Tether's $100 billion ambition 💥

Stablecoin climbs up the crypto ladder. Bitcoin-Ether correlation hits lowest level since 2021. Ethereum staking hits new high. Crypto Whale bets on Chainlink. God instructed to create INDXcoin?

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

Tether, the controversial stablecoin is on the cusp of achieving a prestigious feat – entering the exclusive club of crypto projects with a market capitalisation exceeding $100 billion.

On the Verge of 100 Billion: Becoming the first stablecoin in the club.

Elite Company: Only Bitcoin, Ether, XRP, and BNB have previously crossed the $100 billion threshold.

Stablecoin Dynamics: Unlike other cryptocurrencies, Tether's price is pegged to $1 and its market cap closely tracks circulating supply.

Demand Drives Growth: Tether mints new tokens based on market demand, particularly from traders and liquidity providers.

Dominant Player: USDT is the most traded cryptocurrency with a daily volume of around $45 billion.

Recent Expansion: Tether printed over $10 billion in the past three months, coinciding with increased market activity.

Slow Climb: Despite nearing the $100 billion mark, Tether's ascent has been the slowest among the elite club.

The Demand Shock

Tether purchased 8,888 BTC in Q4 2023, bringing its total holdings to 66,465 BTC, worth $2.8 billion.

Spot Bitcoin ETFs are also acquiring large amounts of Bitcoin, with an estimated 650,000 acquired so far.

This decrease in available Bitcoin on the open market could drive up the price as demand remains high.

Tether Under Fire as UN Report Links Stablecoin to Asian Crime

A United Nations report alleged that Tether plays a key role in criminal activities in Asia.

The report, titled "Global Study on Cryptocurrency Crime," claims that Tether (USDT) has become the "preferred choice" for money laundering in Asian crime rings, particularly those involved in "pig butchering" scams and human trafficking.

Key Points of the UN Report

USDT's Prevalence in Asian Crime: The report estimates that $32 billion in proceeds from pig butchering scams were laundered using USDT.

Tether's Cooperation with Law Enforcement: Tether claims to be cooperating with law enforcement authorities on cases involving USDT.

UN's Misunderstanding of Blockchain Technology: Tether also criticised the UN report, suggesting it misunderstands how blockchain technology works.

Previous Investigation: The report notes a November 2022 investigation by the US Department of Justice, in collaboration with cryptocurrency exchange OKX and Tether, that led to the freezing of $225 million in USDT connected to a Southeast Asia-based human trafficking and pig butchering cyber fraud ring.

Tether's Defense: Tether has denied all allegations of wrongdoing and claims that its reserves are fully backed by US dollars. The company has also said that it is committed to working with law enforcement to combat crime.

TTD Correlation ⏳

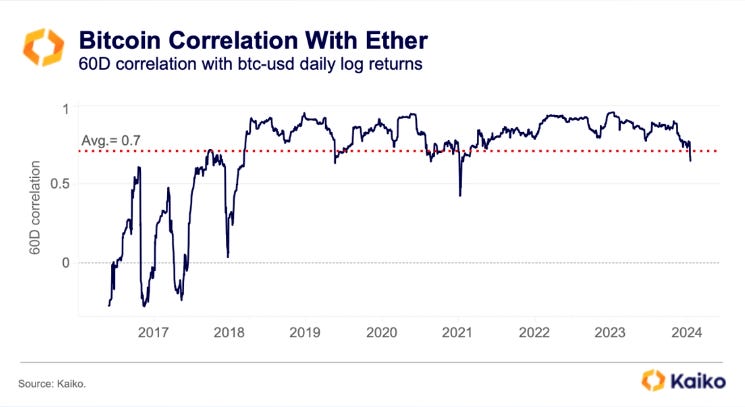

Bitcoin-Ether correlation has weakened below 70% for the first time since 2021, according to Kaiko’s data.

Decoupling of Giants: Bitcoin's rolling 60-day correlation with Ether has dropped below 70%, marking a shift in the relationship between the two cryptocurrencies. This is the first time the metric has dipped below this level since early 2021, when Bitcoin entered price discovery after breaking its all-time high.

Spot Bitcoin ETF Hype: The weakening correlation coincides with the launch of spot bitcoin ETFs in the US, raising speculation that potential spot ether ETF approvals might be next.

Kaiko Research

“It is no coincidence that this occurred on the day that the Bitcoin spot ETFs started trading. For months, the two crypto assets have been diverging in price activity as BTC benefited from ETF hype and speculation while Ether experienced a relatively sluggish rally. Since the Merge, Ethereum has had a bevy of narratives: deflation and ultrasound money, Layer 2s, liquid staking derivatives, re-staking, and now ETFs, with danksharding on the horizon. Despite all of these competing narratives, it appears that the potential approval of spot ETFs is the strongest narrative right now.”

Uncertainty Surrounds Spot Ether ETF Approvals

Analysts offer varying predictions, with Ark Invest and 21Shares' application facing a final decision deadline by May 23, potentially paving the way for May approvals.

However, JPMorgan and TD Cowen remain skeptical, highlighting SEC Chair Gensler's stance on non-Bitcoin cryptocurrencies as securities.

Gensler's predecessor and other SEC officials had previously indicated ether's decentralised nature might exempt it from being considered a security, leaving the approval path unclear.

Market Performance Amidst the Uncertainty: Ether's price has seen a moderate decline (6%) since spot bitcoin ETFs began trading, but remains up 9% year-to-date.

Bitcoin, on the other hand, has dropped 10% during the week and is down over 2% since the beginning of the year.

TTD Numbers 🔢

$28 million

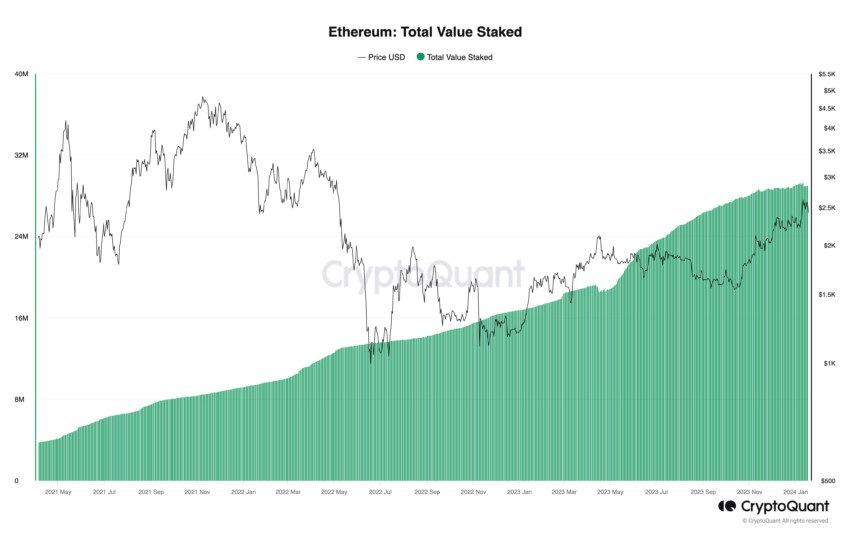

Ethereum (ETH) has achieved a significant milestone with over 28.8 million ETH staked (24% of total supply).

Strong Staking Numbers Despite Withdrawal Option: Despite the new withdrawal option, Ethereum's staking market cap has reached $72.75 billion. The network also boasts a robust 898,110 active validators, demonstrating widespread adoption and trust in the Proof-of-Stake mechanism.

This surge reflects a shift in ETH holder behaviour, prioritising passive income through staking over immediate price appreciation.

CryptoQuant CEO Ki Young Ju reckons that added liquidity and flexibility has contributed to the continued rise in staking despite withdrawal availability.

“I expected significant unstaking activities after the Shapella upgrade, but the staking rate is still increasing.”

Shapella Upgrade Adds Liquidity and Flexibility to Staking: One of Shapella's most anticipated features was the introduction of staked ETH withdrawal functionality. This allows validators and stakers to access their staked tokens and accrued rewards, a significant change from the pre-upgrade lock-in period.

Deflationary Trend and Attractive Staking Rewards Set Ethereum Apart: Ethereum maintaining a negative inflation rate of 0.03% while offering a 4.23% staking reward. This unique combination of deflation and attractive returns positions Ethereum distinctively in the cryptocurrency market.

Staking Profitability Underscores Bullish Sentiment: Preference for holding and staking over trading, indicates strong confidence in Ethereum's long-term value and a bullish sentiment among investors.

Where’s ETF?🚨

Franklin Templeton CEO Jenny Johnson sees Bitcoin as a hedge against oppressive governments and a growing demand for it.👇

TTD Whale 🐋

A crypto whale has recently purchased $8 million worth of Chainlink (LINK), a blockchain oracle network that provides real-world data to smart contracts.

Why This Matters: Chainlink's technology is essential for connecting blockchains with real-world data, which is seen as a key driver of blockchain adoption in the future.

Buying the Dip: The whale's purchase also took place at a time when Chainlink's price had dipped. This could be seen as a sign that the whale believes Chainlink is undervalued and is betting on its price to rebound.

Potential Trend Reversal: Some technical analysts believe that the whale's purchase could be the start of a new upward trend for Chainlink. They point to the fact that Chainlink's price has been forming a bullish pattern in recent weeks.

TTD WTF 😱

A religious couple in Colorado is being sued by the state securities commission for allegedly selling an illegal cryptocurrency called INDXcoin.

The INDXcoin: The couple, Isaiah and Jenessa Regalado, claimed that God instructed them to create INDXcoin. They raised millions of dollars by selling INDXcoin to investors.

The Lawsuit: The Colorado Securities Commission is suing the Regalados for fraud. They allege that the Regalados misled investors and broke securities laws.

The Regalados' Defense: The Regalados say that they spent the money on things like home renovations and vacations.

They also say that God told them to do so.

TTD Surfer 🏄

Google to invest $1 billion in UK data center despite ongoing layoffs.

The Dutch government is pledging $222 million to boost AI innovation and avoid falling behind in the AI race.

Arbitrum is an $85 million grant program to incentivise usage and development on its layer-2 blockchain.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋