The AI trading era 🤖 📈

Crypto Trading bots are the new cool kids. Trading 24/7, they never sleep, never cry, and always learn. Dive in, but choose your bot buddy wisely.

Hello, y'all. Make sure you've claimed your collectible on Asset, and don't forget to give your books a »» Muzify «« spin? 🙌

No surprise at this point. But, still👇

This is The Token Dispatch, you can hit us on telegram 🤟

Remember the good ol' days of trading when your biggest concern was whether to hodl or sell?

Well, the game is evolving, and AI trading bots might be the next big thing.

First off, what is a crypto trading bot?

A crypto trading bot is like an autopilot for cryptocurrency trades. It's a software that trades for you based on rules you set. Here's the lowdown:

Operational 24/7: It works continuously, even when you're asleep.

Rule-based: You set up strategies, and the bot follows them.

Efficient: It executes trades faster than manual trading.

Emotionless: The bot operates purely on logic, without emotional interference.

Risks: Like all trading, there's potential for loss, especially if not set up correctly.

Security: Ensure you're using a reputable bot since it requires trading permissions.

Crypto trading bots strategies

Trends following

Moving Averages: The bot buys when the short-term moving average crosses above the long-term moving average and sells when the opposite happens.

MACD (Moving Average Convergence Divergence): Buys and sells based on signals from the MACD indicator.

Momentum: Bots buy when there's a sudden spike in price or volume, banking on the momentum to carry forward.

Arbitrage

This involves buying a cryptocurrency on one exchange where the price is low and selling it on another exchange where the price is higher. Bots can do this almost instantaneously, capitalizing on slight price discrepancies across exchanges.

Market making:

Bots place multiple limit orders on both the buy and sell side to profit from the bid-ask spread.

Index Fund Rebalancing:

These bots maintain a portfolio of various cryptocurrencies, and they rebalance it regularly to match a particular index or predefined criteria.

Mean Reversion:

This strategy is based on the idea that if a price (or an indicator) moves away from its historical average, it's likely to revert back to it.

So, if Bitcoin is trading above its historical average, the bot will sell, expecting it to revert back.

Dollar-Cost averaging

Bots invest a fixed amount in a cryptocurrency at regular intervals, regardless of its price, averaging out the entry price over time.

Stop loss and take profit

These bots will sell a cryptocurrency when it hits a predetermined low (to prevent further losses) or a predetermined high (to lock in profits).

Ping Pong

Set a specific buy and sell price, and the bot will keep buying at the lower price and selling at the higher price, going back and forth (like a ping pong ball!).

News-based strategies

These bots analyse news feeds to make trades based on real-time news. For instance, if there's news about regulatory crackdowns on crypto, the bot might be programmed to sell.

Sentiment analysis

Bots analyse social media, forum discussions, or other public communications to gauge the sentiment around a particular cryptocurrency and make trades based on this sentiment.

But, seeking a smarter play?

Upgrade time.

Enter AI Crypto Trading bots.

What the heck is AI crypto trading?

Picture a world where software isn't just following a script. Instead, it's learning, AI dives into heaps of trading data, teaches itself the intricacies of the crypto world, and then makes decisions about buying or selling.

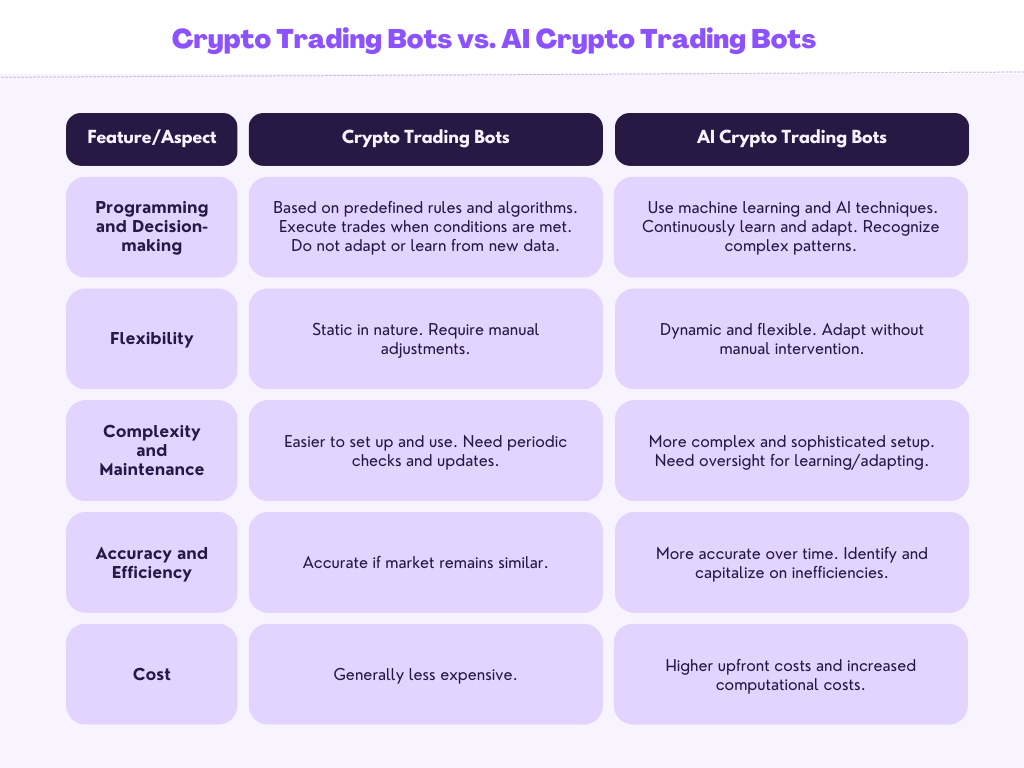

Unlike traditional trading bots that rigidly follow set parameters, AI-driven bots learn from vast amounts of data, adapting their strategies over time. By analyzing historical price patterns, market sentiment from news and social media, and myriad other factors, these bots aim to predict and capitalize on future market movements.

How do they work?

Data Analysis: At its core, AI thrives on data. It processes extensive histories of crypto prices, relevant news, and market sentiment indicators.

Continuous Adaptation: Based on the data it processes, AI refines its strategies, always aiming to enhance its performance.

Execution: Armed with this knowledge, it makes buying and selling decisions, striving to capitalize on market trends.

What are the best ones?

Platform for manual and automated trading.

Supports 16 major crypto exchanges.

Provides various trading bots like DCA, Grid, Options, and Futures.

Integrated with 17+ exchanges.

Offers bots like GRID and Signal Bot.

Advanced features streamline the trading process.

Houses multiple bot types like Grid Trading and DCA.

Provides 16 free trading bots and low trading fees.

No need for 3rd party exchange APIs.

AI-powered bot for day traders.

Features the crypto builder and a marketplace.

Offers a drag-and-drop system for bot creation.

AI-based multi-purpose platform.

Trades in top cryptocurrencies across major exchanges.

Features like backtesting and social trading.

Offers bots, algorithmic orders, and a free demo.

Centralizes all your exchanges in one interface.

Provides access to over 10,000 trading pairs.

Quick setup and 24/7 trading.

Bots use both long and short strategies.

Suitable for beginners.

Multi-platform bot powered by AI.

Offers backtesting feature for strategy validation.

Integrates with major exchanges like Binance.

Develop, backtest, and deploy trading bots.

Features preset functions for trend analysis.

Provides a visual editor for designing crypto algorithms.

Automated trading for passive income.

Supports 100+ exchanges and three OS platforms.

Includes 14 precoded trading strategies.

Provides reliable and timely trade signals

Easy-to-use interface designed for beginners.

All-in-one mobile and desktop web platform.

Supports 80+ assets including BTC

backtest various rules against historical price data

charges a flat monthly rate rather than per-trade fee

How to choose the best?

Align with your trading strategy: Your chosen AI crypto trading bot should mirror your trading strategy, be it Mean Reversion, Momentum Trading, Arbitrage, or machine-learning methods like Naïve Bayes. If you're keen on leveraging news or social sentiments, consider bots equipped with Natural Language Processing (NLP). Backtest bots using past data before entrusting them with real funds.

Assess bot capabilities: Ask yourself if the bot aligns well with your preferred trading methods. Check its compatibility with the cryptocurrency exchanges you operate on. Backtesting is a critical feature; ensuring the bot can be tested using past data can offer insights into its potential efficacy in real-world scenarios.

Delve into reviews and feedback: Explore review platforms, forums, and social media channels to glean insights from those who've already used the bot. While it's natural for any product to have its share of critics, consistent negative feedback on specific issues should serve as warning flags. If possible, kick off your bot journey with a version that offers a trial or demo.

Safety and security

In automated crypto trading, prioritising security is essential. Ensure the bot uses robust data encryption and lacks withdrawal rights to safeguard assets. Choose between the convenience of cloud-based bots and the control of local bots, weighing their security pros and cons. Secure API key integration is crucial, disallowing withdrawal permissions. Opt for providers undergoing regular security audits, and decide between the transparency of open-source bots and the confidentiality of proprietary ones.

Legal compliance

Selecting an AI crypto trading bot demands thorough legal and compliance considerations. Different jurisdictions have diverse regulations about crypto trading. It's vital to familiarize yourself with both your local laws and those where the bot service operates. Adherence to data protection standards, Anti-Money Laundering (AML), and Know Your Customer (KYC) protocols is crucial.

Risks and Benefits

Benefits

24/7 Trading: Capitalise on opportunities around the clock.

Emotionless Trading: Bots operate without human emotional interference.

Speed: Faster trade execution than humans.

Backtesting: Test strategies on past data before real use.

Diverse Strategies: Handle multiple strategies and coins simultaneously.

Efficiency: Consistent operation without fatigue.

Reduced Errors: Automated strategies decrease human mistakes.

Risks

Software Bugs: Potential for glitches leading to losses.

Complexity: Misconfiguration can be costly.

Security: Risk of hacks and unauthorized access.

Market Limitations: No guaranteed profits in volatile markets.

Over-reliance: Sole reliance on bots can be risky.

Costs: Fees can reduce profit margins.

False Marketing: Some bots don't live up to their claims.

Lack of Flexibility: Bots may not adapt quickly to market changes.

Legal Concerns: Potential regulatory issues in some regions.

TTD Week That Was 📆

The week of crypto finding its meaning in the larger scheme of things.

Friday: Stable again? ⚖️

Thursday: Apple can breathe 🍎 🫣

Wednesday: ETFs are waiting...⏳

Tuesday: PayPal has a stablecoin 👊💥

Monday: Huobi trouble 😵💫

TTD Week in Funding 💰

Helios Protocol. $10 million. Combines over-collateralized, decentralised stablecoin lending and borrowing on BNB Chain with multi-chain StaaS and LSDfi services.

Cantina. $7 million. Marketplace for web3 security that gives protocols the flexibility to easily book a security review.

SphereX. $8 million. Specialises in security solutions for smart contracts within the Web3 ecosystem.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us lovee on Twitter, Instagram & Threads🤞

So long. OKAY? ✋