Reality has this peculiar habit of asserting itself at the most inconvenient moments.

Consider the nature of belief. Not religious belief or political conviction, but the stranger, more fundamental kind. The collective agreements that hold civilisation together. We wake up each morning and pretend that coloured paper has value, that invisible numbers in computer systems represent wealth, that corporations are people and people are consumers, and consumers are rational actors making optimal choices.

These shared delusions are remarkably stable. They can persist for decades, centuries even, sustained by nothing more than our mutual willingness to keep pretending. A dollar bill has value because we agree it has value. A stock price reflects reality because we agree that the market is rational. The system works precisely because everyone believes it works.

But belief is a fragile thing. It requires constant maintenance, like a garden or a marriage. Skip too many days of tending, and weeds start growing. Question too many assumptions and the whole structure begins to wobble. When enough people stop believing simultaneously, reality comes crashing back in like water through a cracked dam.

The interesting moments in financial history aren’t when new beliefs form. That happens gradually, almost imperceptibly. The interesting moments are when old beliefs die.

When the collective hypnosis breaks and everyone suddenly sees the emperor’s nakedness all at once.

These moments reveal the arbitrary nature of value itself, the gossamer threads holding together our monetary fictions.

DATs are navigating a challenging transition as the market dynamics that once favored them shift. The companies continue to function, though under different conditions than what initially fuelled their expansion.

For a while the market maintained the illusion that a pile of Bitcoin became more valuable simply by being held within a publicly traded company rather than a private wallet. The premium persisted not because of any logical reason, but because enough people believed it should exist.

What happens when shared financial dreams collide with stubborn arithmetic? The answer is being written in real time across balance sheets and merger documents, in boardrooms and trading floors, as an entire industry grapples with the difference between what markets will pay and what assets are actually worth.

All this high-minded theorising about belief and reality is really just my way of avoiding the obvious question: how did we end up with syringe manufacturers and biotech firms pivoting to Bitcoin treasury strategies?

Your Crypto Shouldn’t be Sitting Idle

With EarnPark, put your BTC, ETH, and stables to work through battle-tested strategies and real onchain yield.

No trading. No stress. Just smart, automated earnings.

Earn yield from DeFi and institutional strategies

Transparent, onchain, and fully non-custodial

Withdraw anytime — no lock-ins

It’s like having a yield team working for you 24/7.

Try EarnPark and start earning →

The Anatomy of a Financial Innovation

Digital Asset Treasury (DAT) companies represent a fundamental departure from traditional corporate structures. Unlike normal businesses that might hold some crypto as a side investment, DATs exist primarily to accumulate and manage cryptocurrency as their core business function.

The model operates through what industry insiders refer to as the “premium flywheel.” When DAT stocks trade above their Net Asset Value (NAV), the company can issue shares at inflated prices and use the proceeds to buy more crypto. Here’s how the mechanics play out:

Imagine a DAT holding $200 million worth of Bitcoin. If the stock market values the entire company at $350 million, that creates a 75% premium to NAV. This premium becomes the engine for exponential growth. The company can issue $50 million in new shares, representing approximately 14% dilution to existing shareholders. But here’s where the magic happens: that $50 million buys $50 million more Bitcoin, increasing the company’s crypto holdings to $250 million.

For existing shareholders, this is accretive dilution. Yes, they own a smaller percentage of the company, but the company now owns more Bitcoin per share than before the offering.

If you previously owned 1% of a company with $200 million in Bitcoin, your stake was backed by $2 million worth of Bitcoin (1% × $200 million = $2 million). After the dilutive share offering, you now own 0.86% of a company with $250 million in Bitcoin, meaning your stake is backed by $2.15 million worth of Bitcoin (0.86% × $250 million = $2.15 million).

The flywheel accelerates when this process repeats. If markets maintain the premium, the company can continue issuing shares above NAV, buying more crypto, and growing each shareholder’s underlying crypto exposure. Strategy perfected this approach, increasing from roughly 38,000 Bitcoin in 2020 to over 639,000 Bitcoin by 2025 through relentless execution of this flywheel mechanism.

The model assumes three critical conditions: premiums persist, markets allow frequent capital raises, and crypto prices generally trend upward over time. When any of these conditions break, the flywheel can reverse into a destructive cycle where companies struggle to raise capital and may even face forced asset sales to meet obligations.

Strategy (formerly MicroStrategy) perfected the model, growing from 38,250 Bitcoin in August 2020 to over 639,000 Bitcoin worth $72 billion by September 2025. The company now controls roughly 3% of Bitcoin’s entire supply.

The appeal for investors was regulated crypto exposure without the hassle of wallets, exchanges, or custody concerns. For institutions barred from holding crypto directly, DATs offered a compliant backdoor into digital assets through familiar equity markets.

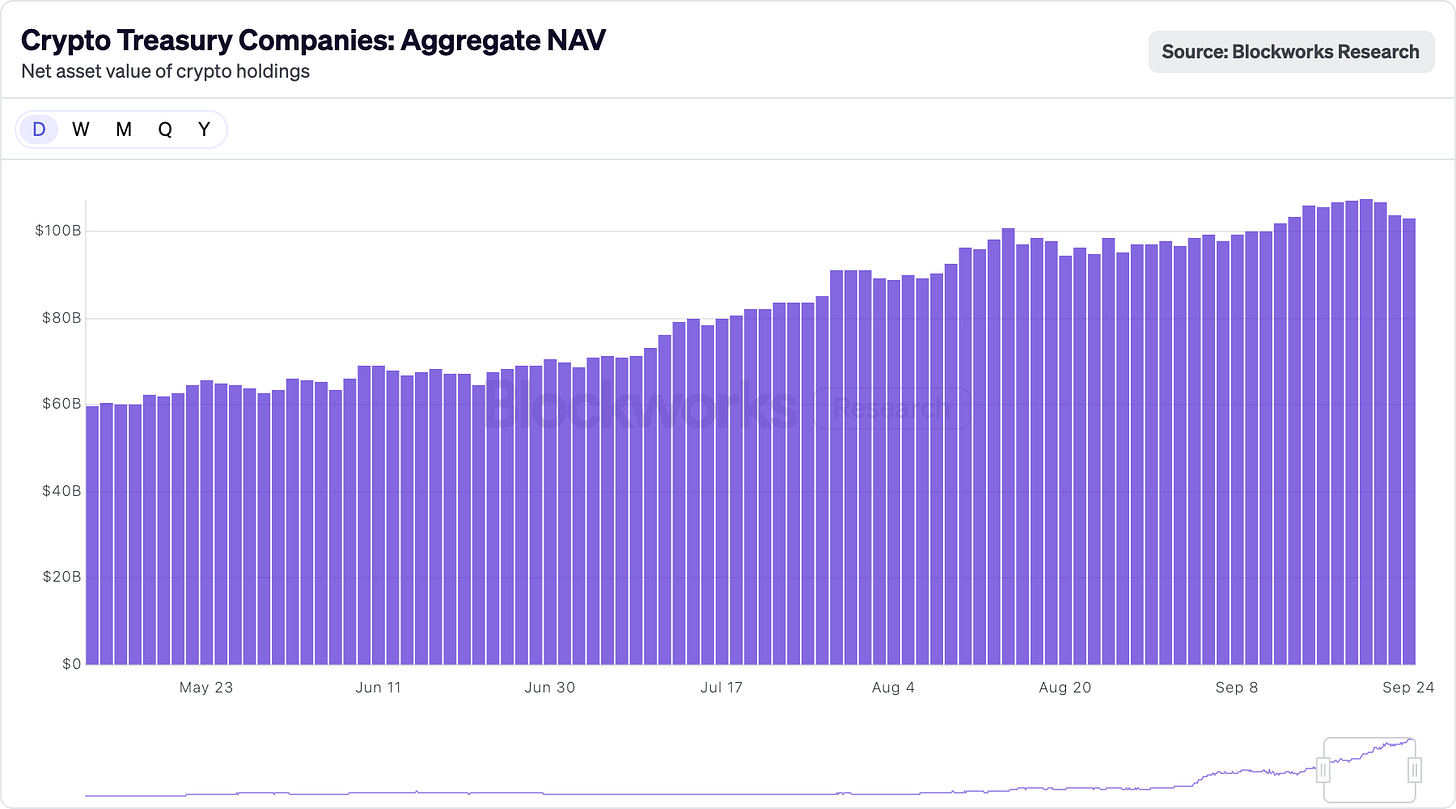

The Boom

The year 2025 marked DAT mania. Companies collectively raised over $20 billion in fresh capital, transforming everything from biotech firms to toy manufacturers into crypto treasury vehicles. The rush to market created some bizarre corporate combinations: a syringe manufacturer became a Solana treasury company, a cleaning products firm pivoted to holding Dogecoin, and a wellness company started accumulating BONK tokens.

Several crypto-related public companies have traded at large premiums to their NAV. MicroStrategy traded at a premium of around 75% to Bitcoin’s NAV.

Metaplanet, a Japanese company known as the “Strategy of Japan,” has traded at very large premiums, reportedly around 384% above its Bitcoin NAV, largely due to investors valuing its growth prospects and capital market access. The Blockchain Group, a smaller firm, traded at premiums above 200%, reflecting speculative demand.

Getting listed on stock exchanges through traditional IPOs takes over a year. SPAC deals might compress that to six months. But the premium window was closing fast, so companies took the fastest route available: reverse takeovers of already listed firms.

“If you don’t create an actual operating business aside from crypto asset accumulation, you’re going to get excluded from Russell indices,” explained analyst Paul McCaffery. This index exclusion could prove fatal for companies dependent on trading above NAV, since institutional buying requirements force roughly 17% of free float purchases when companies join major indices.

The result was a grab bag of questionable business combinations. Take Sharps Technology, which became a Solana DAT despite recording $0 revenue and $2 million in operating losses, with its accounting firm resigning because the company “did not meet internal risk tolerance metrics.” Yet the newly crypto-focused entity committed to remaining in the syringe business, not because it made strategic sense, but because maintaining some operating activity was necessary for regulatory compliance.

September 2025 marked a watershed moment with Strive’s $1.34 billion acquisition of Semler Scientific. This was survival-driven consolidation.

Both companies were trading near or below their Net Asset Values, making further capital raises impossible at attractive prices. By combining their Bitcoin holdings (5,886 BTC + 5,021 BTC), they hoped to create enough scale to reignite a trading premium. The merger essentially represented two drowning companies tying themselves together and hoping to swim.

The deal structure revealed the new reality: no massive premiums, minimal synergies, and a focus on scale over growth. It’s a template for the wave of DATCO consolidation that’s likely coming? Let’s organise that thought a bit.

When the Music Stops

The DATCO model contains several structural vulnerabilities that become catastrophic when markets turn against them.

The Premium Evaporation Problem

The entire DATCO edifice is built on maintaining stock premiums at NAV. When these premiums disappear, as they have for most smaller DATCOs in 2025, the flywheel reverses.

Companies trading at or below NAV face a cruel choice: issue dilutive equity that actually reduces Bitcoin per share, or stop growing entirely. Many have chosen a third option: borrowing money to buy back their own stock, trying to artificially maintain premiums.

The Death Spiral Dynamics

When crypto prices fall and premiums evaporate simultaneously, DATCOs enter what analysts refer to as a “death spiral.” The sequence is:

Crypto Correction: Bitcoin/Ethereum prices decline 30-50%.

Amplified Stock Decline: DATCO stocks fall 50-70% due to leverage effects.

Premium Collapse: Stocks trade at discounts to already-reduced NAV.

Funding Crisis: Cannot raise equity capital without massive dilution.

Debt Pressure: Convertible bonds and credit facilities face stress.

Forced Selling: Companies liquidate crypto to meet obligations.

Cascade Effect: Forced selling further depresses crypto prices.

Several smaller DATCOs experienced a similar sequence during Bitcoin’s correction in early 2025, with stocks falling by more than 60% while Bitcoin declined by 40%. Metaplanet’s shares fell over 60%, significantly outpacing Bitcoin’s roughly 40% price drop. Its stock fell from around $457 in July 2025 to as low as $328.

The Stock Buyback Desperation

Recent reports indicate that at least seven DATCO companies are borrowing money to fund stock buybacks, which is a sign that the model is breaking down. Think about what buybacks mean in this context. Instead of issuing new shares at premiums to buy more crypto (the original flywheel), companies are now borrowing against their crypto holdings to reduce their share count. ETHZilla borrowed $80 million against its Ethereum to fund a $250 million buyback after its stock collapsed 76%. Empery Digital raised $85 million in debt for share repurchases. These are defensive maneuvers.

The buyback strategy reveals three critical problems. First, these companies can no longer access equity markets on favourable terms. When your stock trades below NAV, issuing new shares destroys value rather than creating it. Second, management teams are essentially betting that financial engineering can restore premiums that fundamental market forces have eliminated. Third, borrowing against volatile crypto assets to fund buybacks creates new risks. If crypto prices fall while debt obligations remain fixed, companies face potential forced liquidation scenarios.

The M&A Musical Chairs

The consolidation wave represents admission that the original DATCO thesis was unsustainable. Companies are merging not because of compelling strategic synergies, but because they need scale to remain relevant in an oversaturated market.

If 200 companies are all trying to be Bitcoin proxies, the scarcity premium that justified the original model disappears. Consolidation might help, but it also reveals that many DATCOs were built on fundamentally flawed assumptions about sustained market premiums.

The M&A process has become more complex as regulatory scrutiny increases. The SEC requires enhanced disclosure about cryptocurrency holdings, valuation methodologies, and risk factors. Investment banks preparing fairness opinions must navigate asset valuation complexities, synergy assessments, premium justifications within NAV-based frameworks, and cryptocurrency volatility’s impact on deal certainty.

This regulatory attention has made M&A execution more challenging but potentially more credible, reducing the speculative excesses that characterised earlier DAT activity.

The Bitcoin vs. Ethereum Divide

While Bitcoin DATs dominated headlines, a parallel evolution occurred with Ethereum treasury companies pursuing fundamentally different strategies. Ethereum’s proof-of-stake consensus mechanism allows DATs to earn 3-5% annual yields through staking, creating income streams beyond simple asset appreciation.

BitMine Immersion Technologies exemplifies this approach, holding over 2.4 million ETH, worth approximately $9 billion, which represents more than 2% of Ethereum’s total supply. The company actively stakes its holdings through institutional providers like Figment, generating consistent returns even when ETH prices remain flat.

SharpLink Gaming follows a similar strategy with 837,230 ETH worth $3.7 billion, having staked nearly all holdings to maximise yield. This productive asset approach addresses one of Bitcoin DATs’ fundamental limitations: the inability to generate income from idle holdings without external lending or derivatives strategies.

The Ethereum treasury model also benefits from the blockchain’s expanding decentralised finance (DeFi) ecosystem. Companies can potentially participate in lending protocols, provide liquidity to decentralised exchanges, or invest in tokenised real-world assets. All while maintaining their core ETH treasury positions.

But, Ethereum strategies carry additional risks.

Staking involves technical complexity and carries the potential for slashing penalties. DeFi participation introduces smart contract risks and regulatory uncertainty. The trade-off between Bitcoin’s simplicity and Ethereum’s productivity has created distinct DAT archetypes pursuing different risk-return profiles.

The Weight of Numbers

In the end, mathematics always wins. Not because numbers are more real than stories, but because they’re harder to ignore when the stories stop making sense.

The DAT phenomenon promised to transcend this ancient tension between narrative and arithmetic. It offered a world where belief could literally manifest value, where collective faith in a corporate structure could double the worth of the assets it contained. For a brief, intoxicating moment, it seemed like the market had discovered a new form of financial alchemy, turning conviction into capital through the sheer force of shared imagination.

Yet market forces eventually reassert themselves. Water freezes at thirty-two degrees regardless of what we believe about ice. Gravity pulls objects earthward whether we accept Newton’s laws or not. And companies, eventually, trade at valuations that reflect their underlying fundamentals rather than the stories we tell ourselves about their specialness.

The challenge emerged when everyone shared the same beautiful dream. The dream lost its power to differentiate. When fifty companies offered similar Bitcoin exposure, the collective fiction that sustained premiums dissolved not because it was false, but because it was no longer exclusive.

This may be how all financial innovations mature. They begin as poetry - elegant solutions to impossible problems, sustained by the collective belief that this time is different. They often end as prose - functional tools operating within the boundaries of economic reality, generating returns that justify their existence rather than transcending it.

The next wave of builders may emerge with a clearer understanding of what markets will and won’t accept. The focus could shift toward less financial engineering and more actual engineering. Less premium capture and more value creation. Less emphasis on the stories that justify prices and more attention to the fundamentals that sustain them.

What comes next remains to be written. The companies that adapt may thrive in this new environment. But what does that adaptation looks like?

That’s it for this week’s deep dive.

I’ll see you next week.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.

You may be too biased. Price to Book value is well accepted metric in #tradfi. Warren Buffet uses it. The "premium" is P/BV>1 and is a measure of positive sentiment of future revenue adding more assets ( increase in BV) or cash dividend

As a Bitcoin bank Strategy is less regulated then normal banks and should with time be able to generate additional revenue streams like a bank does. Lending, collateral etc.

Have patience .

Copy cat clone do make life difficult and competition is never good but Brand and good stakeholder management and custody will help. Cybersecurity is a higher risk