The Content Creator Trap 🪤

When every social media post becomes a tradable stock, who really wins?

Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

We are in that in-between stretch of the holidays where you are technically “back,” but your brain is still under a blanket somewhere. Emails are quiet, timelines are loud, and every second post is either a recap of the year or a promise that 2026 is the year you finally “monetise your passion.”

This week feels a bit like the middle of The Truman Show to me. Truman walks around his perfectly ordinary life, and only slowly realises that everyone else is in on a game he did not design and does not fully understand.

The 2025 creator version of that is you, sitting on the sofa, being told that if you just post more Reels and build a “content stack,” you too can escape your job and find freedom. Somehow the ads never quite mention who owns the cameras, the set, or the ad inventory that pays for all of it.

Which is exactly the mood for today’s rewind: The Content Creator Trap.

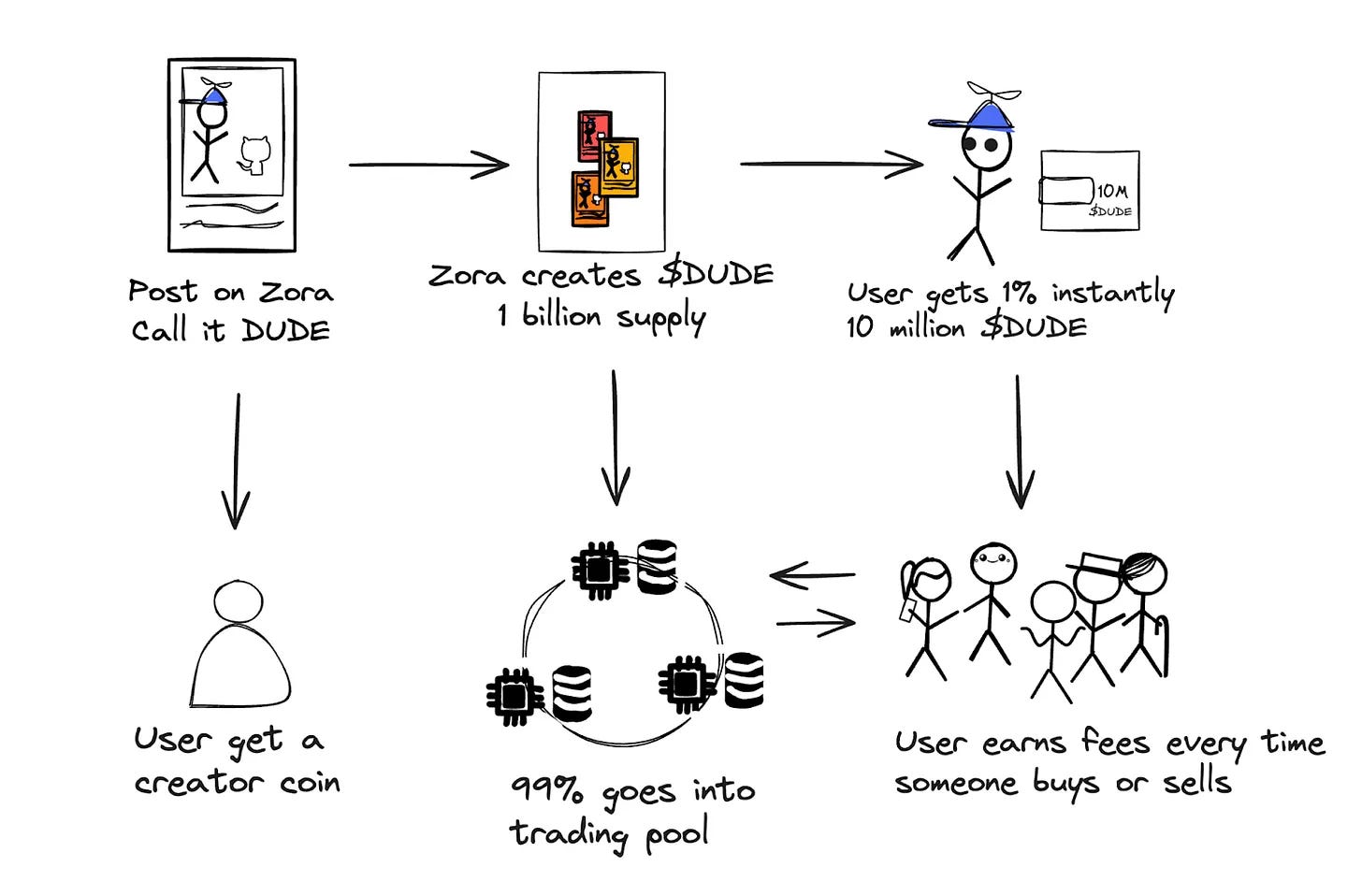

When I wrote that piece, my argument was simple. Turning every post into a financial asset sounds empowering, but mostly upgrades the same old power law. On Zora, your profile is a coin, your posts are coins, attention becomes an order book. It feels like “owning your content”, but it also feels like turning yourself into something that can be traded, farmed and dumped.

That basic machine is still there. Every post is a one-billion-supply coin. Creators get an allocation. They earn on every trade. Recent data puts content-coin volume in the hundreds of millions of dollars, with tens of millions paid out to creators so far.

What has changed is how aggressively the flywheel is now visible. Zora has gone cross-chain, letting people deposit and trade SOL across all its markets, pulling Solana liquidity and new users into the same attention casino. One creator, Nick Shirley, has done about 2 million dollars in volume on his posts alone, with a single post pulling roughly 87,000 dollars of net fresh buy demand into his coin.

They run Zora TV livestreams, highlight “double tap” picks, talk openly about “attention is all you need.” It is entertainment, but it is also order-flow generation.

On-chain dashboards show cumulative DEX volume for Zora coins now north of $400 million. Fees have climbed to just under $10 million since launch, with roughly $7–8 million accruing as protocol revenue and a smaller slice flowing out to coin holders and creators. You can see the step-changes through July and August, then a steady grind up into year-end – real, repeatable fee flow, not just a one-week meme spike. In other words, Zora now looks less like an experimental art platform and more like a mid-sized DeFi business whose balance sheet is literally powered by creators trying not to lose the algorithm lottery. That is the trap in numbers. every time a post “does well,” the coin moves, the protocol skims its cut, and the underlying power curve quietly gets a little steeper.

So, how is it going now? The tech works. Some creators really are making serious money. The market clearly wants this kind of product. But the shape of the curve has not changed. Volume and value still pool around a small number of very visible accounts and the protocol. Most people are still doing unpaid R&D for the feed.

The trap is not “being a creator”. The trap is believing that if you financialise the feed hard enough, it will suddenly become fair. That is the thing I will keep watching in 2026, while the timeline tells you to post more.

That’s it from me for today’s rewind. I’ll be back soon with another 2025 throwback.

Until then, happy holidays. Stay alive.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.