The Aster Counterstrike ⚔️

When the world's largest exchange backs a Hyperliquid competitor, the perpetual DEX wars just got serious

On September 18, 2025, Changpeng Zhao did something he rarely does: he posted a price chart that wasn't Bitcoin or BNB.

The chart showed ASTER, the native token of a decentralized perpetual exchange that had just launched the day before.

"Well done! Good start. Keep building!" he said.

Within hours, ASTER exploded 400% from its launch price. The market got the message loud and clear: the former Binance CEO wasn't just offering congratulations. He was declaring war on Hyperliquid.

As HYPE token holders watched their Hyperliquid bags pump to all-time highs near $60, CZ's calculated tweet landed like a precision strike. Here was crypto's most influential figure, banned from running Binance but certainly not from moving markets. He is throwing his weight behind Hyperliquid's most serious competitor.

Behind the scenes, the machinery of war was already in motion. YZi Labs (the artist formerly known as Binance Labs) had been quietly funding Aster's development. A network of BNB Chain partnerships was activating. The world's largest crypto empire was mobilising against a decentralised upstart that had dared to steal derivatives market share.

It was the opening salvo in the perpetual DEX wars and Binance wasn't planning to lose.

Crypto Investing Without the Crypto Chaos

Forget seed phrases, exchange hacks, and late-night wallet setups.

With Grayscale, you can invest in Bitcoin, Ethereum, and other digital assets the same way you’d buy a stock — through regulated, SEC-reporting products.

No private keys to manage

No unregulated exchanges

No steep learning curve

It’s the easiest way for individuals and institutions alike.

What Is Aster?

Aster emerged from the December 2024 merger of two DeFi protocols: Astherus, a multi-asset liquidity hub focused on yield-generating products, and APX Finance, a decentralised perpetual trading platform. The combination created a unified trading infrastructure designed to compete directly with Hyperliquid's growing market share.

The platform operates as a multi-chain decentralised exchange across BNB Chain, Ethereum, Solana, and Arbitrum, aggregating liquidity from multiple blockchains to enable seamless trading without manual asset bridging. Since launching in March 2025, Aster has processed over $514 billion in trading volume across 2 million users. Following its token launch, the platform briefly hit $2 billion in TVL before settling back to $655 million as of September 2025.

Unlike many DEX platforms that focus purely on spot trading, Aster positions itself as a comprehensive trading platform offering both spot and perpetual futures markets. While perpetual derivatives remain the core focus, the platform also provides spot trading functionality, with the first listed pair being its native ASTER/USDT token. For perpetuals, the platform offers both cryptocurrency and traditional US stock perpetuals, with leverage up to 100x for most assets and up to 1001x for select pairs in what they call "degen mode."

Technical Innovation and Features

Aster's architecture centers on solving the liquidity fragmentation problem that plagues multi-chain DeFi. Rather than forcing users to bridge assets between networks, the platform aggregates orderbook depth across chains, creating what it calls "unified liquidity."

The platform offers two distinct trading interfaces designed for different user types. Simple Mode provides one-click trading with built-in MEV protection, allowing users to execute leveraged trades without navigating complex orderbooks. Pro Mode delivers an advanced trading environment with full orderbook access, real-time charts, and sophisticated order types.

A standout feature is Aster's "Hidden Orders" system, which keeps order size and direction invisible until execution. This dark pool-style functionality addresses a critical problem in on-chain trading: front-running and liquidation manipulation. When CZ previously commented on this feature, he noted it solved "liquidation manipulation seen on other on-chain DEXs."

The platform's margin system supports both isolated and cross-collateral trading, allowing users to employ liquid staking tokens like asBNB or yield-bearing stablecoins as margin.

This capital efficiency innovation lets traders earn passive yield on their collateral while maintaining active trading positions.

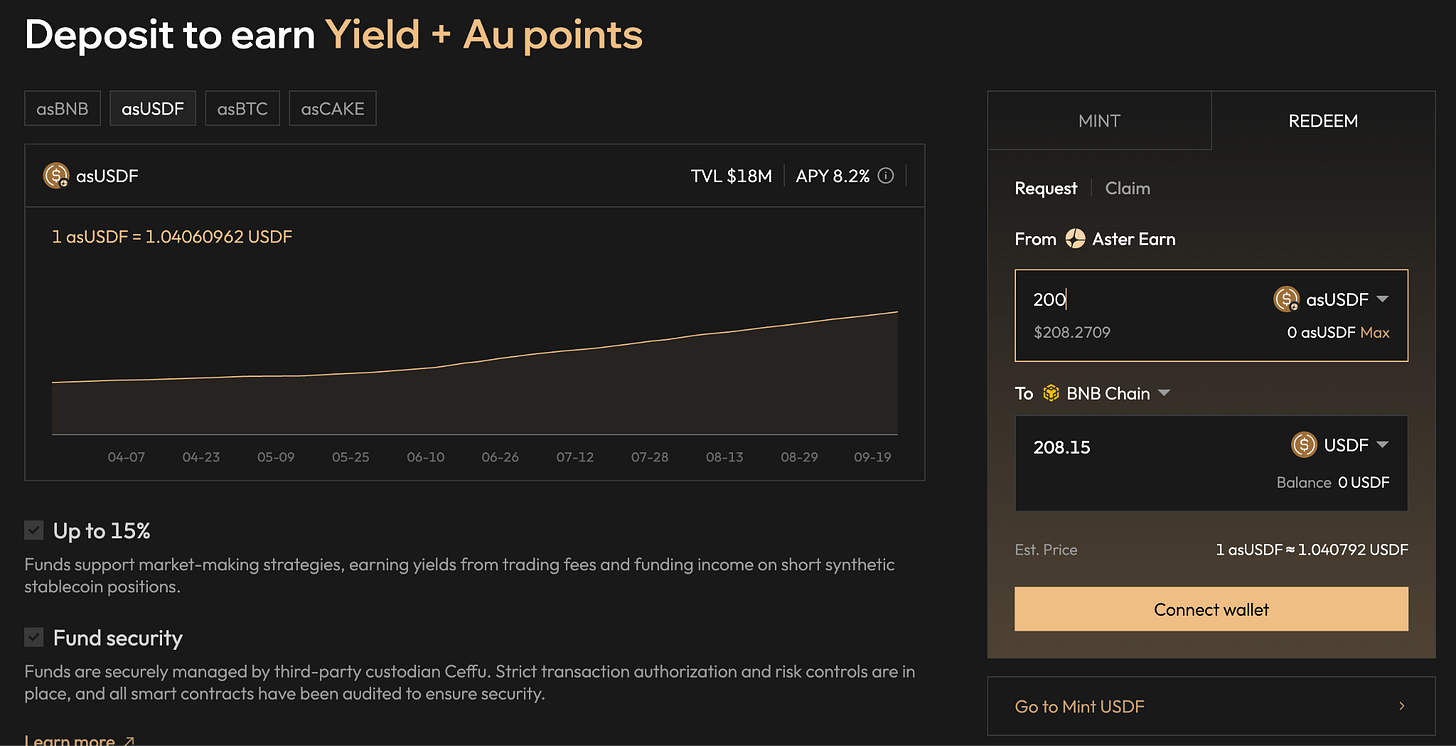

Central to Aster's ecosystem is USDF, a yield-bearing stablecoin backed by delta-neutral positions. Users can mint USDF by depositing supported assets, then use the stablecoin as trading collateral while earning yield. This creates a self-reinforcing liquidity system where stablecoin holders become natural liquidity providers.

Looking ahead, Aster's roadmap includes zero-knowledge proof integration for enhanced privacy and the development of Aster Chain, a purpose-built Layer 1 blockchain optimised for trading. Zero-knowledge proofs would allow traders to prove they have sufficient collateral or meet trading requirements without revealing their actual wallet balances, trading positions, or transaction history to other users or even validators. This technology could enable truly private trading where position sizes, profit and loss, and trading strategies remain confidential while still maintaining the transparency needed for proper risk management and liquidations. A beta version launched for selected traders in June 2025, positioning the platform to eventually compete with Hyperliquid's custom L1 architecture.

How Aster Stacks Against Hyperliquid

The comparison between Aster and Hyperliquid reveals two different approaches to decentralised perpetual trading. Hyperliquid built its own Layer 1 blockchain from the ground up, achieving sub-second finality and fully on-chain orderbook trading that mimics centralised exchange performance. This vertical integration gives Hyperliquid unmatched speed and a seamless user experience but limits it to a single ecosystem.

Aster takes the opposite approach, operating across multiple established blockchains to maximise reach and liquidity access. While this creates some technical complexity, it allows Aster to tap into existing DeFi ecosystems and serve users who prefer specific chains.

Goliath. Hyperliquid dominates with approximately 70% of the DeFi perpetuals market, $15 billion in open interest, and consistent daily volumes above $800 million.

Yet Aster's multi-chain strategy provides advantages Hyperliquid cannot easily replicate. The platform's integration with yield protocols like Pendle and Venus creates capital efficiency opportunities that Hyperliquid's isolated L1 cannot match.

Aster users can earn staking rewards on BNB, yield on USDT deposits, and trading fees simultaneously - a level of composability that single-chain solutions struggle to achieve.

The leverage offerings also differ meaningfully. While Hyperliquid caps leverage at 40x, Aster pushes to 100x for most pairs and 1001x for select assets. More importantly, Aster's stock perpetuals provide 24/7 exposure to traditional equity markets, expanding the addressable market beyond crypto-native traders.

Follow the Token Trail

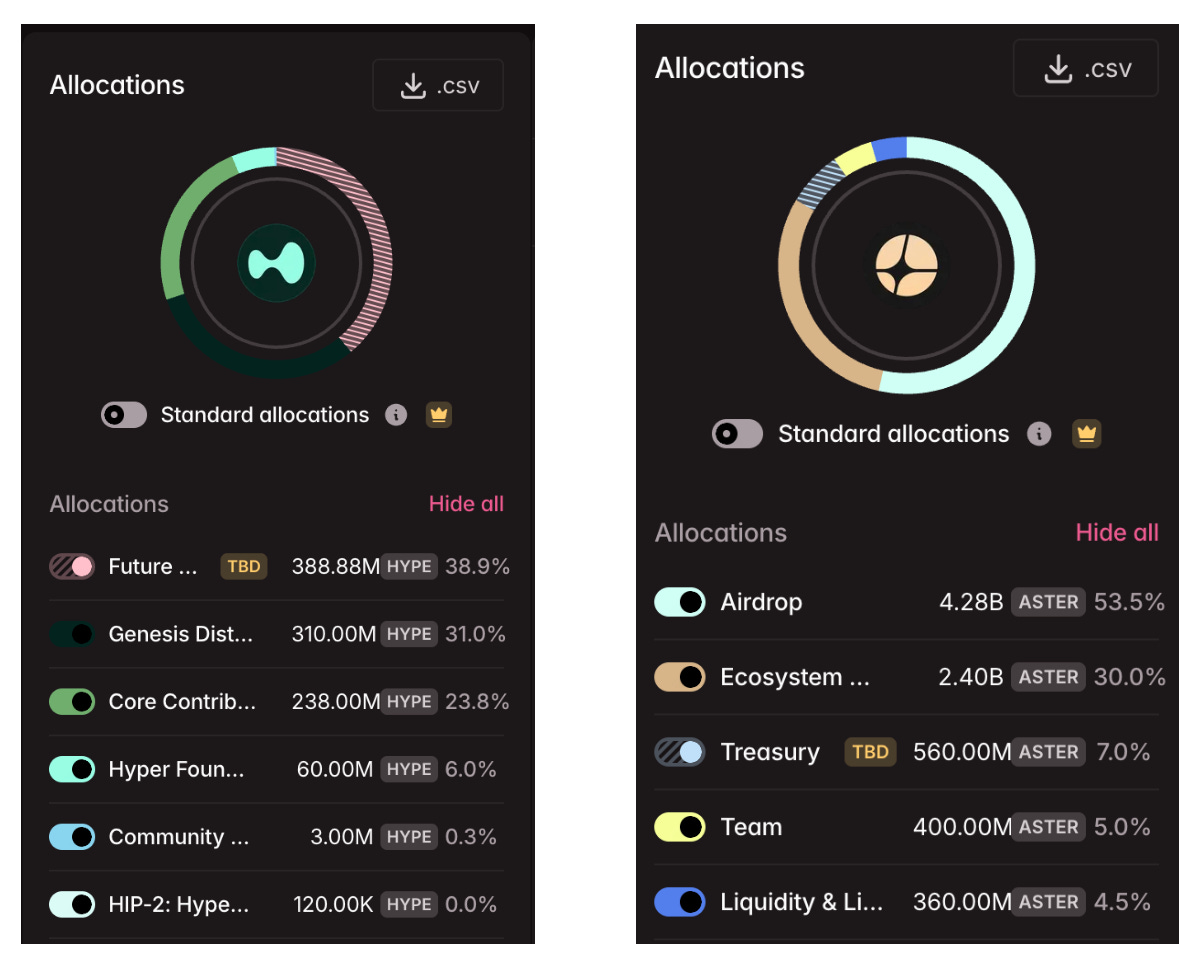

ASTER's tokenomics reveal a project designed for aggressive community distribution and long-term sustainability. The total supply of 8 billion tokens is allocated across distinct categories: 53.5% for airdrops and community rewards, 30% for ecosystem development, 7% for treasury operations, 5% for the team, and 4.5% for liquidity and exchange listings.

The community allocation represents one of the highest percentages in DeFi, exceeding 50% of total supply. This distribution began with a massive airdrop of 704 million tokens (8.8% of total supply) to users who participated in pre-launch campaigns. The vesting schedule starts with 25% immediate unlock at Token Generation Event, followed by a three-month cliff and nine-month linear release for the remainder.

The token serves multiple functions within the ecosystem: governance rights, fee discounts, staking rewards, and access to premium features. Revenue sharing comes through fee buybacks, with a portion of trading fees used to purchase and potentially burn ASTER tokens, creating deflationary pressure as volume grows.

Users can stake their ASTER tokens while simultaneously using yield-bearing derivatives of those tokens as trading collateral. This creates multiple value accrual streams from a single token position.

ASTER vs HYPE: Token Economics Comparison

The contrast between ASTER and HYPE tokenomics reveals different philosophies about value capture and distribution.

Hyperliquid's HYPE token follows a more traditional crypto economics model with aggressive buybacks funded by protocol revenue. The platform generates over $1 billion in annualised revenue and uses the majority for HYPE buybacks, creating strong deflationary pressure.

HYPE's key strength lies in its proven revenue-to-buyback flywheel. With 43.4% of total supply currently staked and massive protocol revenues, the token maintains severe liquid supply constraints. This creates a powerful price support mechanism that ASTER cannot yet match.

HYPE faces a significant challenge: massive token unlocks for core contributors beginning in November 2025. These unlocks will introduce substantial sell pressure that could overwhelm even aggressive buyback programs. Hyperliquid is preparing to launch USDH stablecoin to generate additional buyback pressure, but the timing creates uncertainty.

ASTER's approach prioritises community ownership over immediate value capture. While this means less aggressive buybacks in the short term, it creates stronger network effects and governance decentralisation. The 53.5% community allocation ensures that value accrues to actual users rather than early investors or team members.

The revenue models also differ. Hyperliquid captures value through trading fees and liquidation revenues on its proprietary L1. Aster generates fees across multiple chains while also earning yield from its capital efficiency features. This diversified revenue approach may prove more resilient during market downturns.

The Binance Strategy

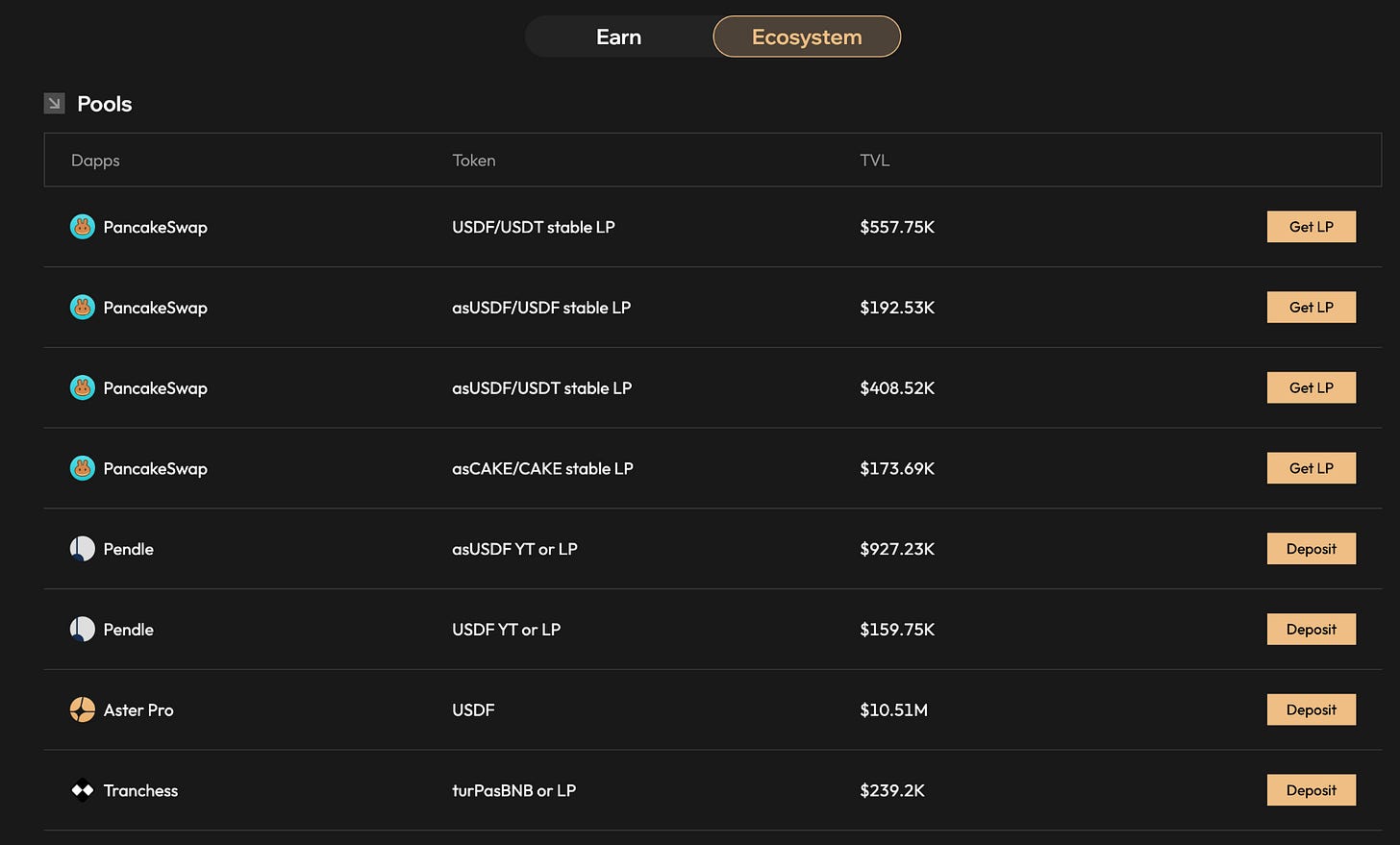

Understanding Aster's liquidity providers reveals the strategic depth behind its launch. Professional market makers provide core orderbook depth, while the platform's cross-chain architecture aggregates liquidity from multiple blockchains. Strategic partnerships with protocols like Pendle, ListaDAO, Kernel, Venus, YieldNest, and PancakeSwap create additional liquidity sources and user incentives.

Pendle enables yield tokenisation, ListaDAO provides liquid staking for BNB (creating asBNB), Venus offers lending services, and PancakeSwap routes arbitrage flows from BNB Chain's largest DEX. These partnerships turn Aster into a hub where users can simultaneously participate in multiple DeFi strategies while trading derivatives.

The yield-backed collateral system solves the opportunity cost problem by allowing users to earn returns on their trading margin. Instead of holding idle USDT, users can mint USDF (Aster's yield-bearing stablecoin) that earns delta-neutral returns while serving as collateral. Similarly, asBNB earns staking rewards (~5-7% annually) while functioning as margin for leveraged positions. This creates multiple revenue streams from a single deposit - staking yields, trading profits, and token rewards - incentivizing users to keep larger amounts on the platform longer, which naturally deepens liquidity pools.

YZi Labs' investment timeline provides crucial context for Binance's strategic thinking. The investment firm completed its backing of Aster's predecessor, Astherus, in November 2024, just as Hyperliquid was demonstrating serious competitive threats to Binance's derivatives dominance. According to a BNB Chain representative, Aster received mentorship, ecosystem exposure, and access to technical and marketing resources as part of YZi Labs' incubation program, establishing it as the number one perpetual DEX on BNB Chain. Hyperliquid's volume has been growing steadily throughout 2024-2025. While Binance maintains vastly higher absolute volumes, Hyperliquid's growth trajectory from near-zero to meaningful levels demonstrates a platform successfully building its own market rather than directly stealing Binance's traders.

YZi Labs' portfolio strategy becomes clearer when viewed alongside other investments like MYX Finance, another perpetual DEX on BNB Chain that experienced explosive growth. These investments suggest a coordinated effort to build BNB Chain's DeFi infrastructure and create alternatives to successful protocols on other chains.

The broader Binance strategy appears focused on ecosystem defense rather than direct competition. Rather than trying to replicate Hyperliquid's custom L1 approach, Binance is leveraging its existing ecosystem advantages: regulatory relationships, fiat on-ramps, institutional partnerships, and deep liquidity pools. Aster benefits from these network effects while providing the decentralised trading experience that sophisticated users increasingly demand.

Instead of viewing decentralised protocols as threats to be ignored or marginalised, Binance is actively investing in and promoting DeFi alternatives that remain within its ecosystem influence.

So the verdict?

Aster's emergence marks either a pivotal moment in decentralised derivatives trading or the most expensive way CZ has ever said "me too" to a competitor. The jury's still out on which.

On paper, the platform checks all the right boxes - multi-chain liquidity, yield-bearing collateral, stock perpetuals, and enough backing. The ability to earn yield while trading derivatives sounds great until you remember that most crypto innovations that sound too good to be true usually are.

The $2 billion TVL spike followed by an immediate crash to $655 million should probably serve as a reminder that initial hype and sustainable adoption are very different animals. When your TVL can drop 67% in a day, you might want to question whether those numbers represent real users or just yield farmers with itchy trigger fingers.

The token economics favor long-term community building over short-term value capture, which is either visionary or naive depending on your perspective. Unlike Hyperliquid's proven revenue-to-buyback machine, Aster's value proposition requires users to believe that earning 3% yield on your margin while trading 100x leveraged positions is somehow a sustainable business model.

The test whether the platform can convince traders to abandon Hyperliquid's battle-tested infrastructure for a multi-chain experiment backed by the same ecosystem that brought us the 2022 FTX collapse. No pressure.

When the world's largest exchange feels compelled to back a DeFi competitor, it suggests the centralised model isn't as unassailable as once believed. Whether that makes Aster a winner or just an expensive hedge remains to be seen.

That’s it for the Sunday deep dive. See you next week with another thought.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.