The Axelar Fix for Multichain Chaos 🌐

One integration. 80+ blockchains. Zero wrapped tokens.

There’s a paradox at the heart of network effects. The more valuable a network becomes, the harder it is to leave. This creates power. But in blockchain, we built something different. We built exit.

Every new Layer 1 is an exit from Ethereum’s fees. Every new chain is an exit from some perceived limitation. We spent a decade celebrating this fragmentation as “specialisation” and “innovation.” And it was. Each chain got better at something specific. Faster transactions. Lower costs. Better privacy. Different consensus.

But here’s what happens when you optimise for exit: you get really good at leaving, and really bad at staying connected.

Your USDC lives on Ethereum. The yield opportunity is on Avalanche. The NFT marketplace is on Polygon. Your attention is on Solana. And none of them talk to each other without risk, friction, and trust in centralised bridges that keep getting exploited.

We built an internet where every website speaks a different protocol. Now we’re surprised that browsing is painful.

That’s where Axelar comes in. Axelar is a protocol layer that makes cross-chain communication as seamless as clicking a link. Not another bridge promising security. Not another Layer 1 promising to unite them all.

Just infrastructure that makes the question of “which chain” start to matter less.

Axelar is a proof-of-stake blockchain that serves as an interoperability network connecting 80+ blockchains. Think of it as a router for blockchain messages, assets, and smart contract calls.

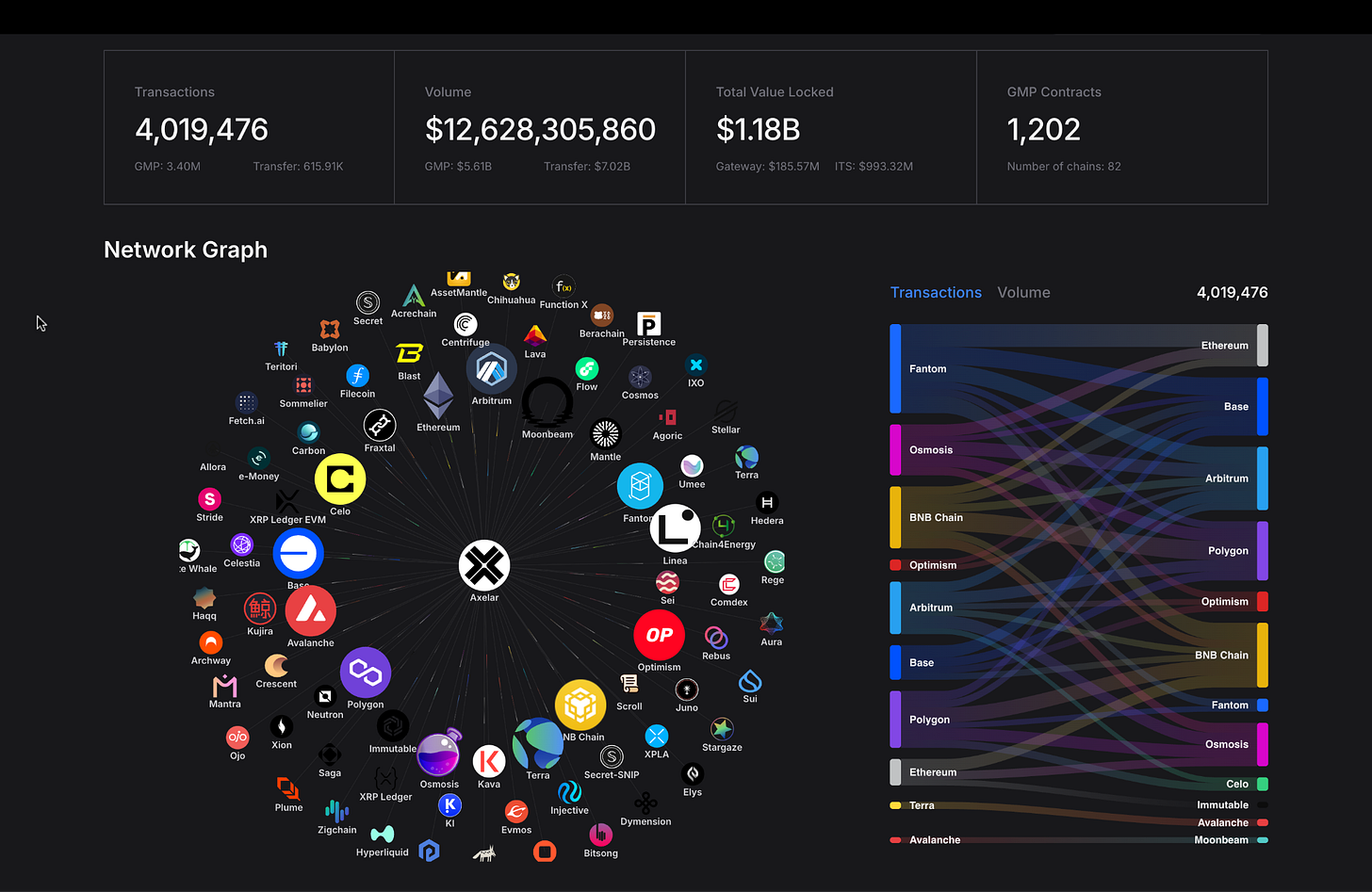

The network operates as a decentralised overlay that sits between blockchains, enabling them to exchange information and value without needing direct connections to every other chain. Instead of 50 blockchains requiring hundreds of individual bridges, each chain connects once to Axelar and gains access to the entire network.

Built on Cosmos SDK with 75 validators securing the network, Axelar uses a hub-and-spoke model. Each blockchain is a spoke connecting to the central hub, which coordinates cross-chain transactions through a decentralised validator set rather than centralised multisigs or oracles.

The key difference from traditional bridges: Axelar doesn’t just move wrapped tokens. It enables General Message Passing (GMP), meaning developers can send arbitrary data and execute smart contract calls across chains. This turns static bridges into programmable infrastructure.

How Axelar Works: The Technical Flow

When you initiate a cross-chain transaction through Axelar, here’s what happens:

Gateway Contracts: Each connected blockchain has an Axelar gateway smart contract. When you want to move assets or data from Ethereum to Avalanche, you interact with Ethereum’s gateway.

Validator Observation: Axelar’s 75 validators monitor events on the source chain. When your transaction hits the gateway, validators observe and verify it independently.

Consensus Layer: Using threshold cryptography, validators reach consensus on the transaction’s validity. This requires a supermajority agreement. No single validator or small group can approve transactions alone.

Execution: Once consensus is reached, validators sign the transaction for the destination chain. The gateway contract on Avalanche receives the instruction and executes it - minting tokens, calling smart contracts, or passing data.

This process typically takes a few minutes, depending on network congestion. The security model relies on economic incentives: validators stake AXL tokens and face slashing if they act maliciously.

General Message Passing is Axelar’s core differentiator from traditional bridges. Beyond moving assets, GMP lets developers build applications that execute logic across multiple chains. A lending protocol could accept collateral on one chain and issue loans on another. An NFT could be minted on Ethereum and displayed on Polygon without wrapping.

The network also includes the Interchain Token Service (ITS), which preserves token fungibility across chains. Instead of creating wrapped versions of tokens on each chain, ITS maintains a unified token identity, solving the liquidity fragmentation problem that plagues current bridges.

How to Use Axelar: The Practical Guide

For most users, interacting with Axelar happens through integrated applications rather than directly. But if you want to move assets cross-chain, here’s the process:

Step 1: Set Up Your Wallet

Use a wallet compatible with Axelar’s network. Keplr works for Cosmos-based chains, while MetaMask or WalletConnect-enabled wallets work for EVM chains.

Step 2: Get AXL Tokens (Optional)

For most bridging operations through applications like Satellite, you won’t need AXL tokens. The platform handles gas payments in the background. However, if you’re interacting directly with Axelar’s network or staking, you’ll need native AXL tokens. Your Axelar address starts with “axelar1”. use this to receive AXL from exchanges.

Step 3: Access a Cross-Chain Interface Navigate to applications built on Axelar like Satellite.money or Squid. These interfaces abstract the protocol complexity, making cross-chain transfers feel like simple swaps.

Step 4: Bridge Your Assets

Select your source chain (where your tokens currently are)

Choose your destination chain (where you want them)

Pick the asset and enter the amount

Input the recipient address on the destination chain

Review transaction details and confirm in your wallet

Wait for validator consensus (typically a few minutes)

Verify arrival using block explorers

The interface handles the complex validator coordination, gateway contracts, and cross-chain messaging automatically. You just see a straightforward transfer flow.

For Developers: Axelar provides SDKs and APIs that let developers integrate cross-chain functionality into their applications. Using the Axelar.js SDK, developers can enable their dApps to:

Send messages between chains

Execute smart contract calls cross-chain

Deploy tokens across multiple networks with ITS

Manage gas payments across different ecosystems

The developer experience focuses on abstracting blockchain-specific complexity, letting builders create “interchain dApps” without managing individual chain integrations.

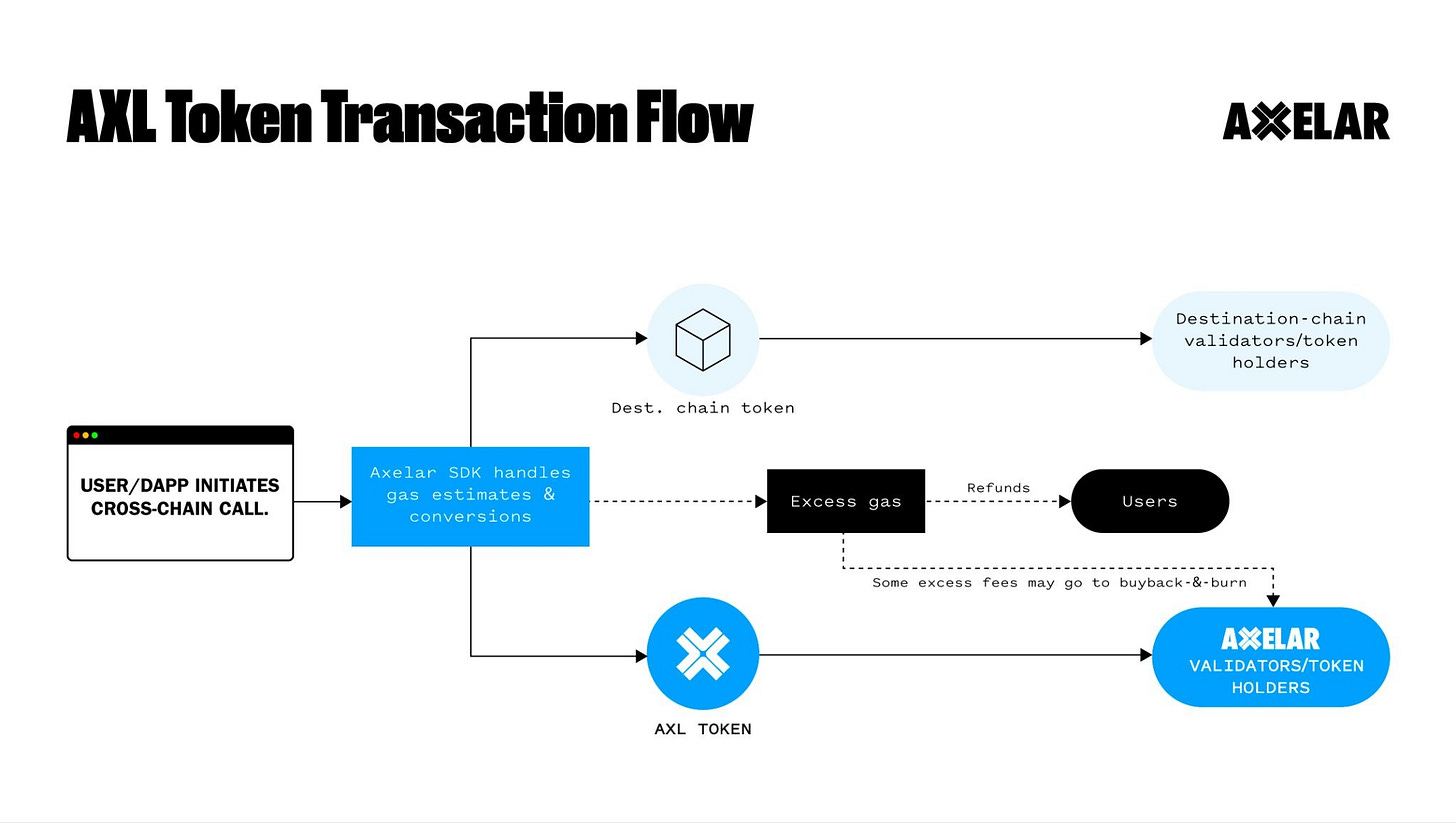

The AXL Token

The AXL token serves three primary functions in the Axelar ecosystem:

Validators stake AXL to participate in consensus and earn rewards. As of October 2025, staking yields hover around 15-22% APR, though this fluctuates with network participation. Delegators can stake through validators using wallets like Keplr, aligning economic incentives with network security.

AXL holders vote on protocol upgrades, new chain integrations, and parameter changes. This includes decisions about which blockchains to connect, security thresholds, and economic parameters.

While users can pay gas fees in various tokens through Axelar’s gas services, AXL can be used directly for cross-chain transaction fees.

Competitors: The Interoperability Landscape

The interoperability space includes several protocols with different approaches:

LayerZero connects 130+ blockchains using an oracle-and-relayer model. Instead of a dedicated blockchain, LayerZero uses off-chain entities (typically Google Cloud for the oracle and LayerZero Labs for the relayer) to verify cross-chain messages. This creates faster finality but introduces dependency on these entities. LayerZero focuses on ultra-light messaging and has strong adoption in gaming and fast DeFi applications. The tradeoff: speed and flexibility vs. the decentralised validator set that Axelar employs.

Wormhole uses a Guardian network of 19 validators to verify cross-chain events. It’s primarily focused on token bridges and NFT transfers, with strong adoption for moving liquidity between chains. Wormhole has processed over 1 billion messages but operates more as a bridge protocol than a programmable interoperability layer. Its security model relies on Guardian consensus rather than economic staking.

Chainlink CCIP (Cross-Chain Interoperability Protocol) leverages Chainlink’s existing oracle network to transmit messages between blockchains. It targets enterprise and institutional applications with built-in compliance features and privacy protections. CCIP connects 60+ chains and emphasises security through battle-tested oracle infrastructure. However, it’s more centralised than validator-based approaches and carries potential vendor lock-in.

Axelar positions itself between speed-focused protocols like LayerZero and security-maximised approaches like Chainlink CCIP. The network prioritises programmable interoperability over pure speed, enabling complex cross-chain applications rather than just asset transfers.

Why This Matters Now

The blockchain industry is maturing beyond the “one chain to rule them all” mentality. Ethereum won’t replace Solana. Cosmos won’t replace Avalanche. Each chain has legitimate strengths, and the winning architecture is a connected ecosystem.

Axelar’s approach of a dedicated blockchain for interoperability makes technical sense. By operating as infrastructure rather than an application, it can remain neutral and focus on security and reliability. The validator model creates economic alignment without centralised control points.

The network’s partnerships with institutions like Mastercard, Microsoft, and J.P. Morgan’s Onyx platform signal that interoperability infrastructure is moving from experimental to production-grade. Real-world asset tokenisation and institutional DeFi require reliable cross-chain rails, not risky bridges with exploit histories.

For developers, Axelar represents an opportunity to build once and deploy everywhere — accessing liquidity and users across the entire blockchain ecosystem without managing dozens of integrations. For users, it promises a future where chain selection becomes invisible, similar to how you don’t think about which server hosts a website.

The interoperability challenge won’t be solved by a single protocol. Different use cases will favor different approaches — LayerZero for speed-critical applications, Chainlink CCIP for institutional compliance, Wormhole for simple bridges. But Axelar’s comprehensive approach, combining security, programmability, and broad chain support, positions it as core infrastructure for the next generation of blockchain applications.

Axelar doesn’t force you to choose between sovereignty and interoperability. It’s betting that the future isn’t one chain winning, but all chains talking. Whether that future arrives depends on whether developers and users decide that seamless cross-chain interaction is worth building on top of infrastructure designed for exactly that purpose. The exits will keep multiplying. The question is whether the connections can keep up.

That’s all for the week. I will see you tomorrow with a crypto profile.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.