daines (R-Mont.) criticised Gensler's actions, stating that he is not an elected representative accountable to the people but rather an "unelected bureaucrat" making sweeping decisions about the American financial landscape. Gensler countered by referencing the authority vested in the SEC by Congress.

Call for Increased Funding

Both Gensler and Commodity Futures Trading Commission's Rostin Behnam highlighted the need for more funding and manpower to efficiently oversee securities markets and safeguard investors. Behnam had previously mentioned to the House that without appropriate funding, proper implementation of legislation would be challenging.

Businesses Beware

A new report by KPMG highlights the threat of AI-generated deepfake content to businesses. Deepfakes, which are manipulated images, videos, and audio, can be used for fraud, extortion, and reputational attacks. Scammers can create fake content using generative AI tools, making it easier to deceive people. Deepfakes can be used in social engineering attacks and cyberattacks against companies, impacting their reputations and potentially leading to financial losses.

Where’s ETF?🚨

Asset manager Franklin Templeton has filed an application with the U.S. SEC for a Bitcoin ETF. The proposed ETF, "The Franklin Bitcoin ETF," would be part of the Franklin Templeton Digital Holdings Trust and listed and traded on the Cboe BZX Exchange.👇🏻

TTD Fraud 🦹🏻

Karl Greenwood, the UK and Sweden citizen, was handed down a 20-year sentence by the US District Court for the Southern District of New York on Sept. 20. On top of his prison sentence, Greenwood is required to pay back the whopping $300 million he accumulated from the pyramid scheme.

The Scam Explained 💸

US Attorney Damian Williams described OneCoin as an unprecedented fraud, conning over 3.5 million individuals and amassing an unbelievable $4 billion.

Founded in 2014, OneCoin was the brainchild of Greenwood and the elusive "Crypto Queen" Ruja Ignatova. Marketed as a "Bitcoin killer" and a pivotal step in a "financial revolution," OneCoin was, in fact, worthless. US Attorney Damian Williams stressed this point, highlighting how investors were lured in by deceitful promises.

OneCoin painted itself as a legitimate crypto contender to Bitcoin. However, it lacked the essential elements of a genuine cryptocurrency, such as a verifiable public blockchain, any form of mining operations, and an accurate number of coins compared to what was sold.

Behind the Bars 🔒

Arrested and extradited from Thailand in 2018, Greenwood had been in custody for a while before his guilty plea to the fraud and money laundering charges last December. Although he faced the possibility of a 60-year sentence, his fate was sealed with two decades of imprisonment.

Whereabouts of Other Culprits: The other mastermind behind OneCoin, Ruja Ignatova, vanished in October 2017 and has since been one of the FBI's Ten Most Wanted individuals. The law is also catching up with other OneCoin executives. Irina Dilkinska, once heading legal and compliance for OneCoin, is now facing charges in the US. Meanwhile, associate Christopher Hamilton was reportedly in line for extradition to the US last year on similar charges.

TTD Vitalik 👦🏻

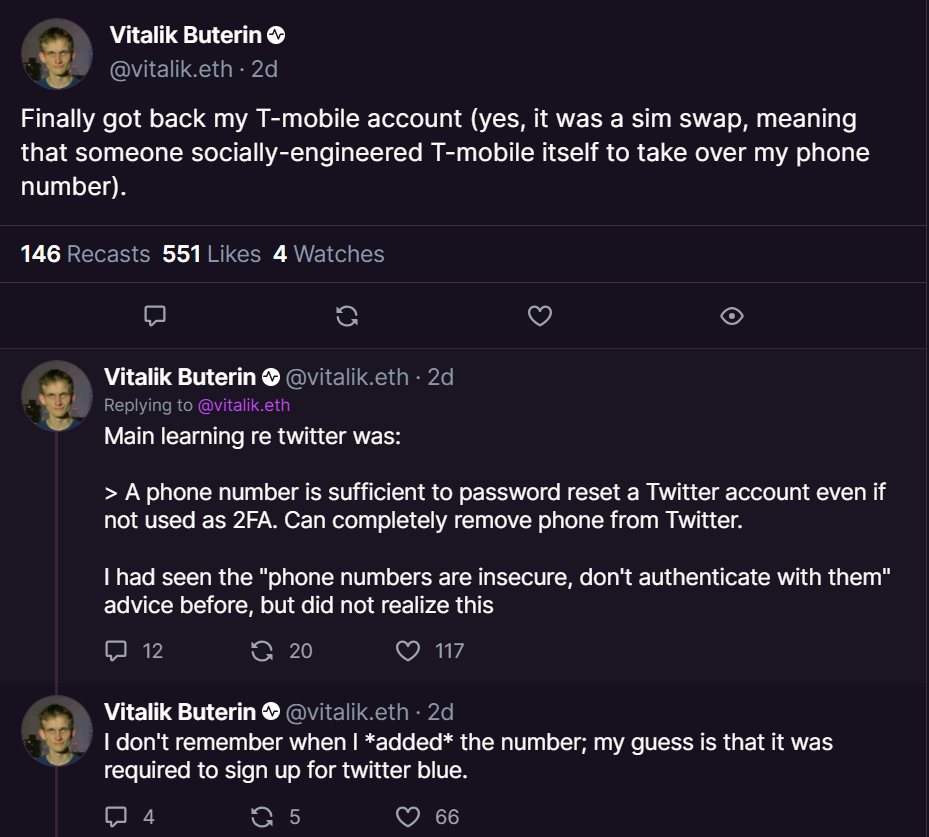

Vitalik Buterin, co-founder of Ethereum, had his X account hacked, resulting in a loss of $691,000 from his followers.

How did that happened? A classic SIM swap strategy.

In an update on decentralised platform Farcaster, Buterin explained that hackers managed to breach his Twitter account by successfully executing a SIM swap. This entailed tricking T-Mobile into transferring Buterin’s phone number to a different SIM card, granting the hackers access.

Buterin pinpointed that despite the recent changes in X, the platform still allows account recovery using just a phone number. This renders accounts vulnerable even if they don’t use phone numbers for 2FA.

A Compulsory Phone Number? Buterin revealed he doesn't recall voluntarily adding his phone number to Twitter (X). It might have been a mandatory requirement when enrolling in Twitter Blue verification, further highlighting the potential privacy issues with compulsory data collection.

The Fake NFT Scam: After breaching Buterin’s account on September 9, the hackers posted a faux NFT giveaway. Users who clicked the malicious link suffered collective losses surpassing $691,000. The first public indication of the hack reportedly came from Buterin's father, Dmitriy "Dima" Buterin.

TTD Asia 🌏

Crypto & LMI Countries

India, Nigeria, and Thailand have claimed the top three spots in the "2023 Global Crypto Adoption Index" by Chainalysis, with LMI (lower-middle-income) countries showing notable crypto enthusiasm.

Regional Dominance: The wider regions of central and south Asia, together with Oceania, are the main players, with six out of the top ten crypto-adopting countries situated here.

A Dip and a Bounce: Despite a global decrease in grassroots crypto adoption following the 2022 FTX meltdown, LMI countries have made an impressive recovery. Notably, they are the only country category to have their grassroots crypto adoption levels surpass the figures from Q3 2020, right before the latest crypto bull run.

India's Crypto Journey: India doesn't just top the regional list; it's also become the world's second-largest crypto market by raw transaction volume. An interesting approach in India is the unique 1% tax on every cryptocurrency transaction, deducted straight from the user's balance during the trade.

Sony Ventures into Blockchain

Sony Network Communications, a branch of the tech behemoth Sony, has unveiled plans to co-develop a blockchain platform with Startale Labs. This collaboration will operate under the banner of Sony Network Communications Labs Pte. Ltd., based in Singapore.

Merging Sony's expertise in IoT, AI, and solution services with Startale's proficiency in blockchain. The joint venture aims to establish a solid foundation for the forthcoming Web3 era, propelling advancements in current industries.

Financial Aspects: The venture is kickstarting with a capital of 1 million SGD (~$733,000). Sony is a dominant stakeholder with a 90% share, whereas Startale holds the remaining 10%. Earlier in June, Sony had invested a substantial $3.5 million in Startale.

While the joint venture's website is filled with lofty aspirations, such as building a "Web3 network connecting souls across generations", the exact strategy of how Sony plans to implement blockchain remains undisclosed.

TTD Surfer 🏄

The White House has signed eight more companies, including NVIDIA, IBM, and Adobe, to its Safe AI Pledge, which focuses on safety, security, and trust in advancing AI.

SBF's Lawyers want to question potential jurors about their views on cryptocurrency, effective altruism, and attention-deficit disorder.

HSBC, one of the largest banks in the world, is reportedly working with cryptocurrency custody firm Fireblocks.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋