The DIY Blockchain Trend 👀

When everyone builds their own highway, who's left to drive on them?

You know how you start with innocent intentions? You buy a couple of Philips Hue smart bulbs because they're supposedly the best. The app is sleek, the colours are amazing, and you feel very sophisticated dimming your lights from your phone like some sort of tech wizard.

Then you decide your thermostat should be smart too. But Nest has the best AI, so you get that. Different apps, different accounts, but whatever, it's just one more thing.

Before you know it, you're living in chaos. Your Ring doorbell doesn't talk to your Alexa speakers, which don't control your Apple HomeKit garage door, which can't communicate with your Samsung SmartThings hub. You need four different apps to turn on the lights, adjust the temperature, and lock the front door. Each company promised you the "seamless smart home experience," but somehow you ended up with a house that's dumber than before, just with more apps.

Circle and Stripe are about to do the same thing to crypto?

Your Shortcut To Crypto’s Inner Circle

Introduction.com is a private, high-trust network designed for the most respected minds in GTM, BD, and leadership across crypto, tech, and finance.

Inside, members tap into a curated ecosystem where collaboration, dealmaking, and growth happen by default.

Cut through the noise. Reduce friction. Unlock the true value of executive connectivity.

Now accepting new applications.

👉🏼 Apply Today

In August 2025. Two big announcements dropped.

First, news broke that Stripe, the $50 billion payments giant, was building Tempo, a "high-performance, payments-focused" blockchain in partnership with crypto VC firm Paradigm. A day later, Circle, the company behind the $67 billion USDC stablecoin, unveiled plans for Arc, their own Layer 1 blockchain designed specifically for stablecoin payments, foreign exchange, and capital markets.

Inside Circle's Arc: Circle built Arc specifically around their USDC stablecoin. Most blockchains require you to pay transaction fees with their native token. ETH on Ethereum, SOL on Solana. On Arc, you pay fees directly in USDC. No need to hold volatile tokens just to use the network.

There is a built-in FX engine. Instead of using external services or DEXs to swap currencies, Arc handles foreign exchange natively at the protocol level. Send USDC, the recipient gets EURC (Euro Coin), and the conversion happens automatically without third-party services or additional fees.

Then the privacy controls. Most public blockchains (Ethereum, Bitcoin, Solana) show everything: addresses, amounts, timing. Privacy coins like Monero hide everything by default. Arc offers selective privacy where institutions can hide transaction amounts while keeping addresses visible, plus built-in regulatory compliance features. It's designed for businesses that need competitive privacy without going fully anonymous.

Inside Stripe's Tempo: Stripe's differentiator appears to be user experience abstraction. While other crypto payment solutions still feel like crypto — connect wallet, sign transaction, wait for confirmation, Tempo seems designed to make blockchain payments feel identical to credit card payments from the user's perspective.

Being Ethereum-compatible means it can tap into existing DeFi infrastructure and developer tools, but the advantage is integration with Stripe's existing merchant ecosystem. Millions of businesses already using Stripe could potentially add crypto payments without changing their checkout flow or learning new systems.

Most importantly, Stripe's existing relationships with banks and regulators could solve a major problem. Most crypto payment solutions struggle with the "last mile," moving money from blockchain back to regular bank accounts. Stripe already has those banking partnerships that other crypto companies spend years trying to build.

Why My Brain Hurt

So we're back to my digitally fragmented house, and that's where the questions start multiplying like the notification badges on my various home automation apps.

The first thing that bothers me: where exactly is the demand for these specialised blockchains?

Circle and Stripe keep talking about stablecoin payments and enterprise features, but the real action in stablecoins happens in DeFi. People use USDC to buy other crypto assets, participate in lending protocols, trade on decentralised exchanges, and interact with the broader ecosystem of financial applications. All of that lives primarily on Ethereum.

I would say it's like building the world's most advanced smart thermostat that only works in houses without any other smart devices.

Sure, the thermostat might be technically superior, but you're cutting yourself off from the entire ecosystem where people actually want to use smart home features.

Second question: What's the point of reinventing the wheel?

Everything Circle and Stripe say they want to do — faster transactions, lower fees, custom features, corporate branding — can already be accomplished with Ethereum Layer 2 solutions. You get the security of Ethereum's base layer, access to the largest DeFi ecosystem, and the ability to customise your network however you want.

Some Layer 1 blockchains have already figured this out. Celo, which launched as an independent blockchain focused on mobile payments, announced plans to become an Ethereum Layer 2 instead. When they did the math, being part of the Ethereum ecosystem made more sense than trying to build their own network effects from scratch.

The more chains we have, the more bridges we need. Bridges are where things go wrong... They move assets between different blockchains. Basically, complex smart contracts that lock your tokens on one chain and mint equivalent tokens on another. But bridges get hacked. A lot. I swear on Ronin. We're not talking about the mild inconvenience of switching from your Philips Hue app to your Nest app. We're talking about potential financial loss if something goes wrong with the bridge software.

Broken UX. In my smart home, the worst thing that happens is I have to open a different app to turn off the porch light. But with corporate blockchains, users might need different wallets, different gas tokens, different interfaces, and different security setups for each network. Most people already struggle with managing one crypto wallet. Imagine explaining why they need different wallets for Stripe payments versus Circle transfers.

But here's what really confuses me, which is that the network effects just aren't there.

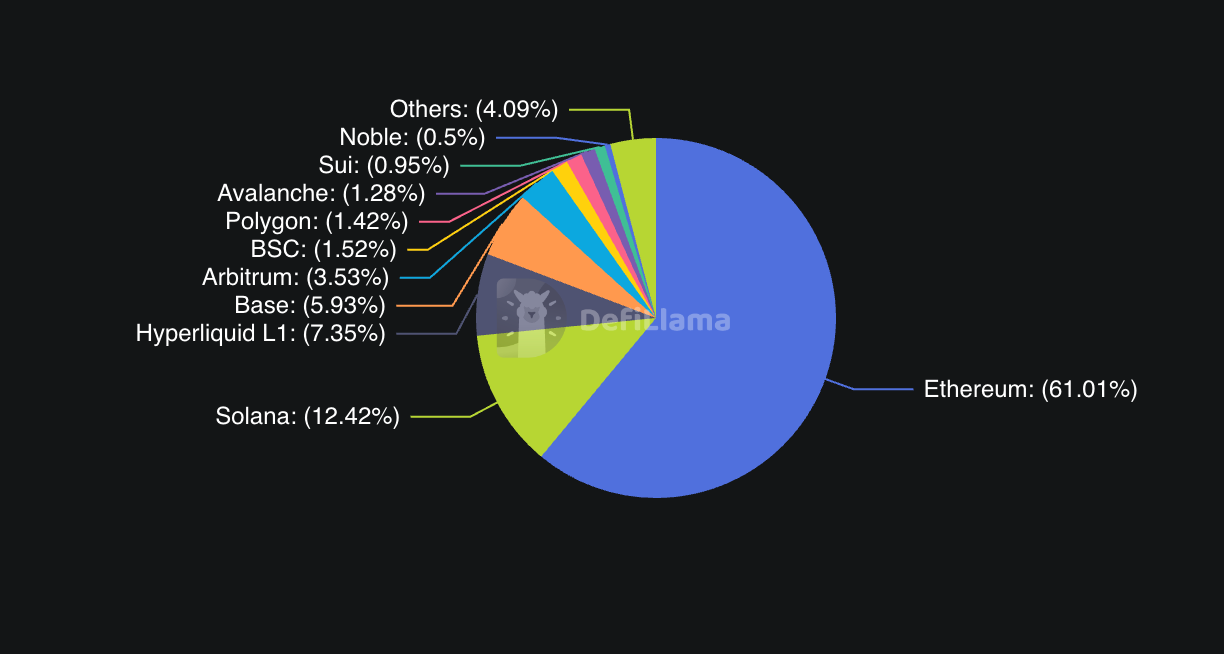

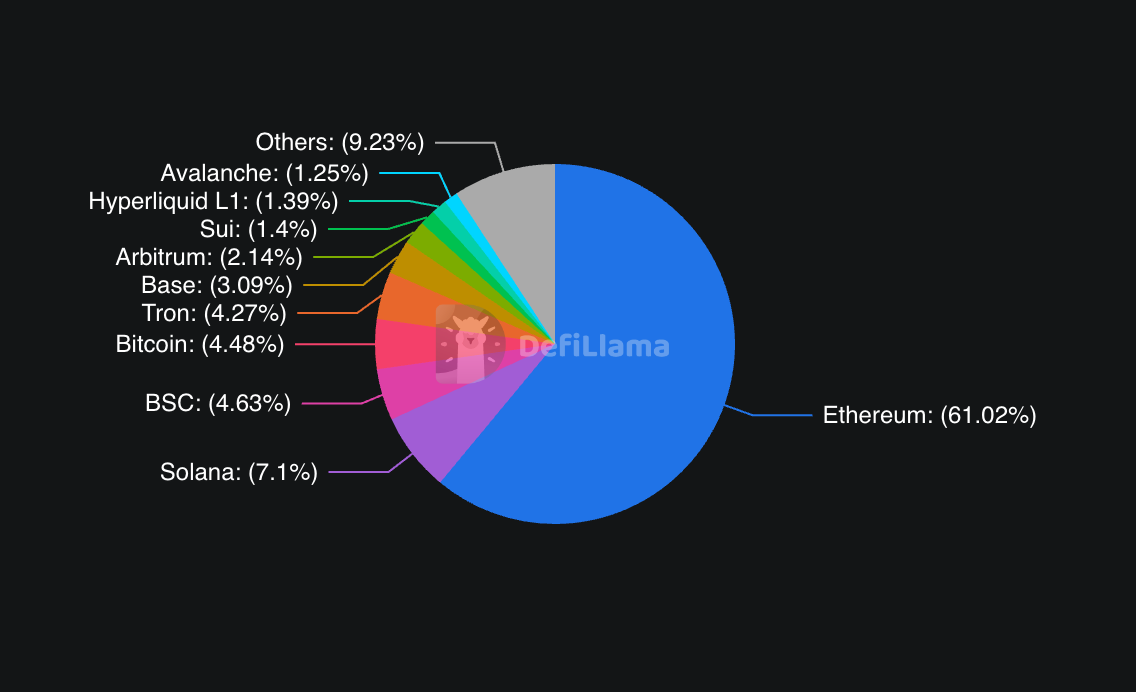

The value of a payment network increases exponentially with the number of users and applications. Ethereum has the most developers, the most applications, and the most liquidity. As of mid-2025, Ethereum maintains a $96 billion TVL (total value locked), representing about 60-65% of all DeFi activity. Solana, often positioned as the high-performance alternative, has $11 billion TVL. Other major chains like Binance Smart Chain ($7.35B), Tron ($6.78B), and Arbitrum ($3.39B) split the remainder.

These corporate chains are choosing to opt out of that network effect to build something isolated, hoping that they will find users by default.

Would you build the perfect store on a deserted island? Sure, countries like the UAE built cities like Dubai and people did go there. But that was because there were physical limitations. They had to do it.

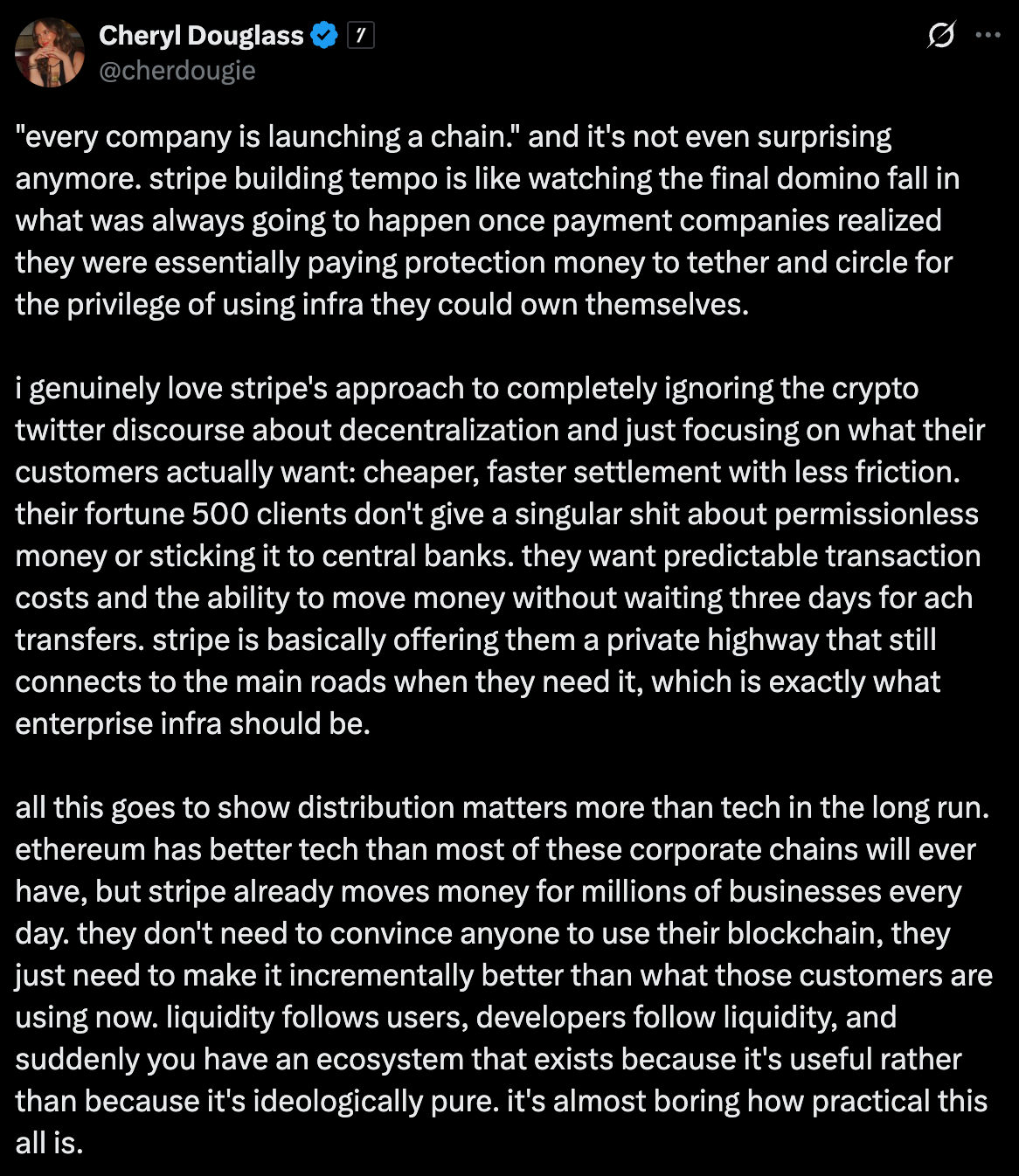

Finally, there's the competition question that nobody wants to address directly. Are these companies really trying to build better infrastructure, or are they just uncomfortable sharing the sandbox with competitors? When I look at my smart home mess, each company had valid technical reasons for its choices. But the real driver was often that they didn't want to be dependent on someone else's platform or pay fees to a competitor.

Maybe that's what's really happening here. Circle doesn't want to pay Ethereum transaction fees, and Stripe doesn't want to build on infrastructure they don't control. Fair enough. But then let's be honest about what this is. It's not about innovation or user experience. It's about control and economics.

The King Doesn't Seem Worried

Ethereum, for its part, appears largely unbothered by this corporate exodus. The network continues processing over a million transactions daily, holds the majority of DeFi activity, and recently saw massive institutional inflows through its ETF. One day in August saw $1 billion in net flows into Ethereum ETFs. That’s more than Bitcoin ETFs collected in the previous week combined.

The Ethereum community's response to these corporate chains has been interesting to watch. Some see it as validation. After all, both Arc and Tempo are being built as EVM-compatible chains, essentially adopting Ethereum's development standards.

But there's a subtle threat here. Every USDC transaction that happens on Arc instead of Ethereum is fee revenue that doesn't flow to Ethereum validators. Every Stripe merchant payment processed on Tempo instead of an Ethereum Layer 2 is activity that doesn't contribute to Ethereum's network effects.

Solana might feel this competition more acutely. The network has positioned itself as the high-performance alternative to Ethereum, particularly for payments and consumer applications. When major payment companies choose to build their own chains instead of adopting Solana, it undermines the "everything can fit on one fast computer" thesis that Solana has been promoting.

The Graveyard of Corporate Blockchains

History isn't particularly kind to companies that try to build their own blockchains. Celo, as I mentioned earlier, made this exact move in 2023.

Remember Facebook's Libra? What started as an ambitious plan to create a global digital currency ended up as Diem, then got sold off for parts after regulatory pressure made it untenable. Not to forget that, under today's clearer rules, with the GENIUS Act explicitly defining how stablecoin issuers should operate, Facebook's project might have actually worked.

JPMorgan's blockchain ventures provide perhaps the most relevant cautionary tale. The bank spent years building JPM Coin (a digital dollar), Quorum (their private blockchain network), and other blockchain projects. Despite having virtually unlimited resources, regulatory relationships, and a massive existing customer base, these initiatives never gained meaningful adoption outside JPMorgan's own operations. JPM Coin processes billions in transactions, but mostly just moves money between the bank's own institutional clients.

Even attempts by major payment companies haven't been particularly encouraging. PayPal launched its own stablecoin (PYUSD) in 2023, making it the first major US fintech to enter the stablecoin space. But instead of building custom infrastructure, PayPal chose to launch on existing networks like Ethereum. The result? PYUSD has a market cap of just $1.102 billion — modest compared to USDC's $67 billion — and remains mostly confined to PayPal's own ecosystem.

This raises the question: if a company with PayPal's reach and payment expertise can't make a major impact with just a stablecoin, what makes Circle and Stripe think building entire blockchains will fare better?

The pattern suggests that building a successful blockchain requires more than just technical competence and financial resources. You need network effects, developer enthusiasm, and organic adoption, which are things that are notoriously difficult to manufacture, even with corporate backing.

Can things be different this time?

There are reasons to think Circle and Stripe might succeed where others have struggled.

First, regulatory clarity has improved dramatically. The passage of the GENIUS Act in the US created a clear framework for stablecoin issuers, removing much of the uncertainty that had plagued earlier corporate blockchain efforts. When Circle launches Arc, they're not operating in a legal grey area. They're a publicly traded company working within established rules.

Second, both companies already have something JPMorgan lacked: massive existing user bases that aren't primarily crypto-native. Stripe processes over $1 trillion annually for millions of merchants worldwide and has been systematically building its crypto infrastructure — acquiring Bridge (stablecoin infrastructure) for $1.1 billion and Privy (crypto wallet technology) to create an end-to-end payment stack. Circle's USDC is already integrated into hundreds of applications and trading platforms. They're not building blockchains and hoping someone uses them. Instead, they're building infrastructure for users they already serve, with the tools to onboard them seamlessly.

When Matt Huang from Paradigm describes Stripe's approach, he emphasises how blockchain technology could "fade into the background" for everyday users. Imagine paying for something online and getting instant settlement, lower fees, and programmable features, but the merchant integration looks exactly like existing Stripe checkout flows. That's a very different proposition from asking people to download MetaMask and manage seed phrases. This is Web2 UX with Web3 infra. Users don’t even feel anything “blockchainy.”

Third, the technology itself has matured. When JPMorgan was experimenting with blockchain in 2017-2018, the infrastructure was genuinely primitive. Today, building a high-performance blockchain with institutional-grade features is challenging but not unprecedented. Circle's acquisition of the team behind the Malachite consensus engine gives them battle-tested technology for sub-second finality. Stripe's partnership with Paradigm brings deep crypto expertise to complement their payments knowledge.

The cost dynamics have shifted dramatically, too. In 2017, starting a new blockchain typically cost $1-5 million with development cycles of 1-2 years or longer. By 2025, launching a functional blockchain application averages $40,000-$200,000 with typical timelines of 3-6 months, thanks to improved developer tooling, consensus engines, and blockchain-as-a-service platforms. Modern deployments can be up to 43% cheaper than centralised applications in some segments due to efficiency gains and infrastructure scaling.

Payment companies realised they were paying others for infrastructure they could build themselves. Instead of paying Circle fees for USDC transactions or relying on Ethereum's fee structure, companies like Stripe can now build their own infrastructure stack for a fraction of what they'd spend on third-party fees over time.

It's the classic 'build vs. buy' decision, and now the build option costs hundreds of thousands instead of millions.

The Coexistence Question

So where does this leave us? Are we heading toward a fragmented future where every major company runs its own blockchain? Or will market forces push toward consolidation and interoperability?

The early signs point toward pragmatic coexistence rather than winner-take-all competition. Circle has been explicit that Arc will complement, not replace, their multi-chain strategy. USDC will continue running on Ethereum, Solana, and dozens of other networks. Arc is being positioned as an additional option for users who need its specific features like institutional privacy, guaranteed settlement times, or built-in FX capabilities.

Stripe's approach seems similar. Tempo isn't being designed to replace existing payment rails entirely, but to offer an alternative for use cases where blockchain features provide clear advantages. Cross-border payments, programmable money, and merchant settlement are areas where blockchain technology genuinely improves on traditional systems.

The user experience will ultimately determine whether this fragmentation becomes a feature or a bug. If "chain abstraction" technologies develop as promised, users might interact with all these different blockchains without knowing or caring which one they're using. Your payment app might automatically route transactions through whichever network offers the best speed and cost for that particular transaction.

Here's my bet (if I am being a little optimistic): we'll see both outcomes simultaneously, but in different market segments.

For institutional and enterprise users, multiple specialised blockchains will probably thrive. A multinational corporation moving $100 million between subsidiaries cares about compliance features, settlement guarantees, and integration with existing treasury systems. They don't care about gas price volatility, whether their blockchain has the coolest NFT projects, or the most active DeFi protocols. A chain that lets businesses off-ramp directly to traditional banking systems, provides built-in regulatory reporting, or offers guaranteed settlement times will be more sought after than Ethereum's general-purpose infrastructure.

Arc might genuinely serve these users better than Ethereum could.

The stable fees, instant settlement, and built-in compliance features could matter more to a CFO than access to the latest DeFi protocols.

For retail users and developers, network effects will continue to matter enormously. The blockchain with the most applications, the most liquidity, and the most developer activity will keep attracting more of the same. That's still Ethereum today, and these corporate chains don't seem positioned to challenge that dominance directly.

The wild card is whether these enterprise blockchains stay enterprise-focused. If Stripe makes payments faster and cheaper for merchants, and customers don't notice they're using blockchain, it could grow beyond just enterprise use.

But here's the thing about infrastructure: the best kind is invisible. When you flip a light switch, you don't think about power plants or transmission lines. When these blockchain experiments succeed, it'll be because they've made the underlying technology disappear completely.

Whether that actually happens remains to be seen. For now, we're in the land grab phase, where everyone wants to own a piece of the future financial infrastructure.

That’s it for today’s deep dive. See you tomorrow with another one.

Until then… Stay alive.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.