Every financial advisor you’ve met starts with the same compound interest sermon.

Invest $500 monthly in index funds, earn 7% annually, and you'll have $1.3 million after 30 years. Great, except by year 15, that $500 monthly investment feels like nothing because rent doubled, you have kids, and your definition of 'enough money' evolved from 'can afford guacamole' to 'can afford a house with good schools.' The traditional path assumes your expenses stay constant while your money slowly grows, but real life works the opposite way.

So when you learned people were earning 15-20% annually on synthetic dollars through crypto derivatives markets, you don’t think about the risks first. It’s the timeline. Finally, returns that could outpace the speed at which life gets more expensive.

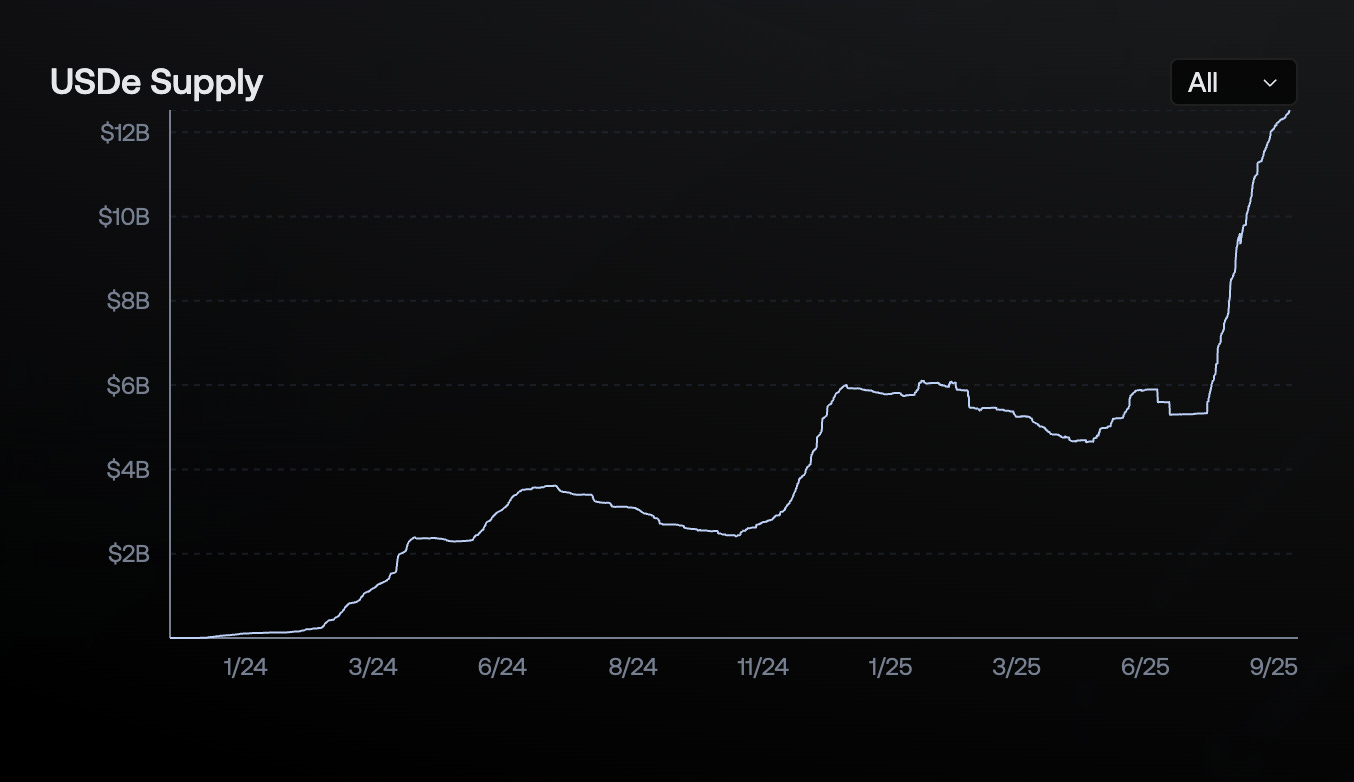

Here's the fact that made me want to write a deep dive on it: A crypto protocol launched 18 months ago just hit $12.4 billion in circulating supply faster than any digital dollar in history. While USDT took until mid-2020 to reach $12 billion (after years of gradual growth), and USDC needed until March 2021 to cross $10 billion, Ethena's USDe sprinted past both milestones in what amounts to a financial speed run.

USDe is harvesting the structural inefficiencies in crypto derivatives markets.

This raises the central question that every investor, regulator, and competitor is asking.

How did they do this so fast, what are the actual risks, and is this sustainable or just another high-yield experiment waiting to collapse?

This is me trying to answer most of those questions.

Your Shortcut To Crypto’s Inner Circle.

Introduction.com is a private, high-trust network designed for the most respected minds in GTM, BD, and leadership across crypto, tech, and finance.

Inside, members tap into a curated ecosystem where collaboration, dealmaking, and growth happen by default.

Cut through the noise. Reduce friction. Unlock the true value of executive connectivity.

Now accepting new applications.

👉Apply Today

The World's Largest Carry Trade

Ethena found a way to turn the crypto market's perpetual appetite for leverage into a money-printing machine. Here's how it works, in simple terms.

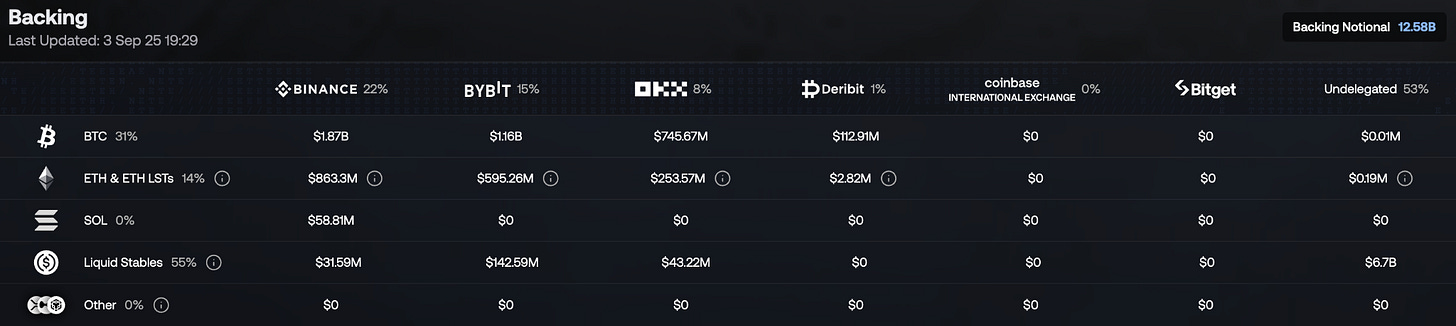

Hold crypto collateral, short an equivalent amount of crypto futures, pocket the difference. The result is a synthetic dollar that stays stable while generating yield from crypto's most reliable money printer.

Let’s break it down further. When someone wants to mint USDe, they deposit crypto assets like ETH or Bitcoin. But instead of just holding those assets and hoping they stay stable (oh btw, they won't), Ethena immediately opens an equal-sized short position on perpetual futures exchanges.

If ETH goes up $100 - their spot holdings gain $100 but their short position loses $100.

If ETH crashes $500 - their spot loses $500 but their short gains $500.

The net result - perfect stability in dollar terms.

This is called delta-neutral positioning. You can't lose, but you also can't win from price movements.

So where does the 12-20% yield come from? Three sources.

First, they stake the ETH collateral and collect staking rewards (currently around 3-4%).

Second, they collect what's called the "funding rate" from their short positions.

In crypto perpetual futures, traders pay funding fees every eight hours to keep positions open. When more people want to go long than short (which happens about 85% of the time), the longs pay the shorts. Ethena sits permanently on the short side collecting these payments.

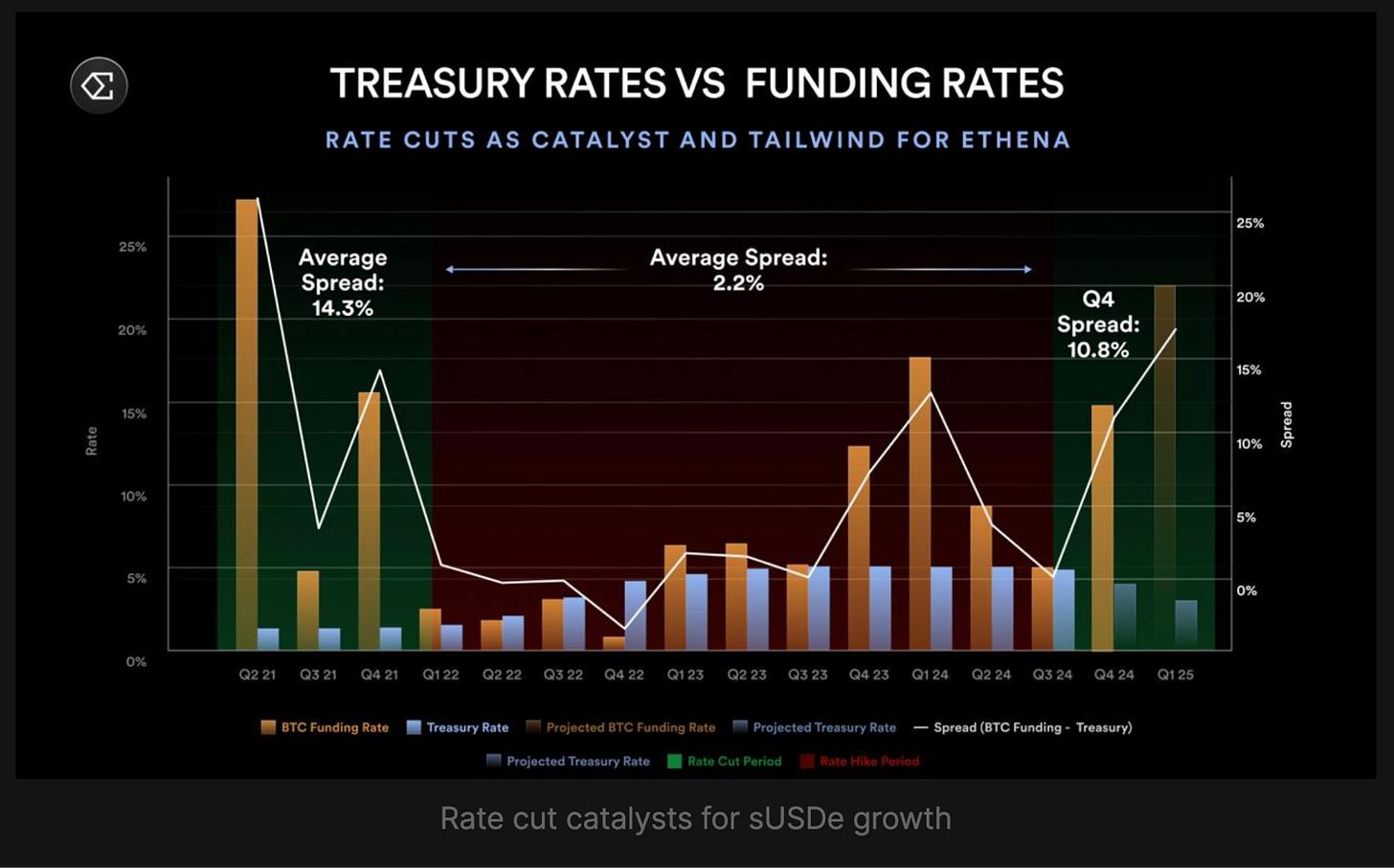

In 2024, open interest-weighted funding rates averaged 11% on Bitcoin and 12.6% on Ethereum. These are actual cash flows paid by leveraged traders to anyone willing to take the other side of their bets.

Third, they earn yield on cash equivalents and treasury products held in reserves. Ethena holds liquid stables with partners who pay out additional yields. USDC pays out loyalty rewards and holding USDtb pays out yield from BlackRock's BUIDL fund.

Combined, these sources generated an average 19% APY for sUSDe holders in 2024.

Crypto funding rates have averaged 8-11% annually over the past few years. Add staking rewards and other income streams, and you get yields that help you sleep better. Isn’t that the whole point?

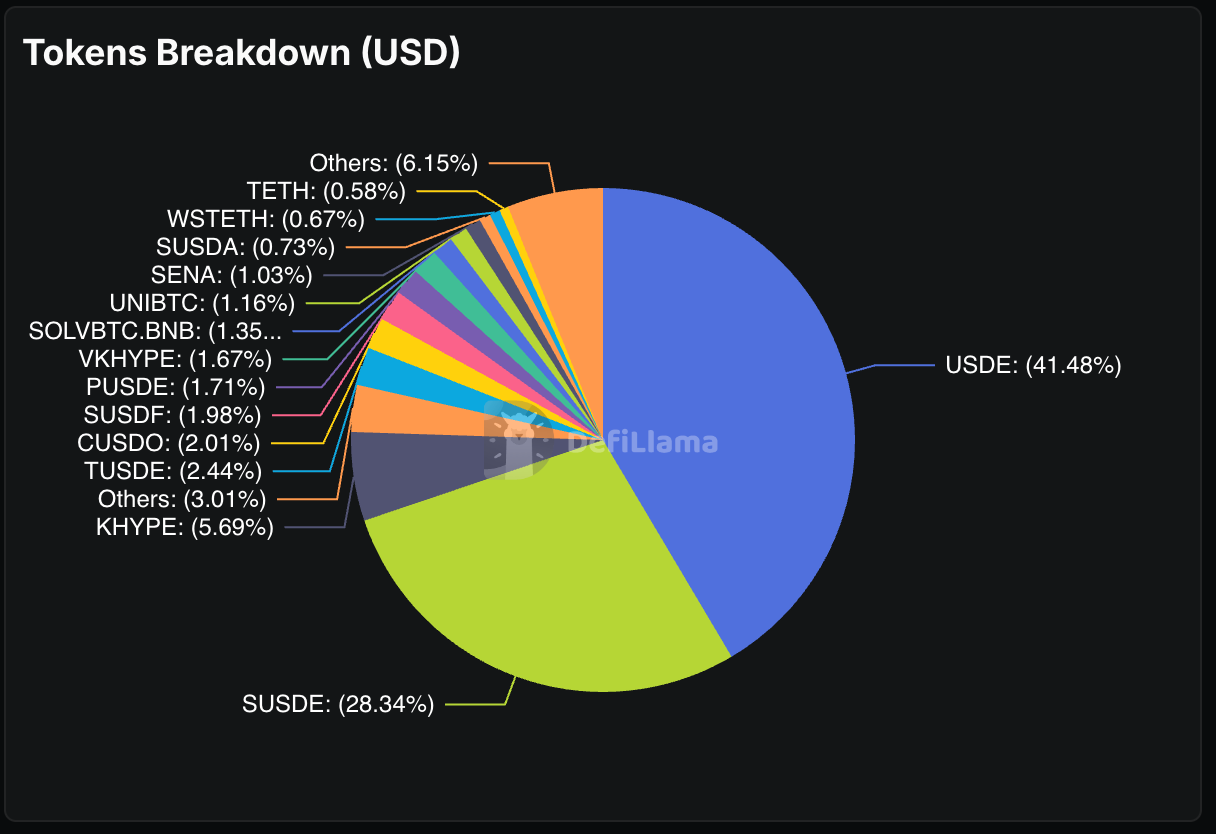

Four tokens power the Ethena ecosystem, each serving distinct functions:

USDe is the synthetic dollar unit that maintains a $1 target through delta-neutral hedging. It doesn't accrue rewards unless staked and can be minted or redeemed by whitelisted participants.

sUSDe is the reward-bearing version received by staking USDe in an ERC-4626 vault.Currently, 100% of Ethena's protocol revenues flow to sUSDe holders as yield rewards. Its value in USDe terms rises as Ethena periodically deposits protocol revenues. Users can unstake after a cooldown period to redeem back to USDe.

ENA serves as the governance token, allowing holders to vote on critical protocol matters like eligible backing assets and risk parameters. It also anchors future ecosystem security models.

sENA represents staked ENA positions. The planned "fee switch" mechanism would allocate a portion of protocol revenue to sENA holders once specific milestones are met. Currently, sENA receives ecosystem distributions like Ethereal's proposed 15% token allocation.

But there's a catch, a big one. This only works as long as people are willing to pay to be long crypto. If sentiment flips and funding rates turn negative, Ethena starts paying instead of getting paid. Before getting into that…

Why 2025 Became Ethena's Breakout Year

Several forces aligned to turn USDe into the fastest-growing digital dollar in history.

1/ The perpetual futures market exploded, with open interest across major altcoins hitting an all-time high of around $47 billion in August 2025 and bitcoin open interest hitting $81 billion. More trading volume meant more funding rate opportunities for Ethena to harvest.

2/The acceleration came from what can be described as financial engineering on steroids. Users discovered they could stake USDe to get sUSDe (the yield-bearing version), tokenise their sUSDe positions on Pendle (a yield derivatives platform), then use those tokenised positions as collateral on Aave (a lending protocol) to borrow more USDe. Rinse and repeat.

This created recursive yield loops where sophisticated players could amplify their exposure to USDe's underlying returns. The result? 70% of Pendle's total deposits are Ethena assets.

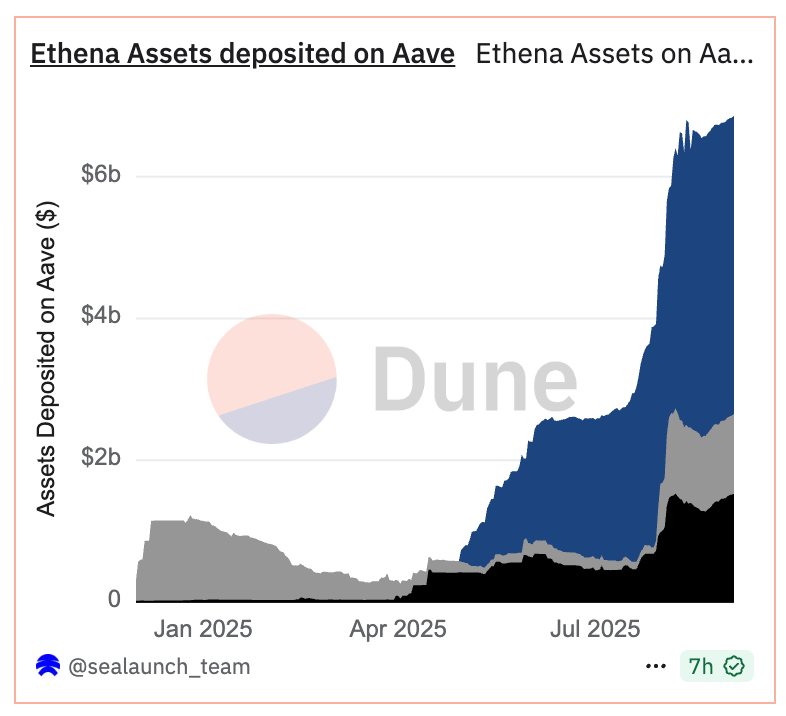

Another $6.6 billion Ethena assets sit on Aave.

It's leverage on leverage on leverage, all chasing those double-digit yields.

3/ A SPAC called StablecoinX announced plans to raise $360 million specifically to accumulate ENA tokens. The entity will deploy proceeds to accumulate ENA tokens under a "permanent capital" mandate, creating a structural buyer that removes selling pressure and supports governance decentralisation.

4/ Ethereal Perpetual DEX. Built specifically on USDe, Ethereal attracted $1 billion in TVL before even launching mainnet. Users deposit USDe to farm points for the eventual token launch, creating another massive sink for USDe supply while generating anticipation for the first major application built natively on Ethena's infrastructure.

5/ Ethena's permissioned L2 Convergence Chain, built with Securitize, targets traditional finance onboarding through KYC-compliant infrastructure. The chain uses USDe as the native gas token, creating structural demand while opening access to institutional capital that can't interact with permissionless DeFi.

6/ Markets are pricing in two fed rate cuts before the end of 2025, with an 80% chance of a September cut. When interest rates fall, traders typically increase risk-taking behaviour, driving funding rates higher. USDe yields have a negative correlation with the federal funds rate, meaning rate cuts could boost Ethena's revenue significantly.

7/ Ethena's fee switch proposal. Ethena's governance approved a five-metric framework for activating revenue sharing with ENA holders. Four of five conditions are met:

USDe supply exceeds $6 billion (currently $12.4B), protocol revenue surpasses $250 million (over $500M achieved), Binance/OKX integration (achieved), and reserve fund adequacy (achieved). The final requirement - yield spread maintaining sUSDe at least 5% above sUSDtb - remains the only hurdle before ENA holders can claim their share of protocol profits.

These conditions are governance-decided safeguards to protect both the protocol and sENA holders from premature or risky revenue sharing. Milestones reflect benchmarks of protocol maturity, financial health, and market integration. Ethena wants to ensure that revenue sharing is both sustainable and valuable before unlocking it fully.

Ethena has also been quietly building partnerships with traditional finance players and crypto exchanges, making USDe available everywhere from Coinbase to Telegram wallets.

Institutional FOMO

Unlike previous stablecoin experiments that grew purely through crypto-native use cases, USDe is attracting attention from traditional finance institutions.

Coinbase institutional clients can now access USDe directly. CoinList is offering USDe with 12% APY through their earn program. Major custodians like Copper and Cobo are handling Ethena's reserves.

They all are related to institutional investors as they provide platforms, custody, or services designed specifically to support accredited investors and institutional clients in crypto markets.

The pattern mirrors what happened with USDC and USDT, but compressed into a much shorter timeframe. Major stablecoin providers took years to build institutional relationships and compliance frameworks. Ethena is doing it in months, partly because the regulatory landscape has matured and partly because the yield opportunity is too compelling to ignore.

Institutional adoption brings credibility, credibility brings more capital, more capital means larger funding rate capture, which supports higher yields, which attracts more institutions. It's a flywheel that keeps accelerating as long as the underlying mechanics hold up.

The speed comparison comes with important caveats. USDe didn't have to convince the world that stablecoins were useful, secure, or legally permissible. It launched into a market where USDT and USDC had already done the heavy lifting of institutional adoption, regulatory acceptance, and infrastructure development.

Leverage Squared

The high concentration on Pendle and Aave creates what risk managers call single-point-of-failure scenarios. If something goes wrong with Ethena's model, it doesn't just affect USDe holders. It cascades through the entire DeFi ecosystem that has become dependent on Ethena flows.

Pendle would lose 70% of its business if Ethena faltered. Aave would see massive outflows. The yield farming strategies that depend on USDe would unwind. We'd be looking at a DeFi-wide liquidity crunch, not just a stablecoin depeg.

The most concerning aspect of Ethena's growth is what people are doing with it. The recursive borrowing loops on Aave and Pendle create leverage multipliers that amplify both returns and risks.

Users stake USDe for sUSDe, tokenise the sUSDe on Pendle to get PT tokens, deposit PT tokens as collateral on Aave, borrow more USDe, and repeat the cycle. Each loop amplifies their exposure to USDe's underlying yield, but also amplifies their exposure to any volatility or liquidity problems.

This is reminiscent of the CDO-squared structures that contributed to the 2008 financial crisis. You have a financial product (USDe) being used as collateral for borrowing more of itself, creating recursive leverage that's hard to unwind quickly.

Maybe I’m just overthinking but if funding rates flip persistently negative, USDe could face redemption pressure. Leveraged positions would face margin calls. Protocols dependent on USDe TVL would see massive outflows. The unwinding could happen faster than any single protocol could manage.

Every high-yield strategy eventually faces the question. What happens when it stops working? For Ethena, there are several scenarios that could trigger an unwind.

The most obvious is a sustained period of negative funding rates. If crypto sentiment turns bearish for weeks or months, Ethena would start paying funding instead of receiving it. Their reserve fund (currently around $60 million) provides a buffer, but it's not unlimited.

A more acute risk is exchange counterparty failure. While Ethena uses off-exchange custody for their spot assets, they still rely on major exchanges to maintain their short positions. If a major exchange fails or gets hacked, Ethena would need to quickly migrate positions, which could break their delta-neutral hedge temporarily.

The leverage loops on Aave and Pendle create additional liquidation risks. If USDe's yield drops suddenly, the recursive borrowing positions could become unprofitable, triggering waves of deleveraging. This could create temporary selling pressure on USDe itself.

Regulatory risk is also increasing. European regulators have already forced Ethena to relocate from Germany to the British Virgin Islands. As yield-bearing stablecoins attract more attention, they could face additional compliance requirements or restrictions.

The Stablecoin Wars

Ethena represents a fundamental shift in stablecoin competition. For years, the battle was about stability, adoption, and regulatory compliance. USDC competed with USDT on transparency and regulation. Various algorithmic stablecoins competed on decentralisation.

USDe changed the game by competing on yield. It's the first major stablecoin to offer double-digit returns to holders while maintaining its dollar peg. This puts pressure on competing traditional stablecoin issuers who keep all the yield from their Treasury holdings while offering users zero return.

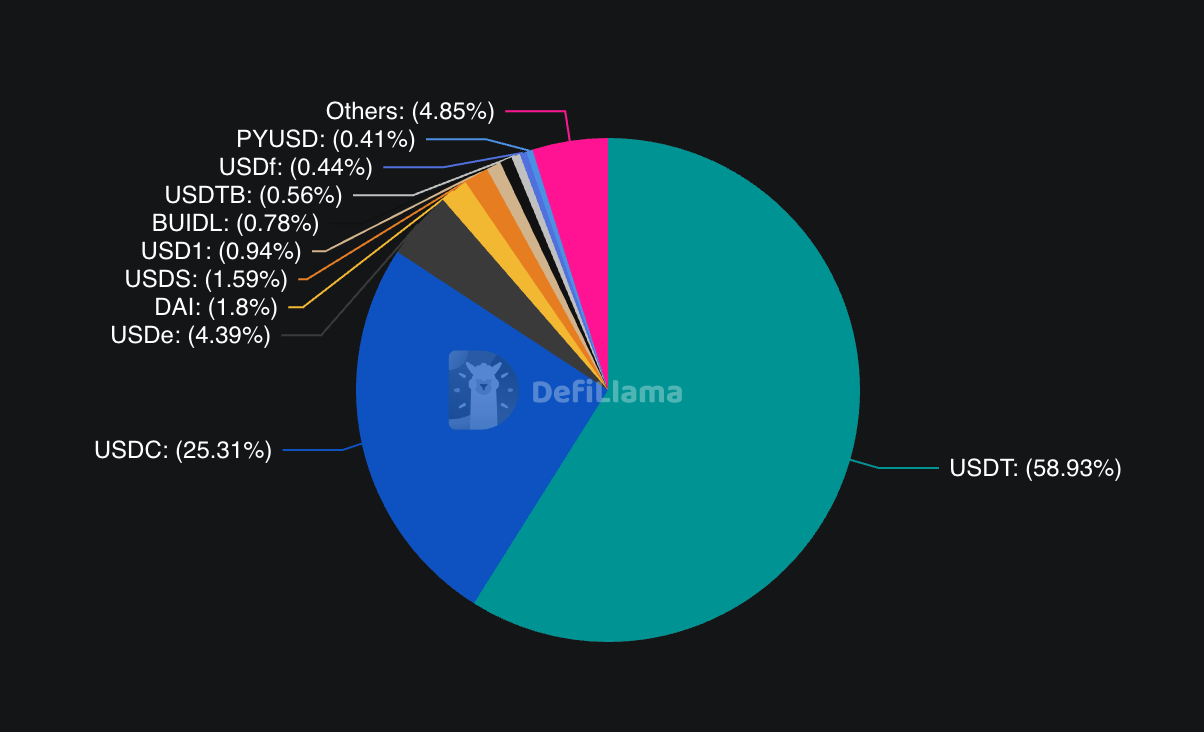

The market is responding. USDe now has over 4% market share among stablecoins, trailing only USDC (25%) and USDT (58%). More importantly, it's growing faster than both. USDT grew 39.5% over the past 12 months, USDC grew 87%, but USDe grew over 200%.

If this trend continues, we could see a fundamental reshaping of the stablecoin market. Users will migrate from yield-free stablecoins to yield-bearing alternatives.

Traditional issuers will either have to share revenue with users or watch their market share erode.

Despite the risks, Ethena's trajectory shows no signs of slowing. The protocol just approved BNB as eligible collateral, with XRP and HYPE tokens meeting onboarding thresholds for future inclusion. This expands their addressable market beyond just ETH and Bitcoin.

The ultimate test will be whether Ethena can maintain its yield advantage while managing systemic risks. If they can, they'll have created the first scalable, sustainable yield-bearing dollar in crypto history. If they can't, we'll have another story about the dangers of chasing yield in volatile markets.

Either way, the speed at which USDe reached $12 billion proves that when you combine genuine innovation with market demand, financial products can scale faster than anyone thought possible.

That’s it for this week’s deep dive.

Until then … stay curious,

Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.