The Content Creator Trap 🪤

When every social media post becomes a tradable stock, who really wins?

I know a lot of people who'd sell their soul to be rich. Am I one of them? Maybe. Becoming a social media creator felt like the obvious career pivot. Same energy, better lighting.

Trust me, I tried. For a while, I was convinced I'd found my calling as the next crypto Instagram sensation. Then reality hit. Turns out you need more than your mom and three college friends as followers. My masterpiece about DeFi yields is still sitting in my drafts because I have zero patience to grind my way to 20 - 50k followers first.

Somewhere along the way, being a social media “creator” became the answer to everything. Career crisis? Start a TikTok. Existential dread? Launch an Instagram. Bored on a Tuesday? Film yourself talking about literally anything and hope the algorithm gods smile upon you. It's not even a backup plan anymore. For many people, it's the plan.

And honestly, I get it. The math looks very satisfying.

Create content, get eyeballs, attract brands, make money. You can be a traveller, a chef, a fitness enthusiast, or just someone with strong opinions about reality TV. As long as people watch, brands will pay you to hold their products with a smile.

But here's the thing about escape routes. Sometimes they lead you into a different kind of trap.

Which brings me to today's topic: Zora, one of the most interesting evolutions of the so-called creator economy yet.

Zora is the solution to every creator's monetisation woes, or the most elaborate way to turn your tweets into a stock market. Maybe both.

Future of Web3 Won’t Look Like Web3

Seed phrases. Chain switching. Wallet confusion. These aren’t features—they’re roadblocks.

NEAR Foundation is building the infrastructure to fix that.

They’re backing the tools and protocols that make Web3 usable for everyone—not just devs and crypto-natives.

Here’s what that looks like:

Login with email, self-custody included

One account across chains and apps

Gasless transactions and smooth onboarding

Abstracted chains, no more switching networks

If you're tired of UX getting in the way of adoption, NEAR is already building the fix.

👉Explore what NEAR Foundation is backing

Circling back to the influencer life, you need around 50,000 followers before most brands will even look at you seriously. Even then, you might make $100-500 per sponsored post if you're lucky. That's after months or years of posting consistently, hoping your content hits the sweet spot between what you want to create and what the algorithm wants to promote.

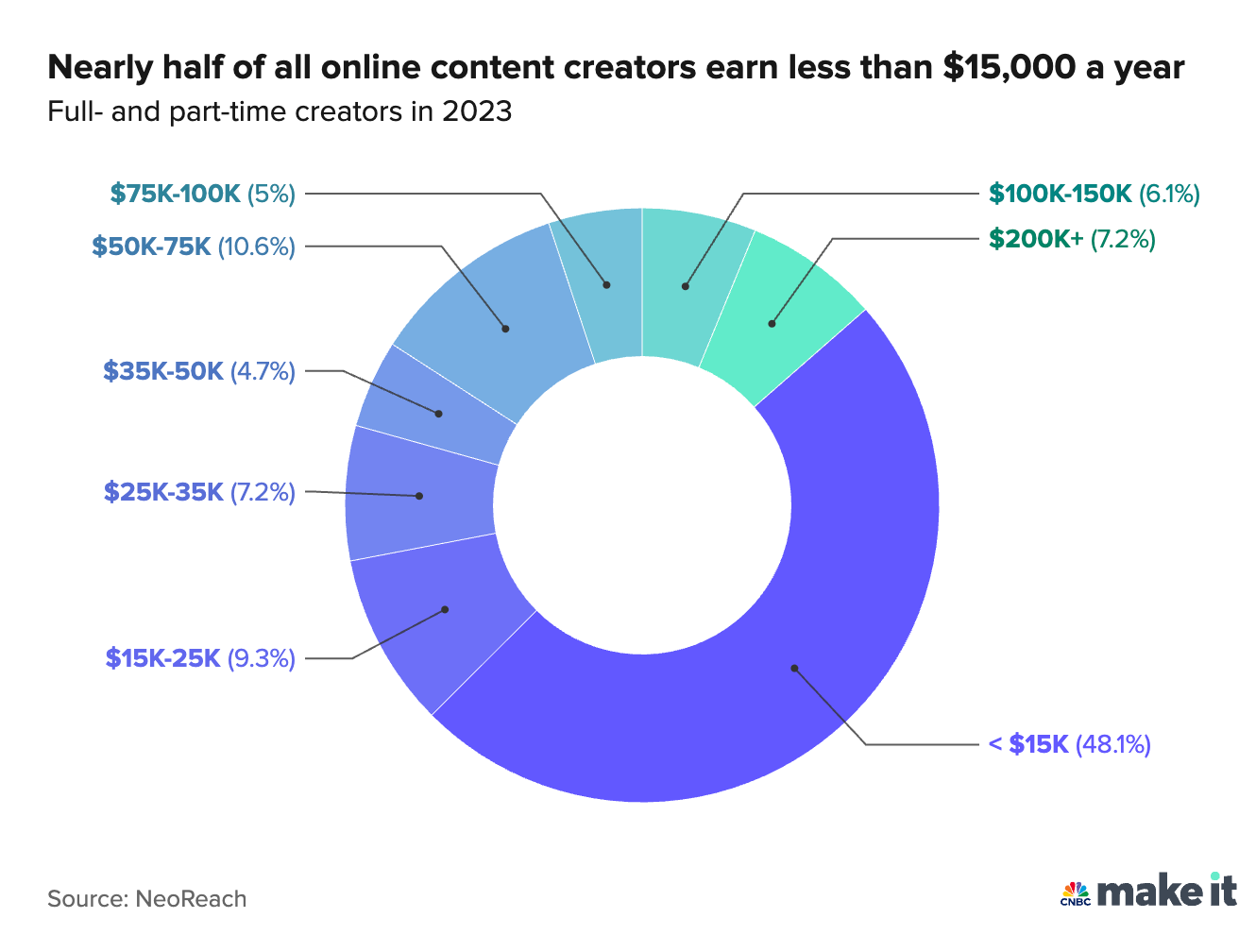

Only about 4% of creators globally earn $100,000 a year or more from their work, according to Goldman Sachs.

Out of the 4.2 billion social media users globally, only around 200 million make money from their content—that’s just 4.7%.

And even among those who are earning something, the reality is pretty bleak.

48% of creators make $15,000 or less per year, according to a 2023 NeoReach study. Fewer than 29% make over $50,000 annually, which is barely a middle-class income in the US.

And speaking of algorithms, those moody AI overlords that randomly decide if your content is worthy, yesterday, your post about tacos got 10K views. Today? Your identical taco post gets 12 views. Why? Because the algorithm woke up and chose violence.

Meanwhile, the platforms rake in billions from advertising while you make all the content that keeps people scrolling. It's a pretty sweet deal. For them. Not so much for you..

Enter SocialFi, the latest crypto buzzword trying to fix this.. The underlying technology has existed for years, but Coinbase's Base App finally made it accessible to people who don't spend their weekends explaining DeFi to confused lil “normies”.

Now let’s go back to Zora. The narrative here isn't about breakthrough innovation.

It's about how a five-year-old protocol that most people had forgotten suddenly found itself processing nearly $500 million in trading volume because it happened to have working infrastructure when Coinbase needed social media features.

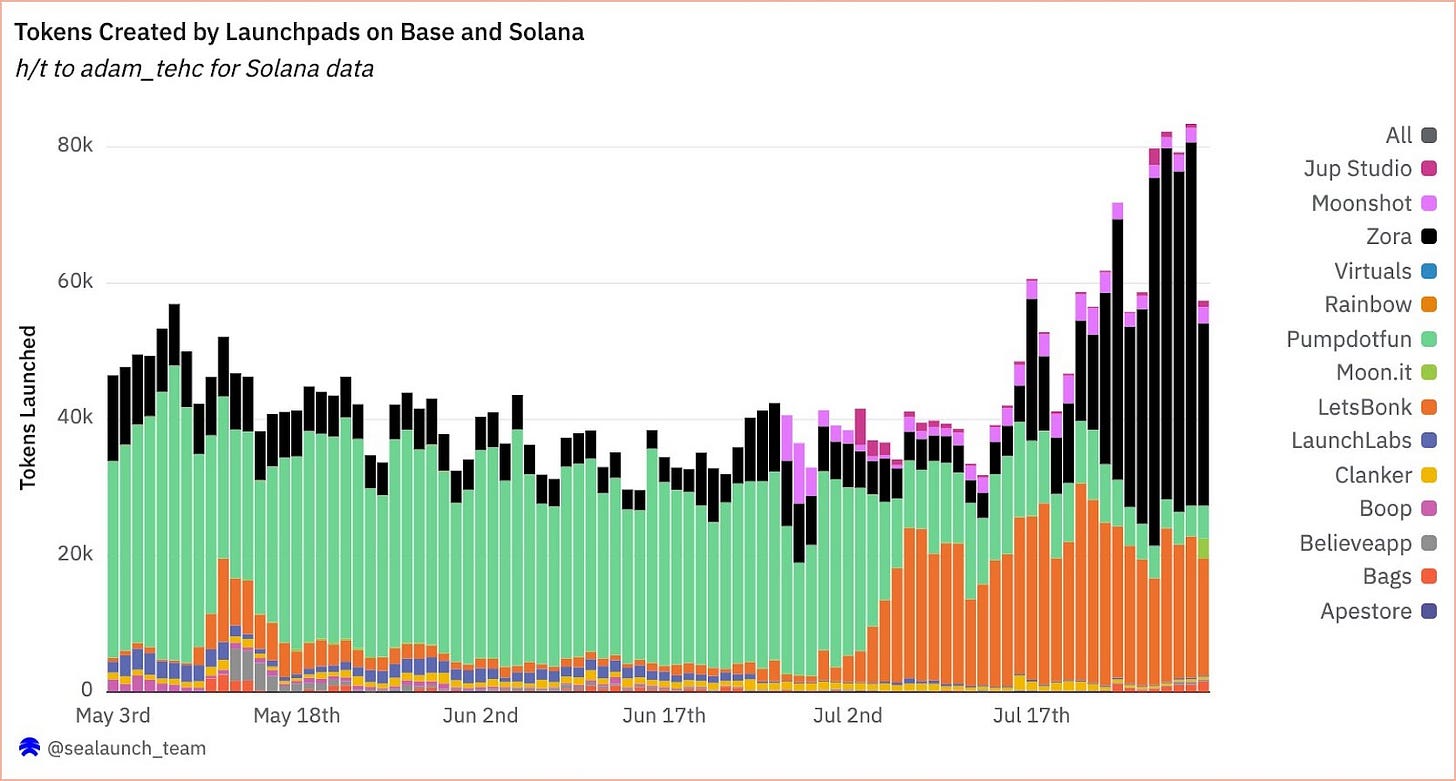

Base went from creating 6,649 tokens daily in early July to over 50,000 by the end of the month. Some days, they were minting 54,000 new tokens while Solana managed 25,000. Most of that activity came from Zora.

Zora's user base jumped from hundreds of thousands to 3 million traders in weeks. Trading volume hit $470 million over a single weekend. They processed 1.6 million new content tokens through Base App.

But here's how it actually works:

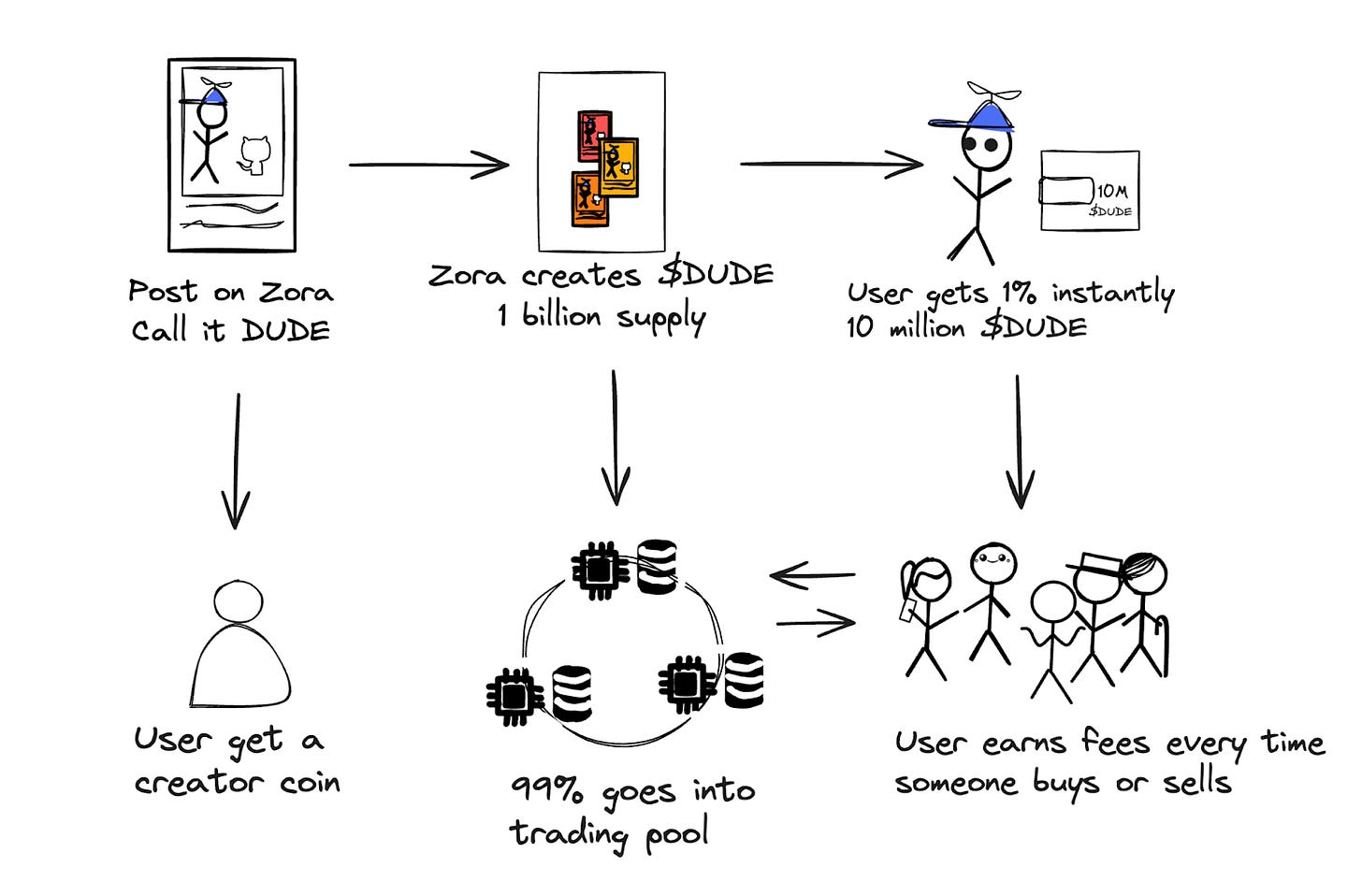

You post something; a photo, a thought, whatever. Zora automatically creates a token for that post. Think of it like creating 1 billion shares of stock in your post. You immediately get 10 million shares (1%), and the other 990 million go into a trading pool where anyone can buy them.

Every time someone trades your post's token, you earn a fee in ZORA tokens. So if your post goes viral and people start speculating on it, you make money from all that trading activity.

You also get a "creator coin" that works differently. Your username becomes the stock ticker (like $JACOB for Jacob Horne). These also have 1 billion tokens, but you get 50% of the supply. Except it's locked up and only unlocks incrementally, when people actually trade your coin. This encourages long-term engagement rather than quick cash-outs.

Zora's co-founder, Jacob’s creator coin, hit a $7.6 million market cap on July 27. His vesting schedule paid out roughly $2,082 the same day. Not bad at all. Look at the math:

Instead of platforms keeping ad revenue while creators get exposure, markets directly decide what your content is worth and pay you accordingly.

Let’s get real about what this means with a concrete example. Take someone like Marques Brownlee (aka MKBHD), who has over 20 million subscribers on YouTube and pulls in 33 million views a month. Estimates suggest he earns anywhere from $8,000 to $130,000 per month just from YouTube ads—that’s $124,000 to $2 million a year, not including sponsorships, merch, or other business ventures. Given his reach and influence, he’s likely on the higher end of that range, if not beyond. His income is steady, structured, and scales with his output. It’s not without pressure, but it’s reliable.

Now compare that to someone like Jacob.

Jacob’s income isn’t fixed. It’s tied to how much people believe in his brand, his activity, and their willingness to speculate on him. That’s exhilarating when things are going up. But if sentiment cools or attention shifts, the value can drop overnight. One week, you’re riding a $7.5M market cap, the next, you’re wondering what on earth happened.

Marques is predictable. Jacob is speculative. One is a salary, the other is a startup stock. Both can work, but one lets you sleep better.

Then there’s the problem of entertainment. Most people scroll through Instagram or TikTok to kill time, see funny memes, or escape from their day-to-day churn for a few minutes. They're not thinking about investment opportunities.

Zora gives you the same visual content and memes, sure, but it's missing that mindless scroll factor. When every post is a potential financial decision, the casual entertainment aspect gets complicated. Even if Zora went completely mainstream tomorrow, there's the mental overhead of treating every post as a potential investment. What if nobody buys your post's token? What if it crashes next week? Suddenly, posting becomes intentional and stressful in a whole new way.

You know how poker stops being fun when there's real money involved? Same thing here. Suddenly, posting a random thought becomes this calculated decision because there's actual money on the line. Do I share this meme or wait for better market conditions? The stress of constant financial decisions creeps into what used to be mindless scrolling.

I spent some time scrolling through Zora to see who's actually making money. Most of the successful accounts belong to people who were already established elsewhere. The creator coins with decent market caps belong to folks like Jacob, Jesse Pollak (who runs Base at Coinbase), and Brian Armstrong (Coinbase's CEO). Many others already have established accounts on X or other social platforms.

Of course, their coins are valuable. They're the ones building and promoting the platform, plus they brought in existing audiences. But this observation highlights what I think is Zora's fundamental limitation. It doesn't solve the problem of discovery.

Zora works great if you already have an audience. If you're Emma Chamberlain with 14 million followers, or Brian Armstrong with crypto industry clout, content coins could be incredibly lucrative. You bring your existing community, and they start trading your tokens immediately.

But what about someone starting from zero? Someone who couldn't make it as a traditional content creator and is hoping content coins might be their breakthrough? This is where I think the model breaks down.

Just like traditional social media, there's a power law at play. A few creators capture most of the attention and trading volume, while everyone else fights for scraps. At least on traditional platforms, there's an algorithm trying to surface new creators to audiences who might be interested.

On Zora, if your content doesn't immediately attract traders, your tokens just sit there with no market activity. There's no algorithm trying to mercifully surface your content to new audiences.

Though there's something appealing about getting paid directly for your content instead of relying on brand sponsorships and platform ad revenue. The idea that every post could potentially earn you money is genuinely exciting, especially if you've been creating content for years without seeing much financial return.

Is this innovation, or are we just financialising everything because we can't figure out a better way to distribute value? Probably both.

Also when you can potentially triple your money in hours by betting on which posts will trend, why wouldn't traders approach it like a casino?

Let's say someone posts a meme about the latest crypto drama. Within minutes, a trader drops $500 on the post's tokens. Not because they care about the creator, but because they think the meme will go viral. Three hours later, when the drama peaks and everyone's sharing crypto memes, they sell for $1,500 and move on to the next hot post. They never look at the creator's other content or care who made the meme.

From the platform's perspective, this is perfect. Every trade generates fees regardless of whether it's gambling or investment. But I think there's a real chance Zora becomes primarily a betting platform disguised as a creator economy, where your income depends more on attracting day traders than building an actual audience. Or maybe that's something creators actually look forward to?

The honest answer is that for most content creators, content coins are unlikely to be the escape route from traditional social media's problems. They might just be a different set of problems, only with better marketing. The creators who succeed on Zora will probably be the same ones who would succeed anywhere else — those with existing audiences, strong personal brands, or just the right timing and luck.

But for the people building these platforms, selling the dream of "turn your posts into money" is in itself a pretty lucrative business model. And maybe that tells us everything we need to know about who these systems are actually designed to benefit.

That’s it for today’s deep dive. See you tomorrow with another one.

Until then… Stay alive.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.