The Bitcoin Retirement Era 👴

The history of money is the history of who gets to decide what happens to it

For most of the 20th century, the answer to this question was simple. Your employer decided. Companies offered pensions, managed the investments, and bore the risk. If the fund performed well, they kept the extra. If it tanked, they covered the shortfall. You had no say, but you also couldn’t lose.

Then came the 401(k), shifting the responsibility. You chose the investments and bore the risk. But, you didn’t have total freedom of choice. Your employer still acted as the gatekeeper, offering only a menu of “prudent” options. Initially, courts once deemed common stocks too risky for retirement accounts. Later, index funds were considered too passive. The definition of prudence evolved, but paternalism remained.

On October 15, 2025, Morgan Stanley redrew the line. The firm’s 16,000 financial advisors can now recommend Bitcoin exposure to any client, including those with IRAs and 401(k)s. There are no wealth minimums, no aggressive risk tolerance requirements. Just Bitcoin, sitting alongside bonds and blue chips in the portfolios that fund America’s golden years.

The stakes are staggering. U.S. retirement assets total $45.8 trillion. Even a 1% shift in allocation means $270 billion flowing into crypto. At 2%, it’s over half a trillion.

What is behind this beautiful math? I have some thoughts to share of course.

Polymarket: Where Your Predictions Carry Weight.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it. Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

👉 Explore Polymarket

Until October, Morgan Stanley restricted crypto access to clients with over $1.5 million in assets, an aggressive risk tolerance, and a taxable brokerage account. Retirement accounts were entirely off limits.

Now those guardrails are gone.

Advisors aren’t buying Bitcoin directly for clients. Instead, they’re allocating funds into regulated crypto investment products, primarily Bitcoin ETFs from BlackRock and Fidelity. Future additions may include Ethereum and Solana ETFs once approved.

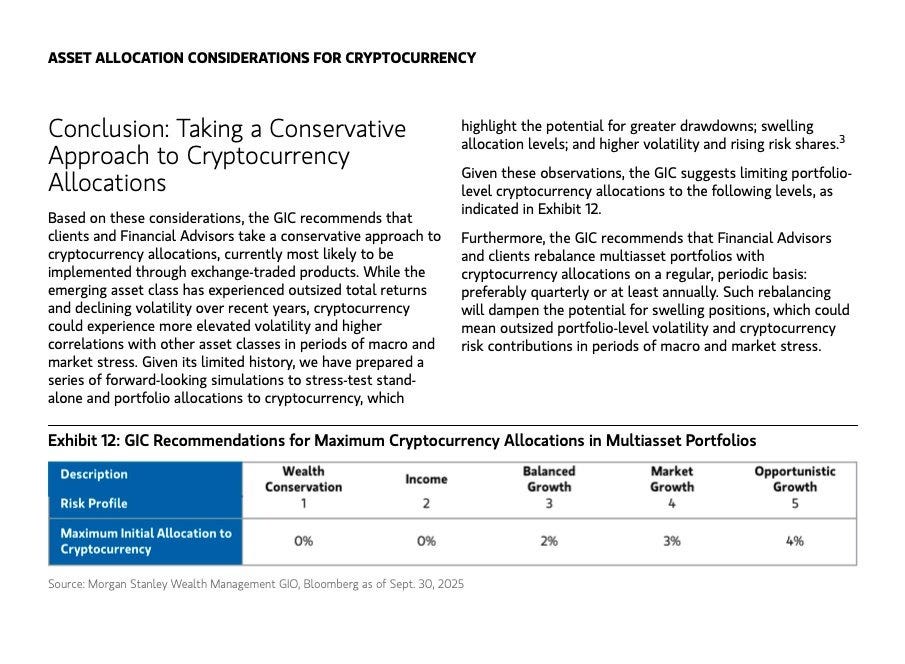

The firm’s automated portfolio systems track each client’s crypto exposure in real time to prevent over-concentration. Morgan Stanley’s Global Investment Committee recommends 4% allocation in “Opportunistic Growth” portfolios for younger or aggressive investors, 2% in “Balanced Growth” portfolios, and 0% for preservation or income strategies.

These limits serve as legal armour. Under the Employee Retirement Income Security Act (ERISA), the 1974 federal law that governs retirement plans and defines what counts as “prudent” investing, companies sponsoring 401(k) plans have fiduciary duties to act in the best interest of participants. If a firm includes imprudent or excessively risky investments without proper oversight, participants can sue for losses. To win, plaintiffs must prove that fiduciaries breached their duties by offering unsuitable investments or managing them with inadequate monitoring.

Morgan Stanley’s 4% cap and real-time exposure tracking are designed to withstand such lawsuits. The firm is betting that conservative allocation limits and real-time risk monitoring will protect it from claims that it negligently exposed retirees to crypto volatility. Whether this defence holds when Bitcoin drops 70% remains untested.

Advisors must log crypto recommendations through internal systems. Compliance teams ensure clients acknowledge volatility disclaimers and risk tolerance adjustments before investing.

While Bitcoin ETFs are available immediately, the firm’s E-Trade platform, also owned by Morgan Stanley, will roll out direct Bitcoin, Ether, and Solana trading in 2026, powered by Zerohash infrastructure.

It’s still highly regulated, risk-scored, and tightly capped by allocation software. But it effectively turns crypto into a mainstream investment option accessible through 80% of American retirement accounts under Morgan Stanley’s management.

Why Now? The Policy Window Just Opened

Three regulatory shifts created the conditions for Morgan Stanley’s move.

First, President Trump’s executive order in August directed the Department of Labor (DOL) and SEC to reexamine rules on alternative investments in 401(k)s and IRAs. The order effectively rewrote retirement investment boundaries, signaling to financial institutions that regulatory backlash was no longer a concern.

Second, the GENIUS Act, signed into law in July established the first comprehensive stablecoin regulation in the U.S. By mandating 1:1 USD reserve backing and quarterly audits, the law reduced systemic vulnerabilities and gave institutions confidence that crypto infrastructure now had regulatory legitimacy.

Third, the DOL reversed its 2022 cautionary stance on crypto in retirement plans. By allowing fiduciaries to assess crypto investments under traditional ERISA standards, the DOL normalised its inclusion in 401(k)s and IRAs without requiring special exemptions.

Together, these changes created a narrow policy window. Morgan Stanley was the first major wealth manager to seize it, while competitors like Fidelity and Schwab were slower due to internal risk committees still debating exposure limits.

Wall Street reads the regulatory tea leaves and concludes that the risk of not offering crypto now exceeds the risk of offering it. But there’s a deeper current driving this shift: what institutions now call the “debasement trade.”

It’s the same thesis goldbugs and Bitcoiners have argued for years. Central banks won’t stop printing money. Fiat currencies will lose purchasing power. Traditional safe havens like gold are surging, the dollar index is in a multi-year downtrend, and investors are rotating into assets with fixed supply. What was once fringe thinking is now institutional consensus. Bitcoin is now an anti-debasement by design: fixed supply, transparent issuance, trustless verification. When money itself is being repriced, Bitcoin starts looking less like speculation and more like capital preservation.

Who Moves Next

Morgan Stanley’s bold move puts pressure on every other wealth manager with a retirement business. Here’s where the major players stand.

Fidelity launched a no-fee Crypto IRA in 2022 and now offers spot Bitcoin ETFs. As the largest 401(k) provider by assets, holding over one-third of U.S accounts, Fidelity has expanded to include Ether and Solana funds. However, it has yet to integrate crypto into the same managed retirement portfolios that advisors oversee daily.

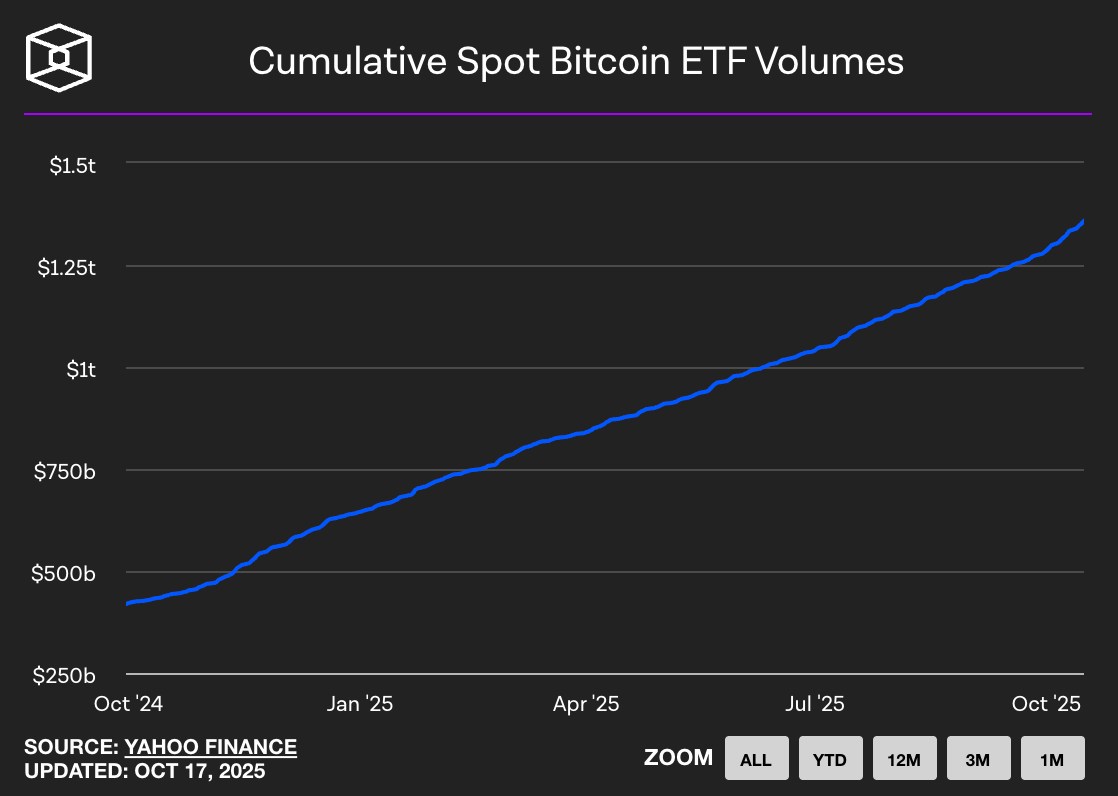

BlackRock’s Bitcoin ETF, IBIT, holds $84 billion in assets with a 57% market share of the Bitcoin ETF market. It’s the fastest-growing ETF in history and may reach $100 billion in under 450 days. BlackRock’s advantage is product dominance, not distribution.

Charles Schwab is set to launch spot crypto trading in 2026, targeting Gen Z investors who account for 33% of new accounts and are under 28 years old. Schwab plans a full product suite by early 2026, though it hasn’t yet opened retirement account access.

Vanguard, with $10 trillion in assets under management, is exploring access to third-party crypto ETFs after years of resisting the asset class. A policy reversal prompted by pressure from clients and a new CEO from BlackRock, has made Vanguard more open to crypto. However, it remains the most cautious among major players.

Goldman Sachs is focusing on tokenised money-market funds via its GS DAP platform in partnership with BNY Mellon for on-chain fund records. The firm is building tokenised asset infrastructure rather than pursuing retail crypto exposure.

The broader banking sector is also mobilising. JPMorgan is expanding its use of JPM Coin for cross-border settlements and serving crypto funds. Citigroup plans to launch digital asset custody in 2026 and is part of a G7 stablecoin consortium. Bank of America, Deutsche Bank, UBS, and Barclays are all participating in multinational stablecoin research groups.

A new player deserves attention: Erebor, a bank based in Columbus, Ohio founded by Palmer Luckey and Joe Lonsdale, both billionaire Trump supporters. Erebor received conditional approval from the Office of the Comptroller of the Currency in October. The tech and crypto-focused bank aims to serve emerging firms in sectors like AI and digital assets. Its approval signals that regulatory doors are opening for institutions purpose-built for crypto banking.

Legacy institutions are racing to retrofit crypto into their existing wealth management infrastructure, while new players are building from the ground up with crypto-native rails.

While Morgan Stanley’s move brings crypto into individual retirement accounts, state pension funds have been quietly accumulating Bitcoin for over a year.

Wisconsin and Michigan have disclosed holdings in BlackRock’s IBIT and ARK’s Bitcoin ETFs worth nearly $400 million combined.

The convergence between Main Street and institutional Wall Street risk-taking is accelerating. Pension funds operate under fiduciary duty, meaning their managers must justify every allocation as prudent and in the best interest of beneficiaries. If they’re comfortable adding Bitcoin, it’s because they’ve concluded that the diversification benefits and asymmetric upside outweigh the volatility risk.

Now that retirement accounts via Morgan Stanley are joining in, it highlights a stealthy but massive reallocation of long-term savings into digital assets. Conservative strategies cap exposure at 5% of a portfolio, while aggressive allocations could reach 35%, depending on risk tolerance.

Bitwise analysts estimate that a 1-2% shift in $45.8 trillion of retirement assets equals $450 to $900 billion flowing into crypto, potentially driving Bitcoin to $200,000. The first inflows could arrive this fall, coinciding with potential Fed rate cuts.

But if crypto drops 70%, that’s $300 billion in retirement losses, which could ripple through consumer spending and erode trust in retirement advisors.

What happens when everyone else follows.

Deutsche Bank analysts predict that central banks may hold significant amounts of Bitcoin and gold by 2030, thanks to growing institutional popularity and a weakening dollar. Gold has already surpassed the $4,000-an-ounce barrier, while Bitcoin is trading just below its record high.

The dollar’s share in global reserves has fallen from 60% in 2000 to 41% in 2025. This decline has spurred record inflows into gold and Bitcoin ETFs, which reached $5 billion and $4.7 billion in June alone.

JPMorgan analysts estimate that stablecoin market growth could translate into $1.4 trillion of additional demand for the dollar by 2027, though this depends on overseas investment appetite. The interplay between Bitcoin’s rise, stablecoin adoption, and dollar hegemony is still unfolding.

What is clear, however, is that retirement portfolios are being rebuilt through Bitcoin ETFs, whether regulators, advisors, or retirees fully understand the implications.

If Fidelity, Schwab, and Vanguard follow Morgan Stanley’s lead, the industry will have effectively decided that crypto is no longer an alternative asset. It’s now core.

That’s it about it. See you next week with another profile.

Until then … stay extremely curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.