The Altcoin ETFs Gold Rush 💰

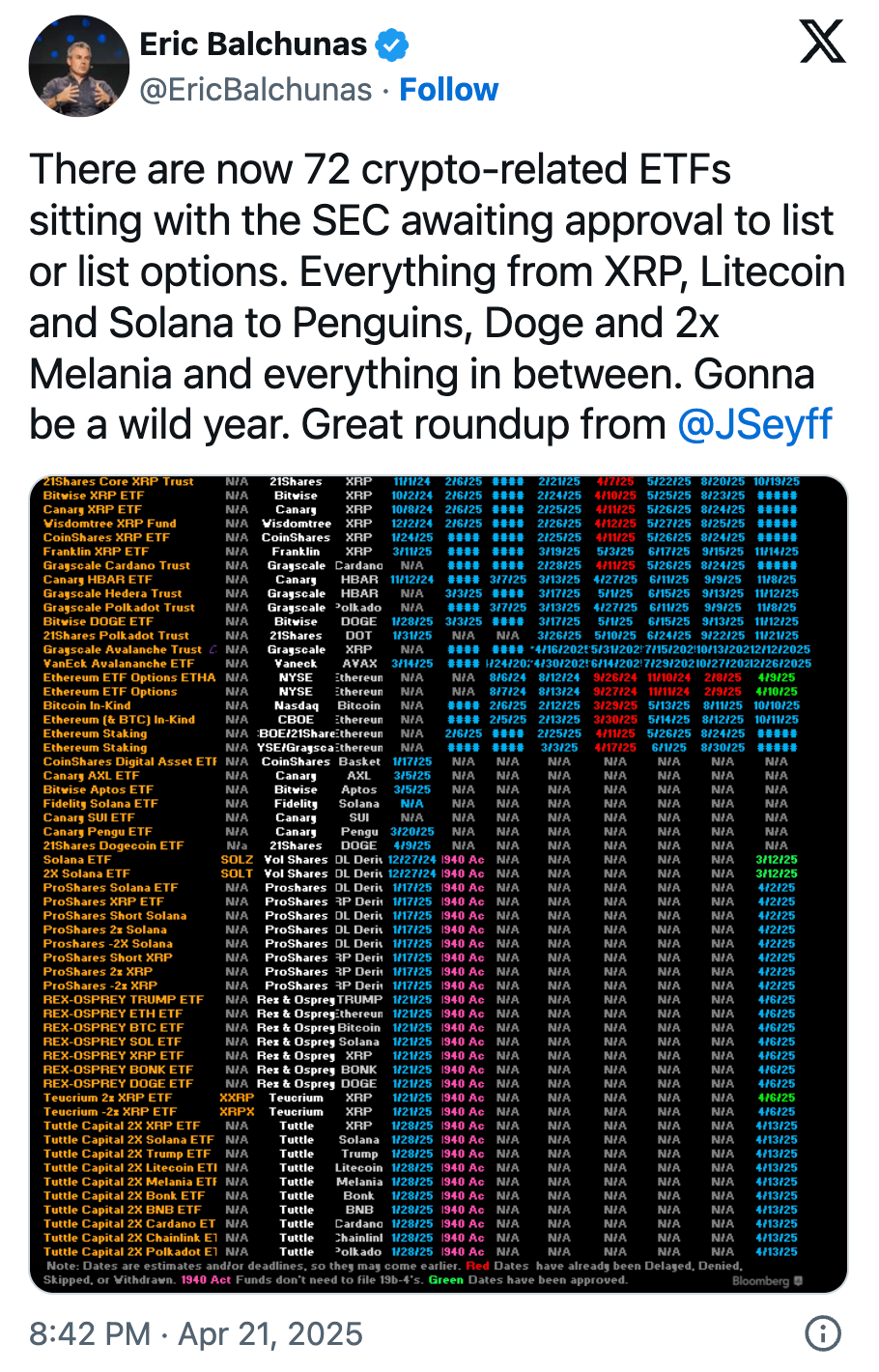

How 72 applications could reshape crypto investing beyond bitcoin

Hello

January 2024 feels like a different lifetime. I mean, it is just about rewinding eighteen months, but it seems definitely bigger and distant. For crypto, it’s been The Bridge on the River Kwai.

January 11, 2024 spot Bitcoin ETFs started trading on Wall Street. In about six months, on July 23, 2024, sport Ethereum ETFs made their debut. Fast forward eighteen months and we have the US Securities and Exchange Commission (SEC) desk drowning in applications - 72 crypto ETF filings and counting.

From Solana to Dogecoin, XRP to even Pudgy Penguins, asset managers are racing to package every conceivable digital asset into a regulated wrapper. Bloomberg analysts Eric Balchunas and James Seyffart have raised approval odds to "90% or higher" for most applications, suggesting we're about to witness the largest expansion of crypto investment products in history.

2024 then is no way like 2025 now. It was a scrappy fight for acceptance then, everyone wants a piece of action now.

Secure Your Life ... But in Bitcoin

Yeah, we didn’t think those words went together either. But here comes Meanwhile flipping the script.

With Meanwhile, you pay your premium in Bitcoin, then borrow against it later without selling. Yup, no tax, no selling pressure, no drama.

Here’s the alpha

You lock in BTC today

It moons tomorrow 🚀

You borrow against it, no capital gains tax

You stay insured, and stay winning

It's like hodling with benefits.

👉 Check out Meanwhile, your future self (and wallet) will thank you.

Bitcoin's $107 Billion Bonanza

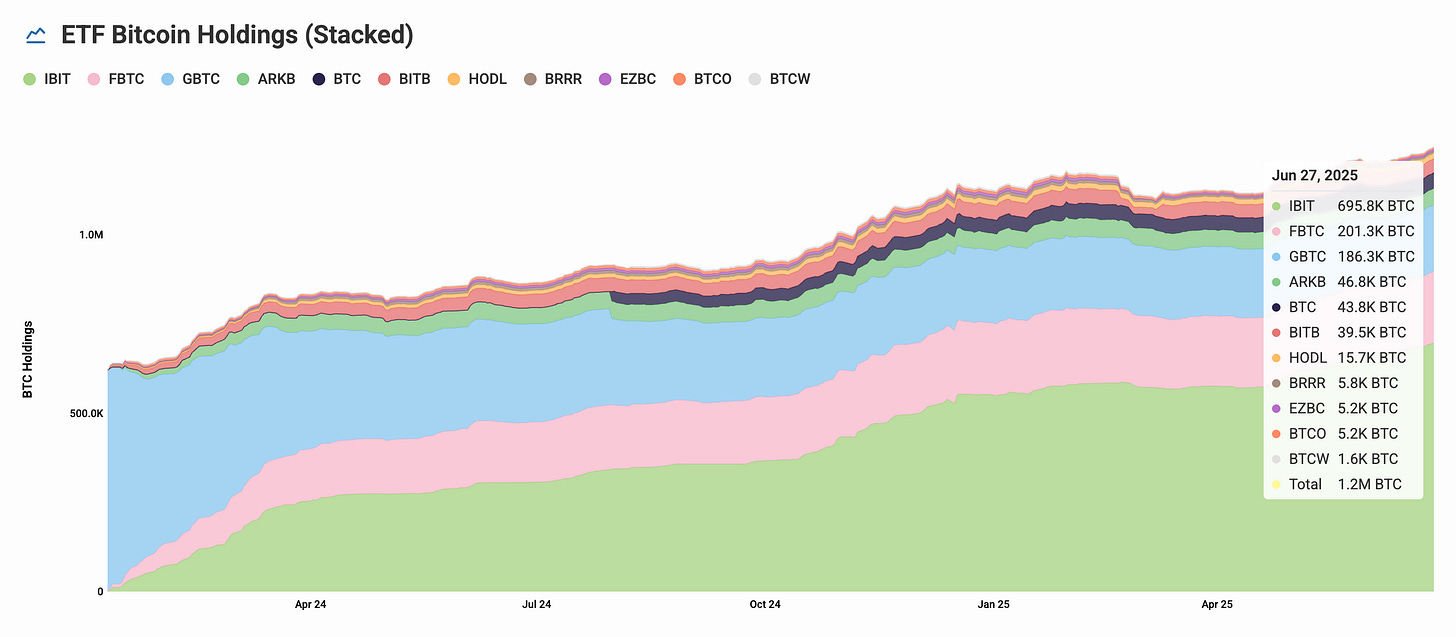

To understand why altcoin ETFs matter, you need to understand just how dramatically Bitcoin spot ETFs exceeded expectations. They rewrote the entire playbook for asset management.

Within one year, Bitcoin ETFs pulled in $107 billion, becoming the most successful ETF launch ever recorded - and 18 months down the road we are looking at $133 billion in assets.

BlackRock's IBIT alone now holds 694,400 Bitcoin worth over $74 billion. The combined ETFs control 1.23 million Bitcoin — roughly 6.2% of the total circulating supply.

When BlackRock's Bitcoin ETF accumulated $70 billion in assets faster than any fund in history, what did it prove? Demand for crypto exposure through traditional investment vehicles is real, massive, and untapped. Institutions, retail and just about everyone is queuing up.

The success created a feedback loop that proved the concept: Bitcoin exchange balances dropped as ETFs vacuumed up supply. Institutional ownership accelerated. Bitcoin price stability improved. The entire crypto market gained legitimacy it had never enjoyed before. Even during market volatility, institutional money keeps flowing in. These aren't day traders or retail speculators, we are talking about pension funds, family offices, and sovereign wealth funds treating Bitcoin as a legitimate asset class.

That success is precisely why ~72 altcoin applications are now queued up at the SEC as of April.

Why Want an ETF?

You can buy the altcoins on crypto exchanges, what use the ETFs then? Therein is the market play that revolves around mainstream acceptance. ETF status is a milestone for cryptocurrencies.

The legitimacy that allows them to exist on traditional stock exchanges under established financial regulations. Crypto ETFs let investors buy and sell exposure to digital assets just like any stock through regular brokerage accounts.

For the majority of retail that is largely in the dark about crypto ways, it is a life saver. No need to set up wallets, secure private keys, or deal with blockchain’s technical aspects. Even if you get through the hurdle of wallets, the risks overhang - hacks, lost private keys, and exchange failures. With ETFs, custody and security are managed on behalf of investors, and it provides highly liquid assets traded on major traditional exchanges.

The Altcoin Gold Rush

The applications reveal the breadth of what's coming. Major players like VanEck, Grayscale, Bitwise, and Franklin Templeton have filed for Solana ETFs with 90% approval odds. Nine separate issuers want piece of the SOL action, including newcomer Invesco Galaxy with their proposed QSOL ticker.

XRP filings follow close behind, with multiple applications targeting the payments-focused cryptocurrency. Cardano, Litecoin, and Avalanche ETFs are working through the review process.

Even memecoins aren't immune. Dogecoin and PENGU ETFs from major issuers.

“I’m surprised we haven’t seen a Fartcoin ETF filed yet,” Bloomberg’s Eric Balchunas said on X.

Why is this all happening right now? It's the result of several converging forces that have created the perfect environment for altcoin ETF proliferation. The Trump administration's crypto-friendly stance marked a dramatic regulatory shift, with new SEC Chairman Paul Atkins dismantling Gary Gensler's "regulation by enforcement" approach and establishing a crypto task force to develop clear rules.

This regulatory thaw culminated in the SEC's recent clarification that "protocol staking activities" don't constitute securities offerings — a complete reversal from the previous administration's aggressive pursuit of staking providers like Kraken and Coinbase.

The institutional validation of Bitcoin and altcoins, combined with the crypto corporate treasuries frenzy and 56% of financialadvisors now willing to allocate to crypto according to Bitwise research, has created unprecedented demand for diversified crypto exposure beyond just Bitcoin and Ethereum.

The Economics Reality Check

While Bitcoin ETFs proved massive institutional demand exists, early analysis suggests altcoin ETFs will see dramatically different reception.

Sygnum Bank's research head Katalin Tischhauser expects altcoin ETFs to attract "several hundred million to $1 billion" in combined inflows — a fraction of Bitcoin's $107 billion success.

Even generous estimates put total altcoin ETF flows at less than 1% of Bitcoin's achievement. This makes economic sense when you examine the fundamentals.

The disparity becomes even starker when comparing Ethereum's performance. Despite being the second-largest cryptocurrency, Ethereum ETFs have attracted only ~$4 billion in net flows over 231 trading days - barely 3% of Bitcoin's $133.3 billion achievement. Even with recent momentum that added $1 billion in just 15 sessions, Ethereum's institutional appeal remains a fraction of Bitcoin's, suggesting altcoin ETFs face an even steeper uphill battle for investor attention.

Bitcoin benefits from first-mover advantage, regulatory clarity, and a simple "digital gold" narrative that institutions understand.

Now 72 applications are chasing a market that might only support a handful of winners.

Staking Changes The Game

One factor could differentiate altcoin ETFs from Bitcoin's offering: yield generation through staking. The SEC’s staking clearance opens the door for ETFs to stake their holdings and distribute rewards to investors.

Ethereum staking currently yields 2.5–2.7% annually. After ETF fees and operational costs, investors might see net yields of 1.9-2.2% — modest by traditional fixed-income standards but meaningful when combined with potential price appreciation.

Solana staking offers similar opportunities.

This creates a new revenue model for ETF issuers and a new value proposition for investors. Instead of pure price exposure, staking-enabled ETFs become yield-generating assets that can justify their fees while providing passive income.

Several Solana ETF applications explicitly include staking provisions, with issuers planning to stake 50-70% of their holdings while maintaining liquidity reserves. The Invesco Galaxy Solana ETF filing specifically mentions using "trusted staking providers" to generate additional returns. But staking introduces operational complexity.

ETF managers dealing with staked crypto assets face several challenges: they must balance keeping enough assets unstaked and liquid for investor withdrawals while also staking as much as possible to maximise returns. They also have to manage the risk of “slashing,” which means losing funds if validators (who help secure the network) make mistakes or break rules. Remember, running validator operations requires technical expertise and reliable infrastructure to ensure everything runs smoothly and securely. So it is not a risk that’s easy to mitigate. So the managers have a big juggling act to successfully operate a crypto ETF with staked assets. Not impossible, but just a hard act to play.

For the Bitcoin and Ethereum ETFs approved and launched, it wasn’t an option as Gary Gensler’s SEC believed that staking violates securities laws as it constitutes unregistered securities offerings. That’s not the case anymore.

Fee Compression Incoming

The sheer number of applications virtually guarantees fee compression. When 72 products compete for limited institutional dollars, pricing becomes a primary differentiator. Traditional crypto ETFs charge 0.15-1.5% management fees, but competition could drive these lower.

Some issuers might even use staking yields to subsidise management fees, creating zero-fee or negative-fee products to attract assets. The Canadian market provides a preview: several Solana ETFs launched with waived management fees for initial periods.

This fee compression benefits investors but pressures issuer profitability. Only the largest, most efficient operators will survive the inevitable consolidation. Expect mergers, closures, and pivots as the market sorts winners from losers.

Token Dispatch View 🔍

The altcoin ETF rush is changing how people think about crypto investing.

The Bitcoin ETFs have been a huge success. Ethereum ETFs gave them a second choice, but adoption was lukewarm due to complexity and disappointing returns. Now asset managers are betting that different cryptocurrencies serve different purposes.

Solana becomes the speed play. XRP becomes the payments bet. Cardano gets the "academic rigor" angle. Even Dogecoin gets framed as the mainstream adoption story. This makes sense if you're building portfolios. Instead of crypto being one weird asset class, it's becoming dozens of different investments with their own risk profiles and use cases.

Bitcoin is the largest crypto by market cap and has become an extension of the traditional investment portfolio for many everyday investors who already participate in equities markets. For these investors, Bitcoin is seen as a complementary asset class, offering both diversification and a hedge against market uncertainty. In contrast, Ethereum did not achieve the same mainstream integration. Despite being the second-largest cryptocurrency, most retail and institutional investors have not embraced Ethereum ETFs as a core part of their portfolios.

We need to see what will altcoin ETFs offer differently to avoid the fate of Ethereum ETFs.

But it also shows how far crypto has drifted from its roots. When memecoins get ETF applications, when 72 products fight for attention, when fees get compressed like any other commodity business, you're watching an industry that's gone fully mainstream.

The question is whether this creates real value or just wraps speculation in regulatory-approved packaging. Probably depends on your perspective. Asset managers see new revenue streams in a crowded market. Investors get easy access to crypto exposure through familiar products.

The market will figure out who's right.

That’s it for this week’s deep-dive.

See you next week,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. You can find all about us here 🙌

If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us.

Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.