Every crypto trader has that moment. You see a token early, recognise the potential, maybe even bookmark it to "research later." Then you watch it pump 500% while you're stuck refreshing charts, wondering why you didn't pull the trigger.

For me, that happened during what I optimistically called my "memecoin trading detour." Chill Guy and Peanut the Squirrel walked right past me. The alpha was right there, visible and trackable, yet somehow always just out of reach.

Missing memecoins is just the tip of the iceberg. The consistent money in crypto spans a much broader universe - perpetual futures, blue-chip alts, and sophisticated trading strategies that generate steady returns regardless of what's trending on X.

Alpha, by the way, is simply information that gives you an edge before the market catches up. Think of it as knowing which way the crowd will move before the crowd knows it's moving. In traditional markets, alpha was hoarded by institutions with deep pockets and insider connections. But crypto promised something different: transparent, on-chain data that everyone could access equally.

Turns out, access and actionability are two very different things. Which brings us to HyperSignals and a problem that's been quietly driving traders insane recently.

Gaimin Cloud is Redefining Decentralised Computing.

AI is booming. But powering it is expensive.

Gaimin taps into unused GPU power from gamers around the world — cutting compute costs by up to 70% and decentralising access for all.

It’s like Airbnb, but for GPUs.

Decentralised compute at scale

Lower costs, higher performance

Real rewards for idle hardware

👉 See how Gaimin powers the future of AI & file sharing →

The 400,000 Trader Problem

Hyperliquid changed the game by making on-chain perpetual trading actually work. Fast, cheap, transparent, which is everything traditional exchanges promised but never delivered. Over 400,000 active traders have flocked to the platform where every move is visible on-chain.

Transparency created a new problem, which is information overload.

Sure, you can see what everyone's doing. But when "everyone" includes 400,000 traders making millions of moves daily, that visibility becomes useless noise.

Most analytics platforms took the easy route. They'd track the top 500 traders, maybe scan for whale movements, call it a day. Everyone follows the same obvious signals, arriving at the same conclusions after the smart money had already extracted the alpha.

"No one has indexed the entire Hyperliquid order book," says the team behind HyperSignals. "Everyone has just sort of done the tip of the iceberg analysis ... We are the first ones to do that [index the entire order book].”

Separating Signal From Noise

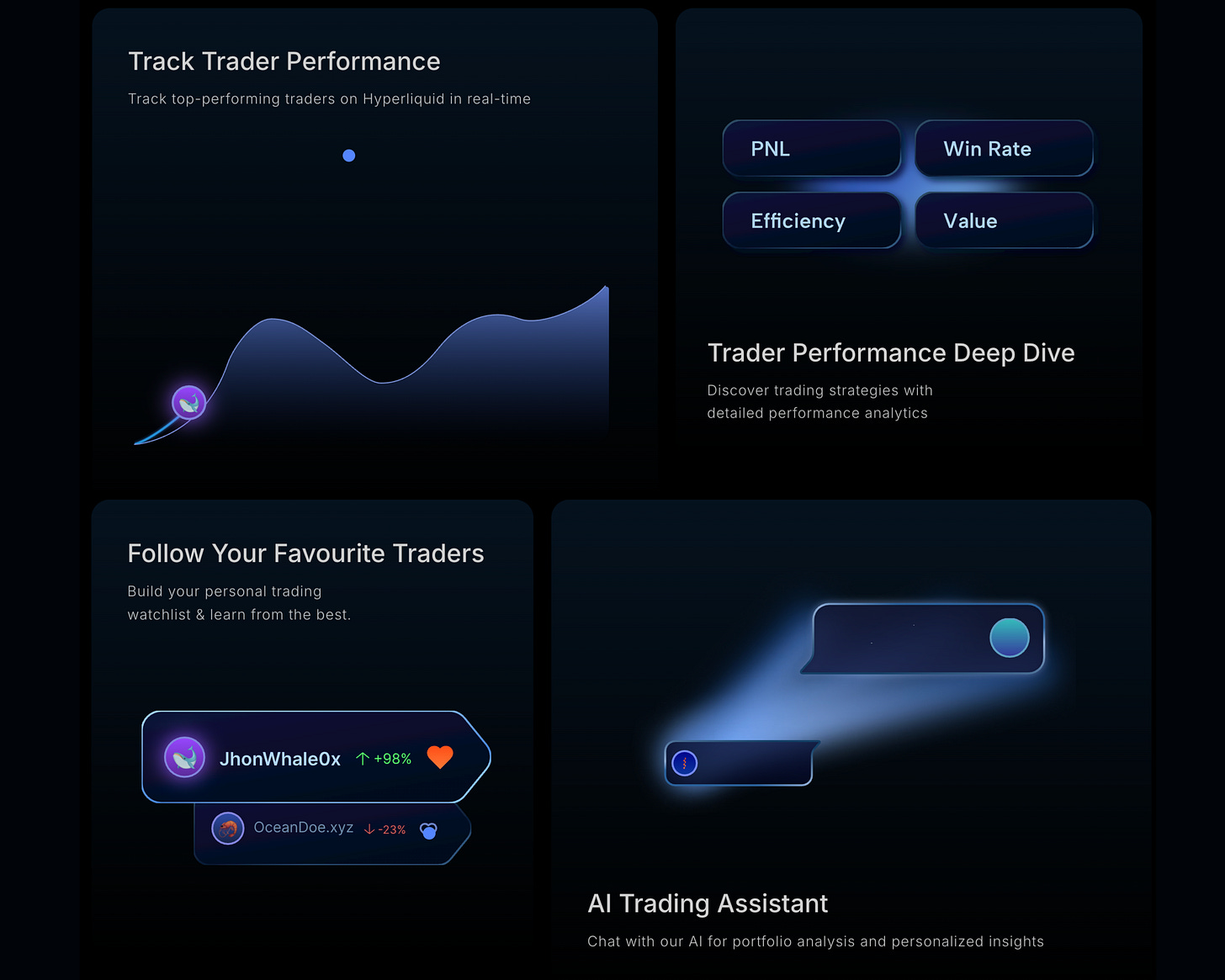

HyperSignals attacks the problem differently. Instead of following the loudest voices or biggest wallets, they built an algorithm to find the traders who are actually good at trading. Not just lucky, not just loud, but genuinely skilled.

Stage 1: 83% of Hyperliquid's traders get eliminated for not hitting $100,000 in volume over 90 days. If you're not actively trading at scale, the algorithm doesn't care about your opinion. Why? Traders with very low activity might just be lucky or not committed, so filtering them out helps focus on those with enough experience and data to judge their real skill.

Stage 2: The survivors face something called HyperScore — a proprietary system that evaluates traders across five dimensions most people never consider.

Take profit-and-loss, the metric everyone obsesses over. HyperScore treats it as barely a starting point. “P&L alone is worthless.”

A trader showing $1 million in profits could have generated $10 million in wins and $9 million in losses, technically profitable, but hardly efficient. Meanwhile, someone with $300K in steady gains who's never had a losing month demonstrates genuine skill. Or consider two traders both showing $500K profits: one achieved it through 100 trades with a 90% win rate, the other through 1,000 trades with a 55% win rate. Same P&L, completely different skill levels. HyperScore sees the difference.

The algorithm digs deeper. It tracks realised versus unrealised P&L, because paper profits don't pay bills. It calculates profit factor, comparing money made on wins versus money lost on losses. It measures efficiency, separating skilled traders from high-volume noise makers. And it analyses consistency, eliminating lucky streaks and one-hit wonders.

Every trader gets scored 0-10. Only the highest scorers make it to your feed.

The Execution Part

Right now, you can see what elite traders are doing and copy their moves with a two-click execution. But where’s the future at? making perpetual trading accessible to people who've never touched a derivative.

"The problem with copy trading is that a lot of folks end up losing money," the team explains. "That's precisely because the intel part is not taken care of. Bots are good at execution, but no one focuses on the intel bit … We ideally want to profile you as a user.“

Their solution involves profiling users the way financial advisors profile clients. Risk tolerance, profit expectations, time horizons, leverage comfort, all the questions that determine whether you should be following a conservative 8-score trader or a degenerate 9-score risk-taker.

The end goal is to create a "done-for-you" mode where the platform matches your risk profile to appropriate strategies and executes automatically. You deposit funds, the algorithm handles everything else.

They're not abandoning the "assist" mode for people who want to learn. The platform provides access to metrics that were previously available only to quantitative traders with custom setups and deep pockets. It's democratising information that institutional traders have used for years.

Beyond the Order Book

Indexing Hyperliquid's entire order book was just the beginning. The team plans to expand beyond pure on-chain analytics into what they call "signal aggregation."

Macro events matter in crypto. Trump tweets, ETF filings, S&P performance — everything correlates eventually. Technical analysis remains popular despite mixed results. Social sentiment and KOL influence can drive significant moves.

"Slowly and gradually, we'll be indexing off-chain stuff too," the team notes. "We'll be working on technical analysis and social media sentiment and macro analysis, trying to provide signals from all sources."

The vision is, on-chain order book data combined with off-chain intelligence, technical indicators, and sentiment analysis. Not just what top traders are doing, but what macro conditions, technical setups, and social trends suggest about market direction.

The Gamification Layer

HyperSignals is building social and competitive elements into the platform. Your HyperScore becomes a badge of honor, something to improve over time. Leaderboards, tier systems, badges for performance milestones.

They're even incentivising identity verification. In a world of anonymous trading, knowing someone's actual Twitter and Telegram accounts makes their signals more trustworthy.

It's turning trading analytics into something closer to social media, but where clout actually correlates with skill rather than follower count.

The Infrastructure Advantage

HyperSignals is built by Biconomy, a company that's been running account abstraction and cross-chain infrastructure for five years. Their tech already processes transactions for giants like dYdX, Trust Wallet, and JP Morgan.

This matters because building robust trading infrastructure is hard. Most projects promising seamless execution and real-time analytics struggle with the technical demands. Having battle-tested infrastructure from day one removes a major risk factor.

It also positions them for the broader shift happening in crypto trading. The top 10 decentralised perpetual exchanges recorded $1.5 trillion in trading volume in 2024, up 138% from $647.6 billion in 2023. Hyperliquid alone processed over $1.57 trillion in on-chain perpetual volume over the past year. As more volume moves on-chain, platforms like HyperSignals become increasingly valuable.

The Bigger Picture

What fascinates me about HyperSignals is what it reveals about how edge evolves in markets.

In traditional finance, edge came from information asymmetry. You knew something others didn't. In early crypto, edge came from technical understanding. You could navigate wallets, bridges, and protocols others couldn't.

Now we're entering a phase where edge comes from information processing. Everyone has access to the same on-chain data, but most people can't turn that data into actionable intelligence. But information asymmetry still exists, it's just that now the advantage goes to whoever can actually understand what the data means. The winners will be those who can filter signal from noise at scale.

HyperSignals is essentially building the Bloomberg Terminal for on-chain trading. It is part of crypto's ongoing professionalisation, the shift from "number go up" speculation to actual financial infrastructure.

Institutional traders get better data, faster execution, deeper analytics. Retail gets whatever scraps filter down through mainstream channels.

Trader analytics isn't new. Platforms like DexCheck AI offers to track smart money across blockchains, eToro built an empire on social trading and copy-trading features, and Token Metrics uses AI to analyse thousands of crypto assets. They all promise to help traders make smarter decisions through data and social insights.

While these platforms analyse what traders have already done, HyperSignals analyses what they're about to do. By indexing Hyperliquid's entire orderbook, every buy and sell order, not just completed trades, they can see hidden liquidity, order imbalances, and market dynamics in real-time.

Crypto's transparency creates an opportunity to flip that dynamic. For the first time, retail traders can see exactly what institutions are doing, analyse their strategies, and potentially front-run their moves. But only if they have the right tools to process that transparency into actionable intelligence.

That's what makes platforms like HyperSignals interesting beyond their immediate utility. They're testing whether crypto's promise of democratised finance can actually deliver — whether transparent markets plus sophisticated analytics can level a playing field that's been tilted toward institutions for decades

The early results suggest it might. Users are reporting better timing, reduced FOMO, more disciplined trading. Instead of chasing what already moved, they're positioning ahead of movements they can see developing.

For now, the window is open. The traders who learn to process information rather than just consume it will capture the alpha everyone else is still trying to spot.

That’s it on HyperSignals. See ya next weekend with another deep-dive.

Until then … DYOR and HODL tight.

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Some content may be promotional in nature. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.