Welcome to our weekly Bitcoin macro and news analysis: Mempool.

We're looking at Week 28 of 2025 (July 07-July 13)

BTC touches $122,000, but signs of fatigue emerge

ETFs notch record single-day inflows

Strategy skips a buy, Wall Street rotates in

S&P 500 hits ATH, still trails in BTC terms

Your GPU Deserves a Side Hustle

Neurolov lets you rent out your GPU power directly from your browser. No downloads, no weird setup.

You earn $NLOV by helping run decentralised AI workloads across Solana and beyond.

Passive GPU income

In-browser AI compute

Powered by Solana + $NLOV

Fire up your GPU and earn with Neurolov!

Week That Was

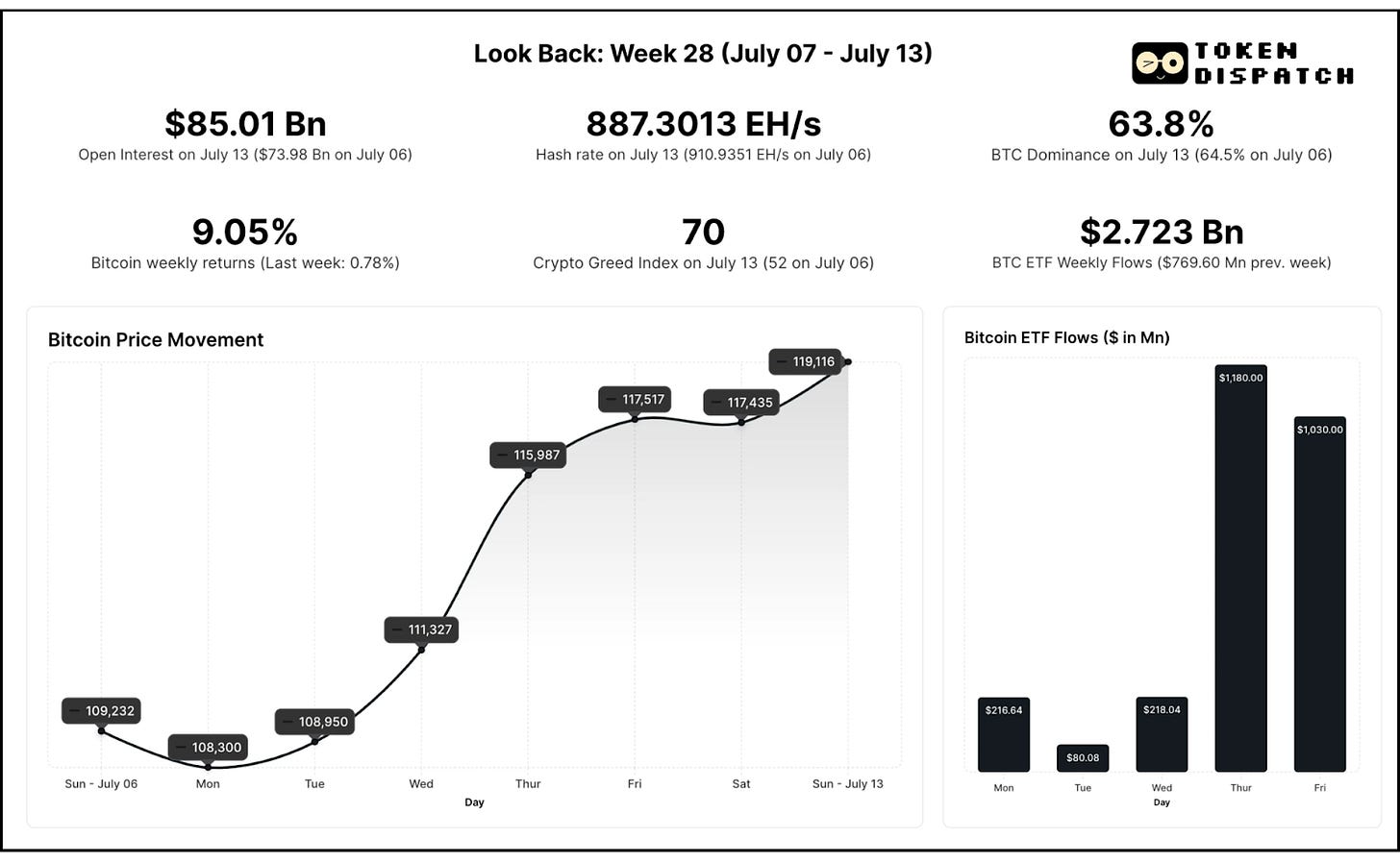

Bitcoin surged more than $10,000 during the week, inching closer to the $120,000-mark on Sunday night, a figure it later breached while on its way to $122,000 in the early hours of Monday.

Its 9% weekly gain, which followed a relatively calmer week (+0.78%), was backed with a solid momentum through the week.

Open interest climbed to a new all-time high at $85.01 billion, up nearly $11 billion from the week before, as traders and investors began taking positions expecting macro events to swing Bitcoin price.

US President Donald Trump signed into law the much-discussed “Big Beautiful Bill” promising more fiscal expansion and reigniting risk appetite across both equities and digital assets alike.

Retail sentiment also flipped with the Crypto Fear & Greed Index climbing from 52 to 70, re-entering “greed” territory for the first time in nearly a month. BTC dominance, however, dipped below 64%, a subtle signal that capital is beginning to explore beyond Bitcoin again, even as it leads the charge.

Zooming in on the chart, the breakout was sharp and linear.

After a quiet drift from ~$109,000 to ~$108,000 on Monday, the price followed a simple template through the week thereafter: Rise, Pause, Repeat.

Each day it closed stronger than the last. On Friday, it leapt from $111,000 to $118,000 and steadily consolidated around the $119,000 mark.

On Thursday, crypto short sellers saw $1 billion being liquidated across 24 hours, wiping out bearish bets worth more than $570 million from Bitcoin shorts alone, as per data from Coinglass.

Investors shouldn’t mistake this as a fireworks scenario. Signs of fatigue are creeping in at such sudden, elevated price jumps. The Relative Strength Index (RSI) readings on the 2-hour chart above crossed 80 in the early hours of Monday, July 14, putting BTC in overbought territory.

RSI acts as a barometer for traders in the market. When it gets too high, it signals that a potential correction might be around the corner.

The vertical climb through the week makes it difficult to predict key technical levels for Bitcoin. But a cooldown or consolidation around the range of $115,000, or even lower, shouldn’t be unhealthy, considering that none of the levels above 110,000 have been retested even once.

Bitcoin’s institutional interest was also solid throughout the week.

ETFs Set Record 1-Day Flows

$2.2 billion

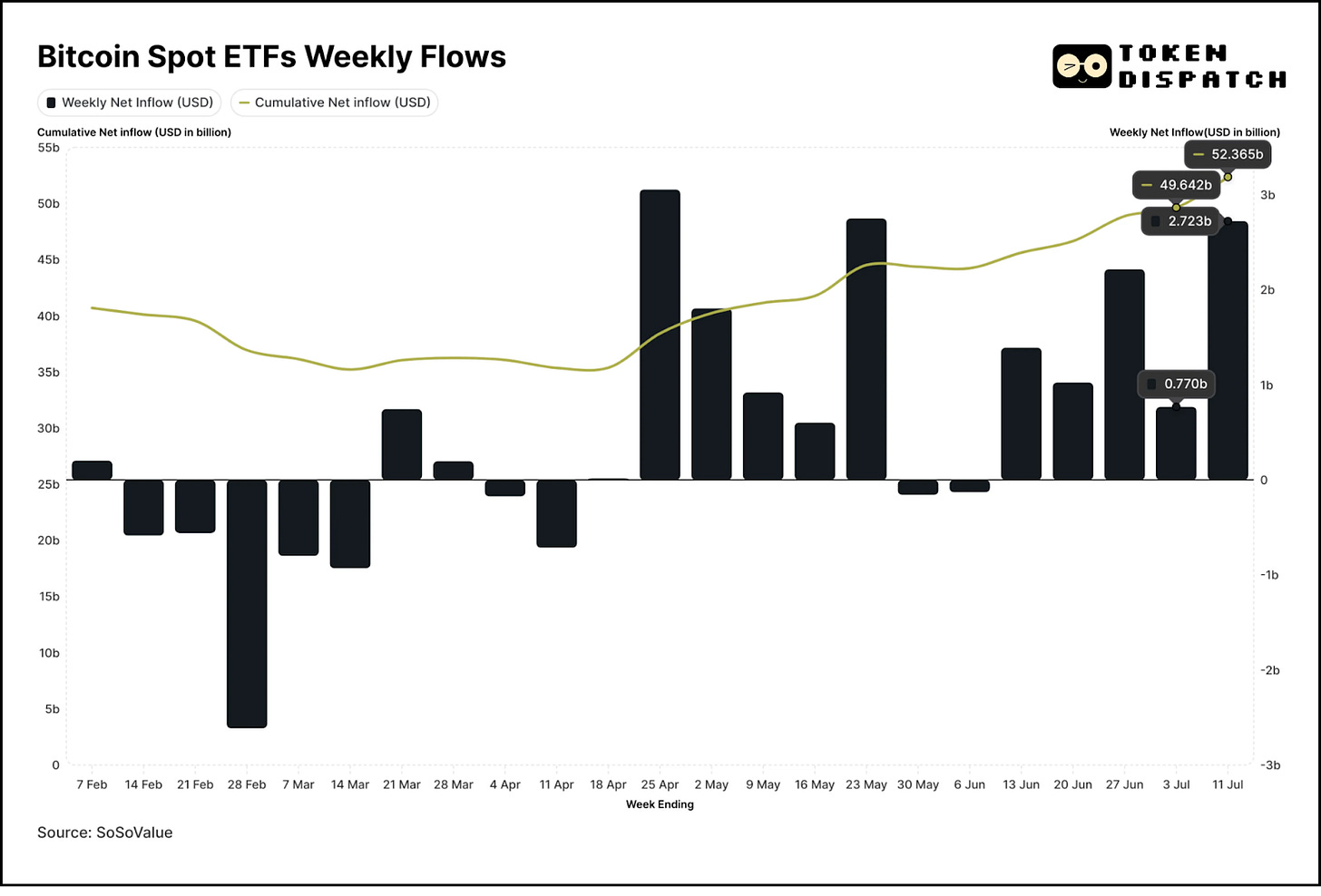

That’s the combined inflow into US Bitcoin ETFs across just two trading days —Thursday and Friday. It’s the first time since their January 2024 launch that we’ve seen back-to-back billion-dollar sessions.

The ETFs recorded their fifth consecutive week of positive net flows with $2.72 billion, also the fifth highest weekly inflows since their inception in January 2024.

Most of that came from BlackRock’s IBIT, which alone absorbed over $1.8 billion during the week, reinforcing its position as the primary institutional gateway into Bitcoin. With this, IBIT became the fastest ETF ever to cross $80 billion in AUM, doing so in just 374 days — faster than even the most popular S&P 500 funds.

Institutional optimism also spilt across Wall Street in most crypto-exposed stocks.

Strategy (formerly MicroStrategy) rose over 7% to touch a seven-month high. The firm, however, skipped its weekly BTC purchase on Monday, July 7, for the first time after 12 consecutive purchases. It opted to issue $4.2 billion in preferred stock instead. This issuance refers to STRD, the 10% Series A Perpetual Stride Preferred Stock, being offered under Strategy’s existing $20 billion shelf registration approved in January 2025.

Read: Asset Wrapped Equities

In June alone, Strategy bought over 17,000 BTC for $1.7 billion.

It was another week of record highs for the exchange stocks, Coinbase and Robinhood, both of which continued their upward momentum.

The former led the pack with a 9% weekly gain, helped by strong trading volumes and new AI-related partnerships. Analysts remain confident in its outlook, with Bernstein’s recent $510 price target reflecting a longer-term belief in its business model.

As for Robinhood, investors showed continuing confidence in their expanding crypto and tokenised asset roadmap in the US and Europe.

Both the miners, MARA and Riot Platforms, stayed positive for another week.

Core Scientific’s story stands apart as the most dramatic over the past month.

Initially, the market welcomed its $9 billion all-stock merger with AI cloud firm CoreWeave as Core Scientific’s stocks jumped 50% from ~$12 to ~$18 in the first week of June. But the stock retraced 30% in the last week. Analysts believe the deal was already priced in, and some flagged concerns around post-deal execution.

Surfer 🏄🏾♂️

Bitcoin’s supply squeeze intensifies as less than 11% of coins remain on exchanges, with institutions including Strategy and other treasury companies stacking and holding for the long term. The aggressive push has fuelled fears of a looming supply shock.

Declining new buyer activity and capital flows have prompted ARK Invest to flag a bearish on-chain signal for Bitcoin despite its bullish moves last week. With dominance at ~64% and volatility at historic lows, the crypto market may be entering a pivotal phase where investors should watch for renewed volatility and shifts in sentiment.

As per data from CryptoQuant, Bitcoin’s recent surge, as accumulator wallets jumped to 71%, signals strong investor conviction. Profit-taking is likely to happen only after BTC hits $130,000, indicating more of an upside before major sell-offs begin..

BTC Outpaces S&P 500

The S&P 500 is on a tear this year, closing at an all-time high of 6,280 and gaining over 6% so far in 2025. Yet, its growth is dwarfed by Bitcoin’s ~30% YTD rise.

In fact, since 2012, the S&P 500 has lost 99.98% of its value in BTC terms. Even tech darlings like NVIDIA, Tesla, and Netflix haven’t kept up over the long run.

In just the last three weeks, Bitcoin has added over $400 billion (20% rise) in market cap. That’s more than Ethereum’s entire market cap, over four times Solana’s, and more than 20 times Hyperliquid’s. It just tells you the sheer scale of Bitcoin compared to the rest of the digital asset market.

That's it for this week's Mempool edition.

See ya next Monday.

Until then …stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

tried neurolov and it worked for 6 hours before it stopped. The catch is for you to keep going then you have to pay for a subscription. Makes no sense to rewarded for something you have to pay for. Will wait for it to reset tomorrow and see what happens. Was not happy with all the hoops I had to jump through to end up having to pay.