Hello,

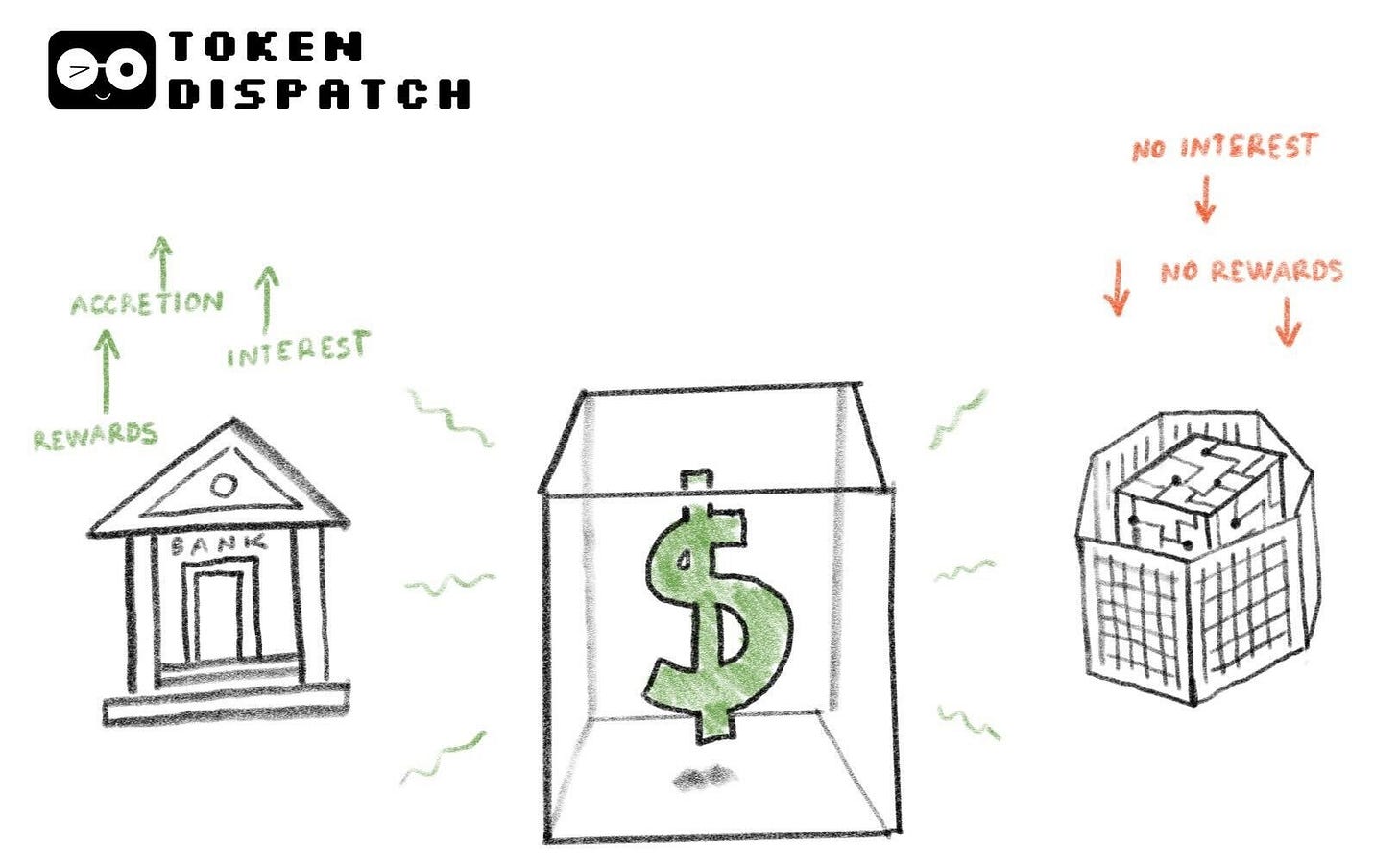

Historically, money was seldom neutral; it was accretive. Long before modern banking, money was expected to earn a return by being held or lent.

Around the third millennium BCE, ancient Mesopotamia practised charging interest on silver loans. Since the 5th century BCE, ancient Greece used nautikà (maritime loans) to fund risky sea trade. In this system, lenders financed a merchant’s cargo for a single voyage, accepting total loss if the ship sank but demanding high interest (often 22-30%) for successful return. In Rome, interest was so embedded in economic life that it often led to debt crises, making voluntary debt relief a political necessity.

Across these systems, the idea that money was not merely a passive store of value remained consistent. Holding money without compensation was an exception. Even as modern finance emerged, people’s opinion about the nature of money strengthened further. Bank deposits earned them interest. It became generally accepted that money that couldn’t compound gradually lost economic value.

It’s in this context that stablecoins entered the financial system. When you strip away the blockchains, they have little in common with any cryptocurrency or speculative asset. They claimed to be digital dollars, adapted for a blockchain-enabled world that blurred geographical boundaries and saved costs. Stablecoins promised faster settlement, lower frictions, and round-the-clock availability. Yet, the U.S. law prohibits stablecoin issuers from paying yield (or interest) to the holders.

This is why the CLARITY Act, currently under deliberation in the U.S. Congress, has become such a contested piece of legislation. When read together with its legislative sibling, the GENIUS Act, which was passed in July 2025, it prohibits stablecoin issuers from paying interest to holders but allows “activity-based rewards”.

This has prompted the banking industry to go up in arms over the current form of the proposed legislation. Some amendments, lobbied by the banking industry, aim to kill rewards on stablecoins altogether.

In today’s deep dive, I will tell you why the CLARITY Act, in its current form, could do to the crypto industry and why that makes the crypto industry visibly upset with the proposed legislation.

Onto the story…

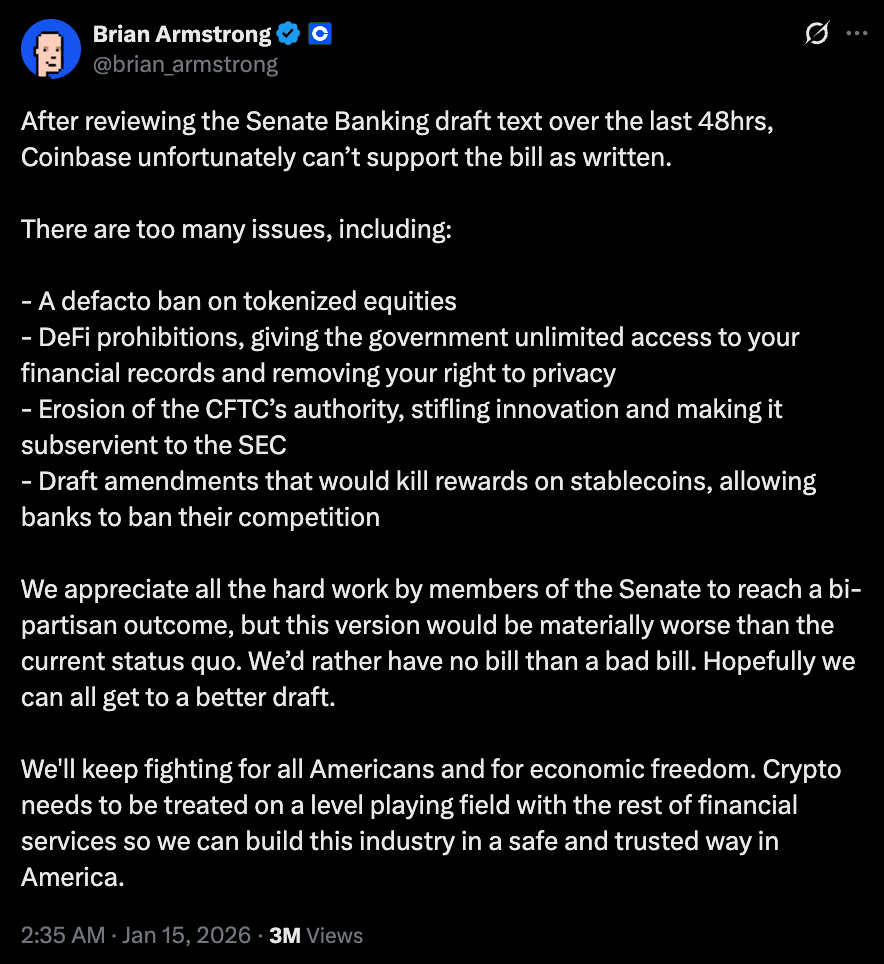

Within 48 hours of reviewing the Senate Banking Committee’s draft, Coinbase publicly withdrew its support. “We’d rather have no bill than a bad bill,” CEO Brian Armstrong tweeted, arguing that the proposal claiming to provide regulatory clarity would leave the industry worse off than under the status quo.

Just hours after the largest U.S.-listed crypto company withdrew its support, the Senate Banking Committee postponed its markup, the executive session that was expected to discuss amendments to the bill.

The core objection to the legislation is hard to miss. The legislation aims to treat stablecoins purely as payment instruments, not as money equivalents in any form. This is the moot point that should upset anyone who expected stablecoins to transform payments for good.

This version of legislation reduces stablecoins to mere conduits, rather than assets that can be used to optimise capital. Money, as I described earlier, never behaved this way. By banning interest at the base layer and activity-based rewards for stablecoin usage, the legislation constrains stablecoins from achieving yield optimisation, which they claim they do best.

This is also where concerns about competition emerge. If banks are allowed to pay interest on deposits and offer rewards on debit/credit card usage, why bar stablecoin issuers from doing the same? This tilts the playing field in favour of the incumbents and undermines the multiple long-term benefits stablecoins promise.

Brian’s critique goes beyond stablecoin yield and rewards and touches on how the legislation hurts the industry more than it helps. He also flagged issues with DeFi prohibitions.

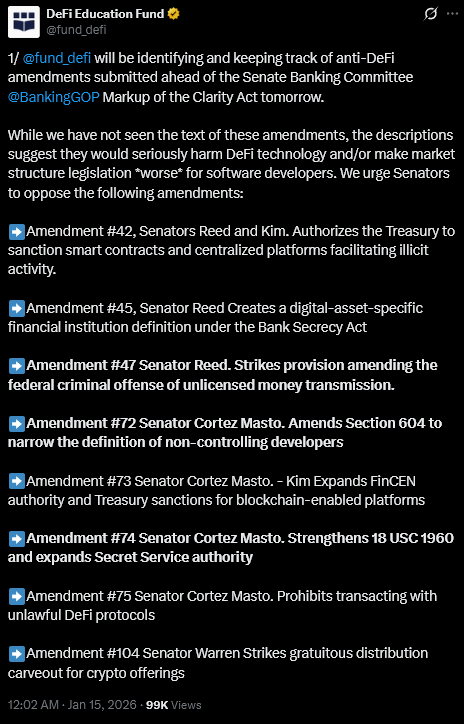

DeFi Education Fund, a DeFi policy and advocacy organisation, also urged Senators to oppose proposed amendments to the legislation that appeared to be “anti-DeFi”.

“While we have not seen the text of these amendments, the descriptions suggest they would seriously harm DeFi technology and/or make market structure legislation worse for software developers,” the organisation posted on X.

Although the CLARITY Act formally recognises decentralisation, it comes with a narrow definition. Protocols that are under “common control” or retain the ability to modify rules or restrict transactions risk being subject to bank-style compliance obligations.

Regulation is expected to introduce scrutiny and accountability. However, decentralisation is not a static state. It is a dynamic spectrum that demands evolving governance and emergency controls that provide resilience, not dominance. These rigid definitions introduce additional uncertainty for developers and users.

Then there is tokenisation, where a gaping hole exists between promise and policy. Tokenised equities and funds offer faster settlement, lower counterparty risk, and more continuous price discovery. Eventually, they enable more efficient markets by compressing clearing cycles and reducing the capital tied up in post-trade processes.

Yet the current draft of the CLARITY bill leaves tokenised securities in regulatory limbo. The language doesn’t explicitly prohibit, but introduces enough uncertainty around the custody of tokenised stocks.

If stablecoins are boxed into payments and tokenised assets are constrained at issuance, the path toward more efficient capital markets narrows considerably.

Some argue that stablecoins can remain as payment instruments, while yield can be offered via tokenised money market funds, DeFi vaults, or traditional banks. It isn’t technically wrong. But there are always players in the market seeking more efficient ways to optimise their capital. Innovation makes people find workarounds. Often, these workarounds could include moving capital offshore. Sometimes, this movement can even be opaque, in a way that could later make regulators regret not anticipating such a flight of capital.

Yet, there’s something that transcends all other arguments as the main argument against the legislation. It is hard not to imagine that the legislation, in its current form, structurally strengthens the banks, weakens the innovation outlook, and handicaps the industry that could help optimise our current markets.

What’s worse is that it possibly does this at two very high costs. The legislation kills any hope of a healthy competition between the banking and crypto industries, while allowing banks to profit more. Second, it leaves customers at the mercy of these banks and without a choice to optimise their yield within regulated markets.

These are high costs, and precisely what keeps the critics from extending their support.

It is concerning that the legislation is framed as an effort to protect consumers, provide regulatory certainty, and bring crypto into the fold, while its provisions subtly suggest the opposite.

The provisions decide in advance which parts of the financial system are allowed to compete for value. While banks can continue to operate within familiar boundaries, stablecoin issuers will feel arm-twisted into existing and operating within a narrower economic landscape.

But money doesn’t like to stay passive. It flows toward efficiency. History suggests that each time capital is constrained in one channel, it finds another. Ironically, this is precisely the scenario the regulation is meant to prevent.

What’s good for the crypto industry is that the disagreements with the legislation extend beyond crypto as well.

The bill still doesn’t command enough support in Congress. Several democrats are unwilling to vote in its favour without discussions and deliberations over some proposed amendments. Without their backing, the bill cannot advance, even if it disregards the crypto industry’s disapproval as noise. Even if all 53 Republicans voted in favour of the bill, it would need support from at least seven Democrats in the full Senate to pass with a supermajority and overcome a filibuster.

I don’t expect the U.S. to arrive at an Act that makes everyone happy. I don’t even think that’s possible and desirable. The problem is that the U.S. is not merely regulating a new classification of assets but is attempting to legislate a form of money whose inherent properties make it highly competitive. This makes it harder, as it forces lawmakers to confront competition and make provisions that could challenge incumbents (banks, in this case).

The impulse to tighten definitions, limit permissible conduct, and preserve existing structures is understandable. However, it risks turning regulation into a defensive instrument that repels capital rather than attracting it.

So, it is important that the pushback against the CLARITY Act should not be interpreted as opposition to oversight. If the objective is to integrate crypto into the financial system rather than simply fence it off, the U.S. must design rules that let new forms of money compete, fail, and evolve within clear regulatory boundaries. This will also compel incumbents to raise their game.

Ultimately, legislation that harms the very constituency it claims to protect is worse than no legislation at all.

That’s all for this week’s deep dive. I will be back with more soon.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

Time will bring change, not as belief, but as structural inevitability.

Systems optimized beyond their load-bearing capacity do not fail because of malice or ambition, but because their framework cannot sustain accumulated stress indefinitely.

Before structural engineering existed, people built dams and towers ever higher. Again and again they collapsed, not due to a lack of will, but due to missing measurement.

Modern economic concentration follows the same pattern.

The question is not whether adjustment will come, but whether more resilient foundations are built before collapse enforces them.

What is not measured will eventually be felt.

A philosophical, epistemic, and scientific elaboration of this perspective, grounded in an understanding of science as disciplined measurement, structural coherence, and responsibility toward reality rather than narrative or authority, is referenced in my publication on Zenodo. The world will read it when it's unavoudable and avoid it as long as possible.

https://zenodo.org/records/18201583