Tearaway Rally 🚦

Crypto market cap hits $2.5 trillion. Memecoins volume up 3000%. First gold ETF took 2 years to hit $10B, Bitcoin ETF takes 2 months. FTX offers disappointing prices for crypto assets.

Hello, y'all. If you think you know your music, then this is for you frens. A complete go. Check out 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Total global cryptocurrency market cap surpasses $2.5 trillion.

Bitcoin is on a tear, nearing an all-time high.

Bitcoin is trading above $65K.

Rose around 6% in the past 24H.

Inching closer to its Everest Peak of $69,000 USD set in November 2021.

Read: Bitcoin ATH around the world⚡

It printed a $20K monthly candle for the month of February, 2024.

It's biggest ever in USD.

Why?

The anticipated halving event.

Investors are pouring money into Bitcoin ETFs.

The emerging Bitcoin layer-2 sector.

Positive sentiment surrounding Bitcoin.

Liquidations?

Coinglass shows that in the past 24 hours, $253.24 million has been liquidated, including $92.22 million in long order.

$180,000 on the Horizon?

A rare technical indicator just flashed a signal that could send BTC skyrocketing to $180,000 this cycle.

The Williams%R Oscillator, a powerful tool for gauging price trends, just entered "overbought" territory on a 3-year timeframe - only the 4th time ever.

This signal has historically preceded massive bull runs, with returns reaching 1,900% in 2013 and 260% in 2020.

Bitcoin on the Move

BTC leaving exchanges at a record pace, with $2 billion exiting in a single day on March 1st.

The fastest withdrawal rate in years, rivalling the peak seen in mid-2021.

Where's it all going? Experts speculate that investors might be shifting their Bitcoin to cold storage for safekeeping, potentially fuelled by the recent price surge towards all-time highs.

Crypto Derivatives?

On March 1, Crypto derivatives' daily trading volumes have reached record highs.

Deribit and Coinbase Institutional reported record highs in trading volumes for crypto derivatives.

Bitcoin L2: The unsung heroes

Bitcoin OG Dan Held predicts layer-2 technology could be the rocket fuel for an unprecedented bull run, sending BTC prices skyrocketing.

Also, Bitcoin NFTs are back. Sales surged 80% last week, even surpassing Ethereum in total volume for the first time ever.

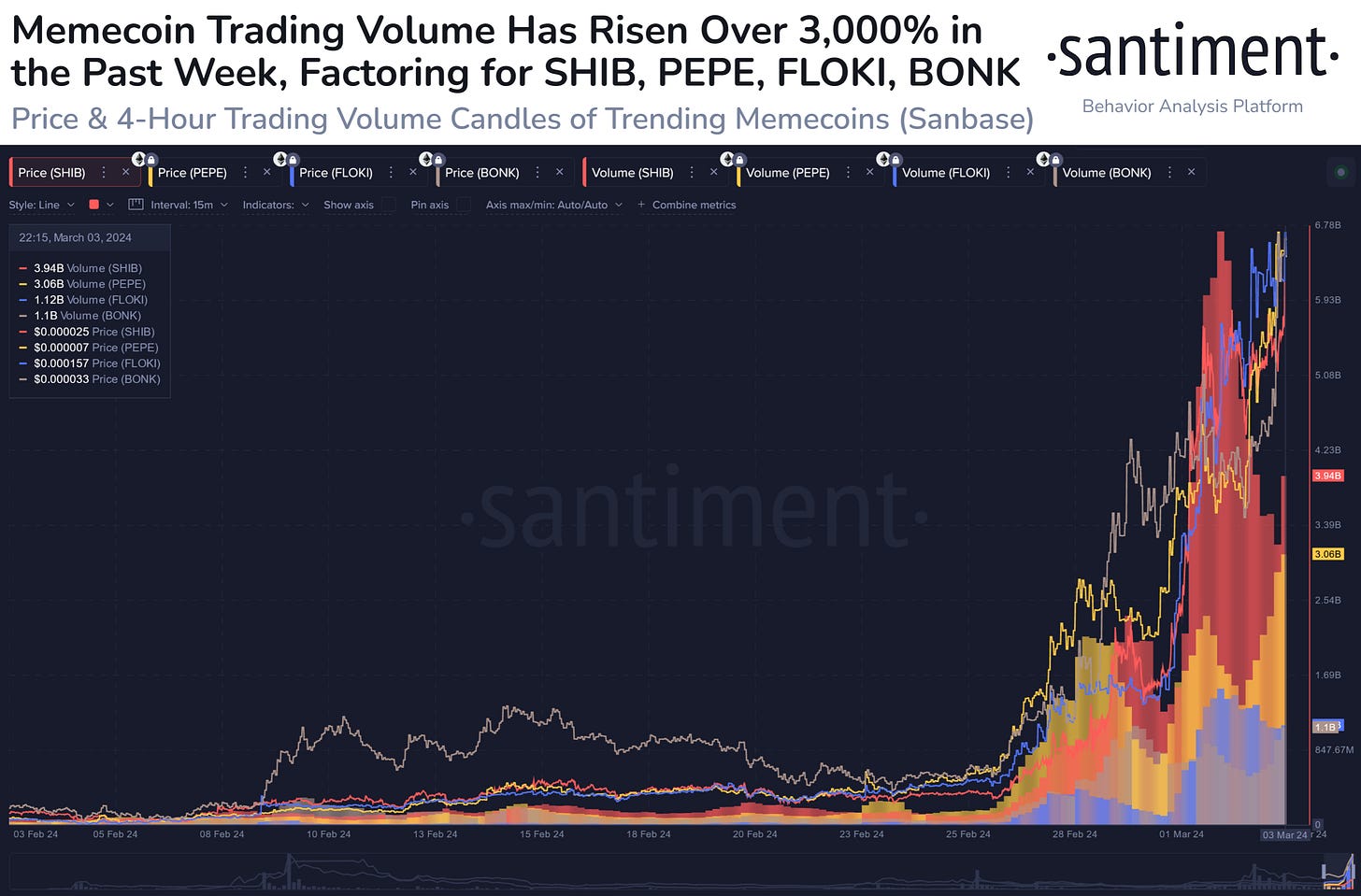

Pepes, Flokis, and Bonks Go Bananas

Weekly trading volume skyrocketed a mind-blowing 3,000%.

Pepe is leading the charge, with its price soaring over 400% in just a week and its market cap doubling in two days.

Floki (up 313%) and Bonk (up 173.7%) are just a little behind, with triple-digit price surges and massive social media buzz.

Even established meme OG's like Dogecoin and Shiba Inu are joining the party, with weekly gains of 90% and 175% respectively.

Read: Memecoin Mania 💫

Block that Quote

MicroStrategy chairman, Michael Saylor.

“I think that we’re in the Bitcoin gold rush era. It started in January of 2024 and will run until about November of 2034.”

During a panel discussion at the Bitcoin Atlantis conference on March 1, Saylor said Bitcoin entered the period of “high growth institutional adoption."

Fuelled by two major forces.

Institutional investors and Artificial Intelligence (AI).

What else he said?

“There will be a day where Bitcoin blasts past gold [and] trade more than the S&P index ETFs.”

“When they can buy via their bank, their institutional wirehouse, their prime broker, they will make a $50 million decision in one hour.”

“If you want to actually watermark, timestamp, cryptographically sign messages and documents and content, you’re going to need Bitcoin to do that as a system of truth.”

“So I think AI will drive demand for Bitcoin in that way.”

“If you want to create an AI version of yourself and have it live on the internet forever, you better give it some Bitcoin. So I think there's going to be an interesting demand function there.”

Saylor's Stash?

Saylor's 2020 Bitcoin bet is now worth over $1 billion.

He might have bought more, solidifying his "whale" status.

MicroStrategy, led by Saylor, owns over $12 billion in Bitcoin.

Where’s ETF?🚨

BlackRock's iShares Bitcoin Trust (IBIT) reached $10 billion in assets under management (AUM) in just over 7 weeks👇

Global financial system is the ‘net new buyers’

Chainlink founder, Sergey Nazarov, claims the global financial system is the biggest net buyer in this crypto cycle, marking a massive shift in market dynamics.

“The question to ask is who are the net new buyers in this cycle, and the net new buyers is the global financial system, which is a very, very big group of net new buyers.”

Here's the breakdown:

New wave of investors: Big banks and institutions are the driving force behind the surge, not just retail FOMO.

Bitcoin ETFs: Just the beginning: These products are the gateway for traditional finance to enter the crypto space comfortably.

Next stop: Tokenisation boom: Nazarov predicts traditional assets like stocks and bonds will be transformed into digital tokens, attracting even more capital.

FTX Offers Disappointing Prices

FTX customers are in for a shock as the platform unveils claim window prices significantly lower than current market value.

Here's the breakdown

Bitcoin: $16,871 vs. $65,031 market price.

Ethereum: $1,258 vs. $3,496 market price.

Solana: $16.24 vs. $131 market price.

BNB: $286 vs. $420 market price.

PwC Steps In: PricewaterhouseCoopers (PwC), handling the FTX bankruptcy, released a statement clarifying the situation. They aim to combine assets from both FTX entities to maximize returns for creditors.

Claim Process

Creditors can submit electronic claims by May 15, 2024.

First distribution expected in late 2024 or early 2025.

All claims will be paid in USD.

The Surfer 🏄

EigenLayer's total value locked (TVL) has surpassed $10 billion.

Tether USD stablecoin's circulating supply is approaching the 100 billion mark.

US judge enters default ruling against ex-Coinbase insider in an insider trading case.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋