The BNB Bailout 🔶

Memecoin degens got bailed out. Responsible traders didn't. What message does this send?

There’s an old thought experiment in philosophy called the Trolley Problem. A runaway trolley is heading toward five people tied to the tracks. You can pull a lever to divert it to another track, where it will kill only one person. Do you pull the lever?

Binance just invented a new version. The trolley is heading toward 160,000 memecoin degens who YOLO’d their life savings in 20x leverage. You can pull a lever and give them $45 million in free BNB. The one person tied to the other track is “moral hazard,” a concept so boring that most people would rather get liquidated than read about it.

Binance pulled the lever.

On October 10, 2025, crypto markets experienced their worst liquidation event in history. Twenty billion dollars in leveraged positions vanished in hours. Bitcoin dropped 15%. Altcoins plummeted 50% or more. Over 1.6 million traders were wiped out.

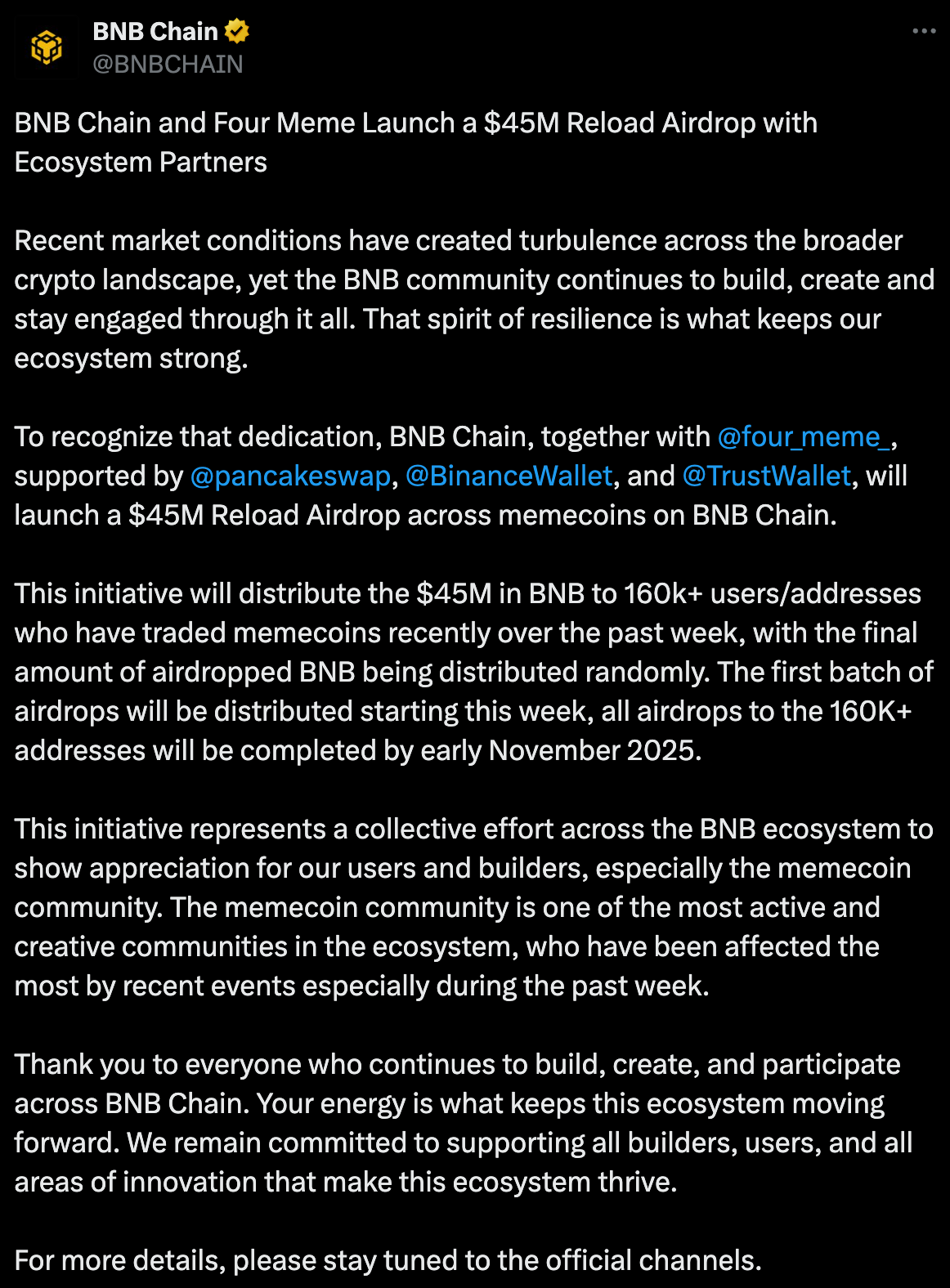

Three days later, Binance and BNB Chain announced a $45 million “reload airdrop” for memecoin traders who lost money in the crash.

The responsible traders who practised risk management, set stop losses, and avoided over leveraging low-liquidity memecoins? They got to watch from the sidelines while the degens collected their participation trophies.

Today’s mantra: “don’t be stupid, instead, be stupid louder.”

KGeN: Gamers, this is your identity engine.

Tired of replaying your achievements for nothing? With KGeN’s VeriFi protocol, your gaming actions, leaderboard wins, quest completions, they all matter. You build a reputation. You earn rewards. You control your data.

Join quests, tournaments, and drops with real utility

Grow reputation you can take across games and platforms

Earn in-game rewards, rKGEN tokens, and unlock exclusive perks

Identity + distribution + community, all in one protocol

It’s not just play, it’s play that powers your future.

The $45 million airdrop will be distributed to more than 160,000 addresses, with ecosystem partners like Four Meme, PancakeSwap, Binance Wallet, and Trust Wallet helping deliver the funds. CZ himself confirmed the rewards would be allocated randomly to users “who have traded memecoins recently over the past week.”

That last part is critical. Not traders who lost money on Bitcoin. Not users whose ETH positions got liquidated. Not the people holding blue-chip altcoins when the market imploded.

Memecoin traders. Specifically.

The official statement from BNB Chain positioned this as recognising the “dedication” of the memecoin community, “one of the most active and creative communities in the ecosystem, who have been affected the most by recent events especially during the past week.”

Which means the people who screamed the loudest on Twitter got paid to stop screaming.

On the surface, compensating users who suffered losses sounds reasonable. Exchanges have done it before when technical failures cause provable harm. But this case is different. The $45 million airdrop sits on top of $283 million Binance already distributed to cover liquidations tied to the USDe depeg and other platform issues.

Combined, that’s $328 million in total compensation. It’s also one of the largest user relief efforts in crypto history. So why did Binance open the checkbook this wide?

What Really Happened on October 10

The crash started when President Trump announced 100% tariffs on Chinese imports via Truth Social. Bitcoin dropped from $124,000 to $105,000. Panic selling cascaded through altcoin markets. So far, so normal. Markets do this. Leverage kills people. Tuesday ends in Y.

Then things got weird.

On Binance, several altcoins, including Cosmos (ATOM), IoTeX (IOTX), and Enjin (ENJ), briefly showed prices of $0. Not near-zero. Actual zero. Meanwhile, on every other exchange, those same tokens were trading well above zero. ATOM fell 53% elsewhere, which is bad. On Binance, it achieved enlightenment and became nothing.

Binance later claimed this was a “display issue“ caused by changes to decimal settings, not actual market prices. The explanation didn’t satisfy anyone who watched their portfolios vanish while the exchange’s interface showed nothing but zeros.

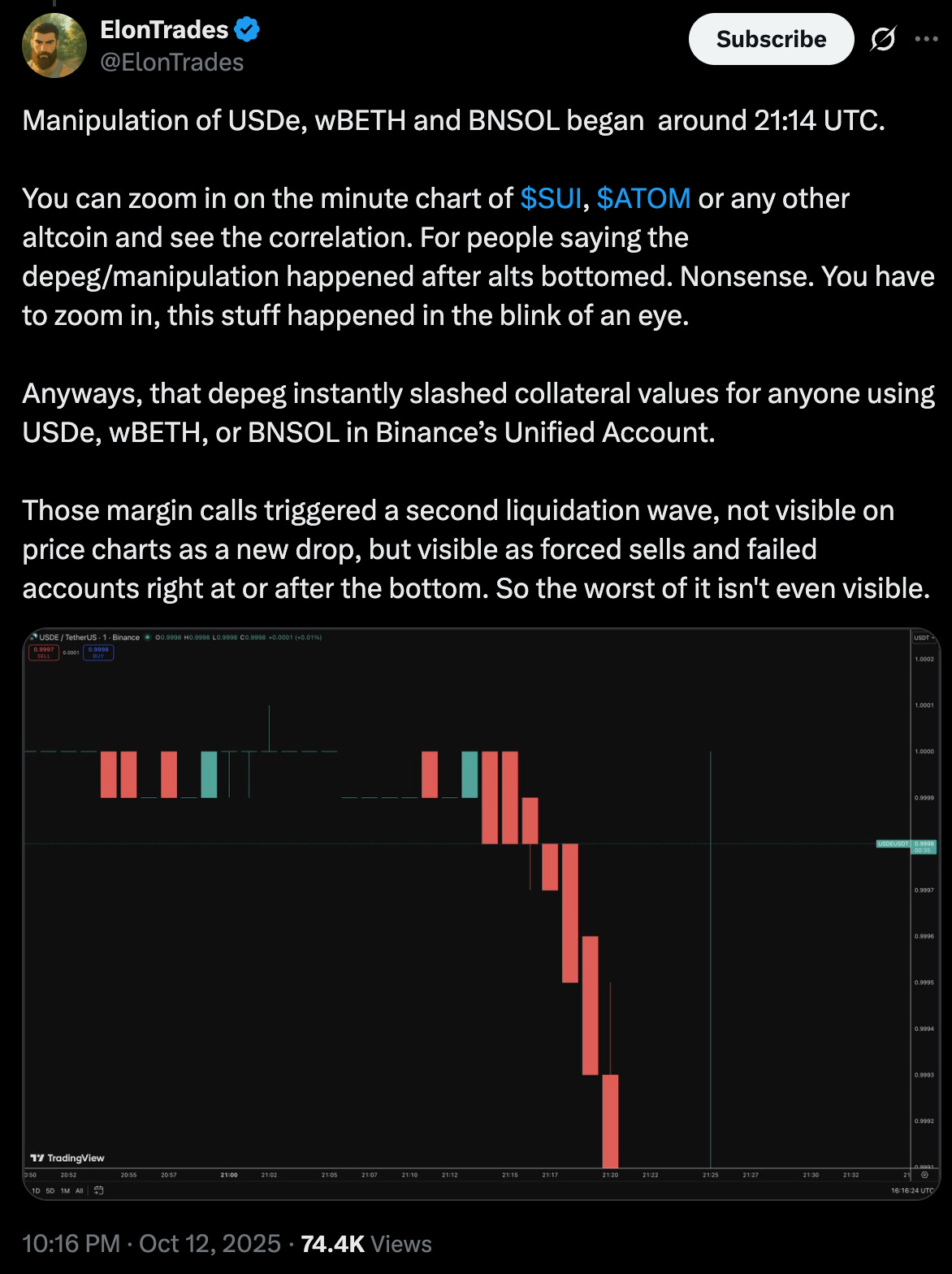

Simultaneously, Ethena’s USDe stablecoin, which maintained its $1 peg on decentralised exchanges like Curve, crashed to $0.65 on Binance. Guy Young, founder of Ethena Labs, explained that Binance was using oracle data from its own thin orderbook instead of external price feeds. That created a massive price discrepancy isolated to Binance, triggering liquidations that wouldn’t have happened on any other venue.

Users reported frozen accounts, failed stop-losses, and an inability to close positions during the worst moments of the crash.

Meanwhile, market maker Wintermute transferred $700 million in Bitcoin to Binance just hours before the crash. When prices started falling, analysts noted that market makers appeared to withdraw liquidity from Binance, leaving order books thin and exacerbating the cascade.

BitMEX co-founder Arthur Hayes chimed in, noting that major exchanges were “liquidating collateral tied to cross-margin positions,” which accelerated the sell-off.

Put it all together and you have a picture that looks less like a technical glitch and more like a perfectly orchestrated profit extraction event. Binance profits from liquidations primarily through collecting liquidation fees (typically 1–1.5% of position size). Liquidated collateral is sold on the open market, with market makers or insurance funds taking the other side, not Binance itself. When Binance’s internal oracle priced USDe at $0.65 while other markets were near $1, many positions were wrongly liquidated. When trading interfaces lag and liquidity drains, cascading liquidations accelerate — each one generating fees. Binance denied any wrongdoing, stating that its “core futures” remained operational and that liquidations on its platform were only a small share of total market activity.

The $283 million compensation package was framed as covering losses from the USDe depeg and other “platform glitches.” The $45 million memecoin airdrop was framed as recognising community resilience.

Neither framing addresses the deeper question, which is why did so many things go wrong at once, and only on Binance?

Let’s assume, for the sake of argument, that everything Binance said is true. The zeros were display bugs. The frozen accounts were due to unprecedented traffic. The oracle issues were isolated incidents. The timing was an unfortunate coincidence.

Even in that best-case scenario, the $45 million airdrop creates a dangerous precedent.

By compensating memecoin traders for losses incurred during extreme volatility, Binance is teaching the market that reckless leverage on low-liquidity assets is fine because the exchange will bail you out if things go wrong.

The airdrop rewards exactly the behaviour that created the problem. Memecoin trading is high-risk, high-reward speculation. Traders who engage in it know the odds. They lever up, chase 100x gains, and accept that most memecoins will rug or collapse. That’s the game.

This is textbook moral hazard. When individuals are insulated from the consequences of risky behaviour, they take on more risk.

This isn’t unique to crypto. Every bailout in history has the same problem. When Bear Stearns and Lehman Brothers collapsed, the Federal Reserve stepped in to prevent systemic risk. The banks learned they could gamble with depositors’ money because the government would backstop losses. The 2008 crisis proved it. The 2020 pandemic bailouts reinforced it.

Now Binance is teaching crypto traders the same lesson.

Who Qualifies? And Why?

The eligibility criteria for the $45 million airdrop raise more questions than they answer.

According to BNB Chain, the airdrop will go to “160,000+ users/addresses who have traded memecoins recently over the past week.” The allocation will be distributed “randomly.”

Random. Not based on actual losses. Not proportional to liquidation amounts. Random.

So a trader who lost $100 might receive the same payout as someone who lost $10,000. Or they might receive nothing while a wallet that traded memecoins once gets a windfall. The lack of transparency makes it impossible to verify whether the distribution is fair or even rational.

More troubling is the asset-class distinction. Why memecoins specifically? Why not altcoins? Why not bitcoin or ETH traders who got liquidated?

The official explanation is that the memecoin community was “affected the most by recent events.” That’s true if you measure losses as a percentage of portfolio value. Memecoins are volatile by design. But measuring total liquidations, the majority came from Bitcoin and ETH positions, which represent far more capital at risk.

Binance’s decision to target memecoin traders specifically suggests the airdrop was never about compensating losses. It was about quieting the loudest critics. Memecoin communities are vocal, organised, and active on social media. A coordinated backlash from memecoin traders could damage Binance’s reputation far more than complaints from institutional Bitcoin holders.

The airdrop is hush money, not restitution.

Strip away the PR spin and the $45 million airdrop serves a clear purpose: deflect attention from what actually went wrong.

Four major issues emerged during the crash, all isolated to Binance:

Four major issues emerged during the crash, all isolated to Binance: interface freezes that prevented users from closing positions, oracle manipulation using thin internal orderbooks instead of external feeds, display glitches showing $0 prices, and liquidation underreporting that captures only one event per second even when hundreds occur simultaneously.

That last one deserves emphasis. If 500 people get liquidated in the same second, Binance reports one liquidation. The $20 billion in reported liquidations could easily be $200 billion or more.

Hyperliquid CEO Jeff Yan pointed out that Binance’s liquidation reporting only captures one event per second, even when hundreds occur simultaneously. This means the true scale of Friday’s liquidations is likely orders of magnitude higher than reported. CoinGlass echoed this, noting that “the actual amount was likely much higher” and that Binance’s methodology creates “100x under-reporting under some conditions.”

Each of these issues points to infrastructure problems, design flaws, or deliberate choices that prioritise exchange profitability over user protection. Paying $328 million in compensation is a small price to avoid admitting that your platform failed when it mattered most.

For context, Binance processes billions in daily trading volume and earns estimated billions annually in fees. A $328 million payout is a rounding error if it prevents regulatory scrutiny, class-action lawsuits, or mass user exodus.

The Too-Big-To-Fail Problem

Binance is the largest crypto exchange in the world. It handles more trading volume than the next three competitors combined. It has survived regulatory battles, lawsuits, and the imprisonment of its founder. It continues to dominate because users have nowhere else to go that offers the same liquidity, asset selection, and global reach.

That dominance creates a different kind of moral hazard. Binance knows it’s too big to fail. Users know it too. Even after October 10, even after the frozen accounts and liquidation chaos, BNB hit a new all-time high of $1,370 just days later.

The market rewarded Binance for bailing out its users. That’s the signal that matters. Not the complaints on Twitter. Not the allegations of market manipulation. The price action says Binance can do whatever it wants as long as it writes checks afterward.

Compare this to FTX, with an important caveat. Sam Bankman-Fried’s exchange collapsed because it couldn’t cover withdrawals. Customer funds were gone, stolen to plug holes in Alameda Research. FTX was trading with user deposits, which is why it imploded when customers wanted their money back.

There’s no evidence Binance is doing anything similar. Customer funds appear to be there. Withdrawals process. The exchange isn’t insolvent. The comparison isn’t about fraud or missing money.

The comparison is about scale and consequence. FTX failed because it ran out of money. Binance will never run out of money. It generates billions from trading fees, liquidations, and spreads.

Binance will never run out of money. It prints it every time a trader opens a leveraged position. The fees, the liquidations, the spreads during volatility. All of it flows to Binance. Paying out $328 million doesn’t hurt when you’re raking in billions.

This is the endgame of centralised crypto infrastructure. Exchanges become banks. Banks become systemic risks. Systemic risks get bailed out.

The difference is that in traditional finance, taxpayers foot the bill. In crypto, Binance is using its own profits. That makes it seem magnanimous. In reality, it’s using money it extracted from traders to compensate the traders it extracted it from. Even if Binance writes a check larger than what it directly earned from liquidation fees on that day, the money is still coming from the ecosystem it operates. The revenue pool that funds compensation is built from trading fees, liquidation fees, and spreads collected from all users over time, including the responsible traders who managed risk properly and never needed a bailout.

That’s not generosity. It’s a refund.

That’s it for this today’s deep dive.

I’ll see you on Friday.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.