I’ve always had a soft spot for Tether.

Not because I think it’s particularly trustworthy, or because I believe the attestations, or because I’m convinced the reserves are bulletproof. I like Tether because it’s the most honest reflection of what crypto actually is: a parallel financial system that doesn’t care about your rules, operates in jurisdictions you can’t touch, and makes so much money doing things that would get a bank shut down that it can afford to just ignore the criticism.

Tether is crypto’s id. It’s what happens when you replace ideological purity with pragmatism. And Tether keeps evolving in ways that reveal where the entire industry is actually headed, not where people say it’s headed.

Which brings me to the gold.

Over the past year, Tether has quietly become one of the largest private holders of physical gold on the planet. It now holds around 140 tons of bullion, worth roughly $24 billion, stored in what CEO Paolo Ardoino describes as “a James Bond kind of place” in Switzerland (a former nuclear bunker, because of course it is). That’s more gold than Australia’s central bank holds. More than Greece. More than Qatar.

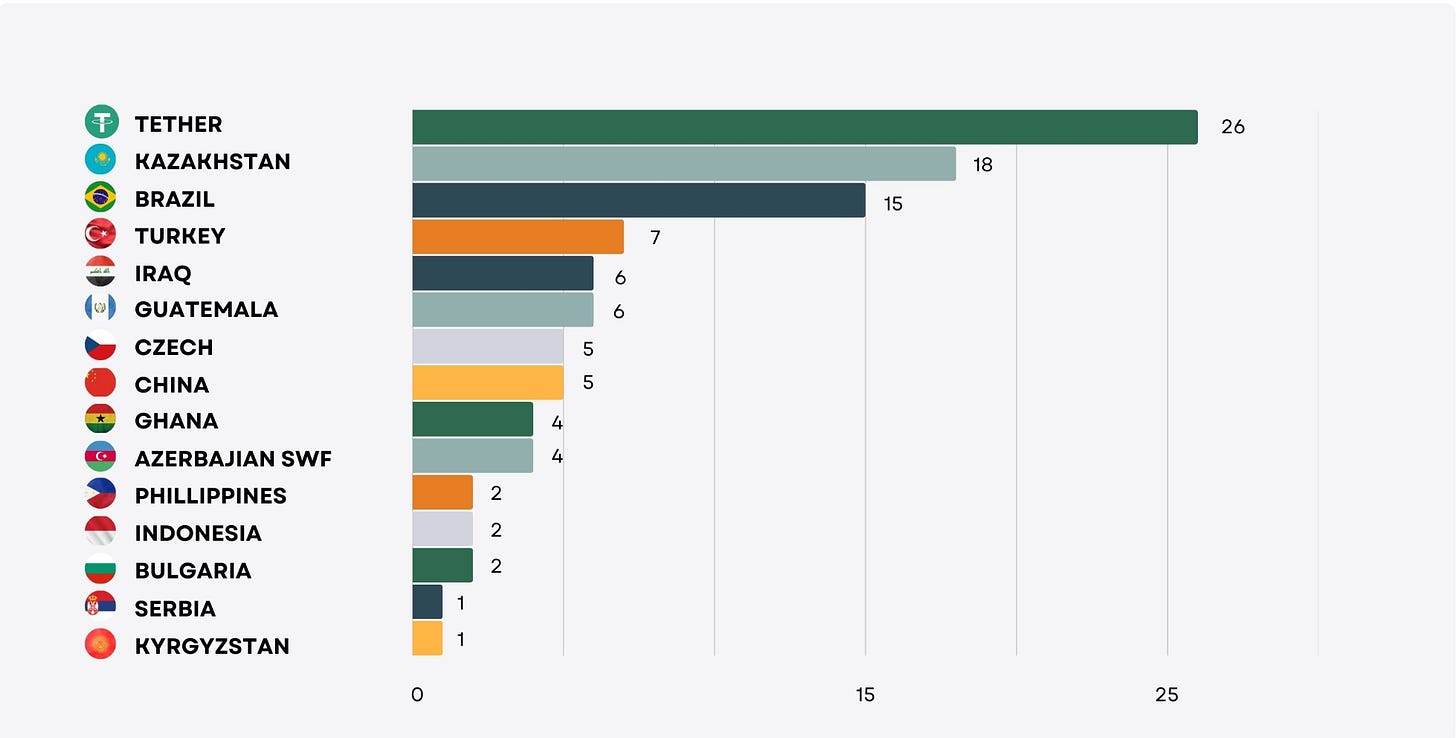

In 2025 alone, Tether bought 26 tons of gold, more than any single central bank except Poland. When a private crypto company is outbuying entire sovereign states, we have to talk about it. And it’s not slowing down. Ardoino told Bloomberg that Tether is buying one to two tons per week and plans to continue “definitely for the next few months.” At current prices, that’s over $1 billion in gold purchases every month.

This is not normal behaviour for a stablecoin issuer. So let me walk you through what’s actually happening here, why it matters, and what it tells us about where Tether thinks the world is going.

The basic Tether model is dead simple. You give Tether a dollar. Tether gives you a USDT token. Tether takes your dollar and invests it in safe, liquid assets like U.S. Treasury bills. When you want your dollar back, Tether redeems the token and returns your money.

For most of Tether’s history, the reserve mix was boring. Treasury bills, cash equivalents, overnight repos. But if you look at Tether’s most recent reserve report, the mix has shifted:

Cash and cash equivalents: 77.23%

Precious metals (gold): 7.13%

Bitcoin: 5.44%

Corporate bonds, secured loans, other: ~10%

Total assets: $181.2 billion

Total liabilities: $174.4 billion

Net equity: $6.8 billion

That 7.13% in gold is roughly $12.9 billion, up from almost nothing a couple of years ago. And it’s growing fast.

This is why S&P Global downgraded USDT’s stability rating to “weak” in November 2025, citing “the rise in exposure to high-risk assets in USDT’s reserves over the past year, including Bitcoin, gold, secured loans, and corporate bonds, as well as limited disclosure.”

Ardoino dismissed the downgrade publicly, saying the company wears S&P’s criticism “with pride.” His argument is that mixing Treasuries with Bitcoin and gold actually reduces long-term risk by diversifying away from dependence on the U.S. dollar system.

Which brings us to the real story: Tether is buying gold like it expects the dollar system to fracture.

Tether’s gold strategy has three distinct layers, and they’re all pointing in the same direction.

Layer one: the physical hoard.

140 tons of bullion, most of which sits in Tether’s own reserves as backing for USDT. This is nation-state scale. Tether is now one of the largest private holders of gold outside of central banks, ETFs, and the commercial banks whose vaults underpin the global bullion market.

And Tether isn’t just passively holding this metal. The company hired two senior gold traders from HSBC to run an in-house metals desk. Ardoino told Bloomberg that Tether wants “the best trading floor for gold in the world” and is exploring arbitrage strategies between futures and physical markets. This is Tether trying to compete with JPMorgan and HSBC in the global bullion market.

Layer two: XAUT, the gold-backed token.

Each XAUT token represents one troy ounce of physical gold stored in Swiss vaults. As of the latest data, there are roughly 520,089 XAUT tokens in circulation, backed by about 16.2 tons of gold. At current prices (around $5,587 per ounce), that’s a market cap of about $2.9 billion.

XAUT is a working proof of concept for tokenized real-world assets at scale. It settles 24/7 on Ethereum, trades on major exchanges, and can be used as collateral in DeFi protocols. And it generates fees. Tether charges 0.25% on both purchases and redemptions of XAUT, plus applicable brokerage or delivery fees if you want physical delivery. As XAUT grows, these become a recurring revenue stream separate from Treasury interest.

Ardoino thinks there’s a “good chance” XAUT will hit $5 to $10 billion in circulation by the end of 2026. If that happens, Tether will need to buy more than one ton of gold per week just for the token, not counting what it’s buying for reserves.

Layer three: gold royalty investments.

Tether has quietly taken stakes in nearly every mid-sized Canadian gold royalty company: Elemental Royalty Corp, Metalla Royalty & Streaming, Versamet Royalties, Gold Royalty Corp. These companies don’t mine gold themselves. Instead, they finance miners in exchange for a percentage of future revenue or the right to buy metal at a discount.

Tether has committed roughly $200 million to Elemental Altus alone, building a 37% stake and securing board representation. This locks in future supply. If XAUT continues to grow and Tether needs a steady stream of physical gold, owning stakes in royalty companies gives it access to production before it hits the open market.

Put all three layers together, and you get a company hedging two very different futures at the same time.

To see what those futures look like, you have to stop thinking about Tether as a crypto firm and start thinking about where its money is being positioned.

Future one: stablecoins become mainstream, regulated financial infrastructure, and Tether wants to be the winner inside the United States.

In January 2026, Tether launched USAT, a U.S. focused stablecoin issued by Anchorage Digital Bank under the GENIUS Act framework. USAT can only be backed by cash, bank deposits, Treasuries, repos, and money market funds. No Bitcoin. No gold. No corporate bonds.

This is Tether’s “made-in-America wrapper.” It’s backed by Cantor Fitzgerald, the financial giant led (until recently) by Howard Lutnick, the US Commerce Secretary. Cantor manages the reserves for both USDT and USAT, holds a 5% stake in Tether, and is one of 24 primary dealers authorised to trade government bonds directly with the Federal Reserve.

Tether hired Bo Hines, a 29-year-old former White House crypto official who ran the administration’s crypto council, to lead the USAT effort. Hines was instrumental in advancing the GENIUS Act. He left the White House and joined Tether within 10 days.

If stablecoins grow into the dominant form of digital money and the U.S. establishes itself as the centre of that market, Tether wants to be the compliant, well-connected issuer with the deepest reserves.

Future two: geopolitics fractures the dollar system, and Tether wants to be the gold-backed liquidity provider for that world.

Ardoino has been explicit about this. “The way I see it, is that there are foreign countries that are buying a lot of gold, and we believe that these countries will soon launch tokenized versions of gold as a competitive currency to the US dollar.”

BRICS countries have been among the most aggressive central bank gold buyers. China officially reported only 27 tons of purchases in 2025, but many traders believe the real number is much higher. Countries that distrust the dollar system are accumulating gold.

If those countries launch gold-backed digital currencies, Tether is positioning itself to be ready. It’s holding the metal, building the infrastructure to trade it, buying stakes in companies that control future production, and issuing a tokenised version that can move instantly across borders.

Read: Gold, Bills, Thrills 🏅 - by Prathik Desai - Token Dispatch

Tether is simultaneously preparing to be the most compliant, federally regulated stablecoin issuer in the U.S. (via USAT) and the most gold-heavy, geopolitically hedged shadow central bank outside the U.S. (via USDT and XAUT).

One overlooked reason Tether can play such a long game is how stablecoin money actually works.

In DeFi, there is one category of fees that does not depend on market pumping: stablecoin fees. On-chain dollars are the settlement layer for everything else, from trading and lending to treasuries and payroll. Tokens move in cycles. Dollars stay parked.

That shows up clearly in the data. Stablecoin issuers dominate crypto’s fee map. Tether alone generates roughly $400 million a month in fees, with Circle close behind. Even newer issuers like Sky and Ethena are climbing the rankings.

This only makes sense when you understand how absurdly profitable Tether is.

Tether made over $13 billion in profit in 2024. Through the first three quarters of 2025, it reported roughly $10 billion. That profit comes almost entirely from interest on the Treasury bills backing USDT.

Here’s how it works. You give Tether $1. Tether gives you 1 USDT. Tether takes your dollar and buys a Treasury bill yielding, say, 4.5%. You hold USDT and trade crypto. Tether collects the interest. When you redeem USDT, Tether gives you back $1 and keeps the spread.

Tether has $186.25 billion in USDT outstanding, backed by roughly $140 billion in Treasuries and cash equivalents. At current rates, that’s billions in annual interest income, and Tether doesn’t pay any of it to USDT holders.

But there’s a problem. Interest rates are falling. A 25 basis point cut reduces annual interest income by roughly $350 million on Tether’s $140 billion Treasury and cash-equivalent base. To offset that drop at current yields, Tether would need to issue around $8 billion to $9 billion in additional USDT just to keep earnings flat.

This is why Tether is diversifying into gold, Bitcoin, and royalty investments. It’s looking for yield that doesn’t depend on Treasury rates. And it’s looking for assets that might hold value if confidence in the dollar system weakens.

But most of its gold (about 124 tons) is sitting in reserves, earning nothing except potential price appreciation. If gold crashes, that $12.9 billion in precious metals could shrink significantly. Tether has a $6.8 billion equity cushion, but a 30% drop in both gold and Bitcoin could wipe out a meaningful chunk of that buffer.

This is the S&P concern: Tether is holding assets that are more volatile than the liabilities they’re supposed to back.

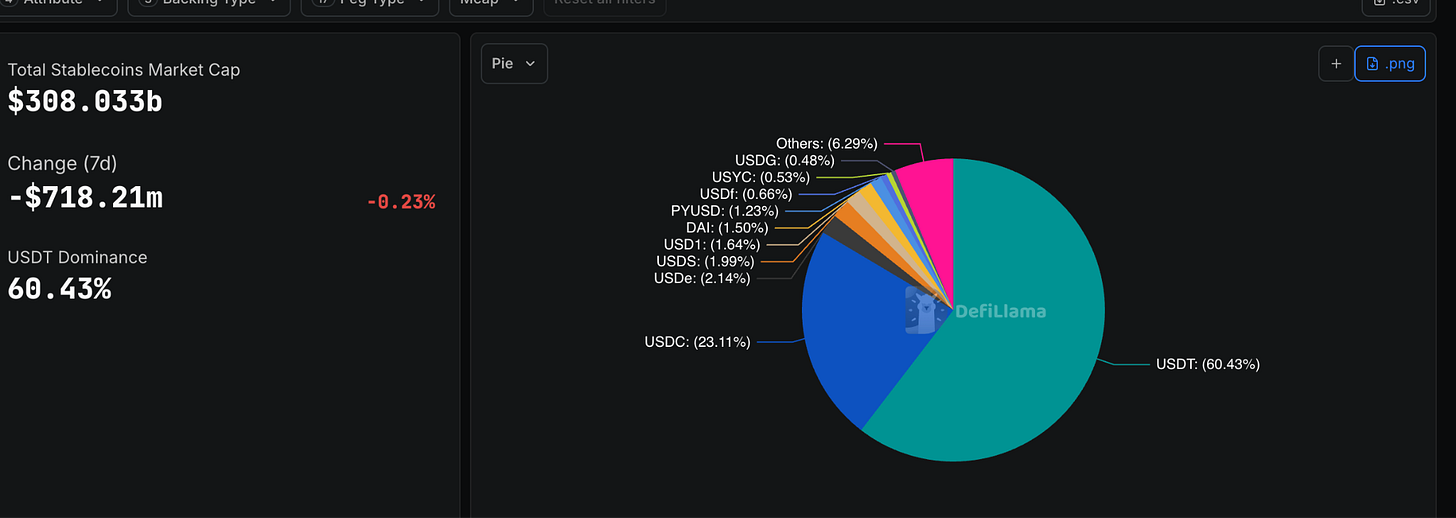

Stablecoin growth is plateauing. The total market cap of stablecoins has been hovering around $308 billion since late 2024. According to recent data, the market dropped by $718 million in the most recent week alone.

Interestingly, USDT has slightly grown during this period, reaching $186.58 billion (60.43% market dominance), while USDC sits at $77.09 billion. USDT is gaining market share even as the overall market stagnates.

This plateau is a problem for the industry’s growth narrative. Citigroup’s “bull case” was $3.7 trillion in stablecoin circulation by 2028, while Standard Chartered and Treasury Secretary Scott Bessent forecast $2 trillion. At the current growth rate, none of these targets are achievable.

Stablecoin demand is still closely tied to crypto market activity. When Bitcoin drops, people don’t mint new stablecoins. They redeem them and move back to fiat. The narrative that stablecoins have become everyday payment rails is overstated.

This plateau is also a problem for Tether’s valuation. The company was reportedly exploring a fundraising round at a $500 billion valuation. If stablecoin growth stagnates, justifying that valuation becomes much more difficult.

Which means Tether needs to create the next wave of demand. And that’s where regulation, new products like XAUT, and narratives around gold as a hedge against dollar debasement come in.

Tether’s gold accumulation is also creating real tension with traditional finance. Standard Chartered estimates that stablecoins could siphon as much as $500 billion in deposits from U.S. banks by the end of 2028, with regional banks most vulnerable.

If deposits leave banks and flow into stablecoins, banks lose their cheapest source of funding. Coinbase already offers 3.5% “rewards” on USDC balances. If stablecoin issuers can pay yield while offering 24/7 global transfers, why would anyone keep money in a checking account that offers nothing?

Critically, Tether and Circle hold almost none of their reserves as bank deposits. Tether holds just 0.02% of its reserves in bank deposits. Stablecoins are pulling money out of the banking system without putting it back.

So where does this leave us?

Tether is issuing dollars like a central bank, managing reserves like a sovereign wealth fund, hoarding gold like it expects the dollar system to fracture, hiring bullion traders to compete in global commodity markets, buying mining royalties, launching a federally regulated U.S. stablecoin, and making billions in profit without full transparency or traditional oversight.

The bull case is that Tether is building infrastructure for a world where the dollar is contested. That it’s diversifying intelligently. That it’s proven resilient through multiple crashes. The bear case is that its reserves are too volatile to back something that’s supposed to be stable, and that the lack of a full independent audit means nobody really knows if it’s as solid as claimed.

What’s clear is that Tether is choosing scale over purity. It’s betting that having both a compliant U.S. product and a gold-backed offshore alternative gives it the best chance to survive, regardless of which future emerges.

Does the market still care what Tether stands for, or whether people just care that it works?

Because if you’re using USDT to trade on Binance or settle a transaction, you’re not thinking about Swiss vaults or geopolitical hedging. You’re just using it because it’s liquid and it’s what everyone else uses.

And maybe that’s enough. Or maybe it’s not.

Either way, Tether is playing a very long game. And the gold isn’t just a signal about the future Tether thinks is coming.

That’s it for this week. See you next week with another thought.

Until then... Stay safe!

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.