Welcome to our weekly Bitcoin feature - Mempool.

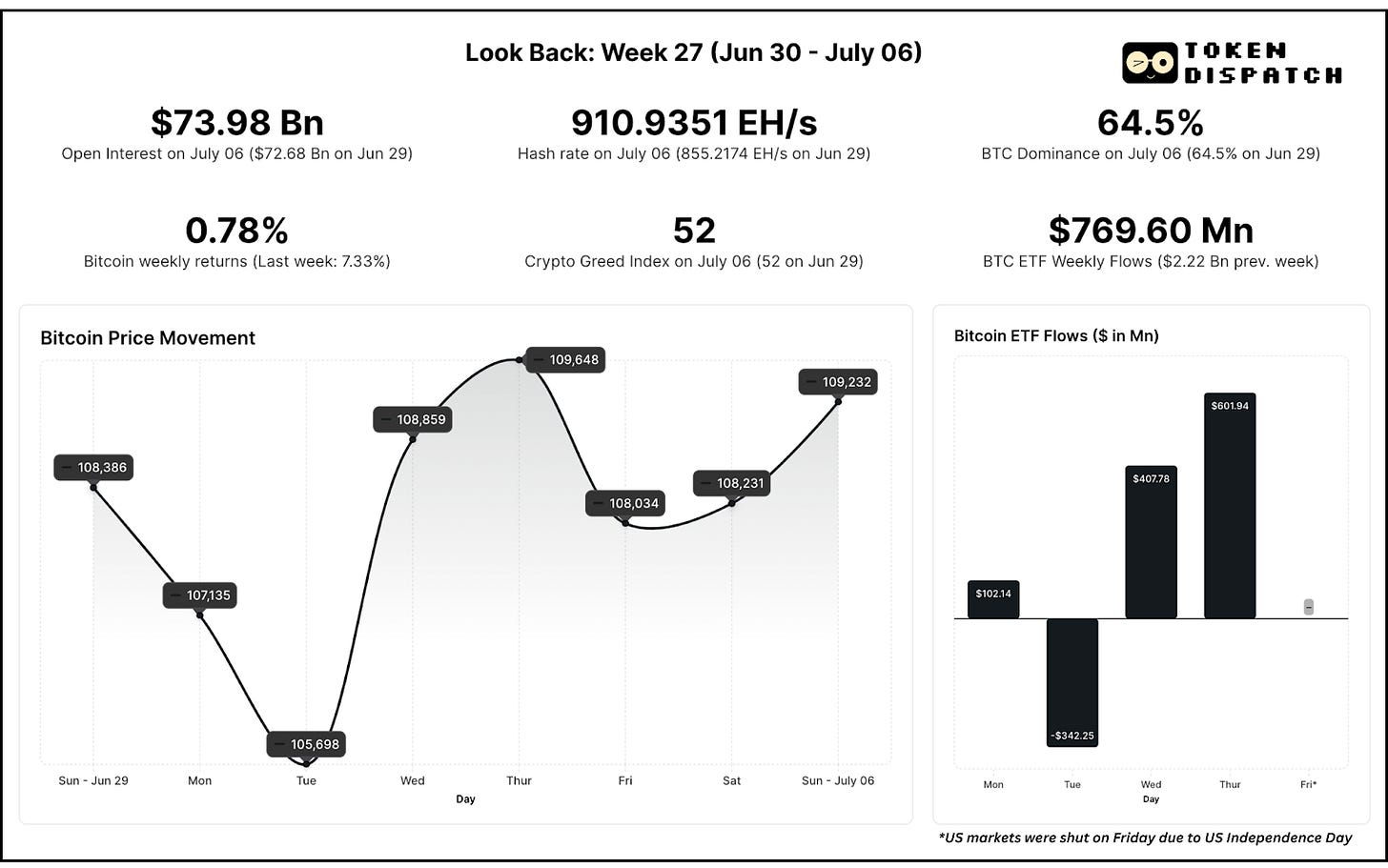

We're looking at Week 27 of 2025 (Jun 30-July 06)

Bitcoin volatility hits 20-month lows

$8.6 billion whale movement fails to break trading range

ETF flows record calmer, yet positive week

Markets turn focus on tariff deals and negotiations

Gaimin Is Redefining Decentralised Computing

AI is booming. But powering it is expensive.

Gaimin Cloud taps into unused GPU power from gamers around the world, cutting compute costs by up to 70% and decentralising access for all.

It’s like Airbnb, but for GPUs.

Decentralised compute at scale

Lower costs, higher performance

Real rewards for idle hardware

👉 See how Gaimin powers the future of AI & file sharing →

The Week That Was

Bitcoin closed with a modest quarter percentage point gain in a week that saw the price move in a much tighter range (~$105,700-$119,700).

The week began with hash rate surging to record territory — 1.0045 zettahashes per second (ZH/s), the third highest ever recorded, before stronger-than-expected jobs data (4.2% versus the expected 4.3%) on Tuesday crushed rate cut hopes and sent Bitcoin tumbling to its weekly low.

It then rallied through Thursday, aided by US President Donald Trump's posts about countries receiving letters regarding trade tariff negotiations, which provided some relief to risk assets. This coincided with Bitcoin ETFs recording their first day north of $600 million in inflows on July 3 after 28 trading sessions.

Bitcoin price dipped again on Friday when a dormant whale moved $8.6 billion worth of coins untouched since 2011, one of the largest transfers in Bitcoin history. That was temporary, though, as it recovered over the weekend to close near weekly highs.

Price Chart Analysis

Bitcoin's third rejection at $110,700 since May 23 has bulls cautious. It has now failed to touch the $111,000 mark, ever since it last set a new all-time high on May 22.

The week's action compressed into an increasingly tight range, with Bitcoin defending $105,000 support while failing to breach overhead resistance. This seven-week consolidation has pushed implied volatility to 20-month lows, levels last seen when Bitcoin traded around $30,000.

The setup resembles a coiled spring.

Multiple failed breakout attempts have created ~$150 million in short liquidations (7-day) clustered above $110,000, setting conditions for a potential squeeze if resistance finally yields. Yet the pattern mirrors previous rejections that triggered significant selloffs, keeping bears lurking around.

Key Technical Levels

Resistance: $110,000 (has $150 million in short liquidations)

Next target: $111,917 (current all-time high)

Immediate Support: $105,000 (tested multiple times in the last fortnight)

Crypto Stocks Record New Highs

All the crypto-related stocks closed the week in the green with at least three of the seven scrips we track registering double-digit gains.

Miners led the charge despite ongoing operational headwinds. Riot Platforms market cap rose by a fifth through the week to reach five-month highs, while MARA Holdings gained 17.5% despite reporting a 25% drop in June Bitcoin production due to weather-related curtailments and increased mining difficulty.

MARA's production slumped to 713 Bitcoin in June from 950 in May, attributed to storm damage at its Texas facility. Yet investors appeared focused on the company's expansion plans, which target a 40% increase in network capacity to 75 exahashes by year-end.

Core Scientific shares rose more than 8% to record a seven-month high.

Robinhood hit fresh all-time highs after it made a host of announcements in Cannes, France: unveiling tokenised US stocks to its European Union users; launch of its native Layer-2 blockchain, and expanding its crypto suite in EU and US with perpetual futures and staking.

Circle's post-IPO momentum continued with a 4.62% rise after a 25% correction in the preceding week.

Only Coinbase lagged with a modest 0.67% gain, weighed down by the Supreme Court's decision to reject its appeal against IRS data access requirements and ARK Invest's $95 million share sale.

ETF Flows Persist in Green

Bitcoin ETFs closed its fourth consecutive week in the green. It came despite Tuesday's $342.2 million exodus, which ended the 15-day positive streak worth $4.7 billion, as Powell's hawkish stance on rates spooked institutional investors.

The reversal was swift though.

Thursday delivered $601.8 million in inflows, the largest single-day total in over a month, as markets positioned for Trump's "Big Beautiful Bill" and renewed optimism around trade negotiations.

BlackRock's IBIT, typically the flow leader, registered unusual quiet periods with two consecutive days of zero activity before returning with $224.5 million on Thursday. The ETF giant's Bitcoin fund now earns more annual revenue than its $624 billion S&P 500 ETF (0.03%), thanks to higher fees (0.25%) on its $75 billion+ in assets.

Retail Ain’t Dead Yet

The "retail is dead" narrative dominating crypto discourse isn’t far from the real picture.

Although on-chain metrics show small wallet activity at multi-year lows, it might not be accurate to interpret it to be muted retail activity.

Retail investors now control close to 75% of US spot Bitcoin ETF holdings, either directly or through investment advisers and hedge funds acting on their behalf, said André Dragosch, the head of research of Bitwise.

Perhaps retail has just traded their hardware wallets for brokerage statements — the stacking hasn’t really stopped.

Surfer 🏄🏾♂️

Hamak Gold, a UK-listed gold explorer, is allocating part of its treasury to Bitcoin while continuing gold exploration. Analysts caution that such Bitcoin reserve strategies, popular among financially pressured firms, could unravel if market liquidity tightens.

Sen. Cynthia Lummis has introduced a new Senate bill proposing major crypto tax exemptions, including a $300 de minimis rule for most digital asset transactions and deferring taxes on mining and staking rewards until sold. The legislation revives tax perks left out of President Trump’s recent spending bill.

BitMEX founder Arthur Hayes warned that Bitcoin could briefly dip to $90,000 before resuming its upward move after President Trump’s “Big Beautiful Bill” was passed in the Congress. Hayes remains bullish long-term, citing potential market volatility as Treasury borrowing increases under the new fiscal policy.

Token Dispatch View 🔍

Bitcoin's third consecutive rejection at $110,000 shows that it could have become a psychological barrier that could define the next major move.

While the cryptocurrency has successfully defended $105,000 support throughout the week, the failure to hold on to the $110,000 mark after multiple attempts suggests selling pressure remains strong.

The 20-month low Implied volatility is reminiscent of the calm before significant storms in Bitcoin's history. This consolidation phase, now extending into its seventh week, has created conditions for an explosive move in either direction. The "retail is dead" misjudged narrative should provide some relief about the sentiment.

What Investors Should Watch

Macro Dependencies: Federal Reserve policy remains the primary driver of institutional flows. Any shift toward dovish rhetoric or actual rate cuts could unleash the massive liquidity currently sitting on the sidelines.

ETF Dynamics: Watch for sustained institutional commitment beyond macro noise. The ability of ETFs to maintain positive flows during adverse conditions will determine whether current price levels represent a floor or merely a waystation toward lower levels.

Tariff Deals: Trump's tariff deals and extended effective date continue providing both upside and downside volatility. The earlier deadline for tariffs to go live, July 9, which marked the end of the 90-day tariffs timeline has now been pushed to August 1. The deals struck and negotiations that couldn’t go through are likely to have an effect on Bitcoin price.

The next few weeks will likely determine whether Bitcoin's consolidation resolves to new highs or initiates the correction many bears anticipate. Either way, the move should be decisive given the compressed volatility and mounting technical pressures.

That's it for this week's Mempool edition.

See ya, next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.